🚨 Ripple’s 24 Hour Bombshell.

Partnerships with BlackRock, VanEck, DBS & Franklin Templeton.

All the NDAs are now coming to light!

You’ve got the blueprint for the NEW FINANCIAL SYSTEM.

Let me explain🧵👇

Partnerships with BlackRock, VanEck, DBS & Franklin Templeton.

All the NDAs are now coming to light!

You’ve got the blueprint for the NEW FINANCIAL SYSTEM.

Let me explain🧵👇

(1/🧵) BlackRock 🤝 Ripple

BlackRock’s BUIDL Fund (tokenized U.S. Treasuries) now runs on Ripple rails.

Through @Securitize + $RLUSD → these bonds can be exchanged instantly, 24/7.

This isn’t “crypto.”

This is the world’s largest asset manager testing Ripple as its settlement layer.

BlackRock’s BUIDL Fund (tokenized U.S. Treasuries) now runs on Ripple rails.

Through @Securitize + $RLUSD → these bonds can be exchanged instantly, 24/7.

This isn’t “crypto.”

This is the world’s largest asset manager testing Ripple as its settlement layer.

(2/🧵) VanEck 🤝 Ripple

VanEck’s VBILL (another tokenized Treasury fund) has joined the same rails.

Together BUIDL + VBILL = a multi-trillion dollar market of tokenized Treasuries beginning to flow across XRPL.

Think about that: the safest assets in the world → live liquidity on Ripple.

VanEck’s VBILL (another tokenized Treasury fund) has joined the same rails.

Together BUIDL + VBILL = a multi-trillion dollar market of tokenized Treasuries beginning to flow across XRPL.

Think about that: the safest assets in the world → live liquidity on Ripple.

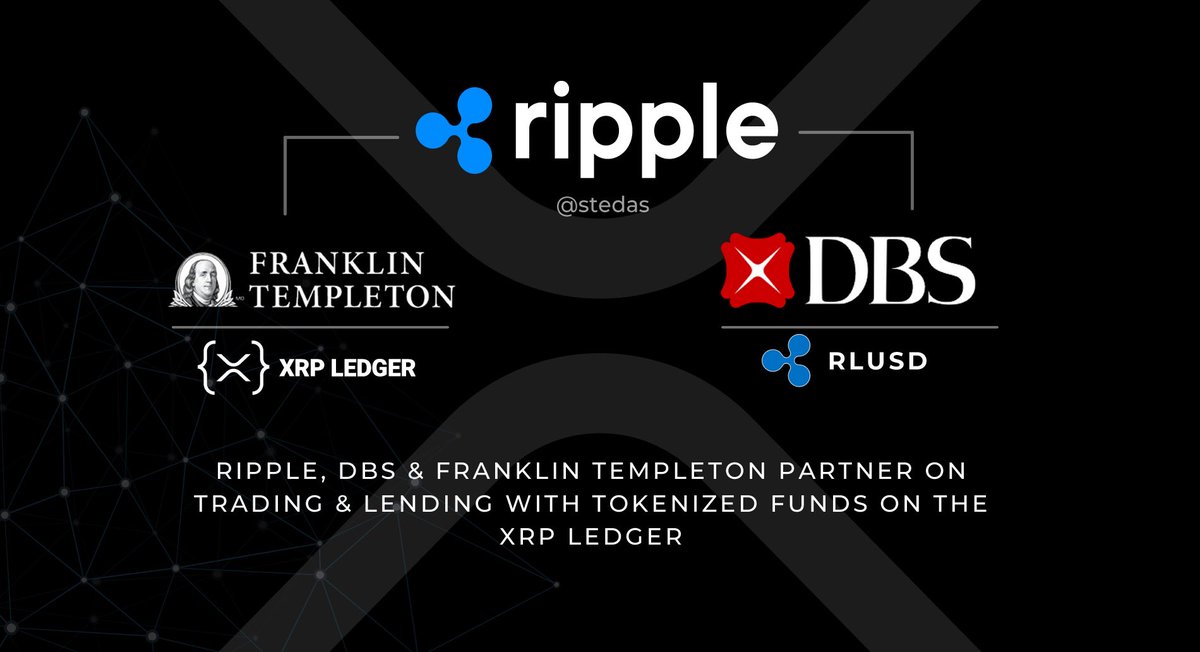

(3/🧵) DBS 🤝 Ripple

Ripple partnered with DBS (Singapore’s biggest bank) + Franklin Templeton.

They’re launching repo markets + money market funds on XRPL.

This is Wall Street plumbing moving onchain: overnight liquidity, collateralized credit, and yield… all via $RLUSD.

Ripple partnered with DBS (Singapore’s biggest bank) + Franklin Templeton.

They’re launching repo markets + money market funds on XRPL.

This is Wall Street plumbing moving onchain: overnight liquidity, collateralized credit, and yield… all via $RLUSD.

(4/🧵) So in 24 hours:

•BlackRock (BUIDL)

•VanEck (VBILL)

•Franklin Templeton (MMFs)

•DBS (repo markets)

All plugged into Ripple’s stablecoin rail, $RLUSD.

💡 Institutions are not “testing crypto.”

They are rewiring the financial system on XRPL.

•BlackRock (BUIDL)

•VanEck (VBILL)

•Franklin Templeton (MMFs)

•DBS (repo markets)

All plugged into Ripple’s stablecoin rail, $RLUSD.

💡 Institutions are not “testing crypto.”

They are rewiring the financial system on XRPL.

(5/🧵) Ripple 🤝 WallStreet

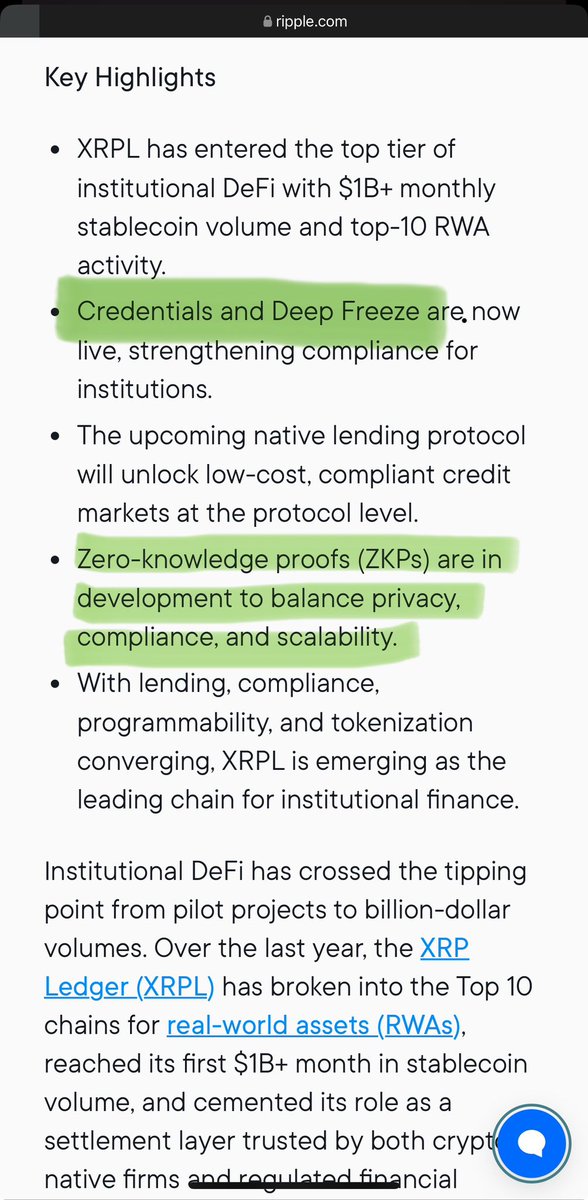

Ripple just announced the next phase: Credentials, Deep Freeze & Zero-Knowledge Proofs (ZKPs).

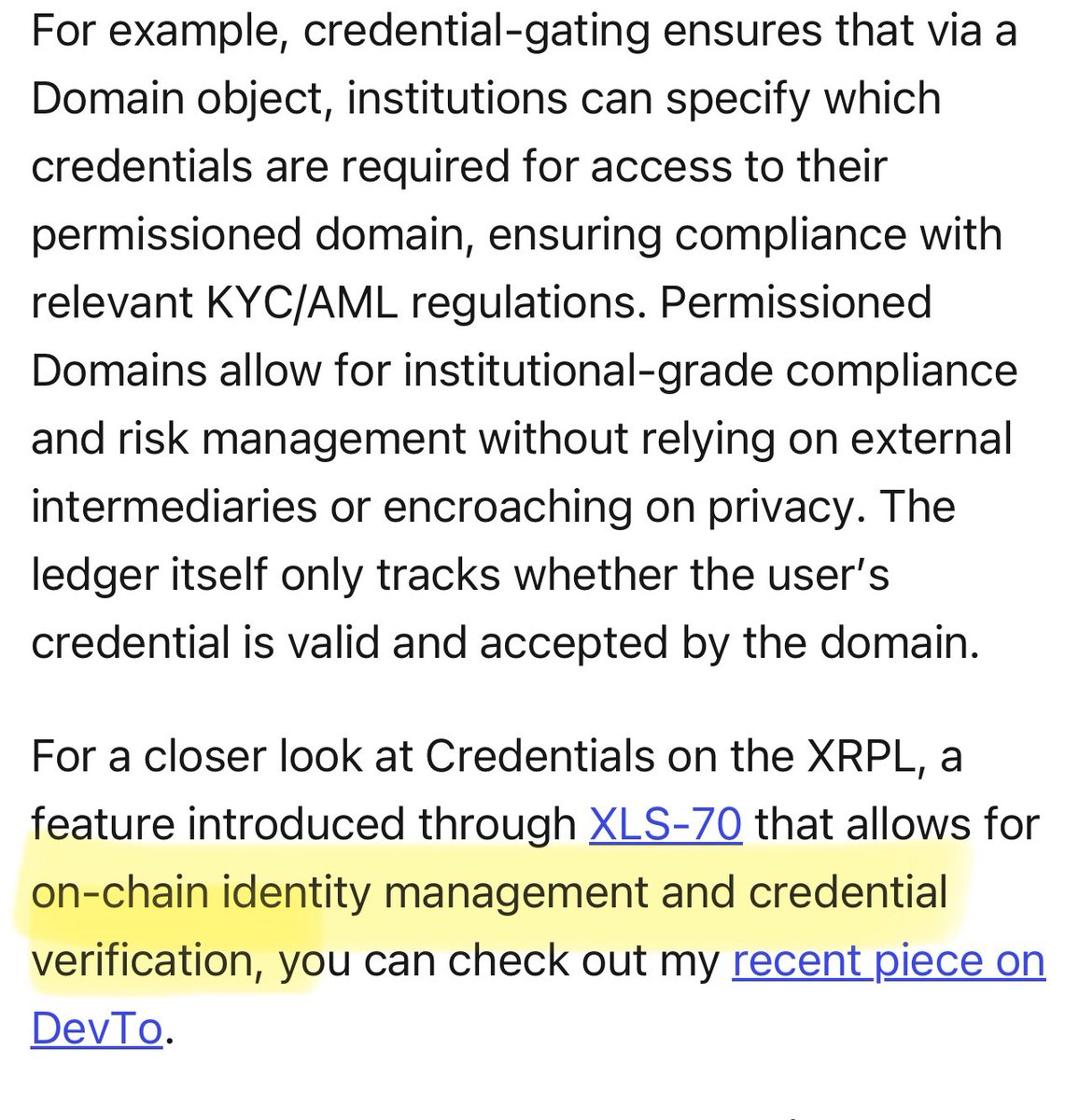

→ Credentials = institutional digital identity.

→ Deep Freeze = regulator-approved emergency compliance.

→ ZKPs = private yet auditable flows.

ripple.com/insights/the-n…

Ripple just announced the next phase: Credentials, Deep Freeze & Zero-Knowledge Proofs (ZKPs).

→ Credentials = institutional digital identity.

→ Deep Freeze = regulator-approved emergency compliance.

