Tennis legend, Bill Ackman, updates thesis behind his concentrated $13.7B portfolio

Here's an overview of his TOP 7 portfolio holdings 🧵👇

Here's an overview of his TOP 7 portfolio holdings 🧵👇

1/ $UBER | Uber

- Strong performance & cost control

- New AV partnerships & scaling tech faster than rivals

- Stock is undervalued

- Strong performance & cost control

- New AV partnerships & scaling tech faster than rivals

- Stock is undervalued

2/ $AMZN | Amazon

- Amazon’s a new buy: AWS leads cloud with 40%+ market share, poised for steady growth as IT workloads shift.

- E-commerce dominance

- Undervalued potential: Relentless focus on low costs and innovation drives long-term margin expansion.

- Amazon’s a new buy: AWS leads cloud with 40%+ market share, poised for steady growth as IT workloads shift.

- E-commerce dominance

- Undervalued potential: Relentless focus on low costs and innovation drives long-term margin expansion.

3/ $GOOG | Alphabet

- Alphabet’s AI leadership shines with AI Overviews serving 2B+ users across 200 countries.

- YouTube dominates watch time in the U.S., boosting ad revenue with innovative upgrades.

- Veo3’s viral hit with 70M videos created since May launch, enhancing Google’s app ecosystem

- Alphabet’s AI leadership shines with AI Overviews serving 2B+ users across 200 countries.

- YouTube dominates watch time in the U.S., boosting ad revenue with innovative upgrades.

- Veo3’s viral hit with 70M videos created since May launch, enhancing Google’s app ecosystem

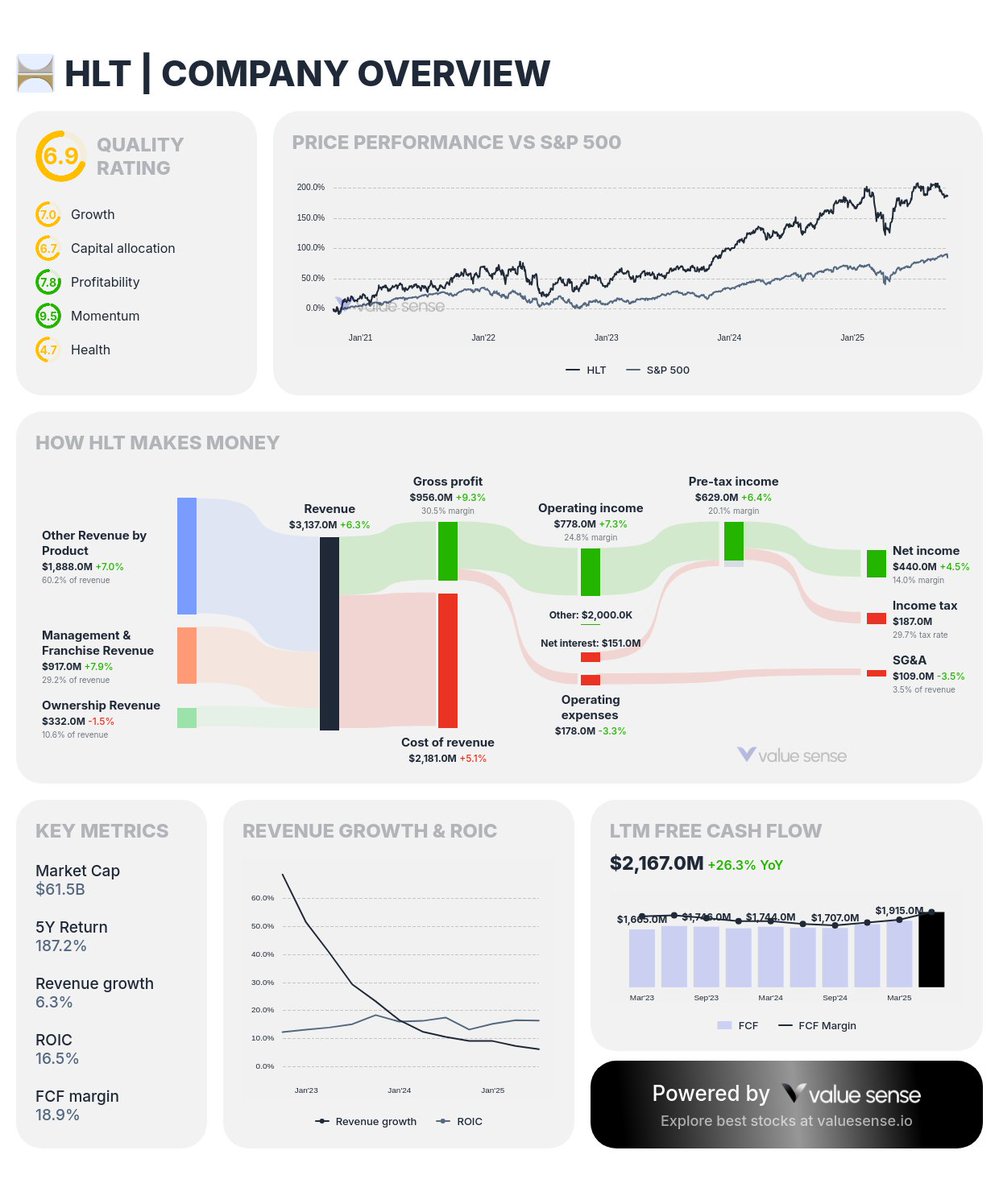

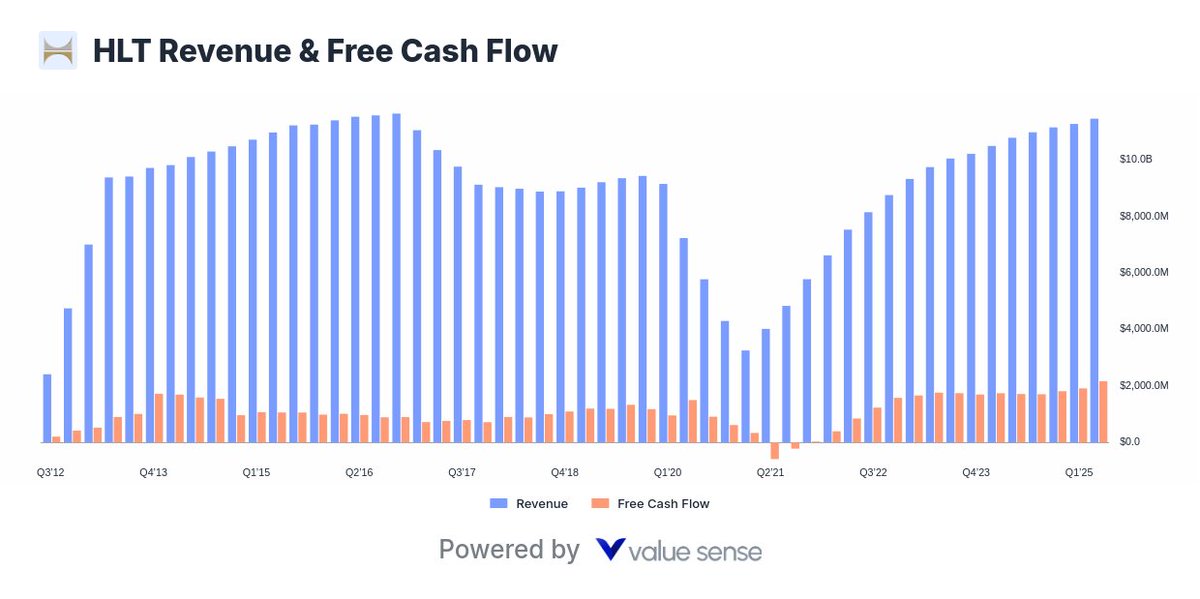

4/ $HLT | Hilton

- Hilton’s net unit growth shines, with $1B debt raised to boost $3B+ capital returns this year.

- Stellar capital allocation drives consistent earnings and high incremental margins.

- Best-in-class leadership and cost discipline position Hilton for robust, predictable growth ahead.

- Hilton’s net unit growth shines, with $1B debt raised to boost $3B+ capital returns this year.

- Stellar capital allocation drives consistent earnings and high incremental margins.

- Best-in-class leadership and cost discipline position Hilton for robust, predictable growth ahead.

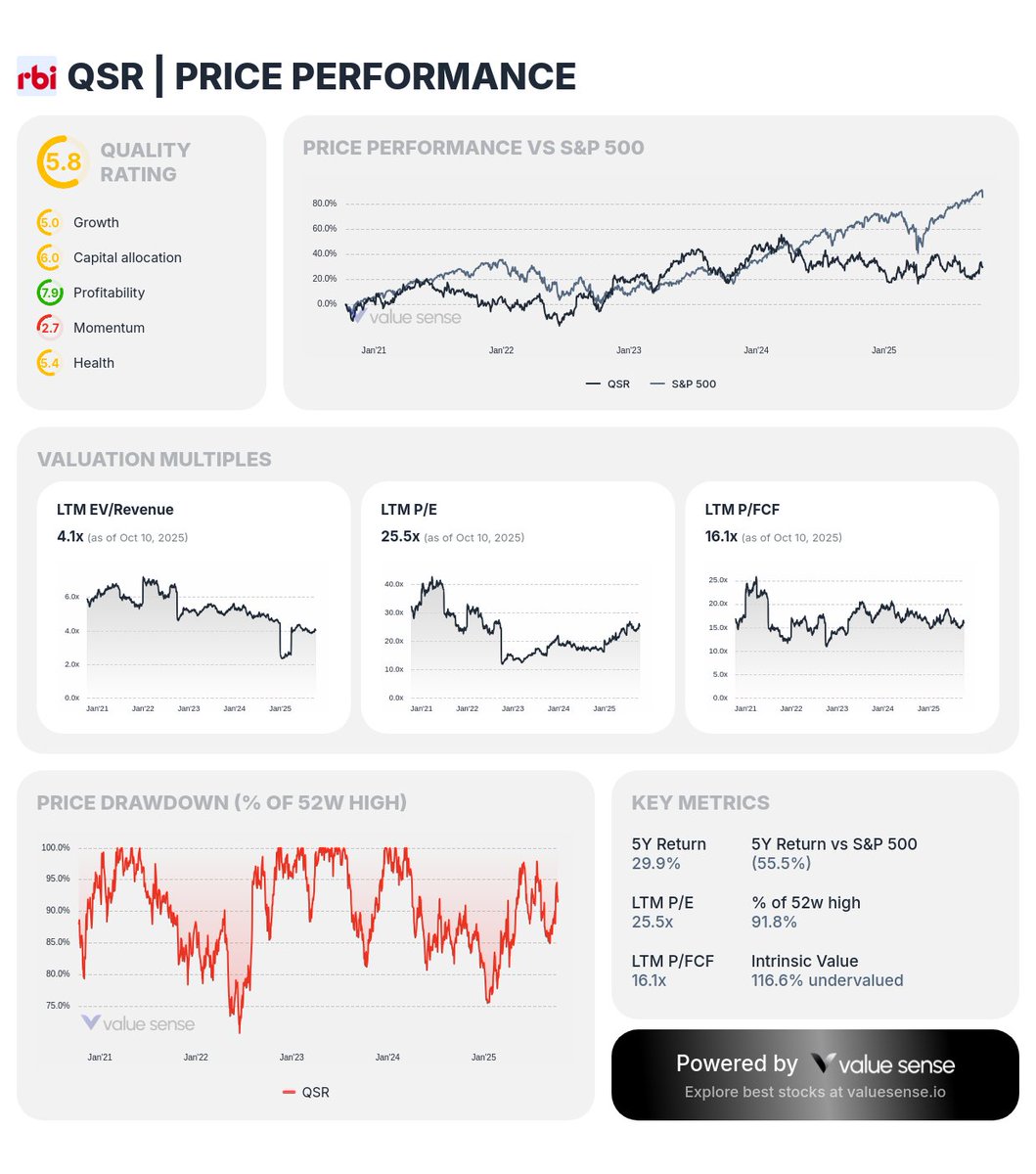

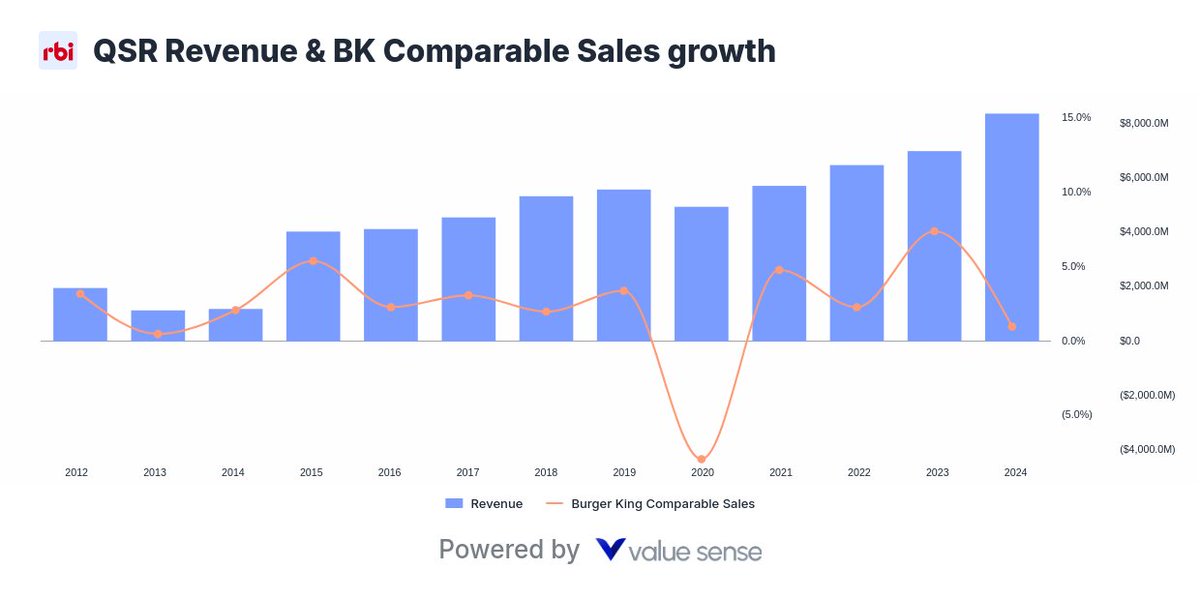

5/ $QSR | Restaurant Brands International

- QSR’s franchise model delivers high-margin royalty fees

- Tim Hortons and Burger King drive 70% of profits, with Tim’s up 4% and Burger King outpacing McDonald’s since the pandemic

- Strong growth expected via expanded presence, cold beverages and digital adoption at both brands.

- QSR’s franchise model delivers high-margin royalty fees

- Tim Hortons and Burger King drive 70% of profits, with Tim’s up 4% and Burger King outpacing McDonald’s since the pandemic

- Strong growth expected via expanded presence, cold beverages and digital adoption at both brands.

6/ $NKE | Nike

- Nike’s turnaround gains traction under CEO Elliott Hill

- Strategic moves include $1B cost savings, selective pricing, and supply chain tweaks to boost margins to low-to-mid teens.

- Improved order book and revenue growth expected by 2026

- Nike’s turnaround gains traction under CEO Elliott Hill

- Strategic moves include $1B cost savings, selective pricing, and supply chain tweaks to boost margins to low-to-mid teens.

- Improved order book and revenue growth expected by 2026

7/ $CMG | Chipotle

- Chipotle poised for a return to its historical growth trajectory as execution improves and macro headwinds ease.

- Management boosts marketing, adds new menu items like Honey Chicken, and enhances efficiency with new slicers.

- Same-store sales down 4% but turning positive in June-July

- Chipotle poised for a return to its historical growth trajectory as execution improves and macro headwinds ease.

- Management boosts marketing, adds new menu items like Honey Chicken, and enhances efficiency with new slicers.

- Same-store sales down 4% but turning positive in June-July

RT this thread if you think he beats Roger Federer and Rafael Nadal in their primes.

Follow @ValueSense_io for his Q3'25 portfolio update!

Follow @ValueSense_io for his Q3'25 portfolio update!

https://x.com/ValueSense_io/status/1977554947639058576

• • •

Missing some Tweet in this thread? You can try to

force a refresh