1/ I'VE BEEN THINKING about Fed Gov Waller's Tuesday speech introducing "skinny Fed master accounts" for payment-only banks. (This is what @custodiabank proposed to the Fed in June 2020, but I digress.) This 🧵discusses implications for the banking system.

federalreserve.gov/newsevents/spe…

federalreserve.gov/newsevents/spe…

2/ I've previously predicted the bank trade associations will litigate the question of whether it's legal for trust companies to engage in deposit-taking activities (more on this below).

But, previously, I also asked a question--if the banks can't beat 'em, why not join 'em?

But, previously, I also asked a question--if the banks can't beat 'em, why not join 'em?

3/ This weekend I updated my database of disclosed capital requirements for OCC trust companies. Of the 35 chartered since 1997 with public disclosures, the most common capital requirement was $2-3 million. The median is $5m. Here's Anchorage's at $7m:

occ.gov/news-issuances…

occ.gov/news-issuances…

4/ Bankers reading this 🧵will no doubt see those capital rqmts for OCC trust cos thru the lens of banks' *far higher* capital requirements. It used to be true that banks could do many more things than trust cos, justifying the far higher capital & compliance costs for banks.

5/ How so? Here are 3 examples:

A - non-fiduciary activities

B - qualified custodian

C - Fed master accounts (specifically access to the payment system, such as Fedwire)

I'll discuss these in order.

A - non-fiduciary activities

B - qualified custodian

C - Fed master accounts (specifically access to the payment system, such as Fedwire)

I'll discuss these in order.

6/ Non-fiduciary activities: The OCC's handbook on custody says custody is "generally not considered" to be a fiduciary activity. Why does this matter?

occ.gov/publications-a…

occ.gov/publications-a…

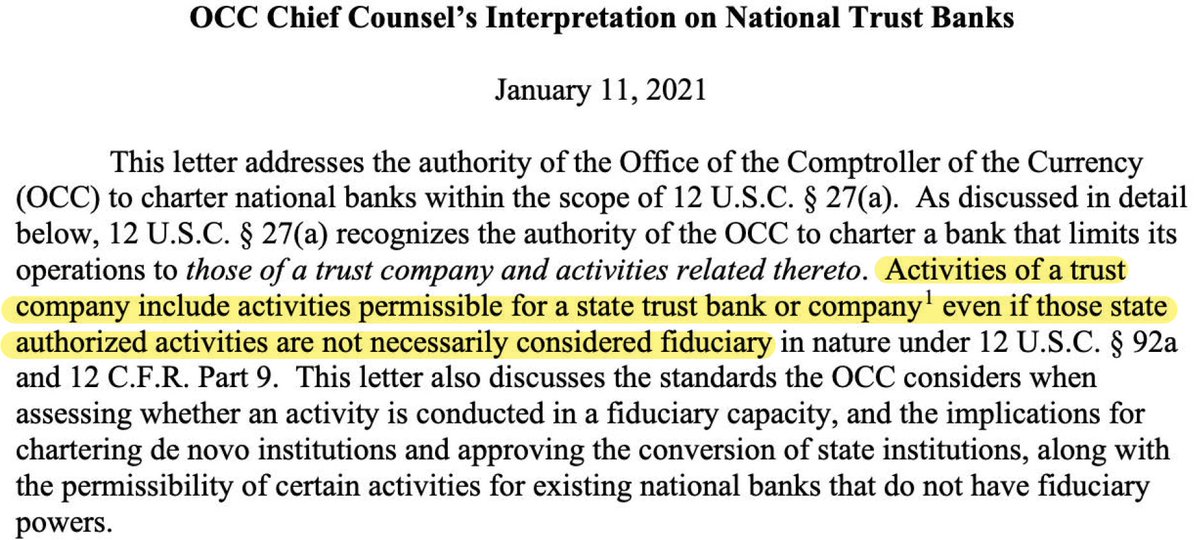

7/ The OCC changed its long-held interpretation that OCC trust cos could be chartered only if their activities were primarily fiduciary in nature, via Interpretive Letter 1176, in January 2021. This left non-fiduciary activities to pretty much banks only. occ.gov/topics/charter…

8/ Punch line: beginning Jan 2021, pure custodians are now eligible for OCC trust charters. Anchorage got its OCC trust charter two days later (it was the only applicant to receive it before the Biden/Warren crew slammed the door shut on all other applicants a few days later).

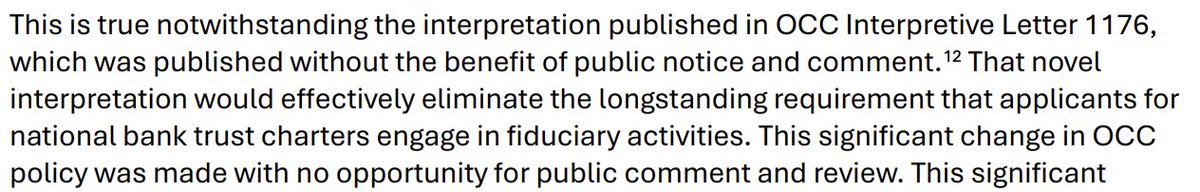

9/ At the time I wondered why the banks' trade associations didn't sue--this was a big change, & it wasn't put out for notice & comment as the APA requires. They do seem to be gearing up to do that now, since they raise this issue in every comment letter about applicants👇.

10/ You can find all the comment letters here: . But complaining won't work, because look at who signed the OCC's IL 1176 in Jan 2021👇: Jonathan Gould. He's now @USComptroller and he sets policy for the OCC. As the saying goes, personnel is policy. occ.treas.gov/topics/charter…

11/ There's a fairly large group of banks that could reduce their overall capital requirement by separating many activities into an OCC trust company subsidiary (namely, banks constrained by what's called the "tier 1 leverage ratio floor") "If you can't beat 'em, join 'em"?🤷♀️

12/ Next let's move to the second topic: "qualified custodian." Nearly every securities custodian has been a bank--not a trust company--to comply with the SEC Custody Rule, until the SEC very recently issued this no-action letter👇

sec.gov/rules-regulati…

sec.gov/rules-regulati…

13/ The vast majority of securities custodians are banks rather than trust cos, and "qualified custodian" is a big reason why. As explained in this paper, tho, there are big differences in what could happen to customer assets if the custodian were to fail: jstor.org/stable/23527077

14/ The upshot: resolution rules for resolving a failed bank prioritize its customers. That's not always true when a state trust company fails tho (customers can, and recently have, taken haircuts on their assets). The Federal Bankruptcy Code prioritizes the estate, not customers

15/ But *banks* are excluded from the Federal Bankruptcy Code. That's why, when a bank fails, customer assets are generally prioritized over the bank's debtors. In a state trust company bankruptcy, customers could face haircuts. It's easy to find my past tweet 🧵s on this topic.

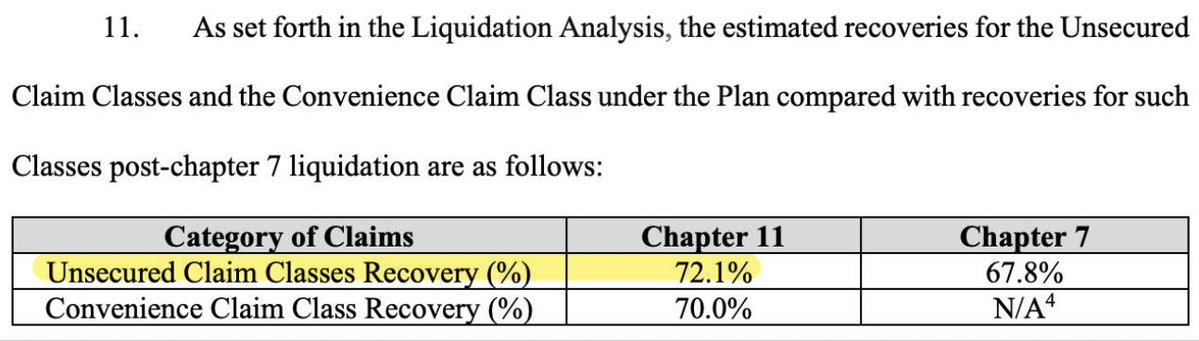

16/ And here's a sad example: crypto custody customers in the bankruptcy of Prime Trust, a trust company in the crypto custody biz, face a ~27.9% haircut on their assets under custody. (That could change based on clawbacks, which are still in litigation.)

cases.stretto.com/public/X274/12…

cases.stretto.com/public/X274/12…

17/ That 27.9% haircut is similar to the 27.5% haircut custody customers took in Celsius' bankruptcy (Celsius went thru a comparable federal bankruptcy process to Prime Trust). And...yet another trust company custodian in crypto may be headed for the same:

news.bloomberglaw.com/bankruptcy-law…

news.bloomberglaw.com/bankruptcy-law…

18/ But despite differences in the potential resolution outcomes for custody customers, it's now a fact that state trust companies can be "qualified custodians" just like banks can, per the SEC no-action letter (& for a fraction of the capital & compliance costs of being a bank).

19/ Third & finally, let's turn to Fed Gov. Waller's speech about "skinny master accounts." He provided a lot more detail in this post-speech interview👇than he did in his actual speech regarding banks vs. trust companies:

https://x.com/EleanorTerrett/status/1980725866226462885

20/ In the interview, he answered a question I raised last week (although he gave a big caveat that his answer wasn't official Fed position and he's not a lawyer): he equated OCC trust companies to banks when discussing legal eligibility to use the payment system (eg, Fedwire).

21/ OCC trust companies are prohibited by statute from receiving *deposits* of US dollars. Yet, Fedwire transfers *deposits* of US dollars. How can an entity legally prohibited from receiving something be able to transfer it?🤔

Banks' lawyers are no doubt gearing up...

Banks' lawyers are no doubt gearing up...

22/ When I heard Waller's answer I first thought of newly OCC-chartered Erebor Bank, whose capital requirement is to maintain a 12% tier 1 leverage ratio in its first 3 years👇(translation: it must hold $1.12 for every $1 of total assets, such as stablecoin reserves held in cash). That's A LOT BIGGER capital requirement than an OCC trust company would have against the very same exposure. (Typically >99% of a trust company's assets are off-balance sheet, which means the capital requirement for the same activity is likely radically different vs. a bank subject to a minimum tier 1 leverage ratio constraint).

occ.gov/news-issuances…

occ.gov/news-issuances…

23/ To sum up, until recently the 3 items discussed in this 🧵were among the key differentiating benefits to holding a bank charter instead of a trust company charter -- even though bank charters entail far higher capital requirements & compliance costs.

24/ If it ultimately proves true that these benefits no longer apply, and a swath of banks can do their same business via a trust charter with far lower costs & required capital, then I predict many banks will "level down." I can see one clear winner from what's coming: lawyers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh