The financial industry requires private, incorruptible systems connected as one global network.

Citi, Deutsche Bank, Mastercard, and 30+ top global institutions joined us to explore the power of Prividiums.

Unveiling The Prividium Breakthrough Initiative.

Citi, Deutsche Bank, Mastercard, and 30+ top global institutions joined us to explore the power of Prividiums.

Unveiling The Prividium Breakthrough Initiative.

Financial institutions are facing an adapt-or-die moment.

Clients now expect internet-speed, always-on, programmable finance they can trust.

Those that cannot deliver will lose relevance as the market moves on.

Clients now expect internet-speed, always-on, programmable finance they can trust.

Those that cannot deliver will lose relevance as the market moves on.

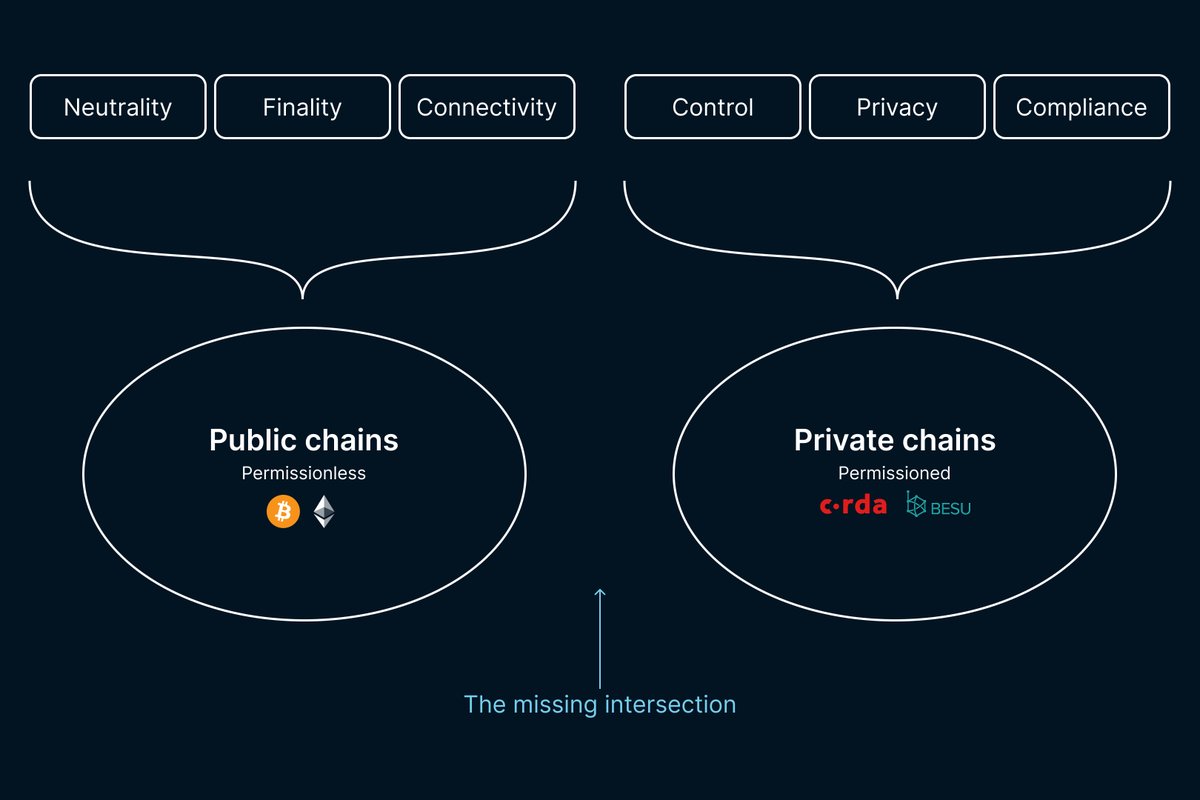

Blockchain technology offers a path forward but splits into two extremes.

Public chains achieved openness but lost privacy.

Private chains regained control but lost interoperability.

No system today meets all institutional requirements, and adoption remains limited.

Public chains achieved openness but lost privacy.

Private chains regained control but lost interoperability.

No system today meets all institutional requirements, and adoption remains limited.

What if financial institutions could have it all?

✅ Ethereum-grade security

✅ Full privacy and compliance

✅ Instant cross-border settlement

✅ No intermediaries

✅ No liquidity fragmentation

✅ 15k+ TPS with one-second latency

✅ Atomic transactions

✅ Ethereum-grade security

✅ Full privacy and compliance

✅ Instant cross-border settlement

✅ No intermediaries

✅ No liquidity fragmentation

✅ 15k+ TPS with one-second latency

✅ Atomic transactions

They now can.

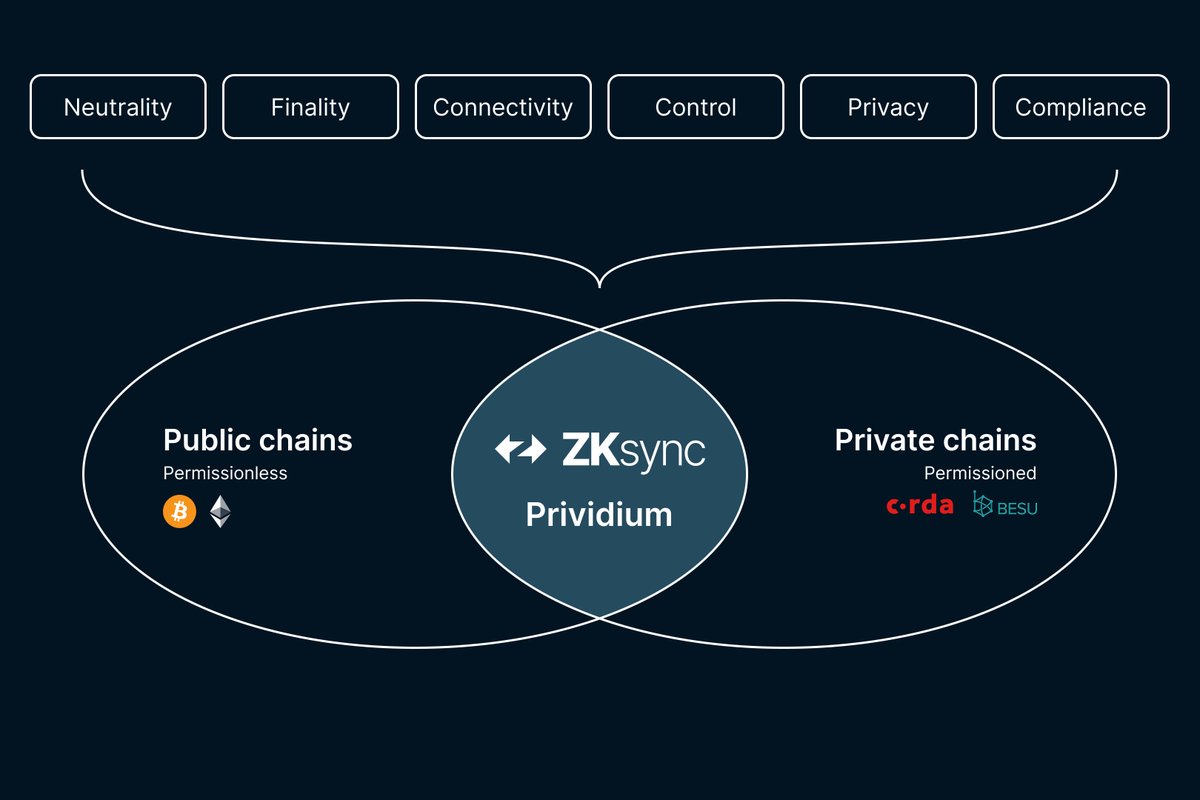

ZKsync Prividiums are Ethereum-anchored, private, permissioned L2s uniting institutional privacy with public verifiability.

Secured by ZK cryptography rather than trusted validators, Prividium is the first architecture to bridge the public and private realms.

ZKsync Prividiums are Ethereum-anchored, private, permissioned L2s uniting institutional privacy with public verifiability.

Secured by ZK cryptography rather than trusted validators, Prividium is the first architecture to bridge the public and private realms.

Prividium is the incorruptible financial infrastructure for institutions. It enables them to operate on their own terms, connecting directly to the global digital economy while maintaining full control over data, access, and compliance.

In partnership with @Deloitte, we organized a series of workshops with participation of more than 35 leading institutions in the financial industry who observed the capabilities of Prividium in live demonstrations.

The observing participants include: @Anchorage, @AntGroup, @avara, @banquedefrance, @BlockdaemonHQ, @Clifford_Chance, @Citi, @moodysratings, @CBDUAE, @CryptoFinanceAG, @DeutscheBank, @DeutscheBoerse, @bundesbank, @bancosantander, @StateStreet, @usbank, @FireblocksHQ, @Mastercard, Fidelity International, @SocieteGenerale, @sygnumofficial, @ubyx_, @Wellington_Mgmt, @ZodiaCustody, and more.

The observing participants include: @Anchorage, @AntGroup, @avara, @banquedefrance, @BlockdaemonHQ, @Clifford_Chance, @Citi, @moodysratings, @CBDUAE, @CryptoFinanceAG, @DeutscheBank, @DeutscheBoerse, @bundesbank, @bancosantander, @StateStreet, @usbank, @FireblocksHQ, @Mastercard, Fidelity International, @SocieteGenerale, @sygnumofficial, @ubyx_, @Wellington_Mgmt, @ZodiaCustody, and more.

The resulting Whitepaper details:

✦ Why banks cannot operate on public blockchains without privacy

✦ How ZK-powered Prividiums enable confidential real-time cross-border transfers

✦ How intraday repo becomes atomic, private, automated, and available 24/7

✦ Why this marks the end of silos and the beginning of programmable finance with privacy

✦ Flow diagrams, benchmarks (15K+ TPS, <$0.0001 per tx), and more

✦ Why banks cannot operate on public blockchains without privacy

✦ How ZK-powered Prividiums enable confidential real-time cross-border transfers

✦ How intraday repo becomes atomic, private, automated, and available 24/7

✦ Why this marks the end of silos and the beginning of programmable finance with privacy

✦ Flow diagrams, benchmarks (15K+ TPS, <$0.0001 per tx), and more

Prividium is powered by the ZK Stack, the industry’s most proven ZK platform.

The recent Atlas upgrade delivers 15K+ TPS (over double VISA’s annualized avg. load), with 1-second ZK finality and $0.0001 proving cost for institutional-grade performance.

The recent Atlas upgrade delivers 15K+ TPS (over double VISA’s annualized avg. load), with 1-second ZK finality and $0.0001 proving cost for institutional-grade performance.

https://x.com/ethereum/status/1975642825074278682

Prividiums are not an incremental step. They are a fundamental redesign of financial infrastructure: unlocking liquidity, reducing operational risk, and preparing enterprises for the new digital economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh