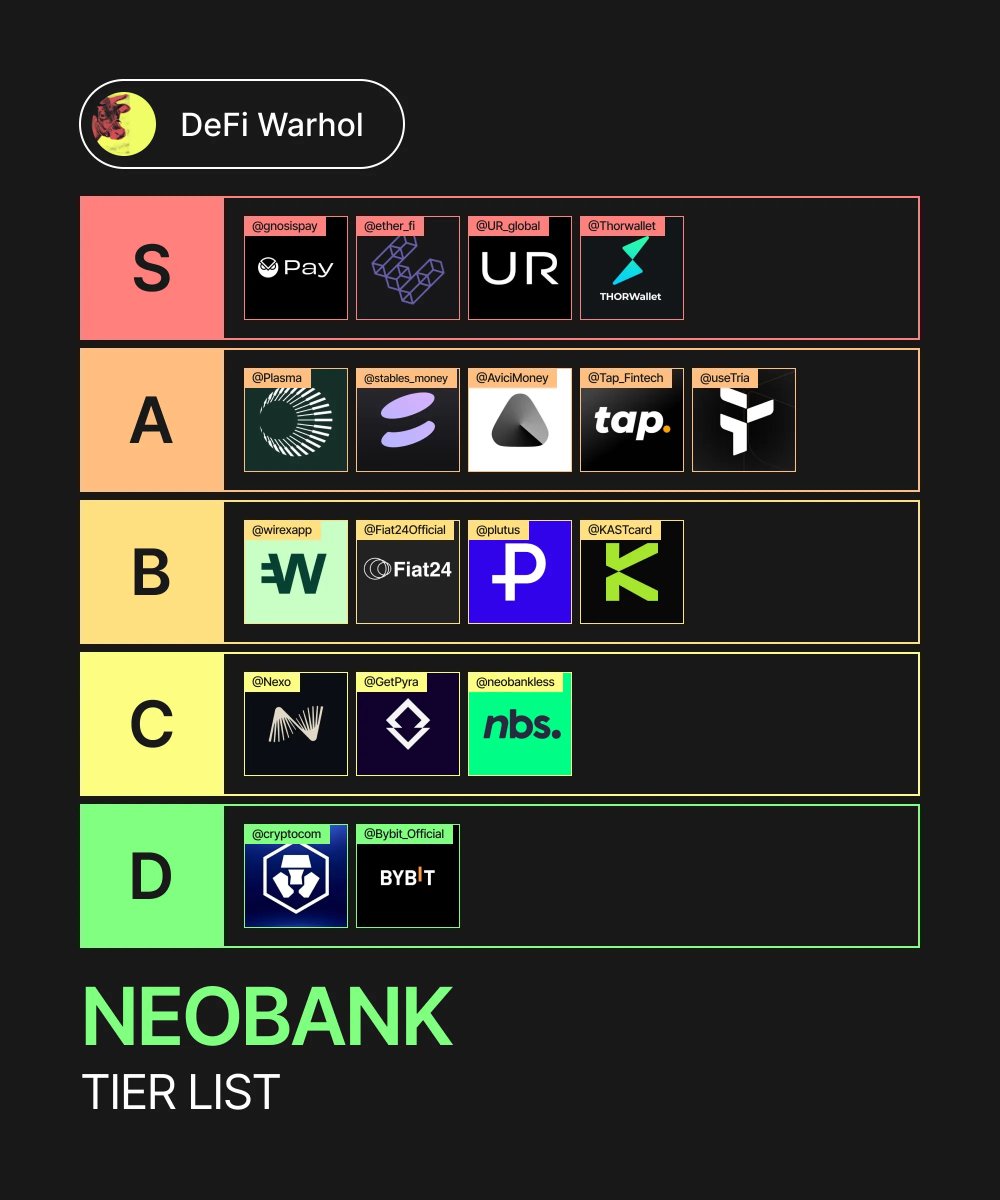

Neobanks Tier List 🧵

S:

@gnosispay: Self-custodial + fiat rails; clean crypto <> fiat bridge with IBAN options, best for EU users. No TX fees.

@ether_fi: Most comprehensive spectrum of native yield opportunities + card with cashback & perks. No FX fees in USD.

@UR_global: Multi-currency money app with card and off-ramp; great UX and usability with full global banking rail access. Minimal fees.

@Thorwallet: Non-custodial wallet with partner Swiss IBAN/card options; great onchain <> banked flow. Minimal fees.

A:

@plasma: Stablecoin-native neobank concept with running virtual/physical card with 4% cashback & 10% native yield, no IBAN yet.

@stables_money: Global USD account for simple top-ups and worldwide easy card spend; strong in the APAC region.

@AviciMoney: Full-scale neobank with cheap-tier crypto cards, an internet native trust score, unsecured loans, and home mortgages onchain. Big cook by @RamXBT.

@Tap_Fintech: Straightforward app with EU IBAN + UK details and a good card. Average fees, and routing that just works for basic crypto <> fiat moves.

@useTria: Self-custodial neobank with great crypto cards and bank connectivity; big potential. IBAN/SWIFT has to roll out soon.

B:

@wirexapp: Veteran player with personal EUR IBAN, card, rewards, and wide country support. Don't like the fee structure.

@Fiat24Official: Wallet-linked Swiss IBAN + debit card. Pretty good usability, but the UI is outdated IMO.

@plutus: EU IBAN/UK and decent cashback. Great for power users, though many perks can depend on your plan.

@KASTcard: Strong global crypto card with high limits. No personal IBAN; conversions are simple, great as a spender, not your full bank.

C:

@Nexo: Exchange-first app with a card and select EUR IBAN support. Works well inside the Nexo ecosystem, but banking features and fees vary a lot by jurisdiction/tier.

@GetPyra: "Spend without selling" UPS using a secured credit line. No IBAN yet; more of a clever credit primitive than a full neobank, but useful for tax optimization.

@neobankless: Brazil-first: Pix → USDC global account and a card on the roadmap. No IBAN and card yet live; promising regional play still in early build/coverage mode.

D:

@cryptocom: centralized exchange app with a popular card with SEPA/transfer support, but requires heavy staking requirements, and has regional shutdowns.

@Bybit_Official: Fully custodial with no IBAN available. If you're ok with centralization, this may be for you.

What else did I miss?

Hope you enjoyed this post and found some new VALUABLE information.

If you wanna support me, I'd appreciate a like, reply, and RT <3

S:

@gnosispay: Self-custodial + fiat rails; clean crypto <> fiat bridge with IBAN options, best for EU users. No TX fees.

@ether_fi: Most comprehensive spectrum of native yield opportunities + card with cashback & perks. No FX fees in USD.

@UR_global: Multi-currency money app with card and off-ramp; great UX and usability with full global banking rail access. Minimal fees.

@Thorwallet: Non-custodial wallet with partner Swiss IBAN/card options; great onchain <> banked flow. Minimal fees.

A:

@plasma: Stablecoin-native neobank concept with running virtual/physical card with 4% cashback & 10% native yield, no IBAN yet.

@stables_money: Global USD account for simple top-ups and worldwide easy card spend; strong in the APAC region.

@AviciMoney: Full-scale neobank with cheap-tier crypto cards, an internet native trust score, unsecured loans, and home mortgages onchain. Big cook by @RamXBT.

@Tap_Fintech: Straightforward app with EU IBAN + UK details and a good card. Average fees, and routing that just works for basic crypto <> fiat moves.

@useTria: Self-custodial neobank with great crypto cards and bank connectivity; big potential. IBAN/SWIFT has to roll out soon.

B:

@wirexapp: Veteran player with personal EUR IBAN, card, rewards, and wide country support. Don't like the fee structure.

@Fiat24Official: Wallet-linked Swiss IBAN + debit card. Pretty good usability, but the UI is outdated IMO.

@plutus: EU IBAN/UK and decent cashback. Great for power users, though many perks can depend on your plan.

@KASTcard: Strong global crypto card with high limits. No personal IBAN; conversions are simple, great as a spender, not your full bank.

C:

@Nexo: Exchange-first app with a card and select EUR IBAN support. Works well inside the Nexo ecosystem, but banking features and fees vary a lot by jurisdiction/tier.

@GetPyra: "Spend without selling" UPS using a secured credit line. No IBAN yet; more of a clever credit primitive than a full neobank, but useful for tax optimization.

@neobankless: Brazil-first: Pix → USDC global account and a card on the roadmap. No IBAN and card yet live; promising regional play still in early build/coverage mode.

D:

@cryptocom: centralized exchange app with a popular card with SEPA/transfer support, but requires heavy staking requirements, and has regional shutdowns.

@Bybit_Official: Fully custodial with no IBAN available. If you're ok with centralization, this may be for you.

What else did I miss?

Hope you enjoyed this post and found some new VALUABLE information.

If you wanna support me, I'd appreciate a like, reply, and RT <3

@gnosispay @ether_fi @UR_global If you're tired of constant off-ramping and want a S-tier card with 3% cashback, 10% APR, and lots of travel perks, time to get your @ether_fi card.

Get one here ↓

ether.fi/refer/489ef648

Get one here ↓

ether.fi/refer/489ef648

• • •

Missing some Tweet in this thread? You can try to

force a refresh