🧵1/ Lockheed Martin Skunk Works may be on the cusp of announcing a CFR (Compact Fusion Reactor). If true, it would usher in an era of clean, stable, cheap, compact and virtually limitless power. It would also completely transform Bitcoin mining. Let's dive in and explore how.⚡️

https://twitter.com/LockheedMartin/status/1969401262949937333

2/ First, why is a Compact Fusion Reactor (CFR) a plausible speculation? A decade ago Lockheed Margin Skunk Works suggested the timeline for a commercial CFR product was only a decade away.

https://x.com/RobertDobalina7/status/1969524074620862813

3/ Watch this 2014 Lockheed Martin Skunk Works video where the company predicted a CFR propulsion system within 10 years (which would be now) and clean limitless power for the grid within 20 years (which would be 10 years from today).

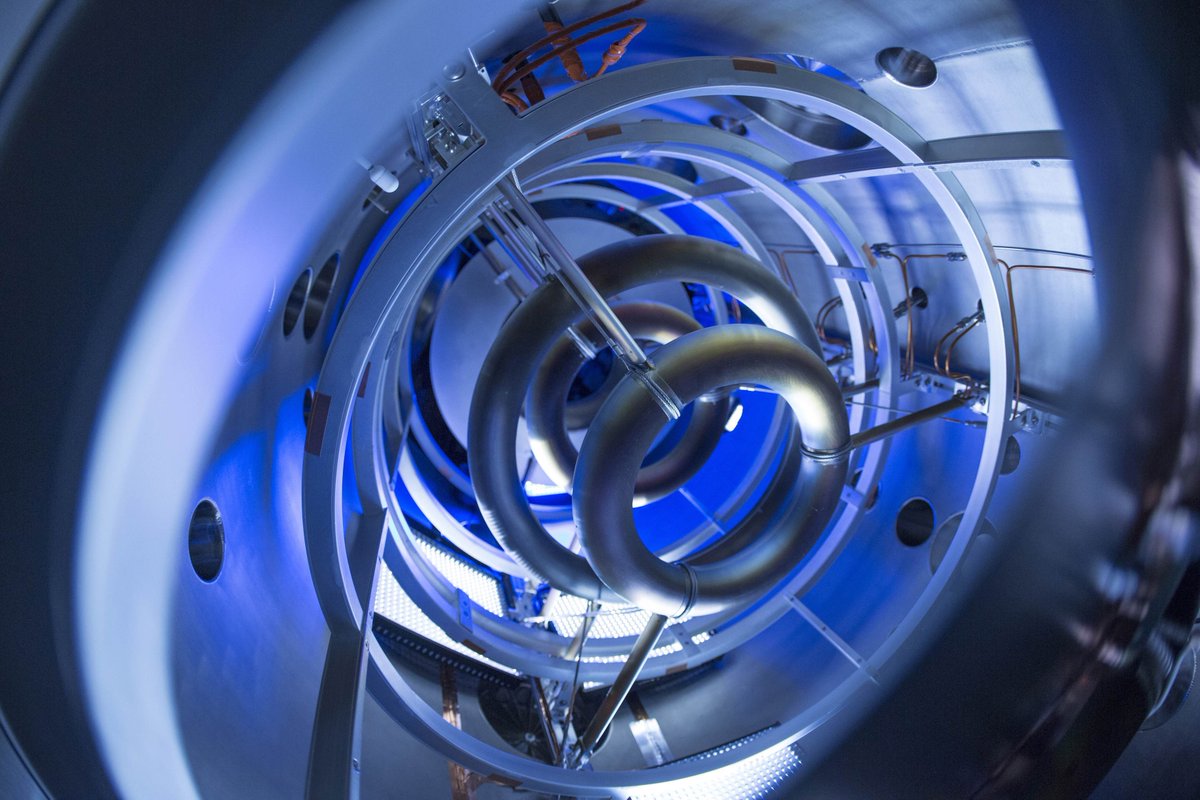

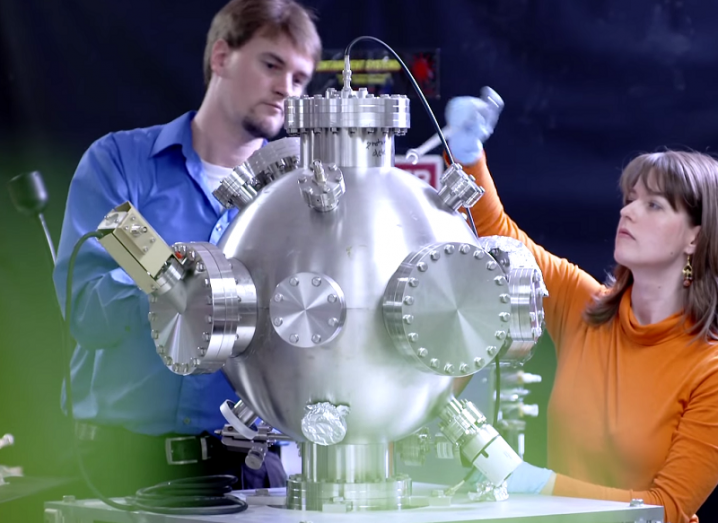

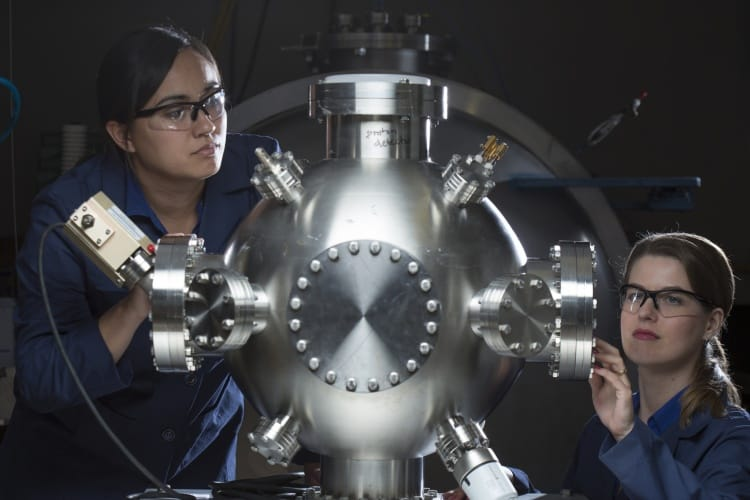

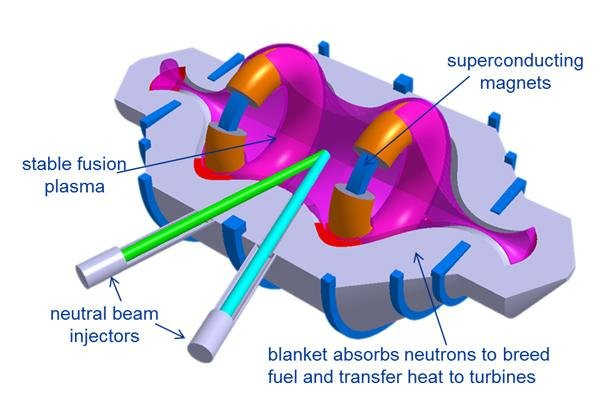

4/ So what is a Compact Fusion Reactor (CFR)? It provides clean and virtually limitless fusion energy in a much smaller, more efficient device compared to traditional large-scale fusion reactors like tokamaks.

5/ The CFR uses a novel magnetic confinement approach. It features superconducting coils that produce a high-beta configuration, enabling the plasma pressure to be equal to or exceed magnetic pressure,

6/ This compact design allows it to be significantly smaller—potentially fitting on the back of a truck—yet powerful enough to generate substantial energy, enough to power a city of up to 100,000 people.

7/ The CFR works by heating hydrogen plasma to extremely high temperatures, around hundreds of millions of degrees, enabling hydrogen nuclei (ions) to overcome their natural electrostatic repulsion and fuse, releasing enormous amounts of energy.

8/ Instead of the traditional toroidal (doughnut) magnetic field used by tokamaks, CFR uses a series of superconducting coils arranged to produce a magnetic field configuration that confines plasma inside the reaction chamber.

9/ This approach provides very efficient plasma confinement with reduced instabilities, allowing a smaller reactor volume and higher plasma pressure. Once fusion begins, the energy from the reaction sustains the plasma temperature, creating a self-perpetuating process.

10/ The heat produced is transferred through heat exchangers to drive turbines and generate electricity or propulsion power.

11/ If Skunk Works has successfully developed a commercialized CFR, it would revolutionize energy production, providing a clean, safe, and virtually limitless source of energy without the long-lived radioactive waste associated with fission.

