🚨🇷🇺🇺🇸🇪🇺 ENERGY WARS IGNITE: A New World Order is Rewriting Global Oil & Gas Rules

This isn't just markets—it's a US-led power grab to rewire the world's energy grid. The stakes? Global dominance.

Buckle up for the truth🧵👇

This isn't just markets—it's a US-led power grab to rewire the world's energy grid. The stakes? Global dominance.

Buckle up for the truth🧵👇

The American Agenda: Pressure & Profit

Washington’s goal is clear: rebalance global energy demand in favor of US producers. The strategy is two-pronged:

🔸Pressure on Europe: Force an accelerated transition away from Russian energy.

🔸Tariffs on China/India: Punish those still buying Russian oil.

Washington’s goal is clear: rebalance global energy demand in favor of US producers. The strategy is two-pronged:

🔸Pressure on Europe: Force an accelerated transition away from Russian energy.

🔸Tariffs on China/India: Punish those still buying Russian oil.

Brussels is caught in an impossible position.

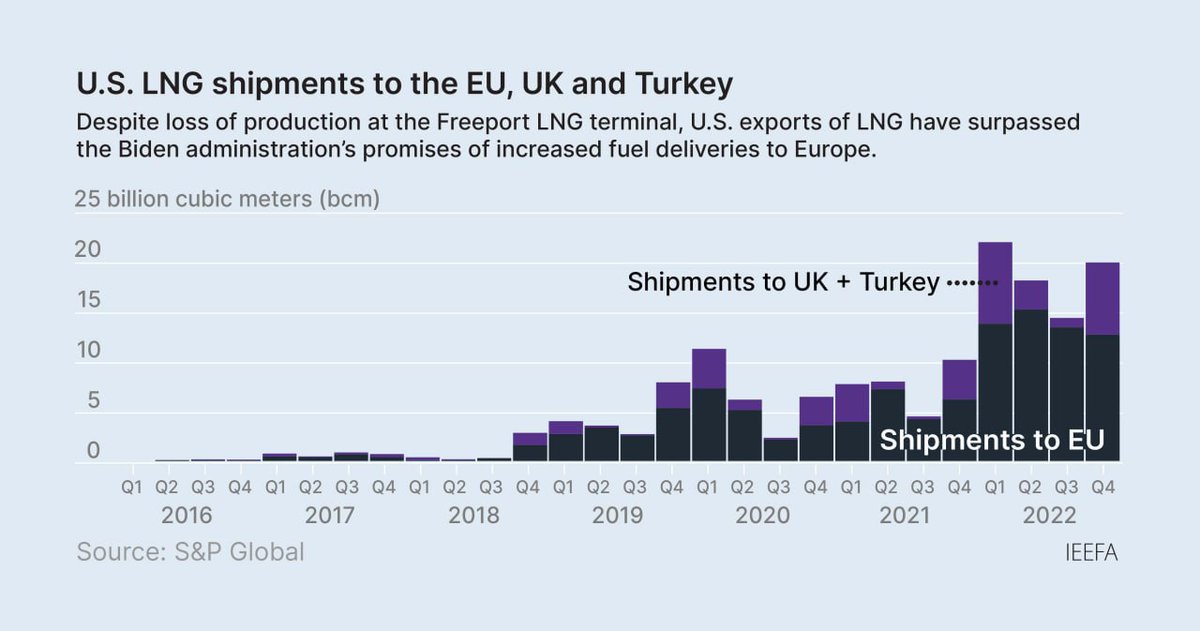

🔸It has acquiesced to the first demand, signing off on $250B in US oil & LNG purchases.

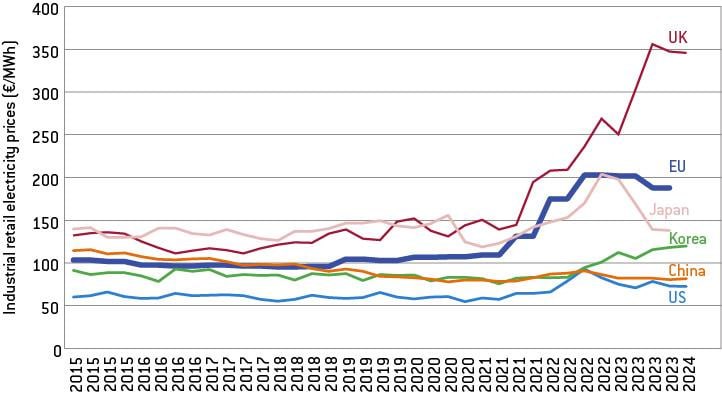

🔸But imposing tariffs on China/India is suicidal. The EU economy couldn't withstand rising energy costs AND retaliatory measures on its industrial chains.

