the most important thinker in AI, in my opinion, is this 23 year old. leo aschenbrenner.

he has been more right, both in a testable predictive sense and in a market sense than virtually anyone else.

and most importantly, he's not an AI doomer, he's not an e/acc, but rather a secret third thing.

he has been more right, both in a testable predictive sense and in a market sense than virtually anyone else.

and most importantly, he's not an AI doomer, he's not an e/acc, but rather a secret third thing.

leo was a reseacher on the openai superalignment team before he was fired in april 2024 (and before that, he worked at FTX of all places). in june 2024 he published an astonishing essay on AI called "Situational Awareness: The Decade Ahead"

situational-awareness.ai

situational-awareness.ai

in the 165-page essay (really, more of a book) he predicts that we will obtain recursively self-improving AI by 2027, leading to an intelligence implosion & AGI. he thinks AI will become a matter of national security and that the US has no choice but to beat China. he thinks we will have full-fledged agents in 2026. he thinks AI efforts will and should be nationalized. he thinks we will build trillion-dollar datacenters before the decade is out. he thinks AI will use 20%+ of US electricity by 2030.

a lot of his analysis is based on simply extrapolating straight lines into the future (compute, FLOPs, model capabilities). the thing is, this has totally held up.

a lot of his analysis is based on simply extrapolating straight lines into the future (compute, FLOPs, model capabilities). the thing is, this has totally held up.

daniel reeves in this post analyzes leo's predictions and finds that even though we are only 1 year in to his "decade-ahead" timeline, his predictions are holding up so far.

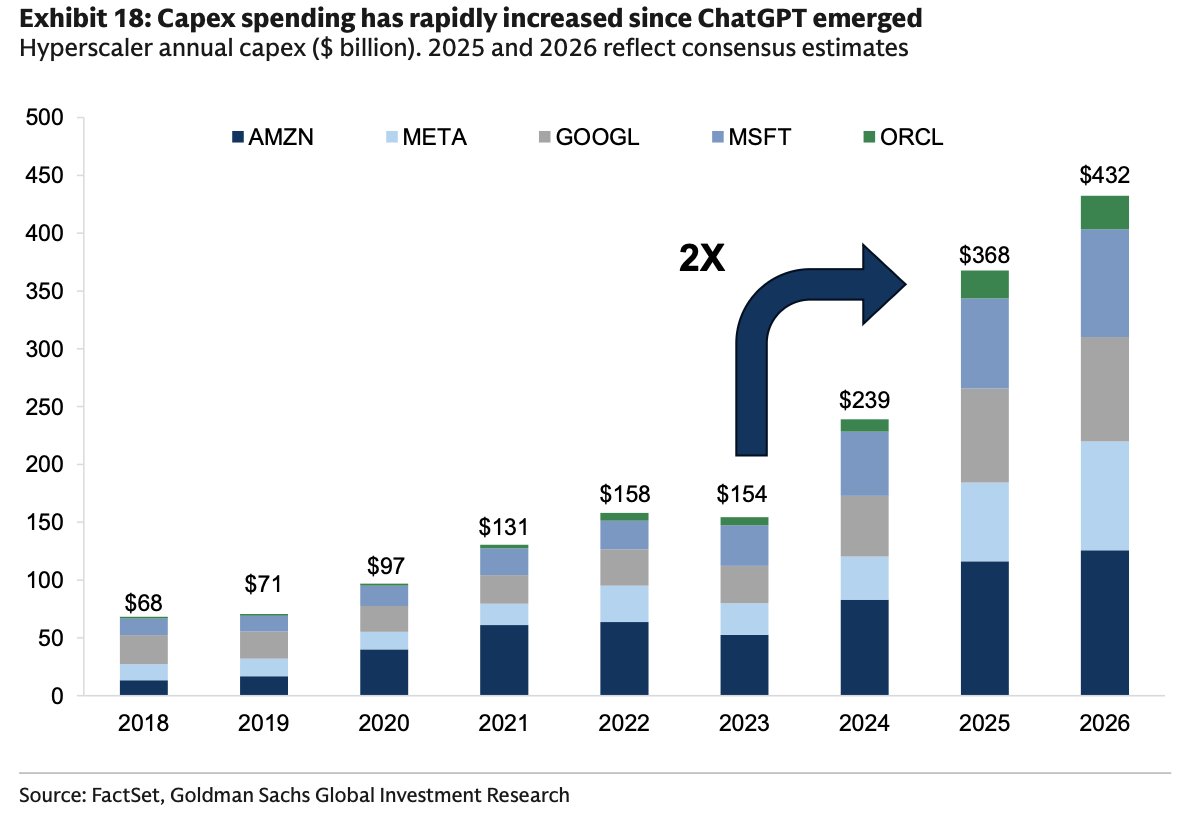

in the last year, AI CAPEX has dramatically expanded. Stargate is a $500b planned project. halfway there on its own.

Leo thought AI CapEx might reach 3% of GDP. hyperscaler CapEx jumped from $239b in 2024 to $368b according to GS and projected at $432b in '26.

according to reeves' book review 1 year on, it looks like leo is mostly hitting the mark.

agifriday.substack.com/p/aschenbrenner

in the last year, AI CAPEX has dramatically expanded. Stargate is a $500b planned project. halfway there on its own.

Leo thought AI CapEx might reach 3% of GDP. hyperscaler CapEx jumped from $239b in 2024 to $368b according to GS and projected at $432b in '26.

according to reeves' book review 1 year on, it looks like leo is mostly hitting the mark.

agifriday.substack.com/p/aschenbrenner

as a sidenote, one reason I really like Leo is because he maintains a kind of "pragmatic cautious optimism" around AI. he thinks it's a civilizationally important project and a matter of urgent national security. he thinks AGI and maybe ASI is possible, but he isn't a doomer. in fact, he's helping bring this future about (more on this later).

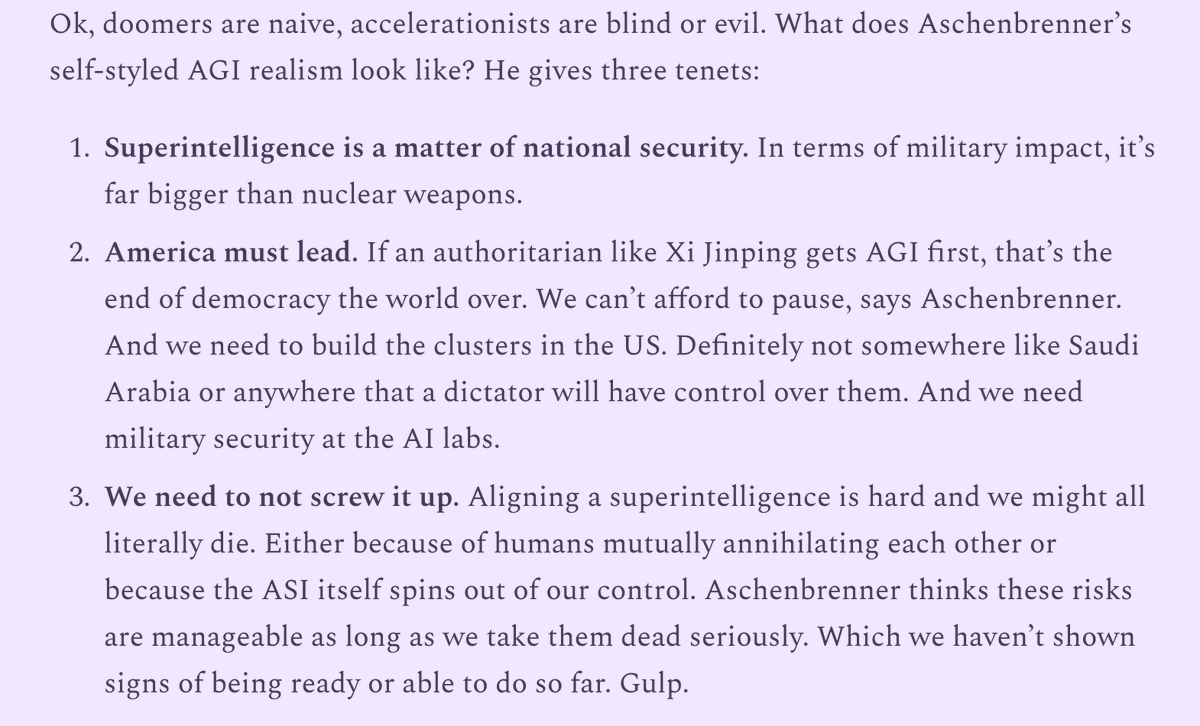

most "AI futurists" in silicon valley are doomers, unfortunately. they unhelpfully think AI is going to literally kill us all. I'm not going to try to "debunk" the doomer mentality here but I think it's far fetched and more of a spiritual/metaphysical position than an empirical one. (secular doomsday cults are the main thrust of religion-without-religion these days, whether climate or now AI.) the doomers also don't really have good suggestions for dealing with the apocalypse they foresee. they just want us to collectively stop building AI, or something. this isn't a very practical suggestion but they are very good at making noise, so they get disproportionate attention. there's a very big market for prophecies of doom and these people take advantage of that.

the second camp is the skeptics mainly found on the left that intone things like "AI is just a stochastic parrot" camp which we can trivially dismiss since they are just obviously wrong. these people tend to think all tech and markets are bad and wrong and think AI is a bubble. not much to say here, they are just wrong.

the other major camp is the e/accs that are kind of the inverse of the doomers; they want to push forward AI no matter what as a kind of political statement. they tend to be a little cavalier with regards to genuine AI safety risks and seem more motivated by owning the libs.

the last camp is simply the people building AI that have a strong economic incentive to downplay the risks. Leo isn't in this camp either. he's sanguine about the risks and the fact that this technology deserves a sort of manhattan project of its own. our ability to deal with it IS existential and he acknowledges that.

daniel reeves describes Leo's philosophy as "AGI realism" and it's the same camp that I subscribe to (even after reading every piece of doomer literature ever written).

most "AI futurists" in silicon valley are doomers, unfortunately. they unhelpfully think AI is going to literally kill us all. I'm not going to try to "debunk" the doomer mentality here but I think it's far fetched and more of a spiritual/metaphysical position than an empirical one. (secular doomsday cults are the main thrust of religion-without-religion these days, whether climate or now AI.) the doomers also don't really have good suggestions for dealing with the apocalypse they foresee. they just want us to collectively stop building AI, or something. this isn't a very practical suggestion but they are very good at making noise, so they get disproportionate attention. there's a very big market for prophecies of doom and these people take advantage of that.

the second camp is the skeptics mainly found on the left that intone things like "AI is just a stochastic parrot" camp which we can trivially dismiss since they are just obviously wrong. these people tend to think all tech and markets are bad and wrong and think AI is a bubble. not much to say here, they are just wrong.

the other major camp is the e/accs that are kind of the inverse of the doomers; they want to push forward AI no matter what as a kind of political statement. they tend to be a little cavalier with regards to genuine AI safety risks and seem more motivated by owning the libs.

the last camp is simply the people building AI that have a strong economic incentive to downplay the risks. Leo isn't in this camp either. he's sanguine about the risks and the fact that this technology deserves a sort of manhattan project of its own. our ability to deal with it IS existential and he acknowledges that.

daniel reeves describes Leo's philosophy as "AGI realism" and it's the same camp that I subscribe to (even after reading every piece of doomer literature ever written).

/ resume thread

so after writing his manifesto, Leo didn't rest on his laurels. he raised approx $1b for a hedge fund focused on AGI-associated bets in H2 2024.

he made bets on chip manufacturers (intel), datacenter-related businesses (broadcom, applied digital), neoclouds (core weave, iris energy, core sci), and utilities (vistra, talen energy, eqt corp)

he refused to be shaken out by the "deepseek" moment that terrified a lot of AI investors in early 2025

he printed a 47% return in the first half of the year

so after writing his manifesto, Leo didn't rest on his laurels. he raised approx $1b for a hedge fund focused on AGI-associated bets in H2 2024.

he made bets on chip manufacturers (intel), datacenter-related businesses (broadcom, applied digital), neoclouds (core weave, iris energy, core sci), and utilities (vistra, talen energy, eqt corp)

he refused to be shaken out by the "deepseek" moment that terrified a lot of AI investors in early 2025

he printed a 47% return in the first half of the year

notably, he had a huge intel call position in the fund. intel, ordinarily a sleep stock, skyrocketed in september when it emerged that the US government would take a stake in the company.

some of his other positions absolutely printed:

- IREN: 6x YTD

- CRWV: 3.5x YTD

- APLD: 4.3x YTD

we don't specifically know his returns since we are guessing based on his 13Fs and Intel strike prices, but I would guess his AUM is well over $2b today, and I believe he is up over 100% in 2025 so far. most likely one of the best performing HFs on the planet this year, especially the scale he's operating at.

some of his other positions absolutely printed:

- IREN: 6x YTD

- CRWV: 3.5x YTD

- APLD: 4.3x YTD

we don't specifically know his returns since we are guessing based on his 13Fs and Intel strike prices, but I would guess his AUM is well over $2b today, and I believe he is up over 100% in 2025 so far. most likely one of the best performing HFs on the planet this year, especially the scale he's operating at.

what I like about Leo is he's doing everything in public. he wrote down his view, and then with no money management expertise, raised a fund, and put capital behind his convictions. compare this with the "AI bubble" callers. how many of them are actually net short AI? how many raised a fund to short AI? I can't name one. writing down your views is one thing, but putting you entire net worth and staking your entire reputation on the trade is another.

it was "obvious" at the time that post ChatGPT release in nov 2022 that AI would be a huge theme, but how many people actually acted on this?

personally, I have a huge concentrated position in one of the names in his fund, and knowing that Leo was in the trade helped give me the conviction to stay in it, even as the market tried to shake me out (deepseek moment, census data etc). I also picked up IREN and APLD after seeing them in his 13F filings.

it was "obvious" at the time that post ChatGPT release in nov 2022 that AI would be a huge theme, but how many people actually acted on this?

personally, I have a huge concentrated position in one of the names in his fund, and knowing that Leo was in the trade helped give me the conviction to stay in it, even as the market tried to shake me out (deepseek moment, census data etc). I also picked up IREN and APLD after seeing them in his 13F filings.

sometimes in your career you just have to get one big thing very right and then apply the right amount of leverage to that idea. Leo is one of the best examples of this we've seen in some time.

we'll see if he can keep up his blistering pace but either way, it's one of the most interesting stories in money management I've come across in some time and I'll be watching carefully.

we'll see if he can keep up his blistering pace but either way, it's one of the most interesting stories in money management I've come across in some time and I'll be watching carefully.

• • •

Missing some Tweet in this thread? You can try to

force a refresh