12/ Importantly, CFR would provide a compact and mobile power source, adaptable for various applications including powering cities, industrial processes, remote locations, ships, aircraft carriers, long-duration space missions and, yes, Bitcoin mining.

13/ If a commercial CFR became a reality it would provide essentially limitless, and extremely low-cost, clean energy and fundamentally transform Bitcoin mining by slashing operational expenses — electricity typically accounts for 70-80% of mining costs today.

14/ The advent of CFR would initially make mining far more profitable for adopting operators, but market dynamics, including Bitcoin's difficulty adjustment mechanism and Jevons Paradox, would quickly reshape mining in ways we cannot yet fully appreciate.

https://x.com/level39/status/1760385736707367180

15/ With energy costs approaching zero, the break-even point for mining would drop dramatically. While this would seemingly reduce the security budget at first glance, Jevons Paradox suggests that, in reality, hashrate would massively accelerate.

https://x.com/level39/status/1760385732999270547

16/ If energy costs halve, hashrate could roughly double to restore cost-revenue balance, keeping the total cost of securing the network stable. With cheap energy available to everyone, attackers would still need to acquire massive hardware and infrastructure.

17. An operation of that magnitude could potentially take years and billions of dollars, as attackers would be chasing a moving target while honest miners scale up too.

18/ In the extreme (near-zero energy costs), security could plausibly increase dramatically because hashrate becomes so immense that attacks are practically impossible, even for nation-states.

19/ It is also plausible that CFR could play a pivotal role in addressing Bitcoin's post-2140 security budget —potentially solving it altogether. With energy nearing free, the marginal cost of adding hashrate drops dramatically. Miners could deploy vastly more hardware.

20/ With CFR, even a modest post-2140 fee budget could support an astronomically high hashrate, making 51% attacks infeasible—even for well-funded adversaries like governments.

21/ Abundant energy could also indirectly grow fees by accelerating Bitcoin adoption. A hyper-secure network (thanks to sky-high hashrate) builds trust, drawing more users and economic activity.

22/ Bitcoin will almost certainly be powered by compact fusion reactors in our lifetime. The time to begin envisioning the impacts of CFR on Bitcoin, AI and energy grids around the world starts now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh