1/ $PYPL is one of the few remaining high-quality, undervalued stocks.

- Margins are expanding again.

- Venmo growth reaccelerated to 20%.

- Its advertising network is ramping up.

Yet, it's trading at just 14 times earnings.

Here's our $PYPL investment thesis: 🧵

- Margins are expanding again.

- Venmo growth reaccelerated to 20%.

- Its advertising network is ramping up.

Yet, it's trading at just 14 times earnings.

Here's our $PYPL investment thesis: 🧵

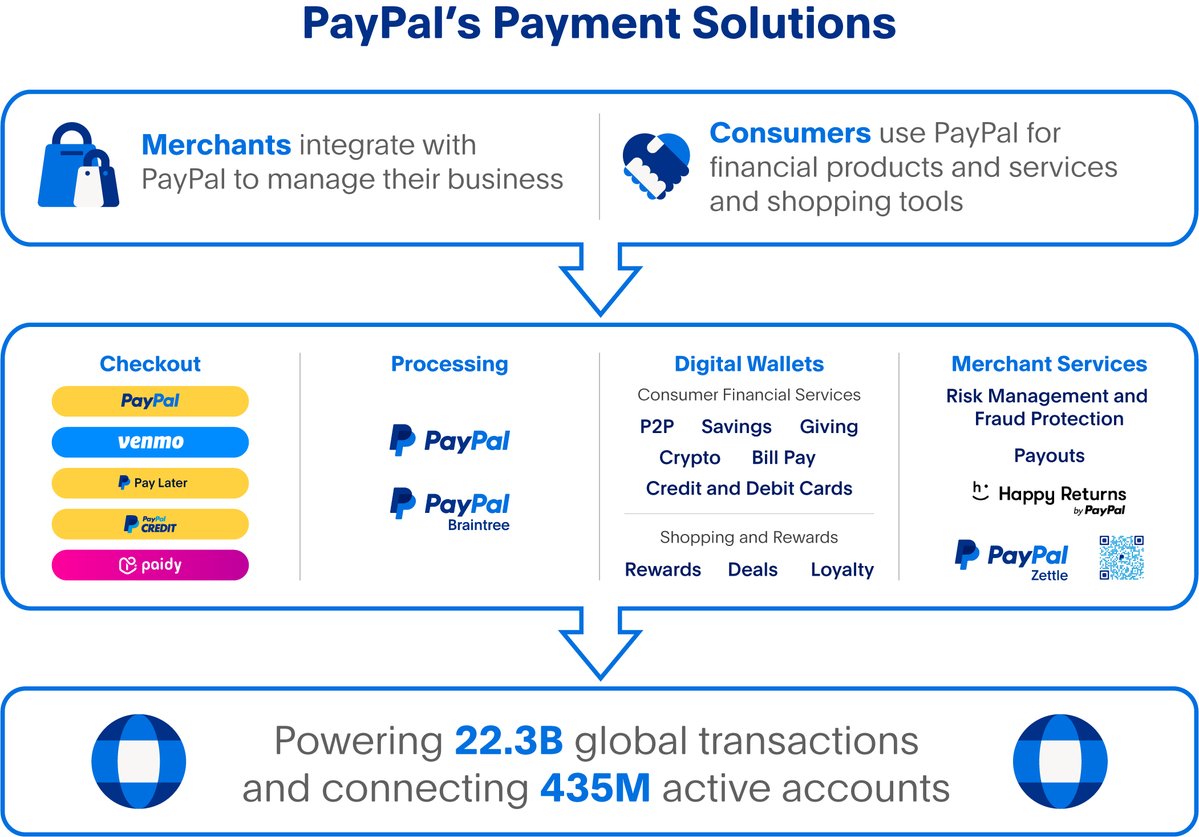

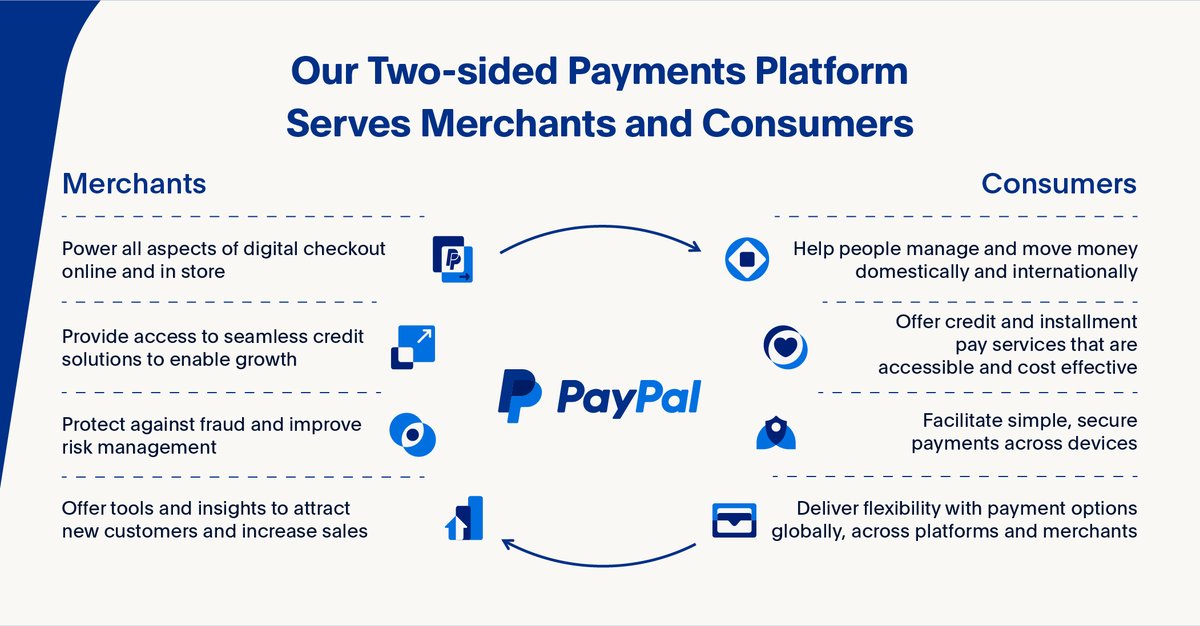

2/ Let's set the stage first.

PayPal is one of the widest moat businesses in the world.

It has a giant network composed of:

- 435 million active accounts.

- 16 million active merchant accounts.

This makes it the largest payment network on the internet.

PayPal is one of the widest moat businesses in the world.

It has a giant network composed of:

- 435 million active accounts.

- 16 million active merchant accounts.

This makes it the largest payment network on the internet.

3/ Network effects provide growth and competitive strength.

As it grows its user count, more merchants are attracted to the platform and vice versa.

This results in a constant TPV growth in the network, driving revenues.

So, why is its stock price struggling?

As it grows its user count, more merchants are attracted to the platform and vice versa.

This results in a constant TPV growth in the network, driving revenues.

So, why is its stock price struggling?

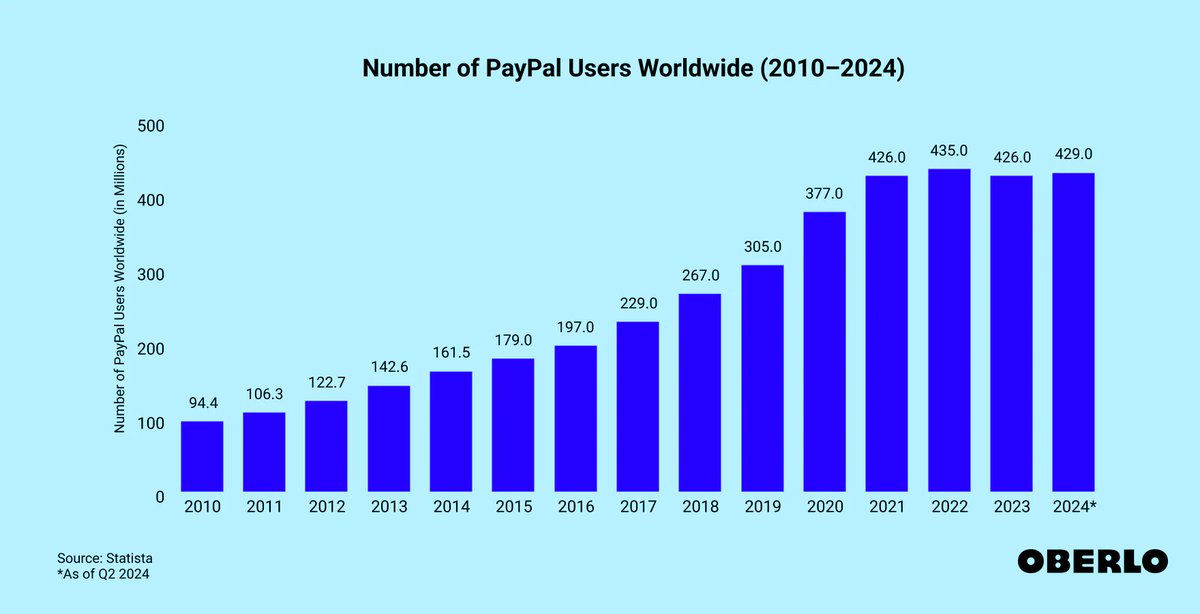

4/ The market is getting saturated.

PayPal grew incredibly fast in the COVID era.

It added over 100 million users between 2019-2021 as people flocked to online shopping.

It saturated its core markets.

This had a severe impact on revenues and margins post-COVID.

PayPal grew incredibly fast in the COVID era.

It added over 100 million users between 2019-2021 as people flocked to online shopping.

It saturated its core markets.

This had a severe impact on revenues and margins post-COVID.

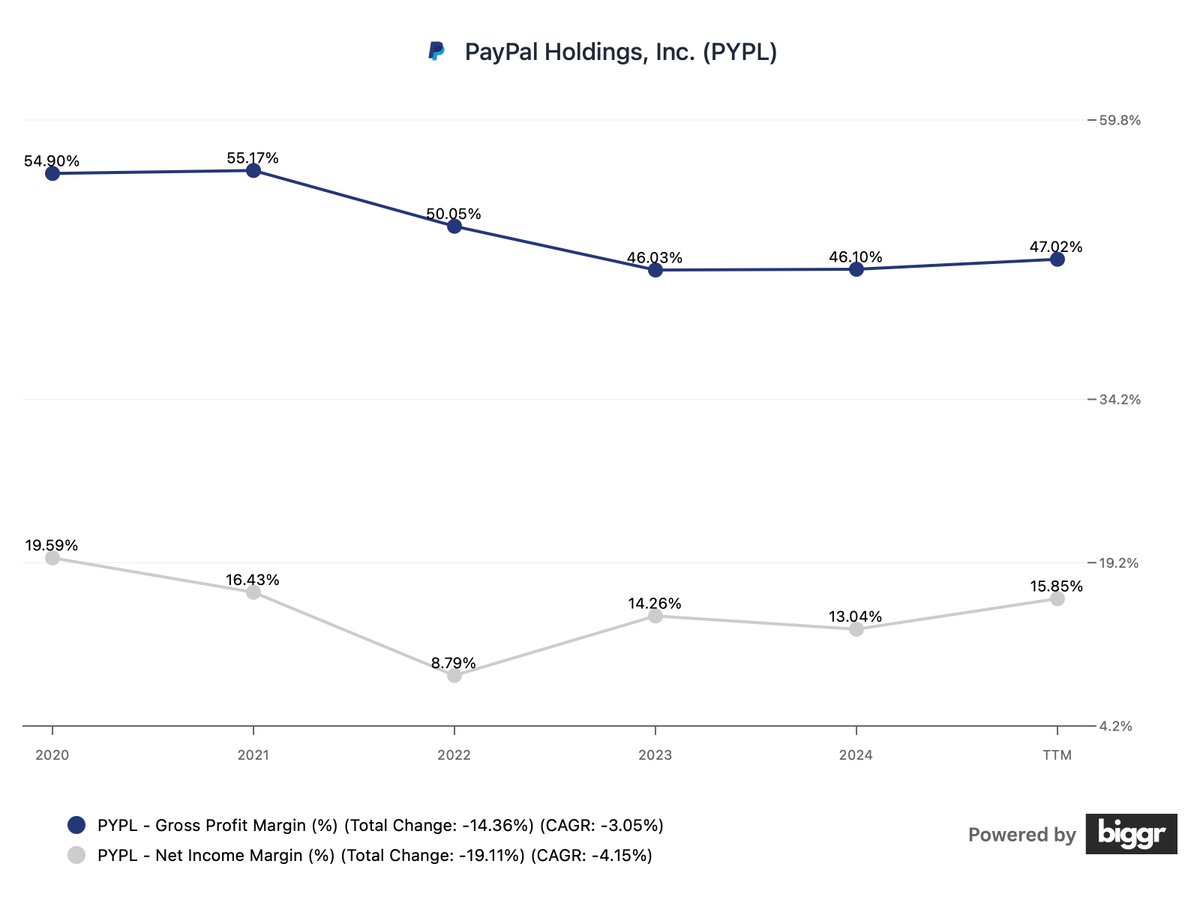

5/ Margins eroded due to increasing competition.

It enjoyed very high margins during the COVID era, as people had to use online payment gateways while they were stuck at home.

This also led to an explosion in alternatives.

As a result, PayPal's margins also eroded.

It enjoyed very high margins during the COVID era, as people had to use online payment gateways while they were stuck at home.

This also led to an explosion in alternatives.

As a result, PayPal's margins also eroded.

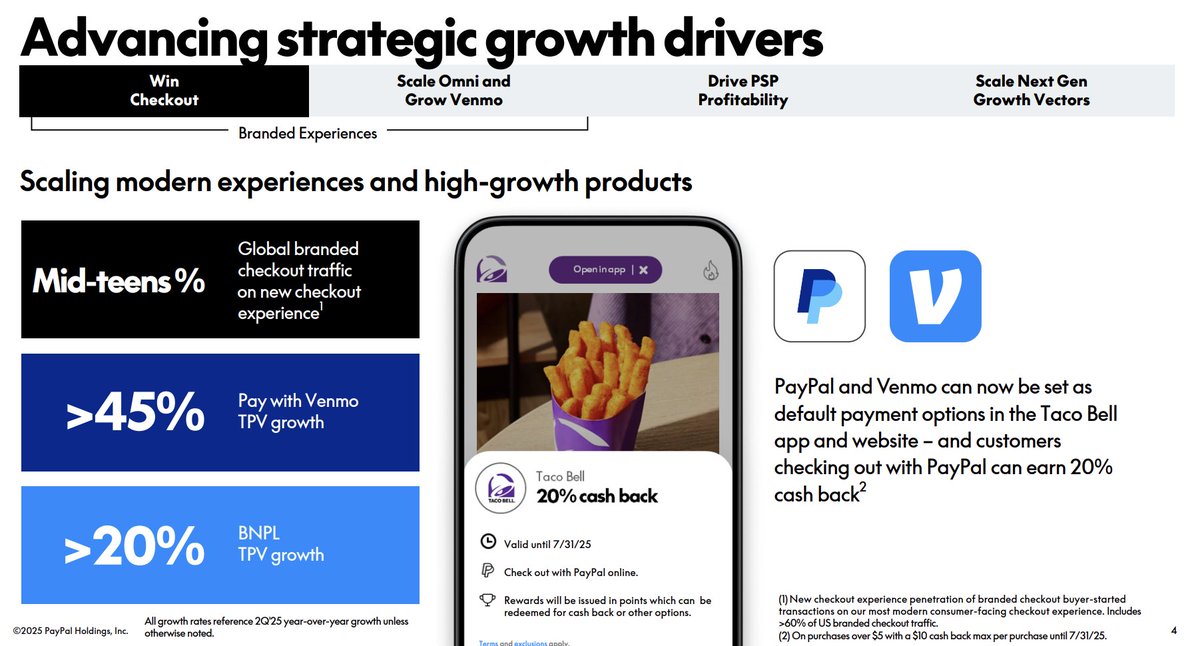

6/ $PYPL had to do two things:

- Tap on the underperforming business segments.

- Create new businesses that fit within its ecosystem.

It's doing them both.

First, strategic initiative is to reaccelerae its branded checkout, which has large margins.

It's engaging in strategic partnerships with big merchants and offer large cash backs to customers.

This increases both the conversion rate for merchants and checkut market share for PayPal.

- Tap on the underperforming business segments.

- Create new businesses that fit within its ecosystem.

It's doing them both.

First, strategic initiative is to reaccelerae its branded checkout, which has large margins.

It's engaging in strategic partnerships with big merchants and offer large cash backs to customers.

This increases both the conversion rate for merchants and checkut market share for PayPal.

7/ It's creating new businesses.

It's tapping into the digital ads market with both in-app and off-site apps.

$PYPL is especially well-positioned for this market as it has accumulated decades of valuable data on customer behavior and shopping preferences.

It's tapping into the digital ads market with both in-app and off-site apps.

$PYPL is especially well-positioned for this market as it has accumulated decades of valuable data on customer behavior and shopping preferences.

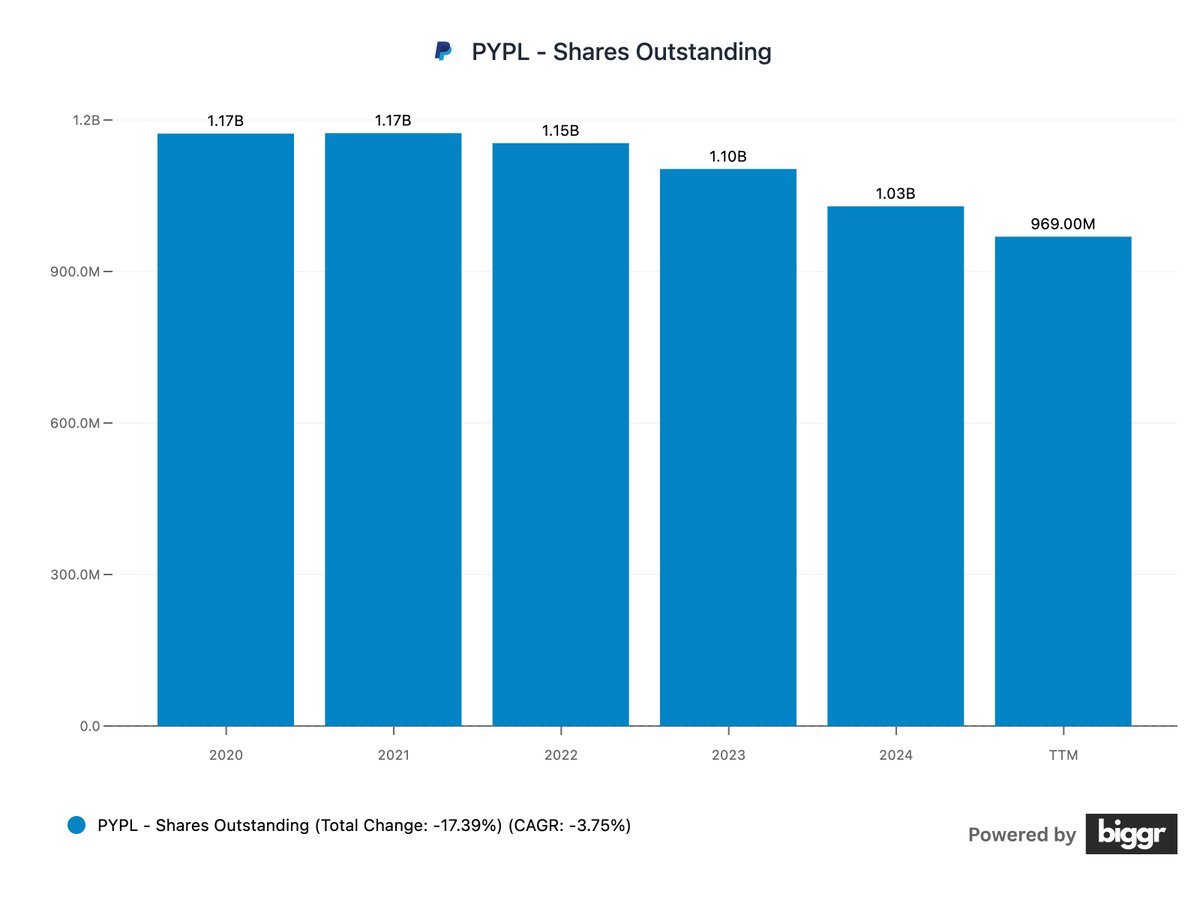

8/ It's rapidly buying back shares.

On top of growth initiatives, it's reducing share count to maximize shareholder value.

It reduced the number of shares outstanding by nearly 18% in the last 5 years.

It is dedicated to doing so as it's spending all of its FCF in buybacks.

On top of growth initiatives, it's reducing share count to maximize shareholder value.

It reduced the number of shares outstanding by nearly 18% in the last 5 years.

It is dedicated to doing so as it's spending all of its FCF in buybacks.

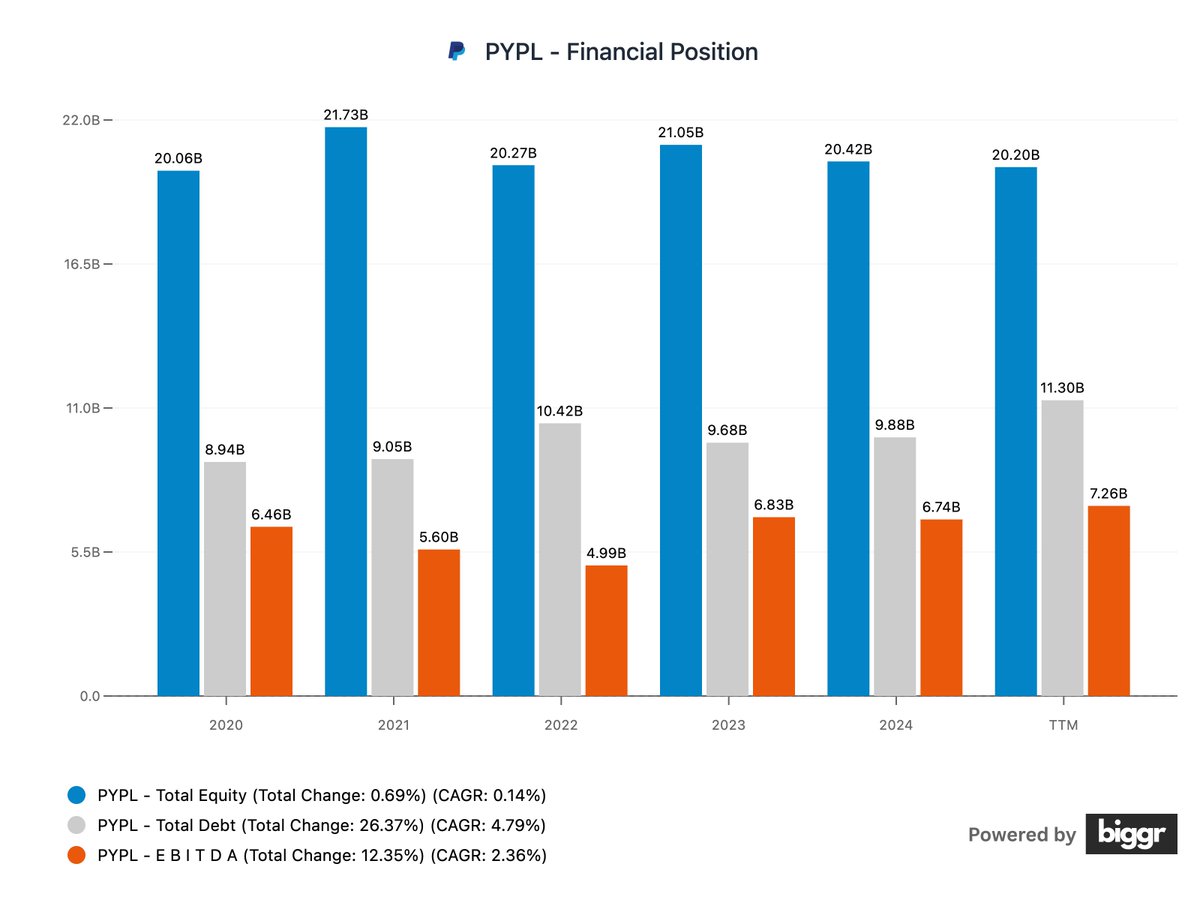

9/ Its balance sheet is also rock solid.

It has $20 billion in equity against just $11 billion in debt.

Its annual EBITDA of $7.6 billion can pay off all the debt in under two years.

Basically, its balance sheet can support every growth initiative and weather any storm.

It has $20 billion in equity against just $11 billion in debt.

Its annual EBITDA of $7.6 billion can pay off all the debt in under two years.

Basically, its balance sheet can support every growth initiative and weather any storm.

10/ Valuation is extremely attractive.

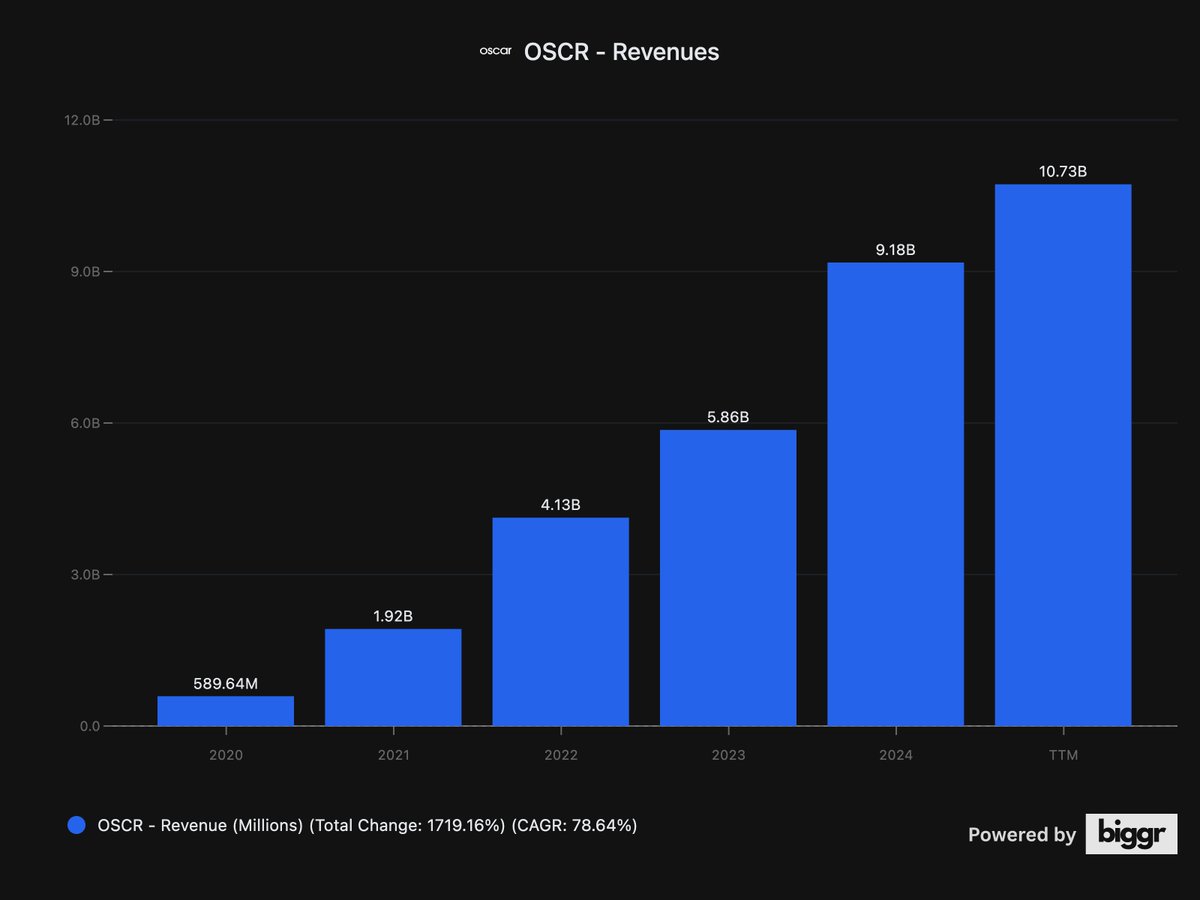

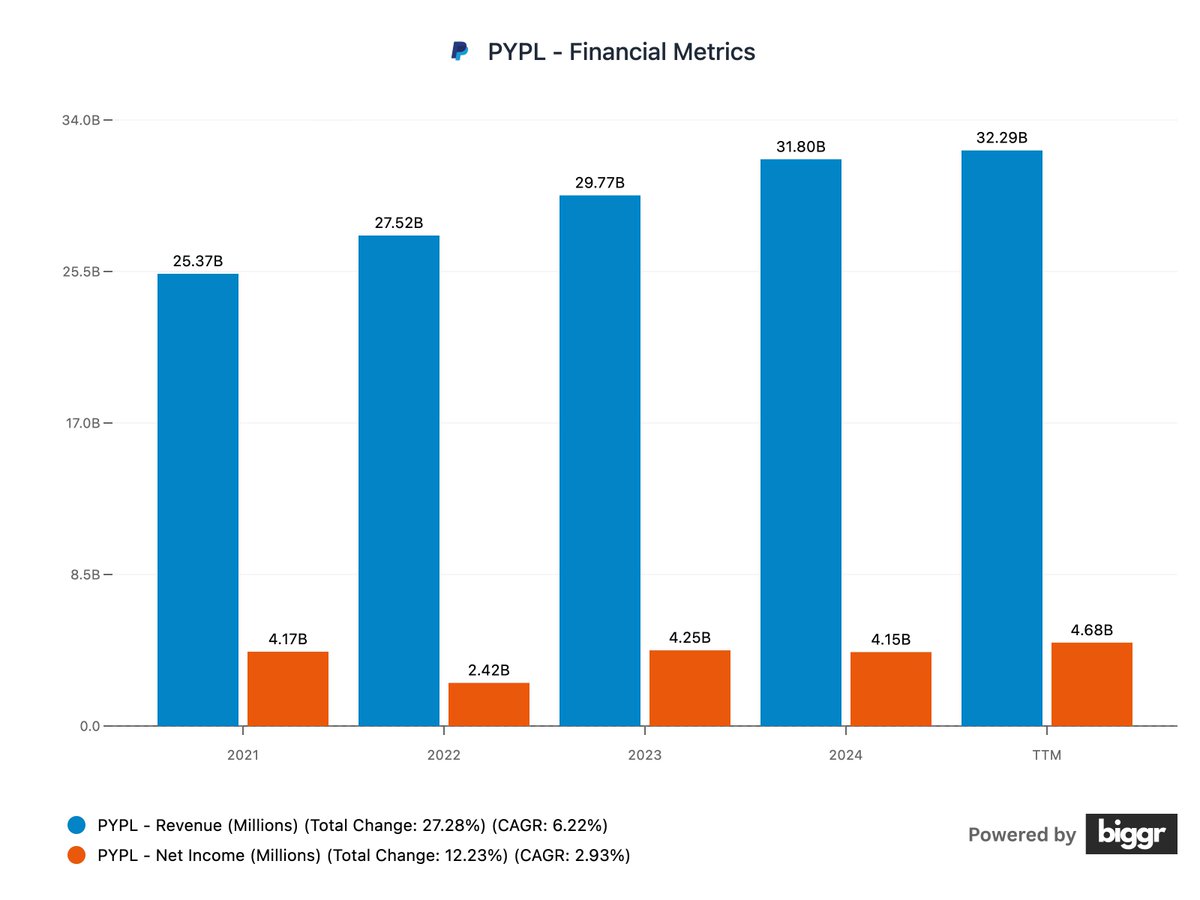

It generated $32 billion in revenue in the last twelve months with a 14.4% net margin.

Given its growth initiatives and management's raising guidance, it can easily grow revenues by 9% annually in the next 5 years.

Meaning, it can generate nearly $50 billion in revenue in 2030.

If it can expand the net margin by just 2.6% to 17%, it'll generate $8.5 billion in net income.

Give it a conservative 15x exit multiple and we'll have a $128 billion business.

It's currently valued at just $65 billion, meaning it can easily double from here in the next 5 years.

It may not look too much, but given the quality of the business, limited downside, and the current market valuations definitely makes it an attractive opportunity.

It generated $32 billion in revenue in the last twelve months with a 14.4% net margin.

Given its growth initiatives and management's raising guidance, it can easily grow revenues by 9% annually in the next 5 years.

Meaning, it can generate nearly $50 billion in revenue in 2030.

If it can expand the net margin by just 2.6% to 17%, it'll generate $8.5 billion in net income.

Give it a conservative 15x exit multiple and we'll have a $128 billion business.

It's currently valued at just $65 billion, meaning it can easily double from here in the next 5 years.

It may not look too much, but given the quality of the business, limited downside, and the current market valuations definitely makes it an attractive opportunity.

Thanks for reading!

P.S. We have just launched our first-ever promotion!

Every new user gets 1 month of free access to AI-Powered stock research tools on Biggr.

Try it below👇

thebiggr.com/page?ref=tw1

P.S. We have just launched our first-ever promotion!

Every new user gets 1 month of free access to AI-Powered stock research tools on Biggr.

Try it below👇

thebiggr.com/page?ref=tw1

• • •

Missing some Tweet in this thread? You can try to

force a refresh