→ ZKPs = private yet auditable flows.

ripple.com/insights/the-n…

(6/🧵) Here’s the part nobody’s connecting:

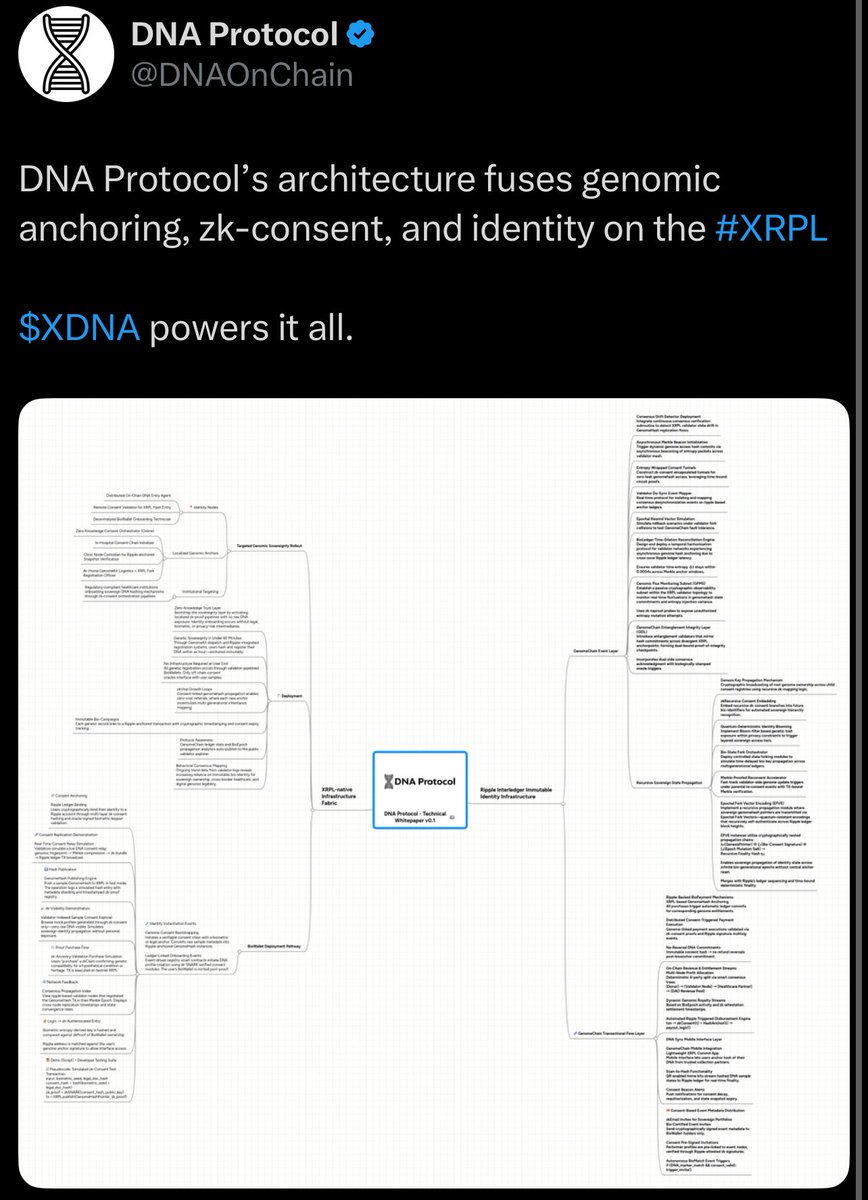

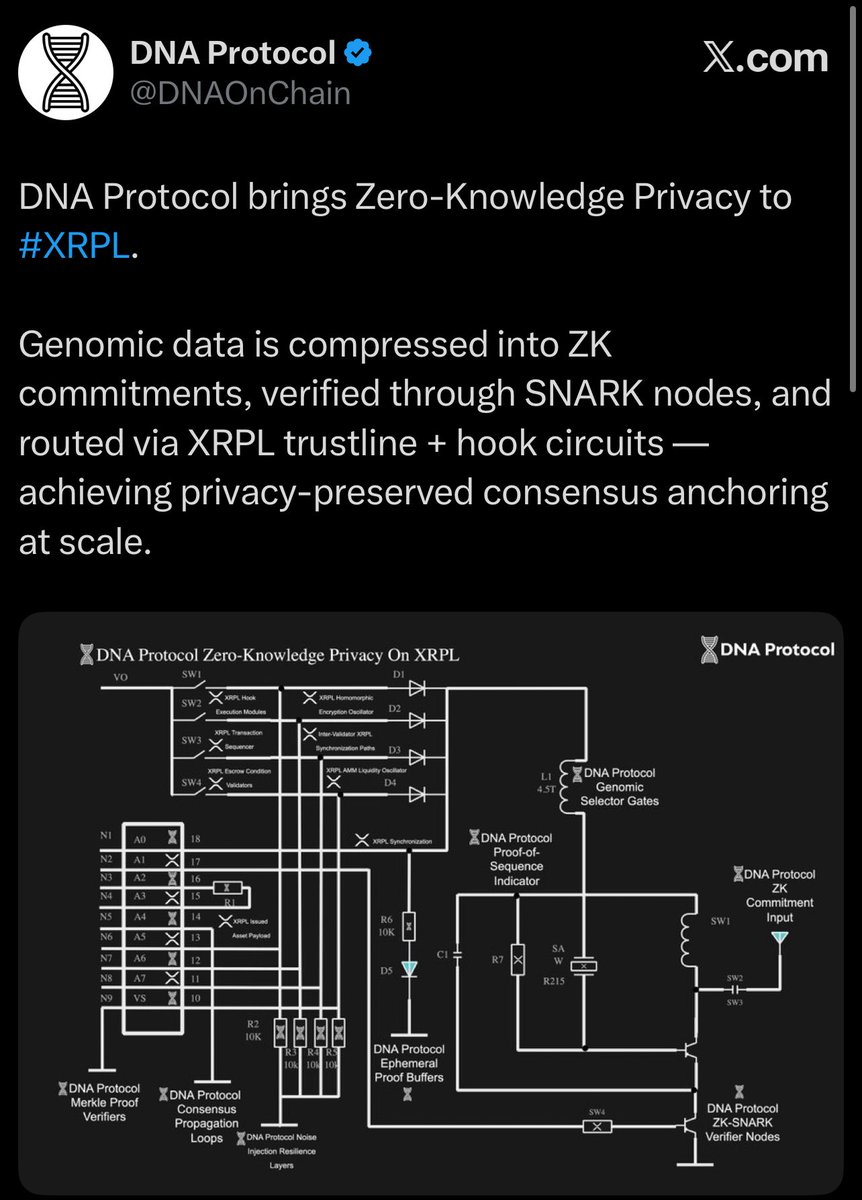

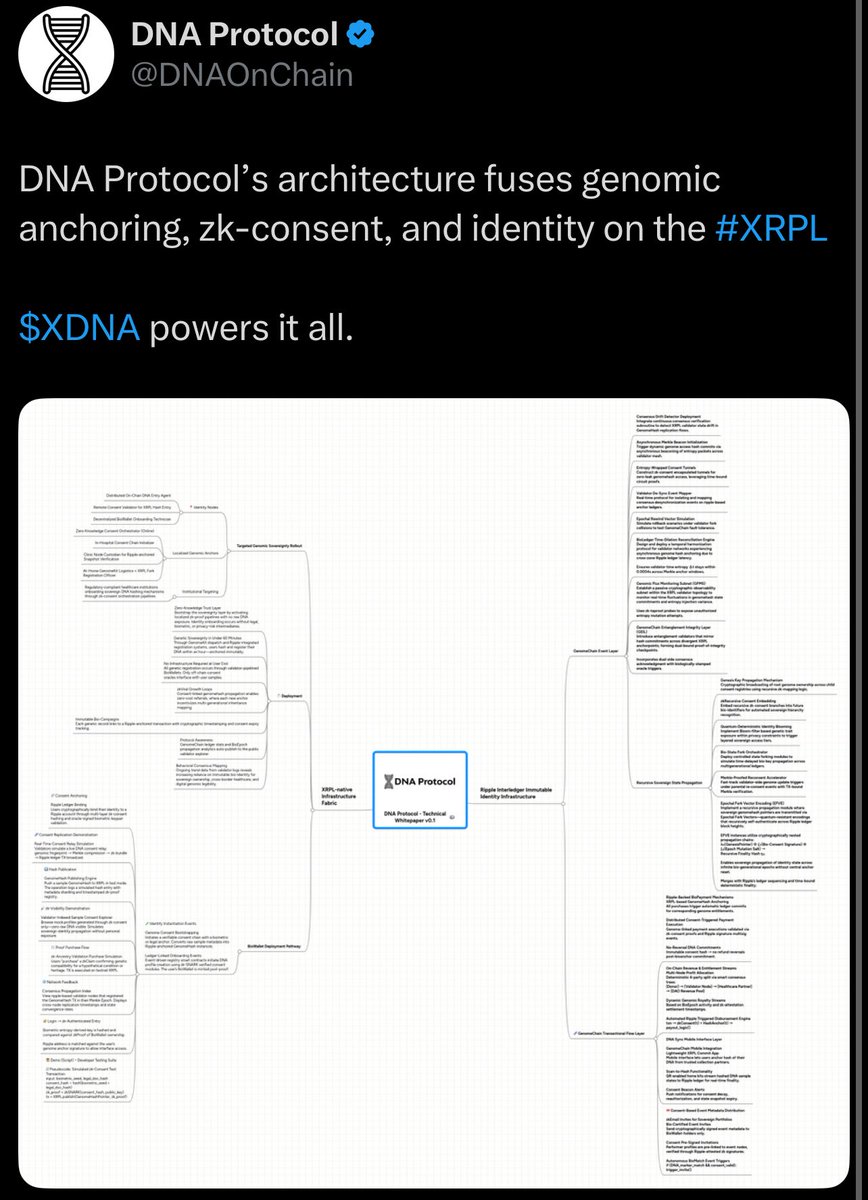

@DNAOnChain is the only protocol on XRPL that has been working on credential systems with ZK-proof, exactly as announced by Ripple.

Building zero-knowledge credential rails for institutions like BlackRock, SWIFT, FED, ECB & more.

It allows trillions in liquidity to move safely, with zk-proof privacy.

xdna.dnaprotocol.org

@DNAOnChain is the only protocol on XRPL that has been working on credential systems with ZK-proof, exactly as announced by Ripple.

Building zero-knowledge credential rails for institutions like BlackRock, SWIFT, FED, ECB & more.

It allows trillions in liquidity to move safely, with zk-proof privacy.

xdna.dnaprotocol.org

(7/🧵) Think of it as Ripple’s Credential layer:

•Institutions get credentials

•Regulators get compliance

•Investors get privacy

Such protocols are crucial only if you’re going to take on the FED and SWIFT👀

This isn’t theory. Ripple just confirmed it’s LIVE.

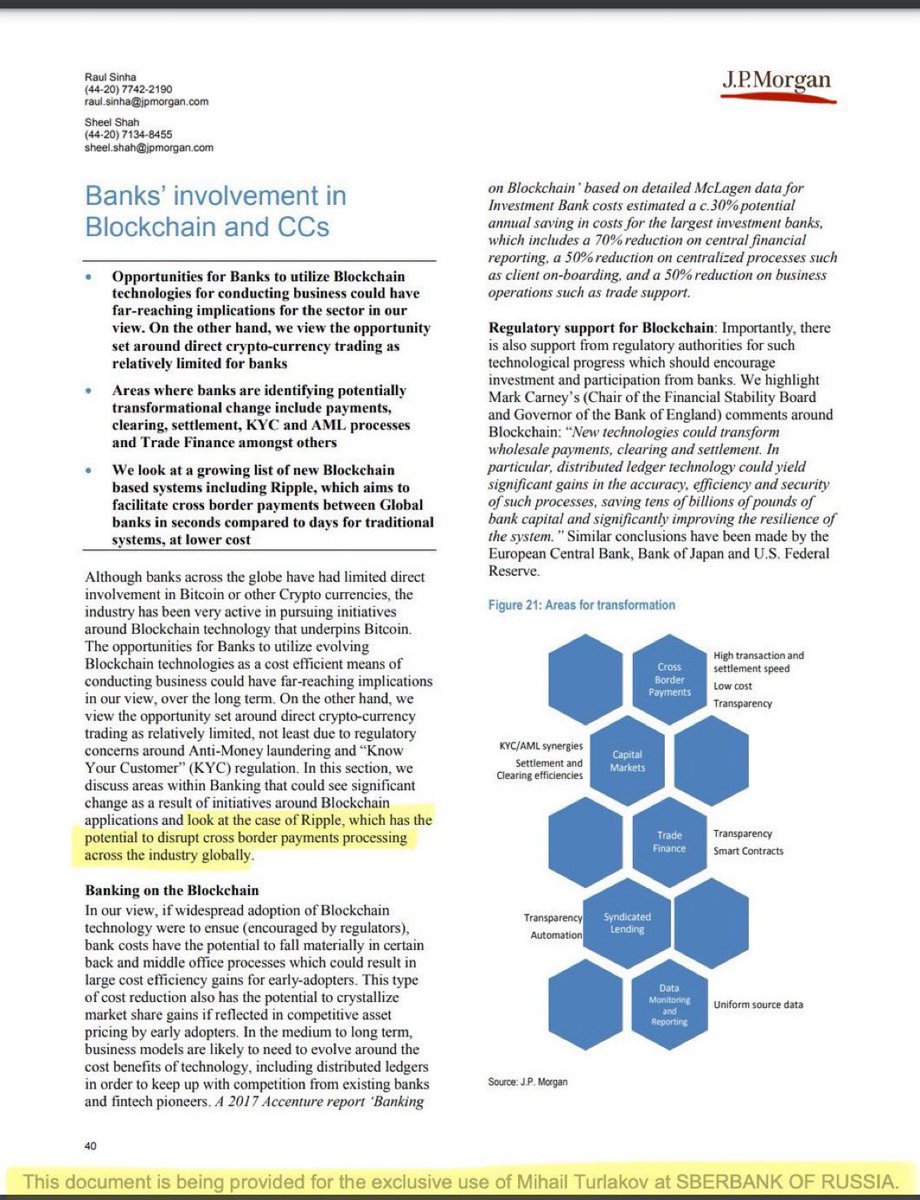

JP Morgan and WEF are also in👇

•Institutions get credentials

•Regulators get compliance

•Investors get privacy

Such protocols are crucial only if you’re going to take on the FED and SWIFT👀

This isn’t theory. Ripple just confirmed it’s LIVE.

JP Morgan and WEF are also in👇

(8/🧵) Ripple 🤝 BlackRock’s $XRP ETF

BlackRock CEO Larry Fink also acted strange when asked about an $XRP ETF, as if something was holding him back(an NDA).

A credential system was crucial for big players like BlackRock and JP Morgan to come in!

Brad had even dropped a hint👇

xdna.dnaprotocol.org

BlackRock CEO Larry Fink also acted strange when asked about an $XRP ETF, as if something was holding him back(an NDA).

A credential system was crucial for big players like BlackRock and JP Morgan to come in!

Brad had even dropped a hint👇

xdna.dnaprotocol.org

(9/🧵) You can ignore it, or you can see the dots: BlackRock, VanEck, DBS, Franklin Templeton don’t “test” retail coins.

They build the rails of the next system.

Ripple owns the settlement… and @DNAOnChain powers the credentials.

The flip has already started. 🚀

xdna.dnaprotocol.org

They build the rails of the next system.

Ripple owns the settlement… and @DNAOnChain powers the credentials.

The flip has already started. 🚀

xdna.dnaprotocol.org

(10/10) 📂 For deeper analysis, supporting documents, and ongoing research into Ripple’s role in global financial infrastructure, I share everything in my Telegram community.

Join me there for the full picture👇

t.me/ripplercult

Join me there for the full picture👇

t.me/ripplercult

• • •

Missing some Tweet in this thread? You can try to

force a refresh