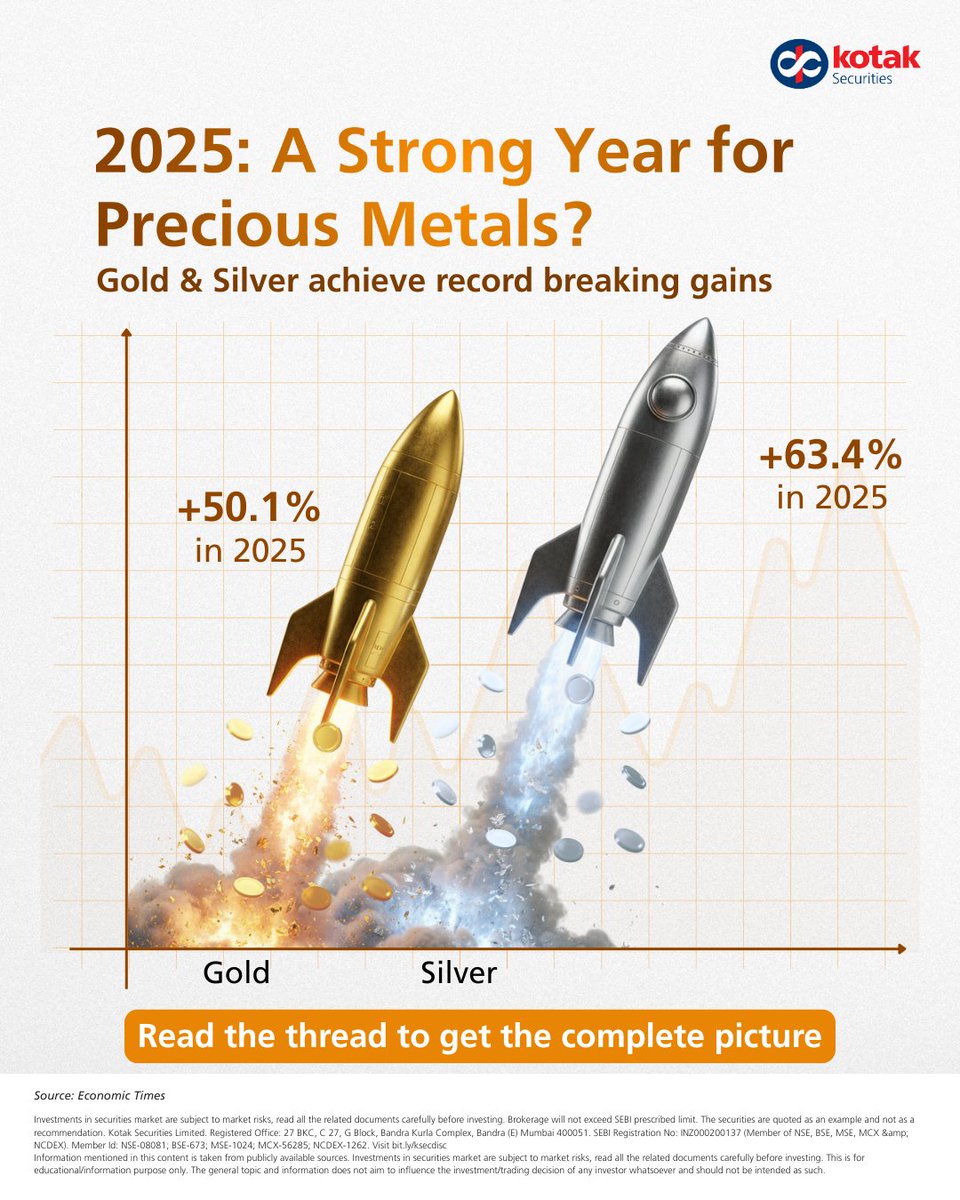

In 2025, Gold & Silver are doing what most assets couldn’t — holding firm amid volatility. Gold up 50.1%, Silver up 63.4%. What's driving this unprecedented rally and more importantly, will it continue?

1/6

1/6

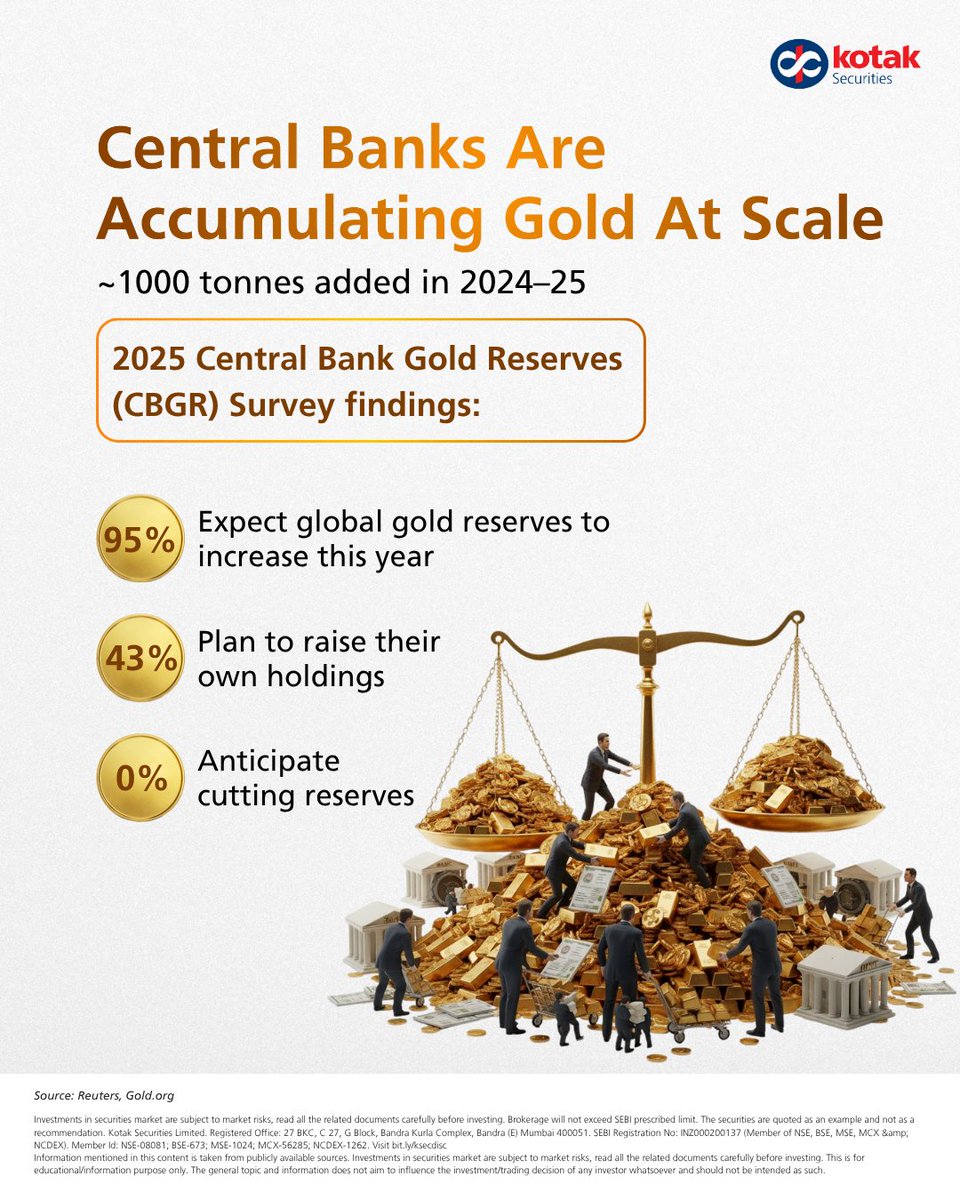

Here's who's really driving this: It's not retail investors, it's central banks making massive moves. Over 1,000 tonnes of gold added in 2024-25, and the 2025 CBGR survey indicates reserves to grow further.

#KotakSecurities #StockMarket #StockMarketIndia #Gold #CentralBanks

2/6

#KotakSecurities #StockMarket #StockMarketIndia #Gold #CentralBanks

2/6

Where does this gold go? The U.S. holds 8,133 tonnes, leading globally. India ranks among the Top 10 with 880 tonnes—reflecting the nation's enduring gold affinity and strategic reserve building.

#KotakSecurities #StockMarket #StockMarketIndia #Gold #GoldReserves

3/6

#KotakSecurities #StockMarket #StockMarketIndia #Gold #GoldReserves

3/6

Now look at silver: It's not just a precious metal, it's an industrial powerhouse. With 59% demand from industry (solar, EVs, electronics) and persistent deficits, silver's fundamentals are uniquely strong.

#KotakSecurities #StockMarket #StockMarketIndia #Silver #GreenEconomy

4/6

#KotakSecurities #StockMarket #StockMarketIndia #Silver #GreenEconomy

4/6

The price action validates the thesis: Gold and Silver prices have surged sharply in the last five years. Gold rose 145%, Silver 108% since 2021, and ETF folios jumped nearly 50% in the 12 months to August 2025.

#KotakSecurities #StockMarket #StockMarketIndia #GoldPrice #SilverPrice

5/6

#KotakSecurities #StockMarket #StockMarketIndia #GoldPrice #SilverPrice

5/6

Looking ahead: Geopolitical uncertainty, dovish central banks, inflation, and safe-haven demand keep prices elevated. Will precious metals continue to outshine traditional assets?

Follow @KotakSecurities for more.

#KotakSecurities #StockMarket #StockMarketIndia #GoldOutlook

6/6

Follow @KotakSecurities for more.

#KotakSecurities #StockMarket #StockMarketIndia #GoldOutlook

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh