There is a new class of people all trying to arb the NFTStrategy contracts. As the self proclaimed guardian of these contracts, I peak at how each participant operates.

Most deploy unaudited contracts to use, typically along with EIP7702 delegations.

1/🧵

Most deploy unaudited contracts to use, typically along with EIP7702 delegations.

1/🧵

2/ I can't stress enough that before delegating your whole account to a contract you spun up with the help of ChatGPT... actually, just don't delegate your whole account to a contract you spun up with the help of ChatGPT.

3/ Some folks are using empty EOAs to run the arb. That's generally fine, as a contract exploit risks at most what you have in your account. However, you still put yourself at risk if you ever use the account for something else in the future.

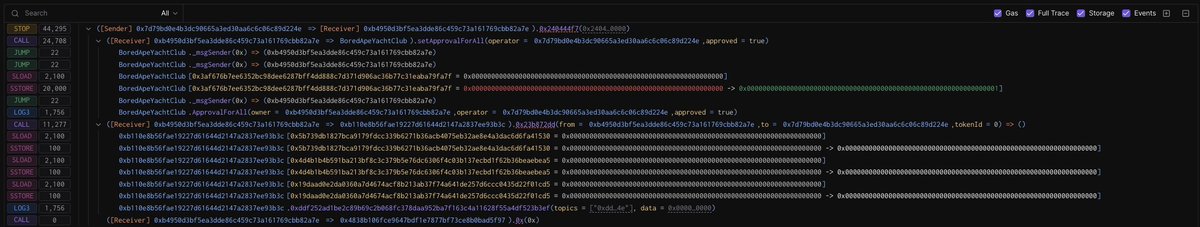

4/ For instance, if 0xB4 ever acquires a Bored Ape without first revoking the approval I forced on his account, the ape is as good as mine.

I'd never take it of course, this was just an onchain warning.

I'd never take it of course, this was just an onchain warning.

5/ Similarly, to OS user "deadcells":

I have your EPG #35 and Howlerz #3924. Delegate to a new contract with some form of access control, especially since your hardcoded miner tip can be used to forcibly drain your ETH.

I'll of course return the NFTs once you're secure.

I have your EPG #35 and Howlerz #3924. Delegate to a new contract with some form of access control, especially since your hardcoded miner tip can be used to forcibly drain your ETH.

I'll of course return the NFTs once you're secure.

6/ So how's it work? These contracts both follow a similar pattern:

- Perform user provided call to a marketplace

- Transfer user provided NFT to the strategy contract (who should be msg.sender)

- Use some percentage of profit to tip the block builder (used to ensure inclusion)

- Perform user provided call to a marketplace

- Transfer user provided NFT to the strategy contract (who should be msg.sender)

- Use some percentage of profit to tip the block builder (used to ensure inclusion)

7/ The problem is threefold:

First, there's no check to ensure that the strategy contract is calling the function.

Second, there's no check to ensure the marketplace call is purchasing an NFT

Third, there's no check to ensure the NFT being transferred is even an NFT

First, there's no check to ensure that the strategy contract is calling the function.

Second, there's no check to ensure the marketplace call is purchasing an NFT

Third, there's no check to ensure the NFT being transferred is even an NFT

8/ The exploit is simple: the marketplace call becomes literally whatever you want (an NFT transfer, WETH approval, or any arbitrary contract call).

The NFT transfer can be anything really, as long as the contract has a transferFrom function that won't revert.

The NFT transfer can be anything really, as long as the contract has a transferFrom function that won't revert.

9/ In the cases above I triggered a zero value transfer on USDC by providing "0" as the expected token ID. "transferFrom(them, me, 0)" is technically a valid transfer in the eyes of the USDC contract.

10/ So again, a call to everybody: get your contracts audited, no matter how simple you may think they are. This space is dangerous, and you should assume everybody is out to get you (they are).

• • •

Missing some Tweet in this thread? You can try to

force a refresh