⭐ Planning your child's education fund early with the right SIP strategy can turn dreams into reality.

🌟 Here’s a step-by-step goal-based SIP guide for a stress-free education journey.👇

👉 A Detailed thread🧵👇

#SIP #portfolio #stocks #StockMarketIndia #investments #FinancialPlanning #financialmanagement #financestrategy

🌟 Here’s a step-by-step goal-based SIP guide for a stress-free education journey.👇

👉 A Detailed thread🧵👇

#SIP #portfolio #stocks #StockMarketIndia #investments #FinancialPlanning #financialmanagement #financestrategy

🌟The Dream Every Parent Has

Meet Naresh, a father planning for his daughter Aaruti’s higher education starting when she is just 1 year old. With a 17-year horizon and disciplined SIP of ₹10,000/month, the expected corpus grows significantly. Early planning helps turn aspiration into achievable goals!

Meet Naresh, a father planning for his daughter Aaruti’s higher education starting when she is just 1 year old. With a 17-year horizon and disciplined SIP of ₹10,000/month, the expected corpus grows significantly. Early planning helps turn aspiration into achievable goals!

🌟The Power of Early Planning

Starting early makes all the difference:

🔸SIP: ₹10,000 monthly

🔸Investment period: 17 years

🔸Total invested: ₹20.4 Lakh

🔸Expected corpus at 12% CAGR: ₹52.5 Lakh approx.

Your disciplined ₹20 Lakh can more than double! Time is your best ally in wealth creation.

Starting early makes all the difference:

🔸SIP: ₹10,000 monthly

🔸Investment period: 17 years

🔸Total invested: ₹20.4 Lakh

🔸Expected corpus at 12% CAGR: ₹52.5 Lakh approx.

Your disciplined ₹20 Lakh can more than double! Time is your best ally in wealth creation.

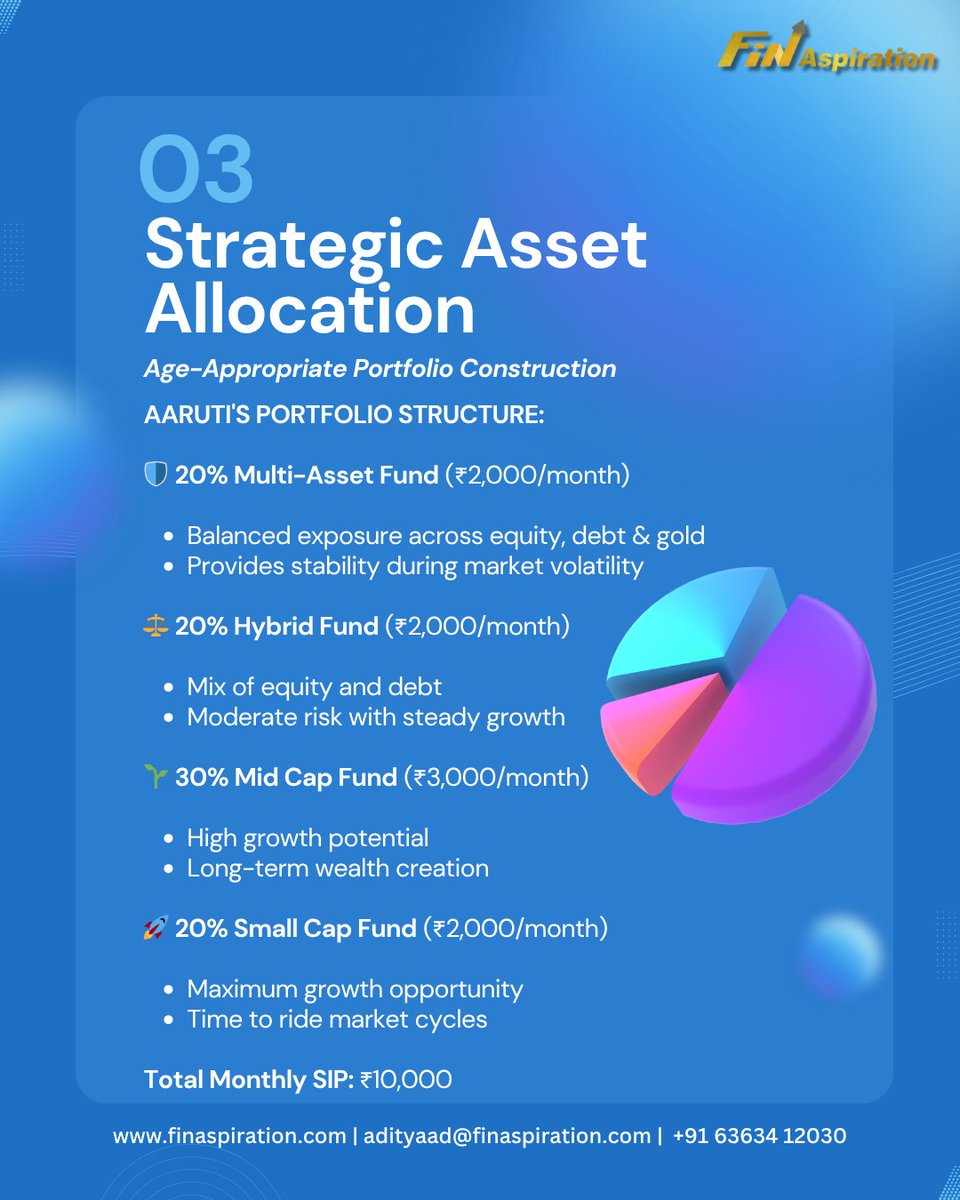

🌟Strategic Asset Allocation

Portfolio matters! Here’s how Aaruti’s SIP of ₹10,000/month is divided for balanced growth and stability:

🔸20% Multi-asset fund (₹2,000)

🔸20% Hybrid fund (₹2,000)

🔸30% Mid-cap fund (₹3,000)

🔸20% Small-cap fund (₹2,000)

Diversification helps ride market cycles and minimize volatility.

Portfolio matters! Here’s how Aaruti’s SIP of ₹10,000/month is divided for balanced growth and stability:

🔸20% Multi-asset fund (₹2,000)

🔸20% Hybrid fund (₹2,000)

🔸30% Mid-cap fund (₹3,000)

🔸20% Small-cap fund (₹2,000)

Diversification helps ride market cycles and minimize volatility.

🌟Why This Mix Works

For a 17-year horizon, higher equity exposure (70%) is optimal to maximize growth and recover from market dips. Diversification across market caps balances risk & reward. Aggressive in early years, prudent as goal nears.

For a 17-year horizon, higher equity exposure (70%) is optimal to maximize growth and recover from market dips. Diversification across market caps balances risk & reward. Aggressive in early years, prudent as goal nears.

🌟The MFD Advantage — Why Professional Guidance Matters

A Mutual Fund Distributor (MFD) helps you:

✔ Customize plans aligned to your goal

✔ Select age and risk-appropriate funds

✔ Monitor & rebalance portfolio periodically

✔ Track performance & make timely adjustments

✔ Offer tax-efficient & documented investment advice

Expert help means confidence and smoother journey.

A Mutual Fund Distributor (MFD) helps you:

✔ Customize plans aligned to your goal

✔ Select age and risk-appropriate funds

✔ Monitor & rebalance portfolio periodically

✔ Track performance & make timely adjustments

✔ Offer tax-efficient & documented investment advice

Expert help means confidence and smoother journey.

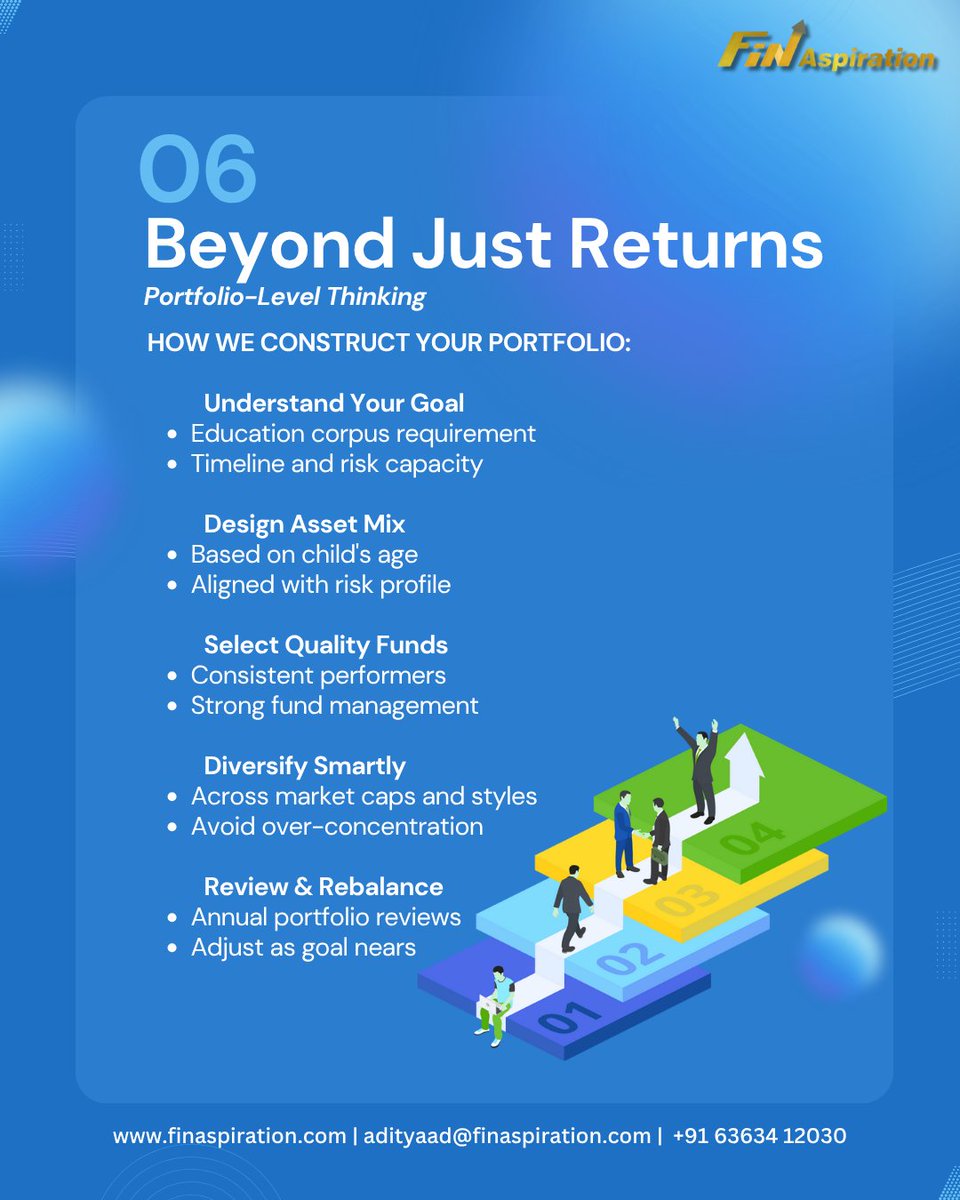

🌟Beyond Just Returns — Portfolio-Level Thinking

Your portfolio design focuses on:

🔸Understanding education cost & timeline

🔸Designing asset mix by child’s age & risk profile

🔸Selecting quality, consistent funds

🔸Diversifying smartly across caps and styles

🔸Annual reviews and rebalancing to stay on track

It’s about the journey, not just returns!

Your portfolio design focuses on:

🔸Understanding education cost & timeline

🔸Designing asset mix by child’s age & risk profile

🔸Selecting quality, consistent funds

🔸Diversifying smartly across caps and styles

🔸Annual reviews and rebalancing to stay on track

It’s about the journey, not just returns!

🌟The Rebalancing Journey

Portfolio evolves as your child grows:

⚡️Age 1-10: Aggressive growth with 70% equity

⚡️Age 11-14: Moderate risk with gradual shift to balanced funds

⚡️Age 15-18: Capital protection with debt-oriented funds

MFDs manage these transitions to secure the corpus at the right times.

Portfolio evolves as your child grows:

⚡️Age 1-10: Aggressive growth with 70% equity

⚡️Age 11-14: Moderate risk with gradual shift to balanced funds

⚡️Age 15-18: Capital protection with debt-oriented funds

MFDs manage these transitions to secure the corpus at the right times.

🌟Real Impact — What This Means at Age 18

With disciplined SIP and professional management, Aaruti can:

🎓 Pursue premium courses (Engineering, Medical)

🌍 Opt for international education

💰 Avoid education loans

Stress-free admissions and a bright future — thanks to early planning!

With disciplined SIP and professional management, Aaruti can:

🎓 Pursue premium courses (Engineering, Medical)

🌍 Opt for international education

💰 Avoid education loans

Stress-free admissions and a bright future — thanks to early planning!

🌟Common Mistakes to Avoid

Don’t let mistakes derail your plan:

⛔ Delaying start reduces corpus

⛔ Random fund selection lacks strategy

⛔ Stopping SIPs during market dips misses opportunities

⛔ No portfolio reviews lead to poor performance

Partner with an MFD to stay on track and avoid pitfalls.

Don’t let mistakes derail your plan:

⛔ Delaying start reduces corpus

⛔ Random fund selection lacks strategy

⛔ Stopping SIPs during market dips misses opportunities

⛔ No portfolio reviews lead to poor performance

Partner with an MFD to stay on track and avoid pitfalls.

🌟Your Turn to Act — Start Today!

3 simple steps:

1️⃣ Calculate your education goal (cost & timeline)

2️⃣ Start your SIP (even ₹5,000/month helps)

3️⃣ Partner with an MFD for personalized advice & discipline.

Secure your child’s future with goal-based planning now! Ready? Reach out today!

3 simple steps:

1️⃣ Calculate your education goal (cost & timeline)

2️⃣ Start your SIP (even ₹5,000/month helps)

3️⃣ Partner with an MFD for personalized advice & discipline.

Secure your child’s future with goal-based planning now! Ready? Reach out today!

👉🏻Link to telegram channel : t.me/FinAspiration

• • •

Missing some Tweet in this thread? You can try to

force a refresh