How to trade $SPY and $QQQ 0dte for a living

Copy and Paste Method 🧵

Copy and Paste Method 🧵

1/ About me

You probably see me post absurd 100% gains on $SPY and think "This guy is just lucky". I've been trading the indices before 0dte were popular (prior to 2022 they would only be Mon, Wed, Friday.) But I ONLY trade them when my exact rules are met.

You probably see me post absurd 100% gains on $SPY and think "This guy is just lucky". I've been trading the indices before 0dte were popular (prior to 2022 they would only be Mon, Wed, Friday.) But I ONLY trade them when my exact rules are met.

2/ The brutal truth most people won't tell you

Most traders think they can trade $SPY and $QQQ 0dte, until they get a little bit too confidence and blow their account. Not every candle on $SPY is a tradeable setup (unless you really think ICT coded the algo.) This is the ONLY setup you need.

Most traders think they can trade $SPY and $QQQ 0dte, until they get a little bit too confidence and blow their account. Not every candle on $SPY is a tradeable setup (unless you really think ICT coded the algo.) This is the ONLY setup you need.

3/ I learned the expensive

I paid around 40k to the 0dte University of hard knocks before I finally learned something useful in college. Just like in my early 20s I thought I was smarter than everyone. Until I blow my account trying to time the "top."

I paid around 40k to the 0dte University of hard knocks before I finally learned something useful in college. Just like in my early 20s I thought I was smarter than everyone. Until I blow my account trying to time the "top."

4/ The toolbox

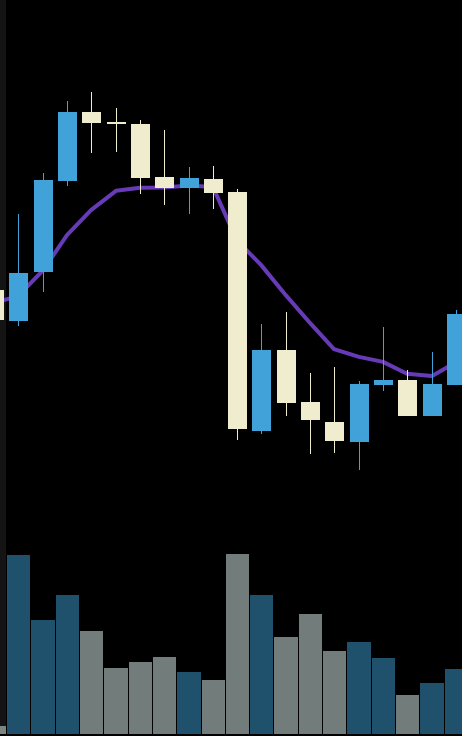

You need 3 things and a 10m chart.

1. 🟣 indicator = 8ema, your trend guide

2. 🟢 line = Previous Day High (PDH)

3. 🔴 line = Previous Day Low (PDL)

Your chart will look like this every morning. Simple. Clean.

You need 3 things and a 10m chart.

1. 🟣 indicator = 8ema, your trend guide

2. 🟢 line = Previous Day High (PDH)

3. 🔴 line = Previous Day Low (PDL)

Your chart will look like this every morning. Simple. Clean.

5/ The rules

Buy calls ONLY if:

We are above 🟢PDH and 🟣8ema.

Buy puts ONLY if:

We are below 🔴PDL and 🟣8ema.

If none of this criteria is met = You sit on your hands. No Exceptions.

Buy calls ONLY if:

We are above 🟢PDH and 🟣8ema.

Buy puts ONLY if:

We are below 🔴PDL and 🟣8ema.

If none of this criteria is met = You sit on your hands. No Exceptions.

6/ The entry System: LE Model

You simply follow the LE Model. Which stands for Levels first, then EMAs.

Step 1: Look for a level retest PDH/PDL if the level is too far away, see step 2.

Step 2: Look for an EMA retest.

This limits us to 2 entry points.

You simply follow the LE Model. Which stands for Levels first, then EMAs.

Step 1: Look for a level retest PDH/PDL if the level is too far away, see step 2.

Step 2: Look for an EMA retest.

This limits us to 2 entry points.

7/ The setup that destroys 90% of traders

An inside day by definition is chop. This is when price is trapped between the Previous day levels causing price to become very wicky and gross. You MUST avoid this at all costs.

An inside day by definition is chop. This is when price is trapped between the Previous day levels causing price to become very wicky and gross. You MUST avoid this at all costs.

8/ Why this is bad for new traders

New traders seem to love seeing setups that don't exist. How many times have you entered a "flag" only for it to dump out of no where? It is because the stock is in between those Previous Day levels. This is what we call no mans land.

New traders seem to love seeing setups that don't exist. How many times have you entered a "flag" only for it to dump out of no where? It is because the stock is in between those Previous Day levels. This is what we call no mans land.

9/ Here's what actually works: Outside Days

We can see this stock broke the Previous Day Lows (PDL.) The market is screaming "I am bearish today." We don't enter on the break. Why? Because this is where people who shorted the top will take profits causing price to bounce.

We can see this stock broke the Previous Day Lows (PDL.) The market is screaming "I am bearish today." We don't enter on the break. Why? Because this is where people who shorted the top will take profits causing price to bounce.

10/ You WANT the bounce

On bearish setups the bounce is our friend. Why? Because this our chance to "short the pop." This gives us the best risk reward for an entry. We use the LE Model, Levels first then EMAs. Where did the wick reject off? The Level so we entered.

On bearish setups the bounce is our friend. Why? Because this our chance to "short the pop." This gives us the best risk reward for an entry. We use the LE Model, Levels first then EMAs. Where did the wick reject off? The Level so we entered.

11/ The stop loss

Our stop loss is the high of the 10m candle. If price reverses we can't use the purple line because its too far away. This gives us a tight stop and a high reward. Notice how we didn't chase. Patience over FOMO every time.

Our stop loss is the high of the 10m candle. If price reverses we can't use the purple line because its too far away. This gives us a tight stop and a high reward. Notice how we didn't chase. Patience over FOMO every time.

12/ Sizing

If your account is $5,000 you will buy 10 contracts at 1.00.

Sell 5 Contracts at 100% making your other 5 contracts risk free. If the trades reverses you and those 5 runners go to 0 the trade is breakeven.

If your account is $5,000 you will buy 10 contracts at 1.00.

Sell 5 Contracts at 100% making your other 5 contracts risk free. If the trades reverses you and those 5 runners go to 0 the trade is breakeven.

13/ Math

10 cons x $100 = $1000 position size

Sell 5 cons at 2.00 = $1000 (original capital.)

5 contracts left over could go 200-300-400%. If they go to 0? Who cares its a break even trade. This is how the money is made.

10 cons x $100 = $1000 position size

Sell 5 cons at 2.00 = $1000 (original capital.)

5 contracts left over could go 200-300-400%. If they go to 0? Who cares its a break even trade. This is how the money is made.

14/ My real results

I took this same exact trade. I took the LE Model entry and made 155%. I sold half my contracts at 100% and let the rest run. Those runners I wasn't even stressed about. $SPY could teleport to 800 and the trade would be breakeven at WORSE. Instead it made me 155%.

I took this same exact trade. I took the LE Model entry and made 155%. I sold half my contracts at 100% and let the rest run. Those runners I wasn't even stressed about. $SPY could teleport to 800 and the trade would be breakeven at WORSE. Instead it made me 155%.

15/ The mistake costing you thousands

You're trading 0dte without waiting for confirmation. You see $SPY moving and FOMO takes over.

Stop. Take a breath. Ask yourself: "Is this above/below PDH/PDL? Is the purple line holding?" If no = it's not a trade, it's a gamble.

You're trading 0dte without waiting for confirmation. You see $SPY moving and FOMO takes over.

Stop. Take a breath. Ask yourself: "Is this above/below PDH/PDL? Is the purple line holding?" If no = it's not a trade, it's a gamble.

16/ The community factor

I call these setups daily live on stream for free. My community is filled with people who all have studied the LE Model and support each other. We don't have egos we have results. If you want to join for free click here: letradingacademy.com/free-discord?u…

I call these setups daily live on stream for free. My community is filled with people who all have studied the LE Model and support each other. We don't have egos we have results. If you want to join for free click here: letradingacademy.com/free-discord?u…

17/ Summary

Two tickers. Two Levels. One purple line is all it takes to trade full time.Stop overcomplicating the indices. I have been using this exact system for 6+ years.

Drop a like and a RT if you found this thread helpful.

Two tickers. Two Levels. One purple line is all it takes to trade full time.Stop overcomplicating the indices. I have been using this exact system for 6+ years.

Drop a like and a RT if you found this thread helpful.

https://x.com/EllyDtrades/status/1978250242886656501

• • •

Missing some Tweet in this thread? You can try to

force a refresh