Lot of crypto folks asking me "What happened?"...

It's probably time to dust off the Taleb book 'Antifragile'.

The amount of Open Interest that has been taken off in one day is unreal. 15B -> 6B on hyperliquid alone, the real total number must be insane!

People always want a clear simple headline. FTX, Luna, Celsius, we've had plenty smoking gun collapses in the past so makes sense to look.

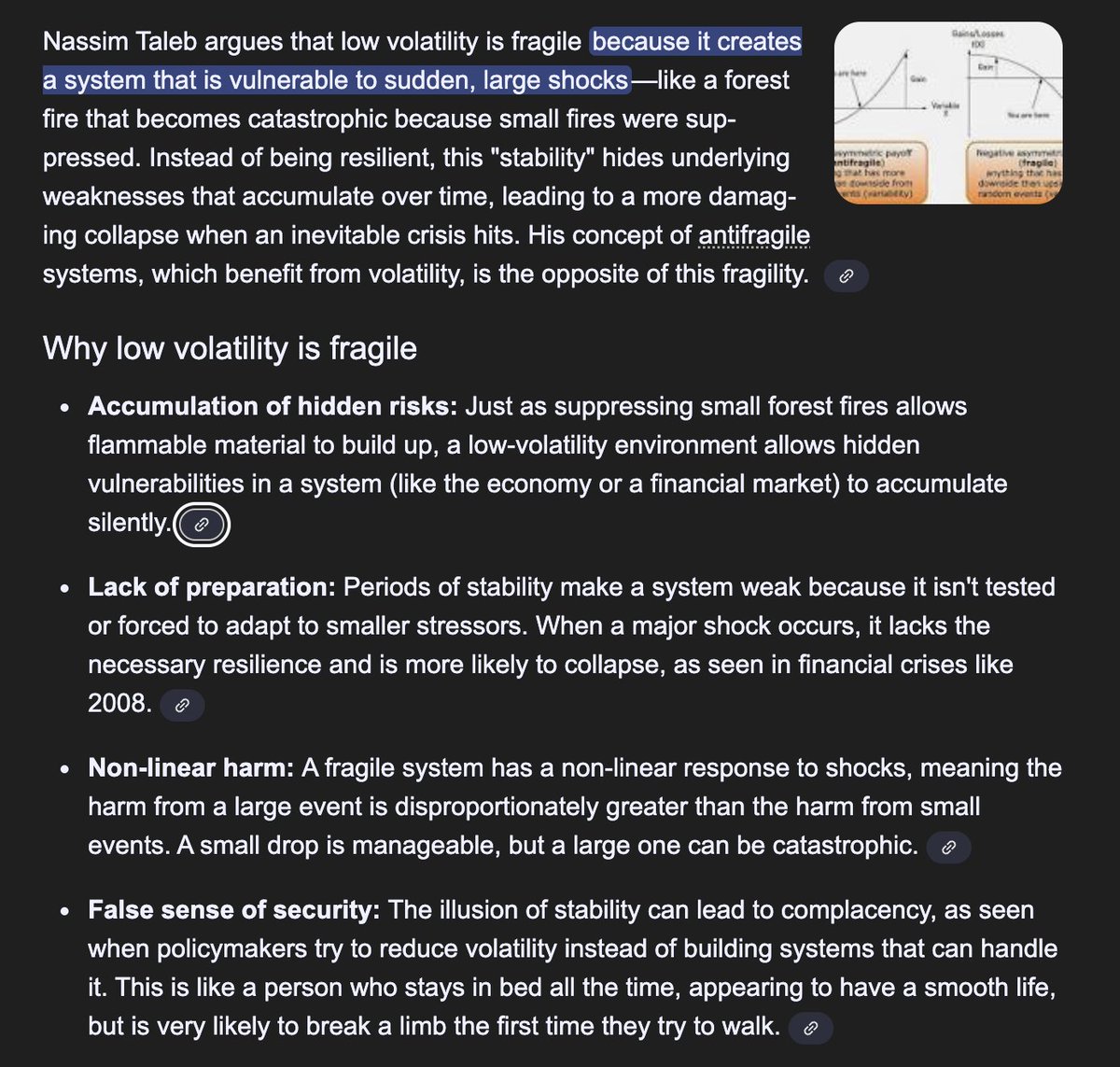

But most likely this is more like the liquidation cascade of May 2021 where after months of run-up and low volatility, people start taking more and more risk as they chase more money.

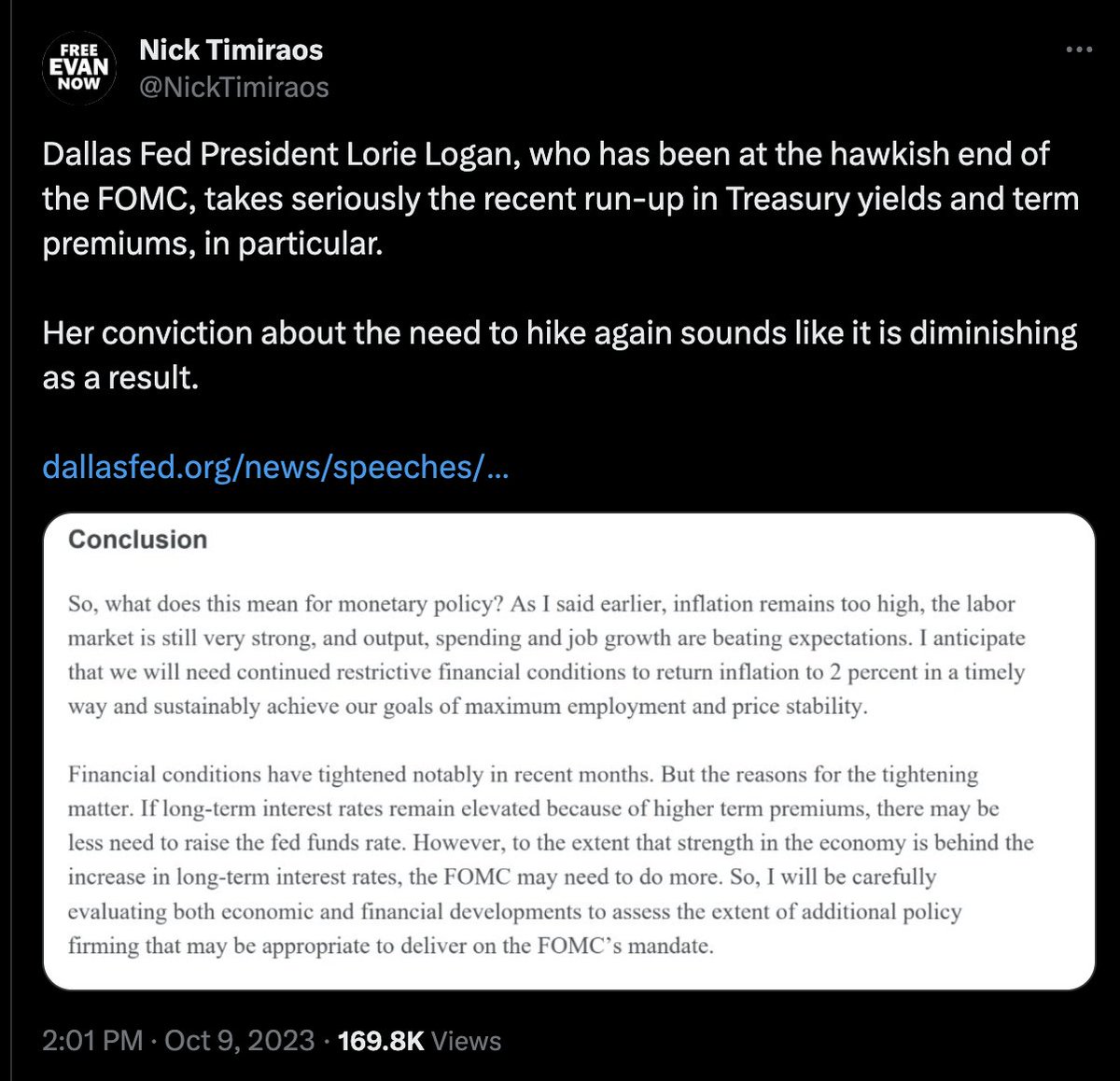

Especially in this macro environment where gold is at $4k, stocks break all time high every day, and even if you are up you don't know if you are up relative to others when the denominator USD is rekt.

In recent months I've been hearing more and more retarded theses for buying coins. Did you know that CZ's gardener dog is called $ASTERIX? Time to bet on that shit, its BSC season.

Solana trenchers used to flipping shitcoins on their mobile phantom trying to tell me why this or that shitty perp dex is worth billions. Zero self-awareness of knowing what their game is and what it isnt.

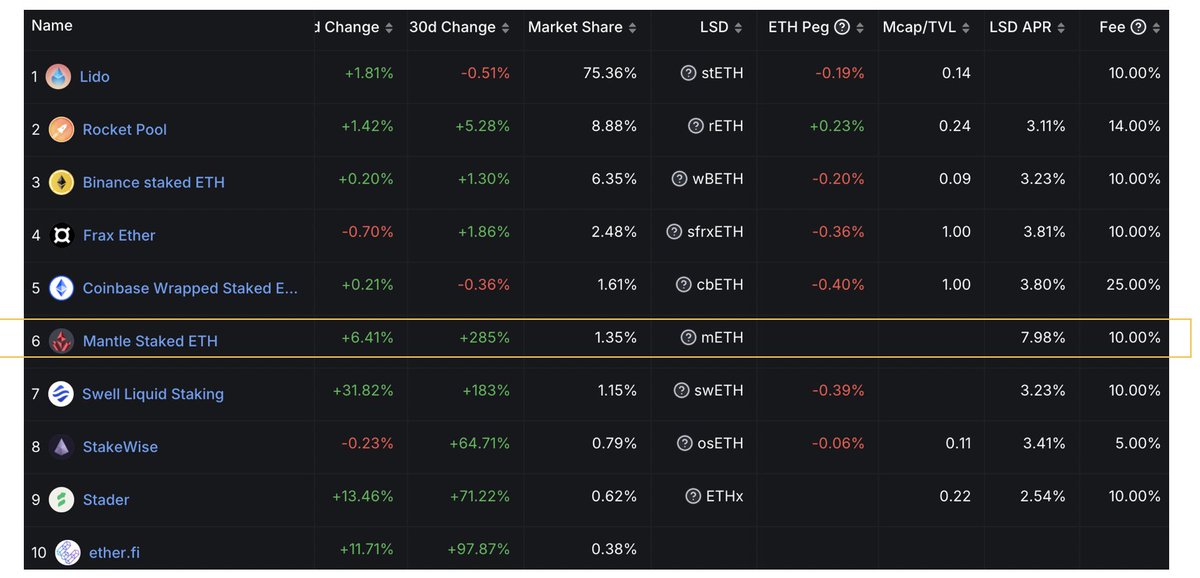

Add to that people chasing perps as a narrative, while the liquidity isnt there to support. Hidden risks everywhere, where people are using synthetic dollars as collateral, trading premarket perps with no funding external reference, and telling you not to cry in the casino like they are some hotshot from a Joe Pesci mob movie.

Reality is, in recent months as we were awash with liquidity and every launch was faced with a huge hot ball of money, a lot of the fragility was being hidden under it.

Too much FOMO from retail, not enough focus on robustness from founders seeing their token price as the school report card instead of thinking about their product being more resilient to shocks.

I get it, if you dont play the hype game in crypto you die anyway. If you dont fomo sometimes you miss the big trades. Its a fine balance and none of us are perfect at finding it. And maybe there are some timeless lessons from that cranky boomer that can at least explain why this happened.

It's probably time to dust off the Taleb book 'Antifragile'.

The amount of Open Interest that has been taken off in one day is unreal. 15B -> 6B on hyperliquid alone, the real total number must be insane!

People always want a clear simple headline. FTX, Luna, Celsius, we've had plenty smoking gun collapses in the past so makes sense to look.

But most likely this is more like the liquidation cascade of May 2021 where after months of run-up and low volatility, people start taking more and more risk as they chase more money.

Especially in this macro environment where gold is at $4k, stocks break all time high every day, and even if you are up you don't know if you are up relative to others when the denominator USD is rekt.

In recent months I've been hearing more and more retarded theses for buying coins. Did you know that CZ's gardener dog is called $ASTERIX? Time to bet on that shit, its BSC season.

Solana trenchers used to flipping shitcoins on their mobile phantom trying to tell me why this or that shitty perp dex is worth billions. Zero self-awareness of knowing what their game is and what it isnt.

Add to that people chasing perps as a narrative, while the liquidity isnt there to support. Hidden risks everywhere, where people are using synthetic dollars as collateral, trading premarket perps with no funding external reference, and telling you not to cry in the casino like they are some hotshot from a Joe Pesci mob movie.

Reality is, in recent months as we were awash with liquidity and every launch was faced with a huge hot ball of money, a lot of the fragility was being hidden under it.

Too much FOMO from retail, not enough focus on robustness from founders seeing their token price as the school report card instead of thinking about their product being more resilient to shocks.

I get it, if you dont play the hype game in crypto you die anyway. If you dont fomo sometimes you miss the big trades. Its a fine balance and none of us are perfect at finding it. And maybe there are some timeless lessons from that cranky boomer that can at least explain why this happened.

• • •

Missing some Tweet in this thread? You can try to

force a refresh