🔸It has acquiesced to the first demand, signing off on $250B in US oil & LNG purchases.

🔸But imposing tariffs on China/India is suicidal. The EU economy couldn't withstand rising energy costs AND retaliatory measures on its industrial chains.

Trump's pressure on Europe serves a concrete purpose:

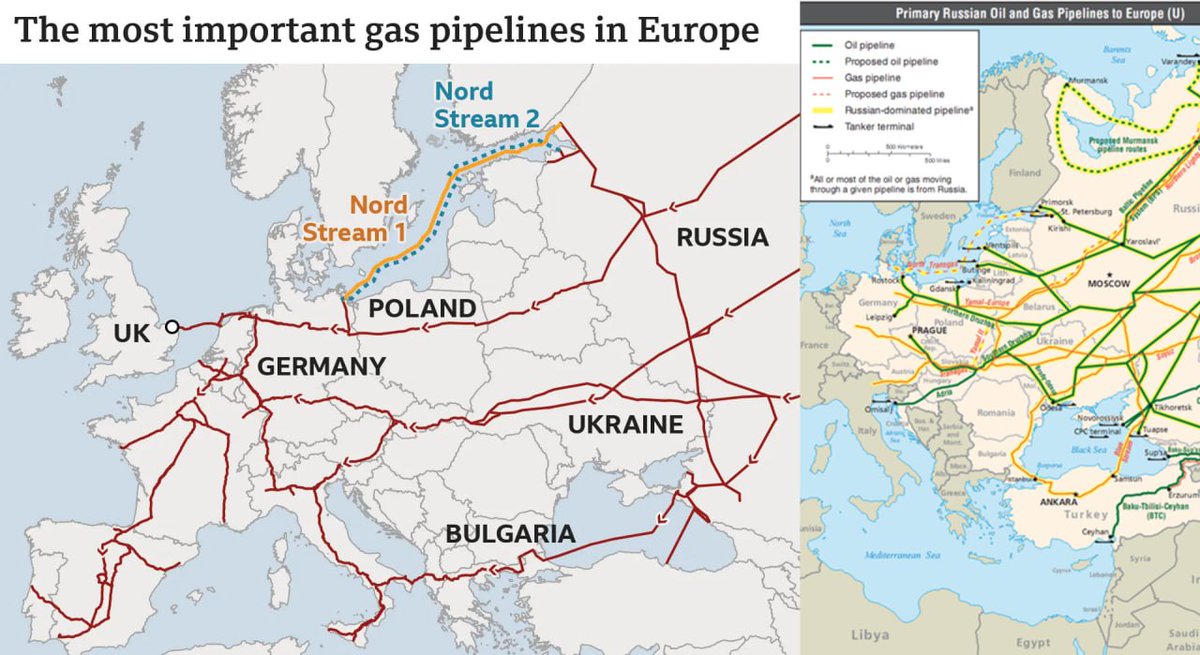

🔸Minimum Goal: Monopoly power for US companies in the EU market + leverage to gain a share of the Russian fuel supply chain to Europe (control over routes like Nord Stream).

🔸Maximum Goal: Drag Europe into a full economic standoff with China.

🔸Minimum Goal: Monopoly power for US companies in the EU market + leverage to gain a share of the Russian fuel supply chain to Europe (control over routes like Nord Stream).

🔸Maximum Goal: Drag Europe into a full economic standoff with China.

Russia is a target, but also an inescapable part of the puzzle.

🔸Decades-old infrastructure doesn’t vanish overnight.

🔸US LNG can't eliminate geography, seasonality, or the "last-mile" problem.

🔸This reality fuels secret negotiations, moving from ideology to potential deals.

🔸Decades-old infrastructure doesn’t vanish overnight.

🔸US LNG can't eliminate geography, seasonality, or the "last-mile" problem.

🔸This reality fuels secret negotiations, moving from ideology to potential deals.

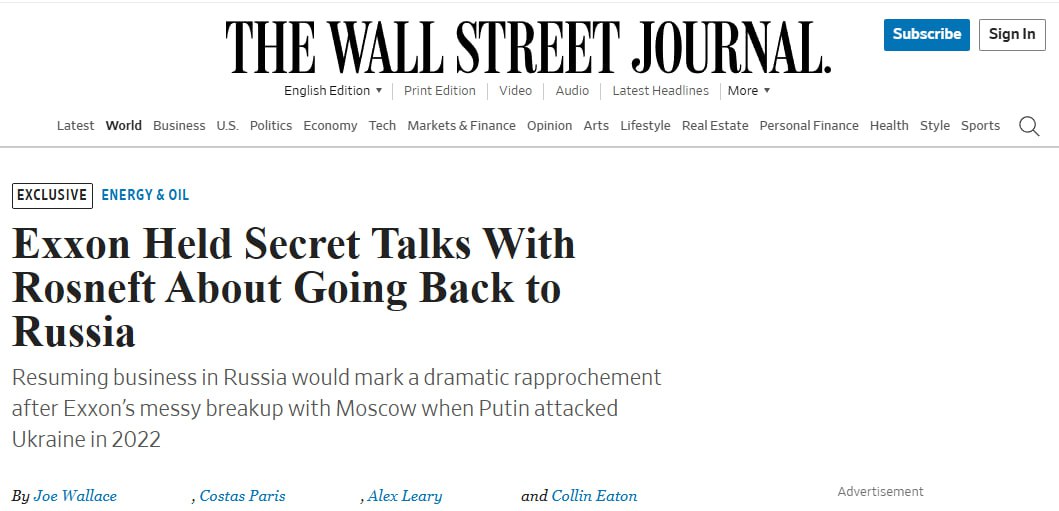

Even US energy giants are playing a double game.

🔸Publicly: ExxonMobil says it has no plans to return to Russia.

🔸Privately: Reports of secret contacts with Rosneft signal that bridges are not burned, but "dismantled section by section" for potential reassembly.

🔸Publicly: ExxonMobil says it has no plans to return to Russia.

🔸Privately: Reports of secret contacts with Rosneft signal that bridges are not burned, but "dismantled section by section" for potential reassembly.

China and India are facing the challenges:

🔸They are vying for new discounts on Russian energy.

🔸They benefit from price arbitrage, turning Western pressure on Russia into their own economic advantage.

🔸They are vying for new discounts on Russian energy.

🔸They benefit from price arbitrage, turning Western pressure on Russia into their own economic advantage.

Japan's Strategic Maneuvering Efforts:

🔸It rejected raising duties on Russian molecules, hiding behind WTO rules.

🔸The real goal: protecting its strategic position in LNG, specifically the critical Sakhalin-2 project.

🔸It rejected raising duties on Russian molecules, hiding behind WTO rules.

🔸The real goal: protecting its strategic position in LNG, specifically the critical Sakhalin-2 project.

EU Fractures: Centers vs. Peripheries

🔸Core (von der Leyen): Announces accelerated phaseouts and new sanctions.

🔸Periphery (Hungary, Slovakia): Seek exceptions, fearing industrial collapse without Russian crude. They hope Trump's threats are just a negotiating tactic.

🔸Core (von der Leyen): Announces accelerated phaseouts and new sanctions.

🔸Periphery (Hungary, Slovakia): Seek exceptions, fearing industrial collapse without Russian crude. They hope Trump's threats are just a negotiating tactic.

The Battle of Schedules: Regulation vs. Reality

🔸Regulators write 200 pages of complex "exceptions."

🔸The Market adapts overnight, finding new routes and payment methods. Industry clings to "today's gas" over "tomorrow's promises."

🔸Regulators write 200 pages of complex "exceptions."

🔸The Market adapts overnight, finding new routes and payment methods. Industry clings to "today's gas" over "tomorrow's promises."

Europe faces a choice with no good outcome:

🔸Rapid Rupture: A blow to industry from high energy costs and a tariff war with Asia.

🔸Slow Rupture: Living in a world of "exceptions," losing agency to Washington, and enduring constant uncertainty.

🔸Rapid Rupture: A blow to industry from high energy costs and a tariff war with Asia.

🔸Slow Rupture: Living in a world of "exceptions," losing agency to Washington, and enduring constant uncertainty.

Conclusion: Energy is the Foundation, Not a Tool

Oil and gas are again the primary factor in strategic choice. The reshuffling of routes is a direct reflection of a new world order where energy is the foundation of geopolitics.

This realignment is not a temporary shift—it will define the landscape for a long time.

Oil and gas are again the primary factor in strategic choice. The reshuffling of routes is a direct reflection of a new world order where energy is the foundation of geopolitics.

This realignment is not a temporary shift—it will define the landscape for a long time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh