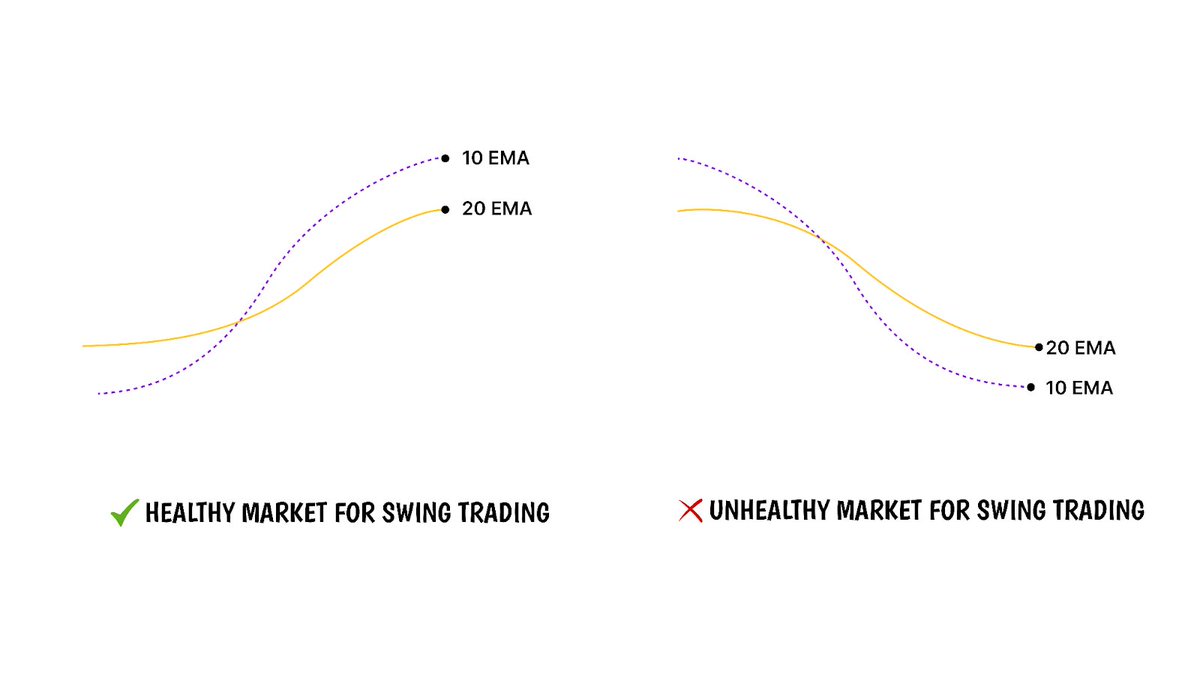

1/ Market conditions set the stage

Don't fight the broader market. Studies consistently show that 70%+ of stocks follow the general market's trend.

Breakouts fail more often in downtrends or choppy markets. Your edge improves dramatically when you buy breakouts during uptrends and sell breakdowns during downtrends.

Work with the tide, not against it.

Don't fight the broader market. Studies consistently show that 70%+ of stocks follow the general market's trend.

Breakouts fail more often in downtrends or choppy markets. Your edge improves dramatically when you buy breakouts during uptrends and sell breakdowns during downtrends.

Work with the tide, not against it.

2/ Stock character is everything

Every stock has a distinct personality - and it rarely changes. Some stocks are "trending animals" that respect moving averages, produce large candle ranges, and show multiple full-range bars in sequence.

Others are "sloppy" with poor MA respect, small range candles, low ADR, and inconsistent buying pressure.

Trade the former, avoid the latter.

Every stock has a distinct personality - and it rarely changes. Some stocks are "trending animals" that respect moving averages, produce large candle ranges, and show multiple full-range bars in sequence.

Others are "sloppy" with poor MA respect, small range candles, low ADR, and inconsistent buying pressure.

Trade the former, avoid the latter.

3/ The right side of the base tells the story

This is where amateurs get trapped. An asymmetrical right side filled with wicks, chop, and aggressive downmoves? Stay away.

Instead, hunt for a "constructive" right side: characterized by tight consolidation, higher lows, reduced volatility, and clean closes near the highs.

This shows institutional accumulation, not distribution.

This is where amateurs get trapped. An asymmetrical right side filled with wicks, chop, and aggressive downmoves? Stay away.

Instead, hunt for a "constructive" right side: characterized by tight consolidation, higher lows, reduced volatility, and clean closes near the highs.

This shows institutional accumulation, not distribution.

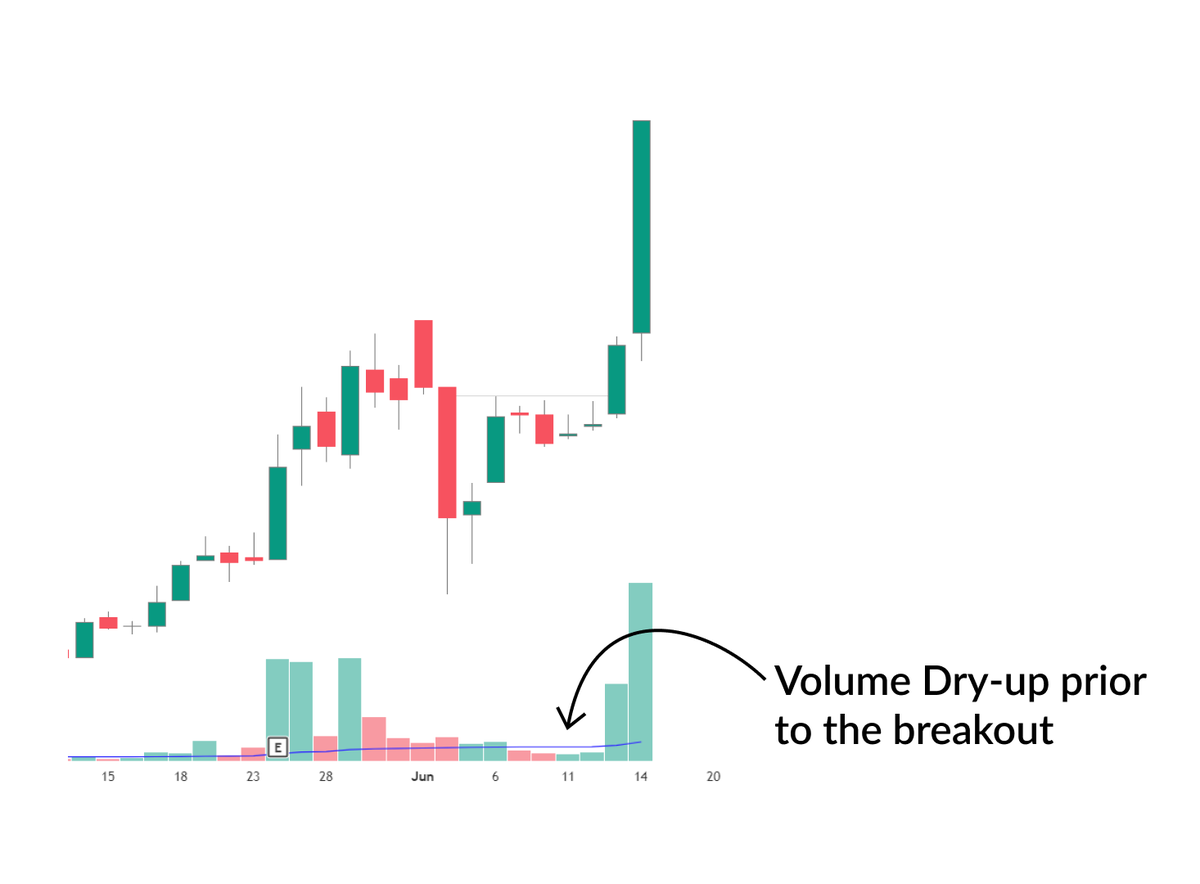

4/ Let volume rest before you act

Failed breakouts often happen because traders enter too early. The stock hasn't rested enough.

Before taking a breakout, check if volume has dried up to 30-50% of average for at least several days, paired with lower volatility and tight range-trading.

Drying volume signals the "squeeze" phase before the move.

Failed breakouts often happen because traders enter too early. The stock hasn't rested enough.

Before taking a breakout, check if volume has dried up to 30-50% of average for at least several days, paired with lower volatility and tight range-trading.

Drying volume signals the "squeeze" phase before the move.

5/ Sector and stock rank matter more than you think

Don't waste time on laggards. The best breakouts come from leading sectors in leading stocks - the cream of the market.

Bottom-barrel stocks, even with perfect technicals, fail to breakout properly or fizzle quickly. If the sector isn't leading or the stock isn't a sector leader, the odds are already stacked against you.

Follow the money to where it's actually flowing.

Don't waste time on laggards. The best breakouts come from leading sectors in leading stocks - the cream of the market.

Bottom-barrel stocks, even with perfect technicals, fail to breakout properly or fizzle quickly. If the sector isn't leading or the stock isn't a sector leader, the odds are already stacked against you.

Follow the money to where it's actually flowing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh