🧵 Whoever owns the stablecoin base, owns the future of banking.

For 200 years, banks scaled by holding deposits. Fintechs scaled by renting them.

Now stablecoins have made them portable, and that shift is about to redraw global banking.👇

For 200 years, banks scaled by holding deposits. Fintechs scaled by renting them.

Now stablecoins have made them portable, and that shift is about to redraw global banking.👇

2/ Every banking revolution started with a change in where money lived.

In the 1800s, banks issued private notes backed by gold, but trust was local and fragile.

The 1900s centralized that trust through the Fed and FDIC, creating giants like JPMorgan and Citi.

The 2010s digitized it through fintech neobanks like Revolut and Nubank.

Now, stablecoins have pulled deposits out of banks entirely and made them programmable, borderless, and liquid at internet scale.

In the 1800s, banks issued private notes backed by gold, but trust was local and fragile.

The 1900s centralized that trust through the Fed and FDIC, creating giants like JPMorgan and Citi.

The 2010s digitized it through fintech neobanks like Revolut and Nubank.

Now, stablecoins have pulled deposits out of banks entirely and made them programmable, borderless, and liquid at internet scale.

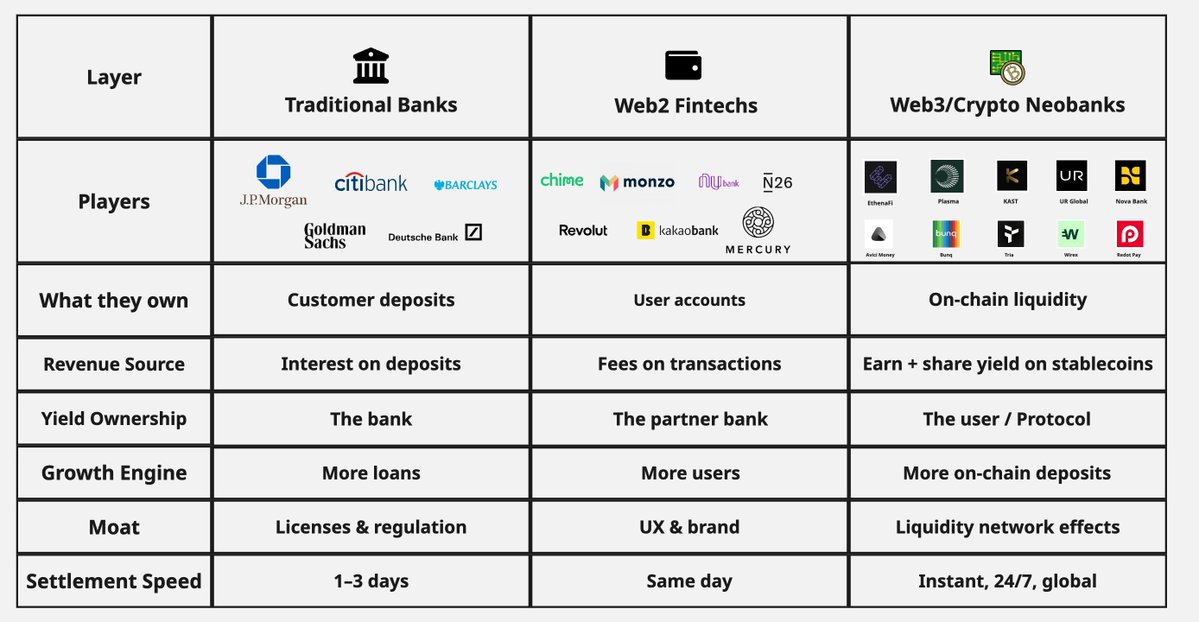

3/ Web2 fintechs did rebuilt the banking’s interface, but infrastructure for was still the same.

For example, Revolut keeps its customer deposits with Lloyds. Nubank’s reserves ultimately sit at Brazil’s central bank. Wise still clears through SWIFT. These companies changed how people interact with money, but not where that money actually lives.

And that’s why, out of the 15 biggest neobanks, 9 still make less than $100 per user, per year.

For example, Revolut keeps its customer deposits with Lloyds. Nubank’s reserves ultimately sit at Brazil’s central bank. Wise still clears through SWIFT. These companies changed how people interact with money, but not where that money actually lives.

And that’s why, out of the 15 biggest neobanks, 9 still make less than $100 per user, per year.

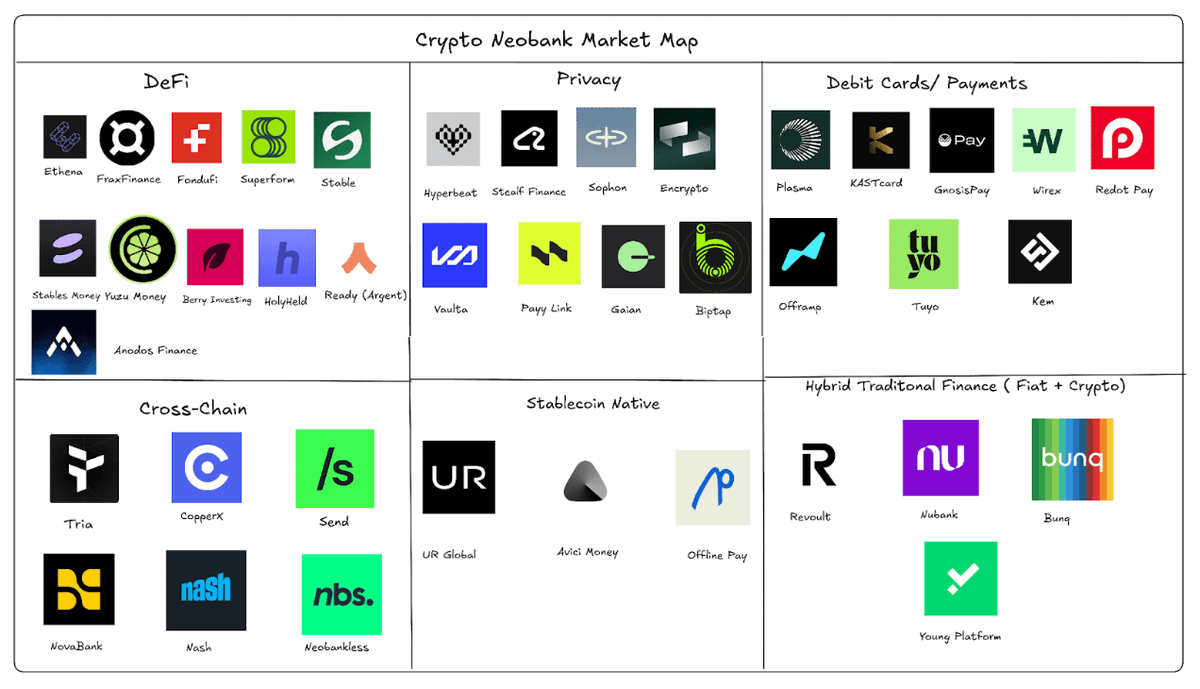

4/ Web2 fintechs built better banking apps, now Crypto neobanks are building better banks.

They do it by holding stablecoins deposits directly on-chain and then use those balances as their funding base. Like banks, they deploy deposits, but instead of lending through opaque balance sheets, they channel liquidity into transparent on-chain markets like tokenized U.S. Treasuries or DeFi lending pools.

Users can see where funds move and, in some cases, share in the yield.

They do it by holding stablecoins deposits directly on-chain and then use those balances as their funding base. Like banks, they deploy deposits, but instead of lending through opaque balance sheets, they channel liquidity into transparent on-chain markets like tokenized U.S. Treasuries or DeFi lending pools.

Users can see where funds move and, in some cases, share in the yield.

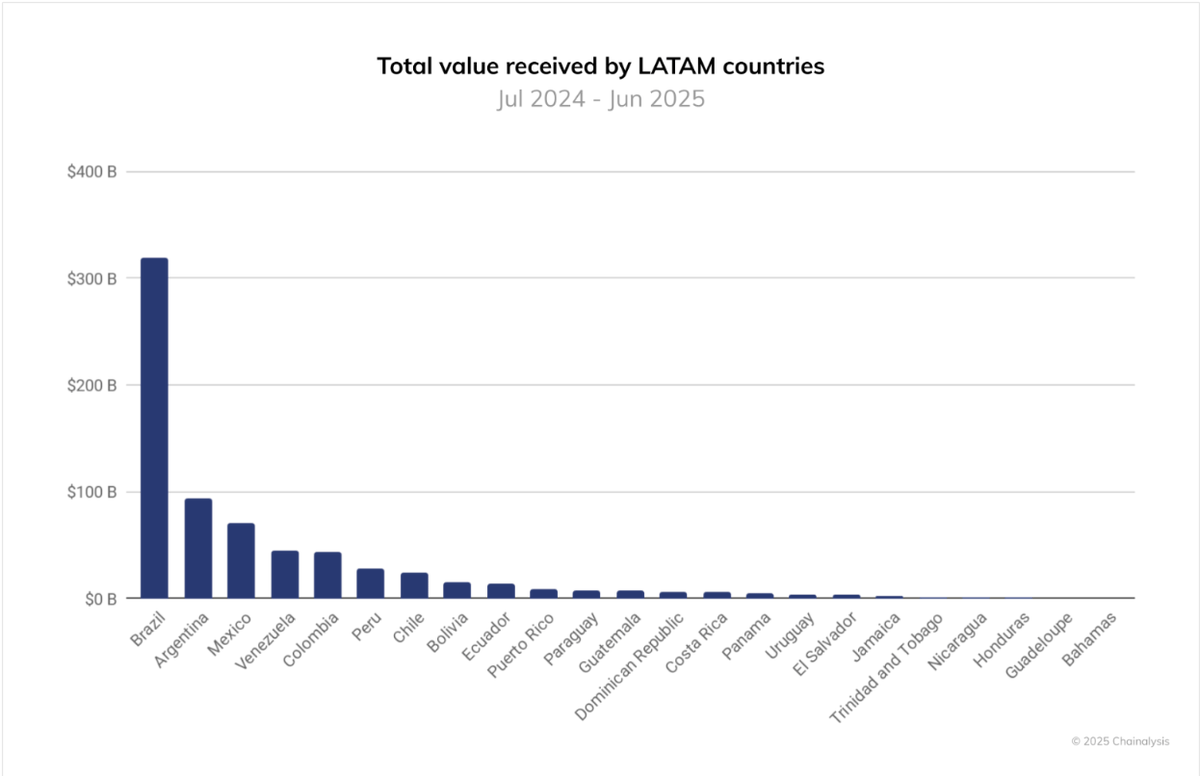

5/ Because programmable finance doesn’t need branches, it scales fastest in places where traditional banks fail.

Stablecoin powered neobanks are now the default way to save, pay, and move money in places where banks can’t protect value.

According to Chainalysis, Latin America saw over $1.5 trillion in crypto inflows last year, with $319B in Brazil alone, where nearly 90% came from stablecoins used for savings, salaries, and remittances.

Stablecoin powered neobanks are now the default way to save, pay, and move money in places where banks can’t protect value.

According to Chainalysis, Latin America saw over $1.5 trillion in crypto inflows last year, with $319B in Brazil alone, where nearly 90% came from stablecoins used for savings, salaries, and remittances.

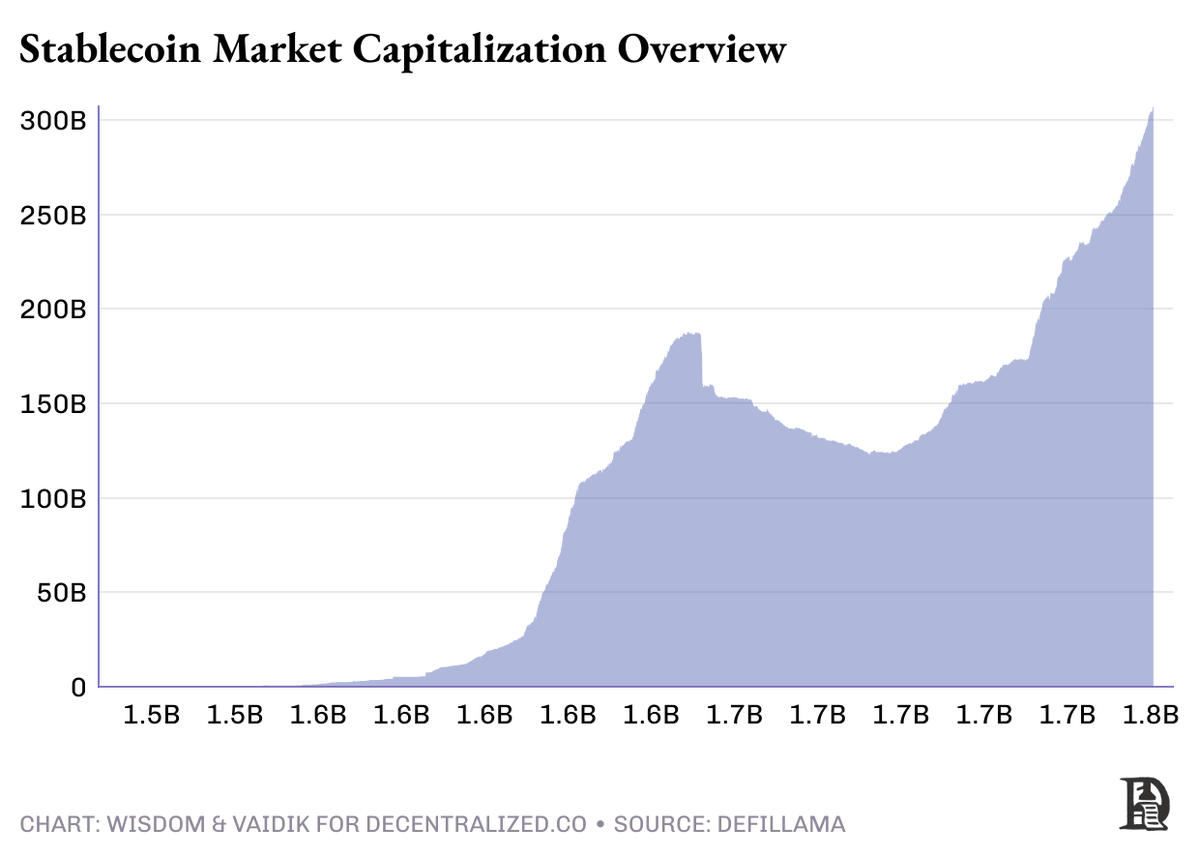

6/ As stablecoins went mainstream, deposits began pooling outside the banking system too.

Today, over $300 billion flows in digital dollars across wallets and tokenized treasuries, which is uncoordinated, but still massive.

The same thing happened in the 1800s. Hundreds of “free banks” issued their own notes, each backed by different reserves. It led to constant bank runs and broken trust until J.P. Morgan and others began consolidating deposits to restore stability and unify the system.

Crypto neobanks are solving the same problem, by organizing the scattered deposits of the digital dollar.

Today, over $300 billion flows in digital dollars across wallets and tokenized treasuries, which is uncoordinated, but still massive.

The same thing happened in the 1800s. Hundreds of “free banks” issued their own notes, each backed by different reserves. It led to constant bank runs and broken trust until J.P. Morgan and others began consolidating deposits to restore stability and unify the system.

Crypto neobanks are solving the same problem, by organizing the scattered deposits of the digital dollar.

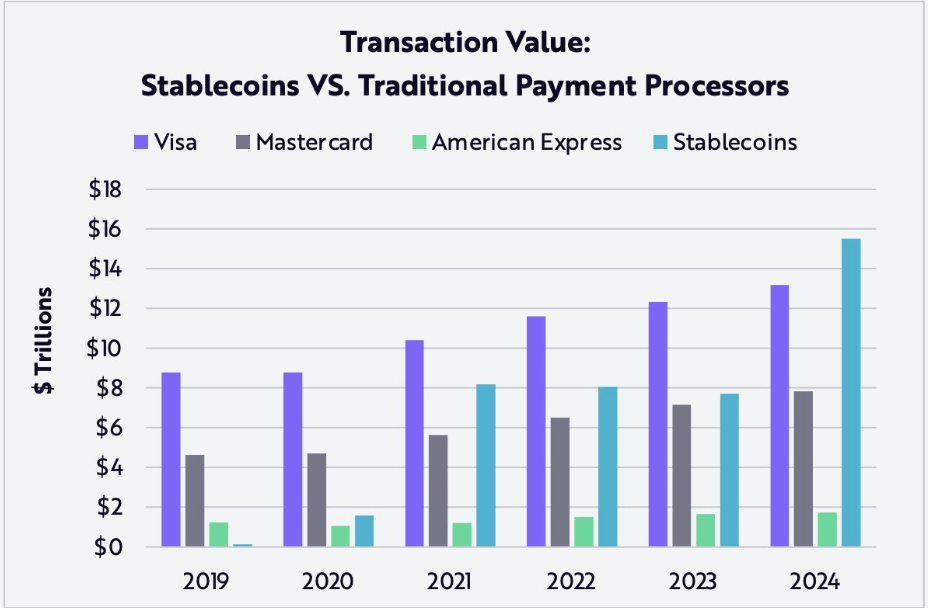

7/ According to ARK Invest's "BIG IDEAS 2025" report, Stablecoins settled over $15.6 trillion in 2024, more than Mastercard and Amex combined.

The platforms managing that flow, like wallets, exchanges, and crypto neobanks, are quietly becoming the new settlement layer for global finance.

The platforms managing that flow, like wallets, exchanges, and crypto neobanks, are quietly becoming the new settlement layer for global finance.

8/ Platforms like KAST, Tria, and protocols like Plasma are emerging as the default hubs for stablecoin liquidity, the same way JPMorgan once centralized dollar clearing, or Stripe did for online payments.

KAST is a payments neobank. Tria builds self-custodial accounts for users. Plasma powers the underlying on-chain rails that move the money.

That’s why giants like BNY Mellon and Visa are racing to integrate stablecoin rails, and Stripe is building its own Layer 1. They’re all chasing the same thing: control over where digital dollars rest, because everything else in finance builds on top of that.

KAST is a payments neobank. Tria builds self-custodial accounts for users. Plasma powers the underlying on-chain rails that move the money.

That’s why giants like BNY Mellon and Visa are racing to integrate stablecoin rails, and Stripe is building its own Layer 1. They’re all chasing the same thing: control over where digital dollars rest, because everything else in finance builds on top of that.

9/ When banks invest your deposits, they earn several percentage points in yield on loans and securities, but pass almost none of it back to you.

With tokenized dollars, yield doesn’t hide behind a bank’s balance sheet. You can see where it comes from, where it goes, and even share in it instantly.

With tokenized dollars, yield doesn’t hide behind a bank’s balance sheet. You can see where it comes from, where it goes, and even share in it instantly.

10/ Global commerical deposits total around $87 trillion.

As more of it migrates on-chain, that capital won’t need intermediaries to move or earn, It’ll need efficiency. And whoever builds those rails, will define the next era of banking.

As more of it migrates on-chain, that capital won’t need intermediaries to move or earn, It’ll need efficiency. And whoever builds those rails, will define the next era of banking.

• • •

Missing some Tweet in this thread? You can try to

force a refresh