How to Profit on Correlated Markets in @Polymarket

I've analyzed the current odds across all major markets

And found three working cross-market strategies

Strategy 3 delivers up to 4900% ROI on select cross-markets

> Strategy #1: Calendar Spread (Venezuela)

Summary: One event, different deadlines - trade the time spread.

Markets:

US x Venezuela military engagement by Nov 30 → 35% ($0.35)

polymarket.com/event/us-x-ven…

US x Venezuela military engagement by Dec 31 → 57% ($0.57)

polymarket.com/event/us-x-ven…

Package Logic:

If the event happens before Nov 30:

Nov 30 market = WIN ✓

Dec 31 market = AUTOMATIC WIN ✓ (since November is included in December)

If the event happens between Nov 30 and Dec 31:

Nov 30 market = LOSS ✗

Dec 31 market = WIN ✓

How to trade (step by step):

STEP 1: Enter the first market (Dec 31)

Go to the “US x Venezuela by Dec 31” market

Buy YES (example: $570 = 1000 contracts at $0.57 each)

If the event occurs before Dec 31, you get $1000 back; if not, you get $0.

STEP 2: Hedge through the second market (Nov 30)

Go to the “US x Venezuela by Nov 30” market

Buy NO (example: $175 = 500 contracts at $0.35 each)

You instantly receive this money - insurance if the event happens early.

STEP 3: Calculate your net outlay

Spent on Dec 31 YES: $570

Received from Nov 30 NO: $175

Actual outlay: $570 - $175 = $395

Your max risk is $395.

Scenarios:

If the event happens before Nov 30:

Dec 31 YES wins → $1000

Nov 30 NO loses (nothing more received)

Net: $1000 - $395 = +$605

If the event happens in December:

Dec 31 YES wins → $1000

Nov 30 NO wins → $175 (received up front)

Net: $1000 + $175 - $395 = +$780 ✓✓✓

If the event never happens before Dec 31:

Dec 31 YES loses → $0

Nov 30 NO wins → $175

Net: $175 - $395 = -$220

Why it works:

The market pays 57% for Dec 31, but with a lower true probability spread.

You buy YES below fair value and hedge with NO for November for added efficiency.

> Strategy #2: Contrarian Straddle (MicroStrategy)

Summary: The market doesn’t believe in either extreme scenario, but one must happen.

Markets:

MicroStrategy holds 680k+ BTC → 14% ($0.14)

polymarket.com/event/will-mic…

MicroStrategy margin call in 2025 → 4% ($0.04)

polymarket.com/event/will-mic…

Total probability: 18%

Logic:

Market assumes nothing extreme will happen (82% chance no big move).

BUT in reality: MicroStrategy regularly buys BTC, CEO says more is coming.

One extreme will hit: Either strong BTC growth to 680k+, or a margin call crash.

How to trade (step by step):

STEP 1: Buy YES on 680k+ BTC - $70 (500 shares at $0.14)

STEP 2: Buy YES on margin call - $20 (500 shares at $0.04)

STEP 3: Total spend: $90

Scenarios:

If MicroStrategy reaches 680k+, get $500, lose $20, net profit $410

If margin call happens, get $500, lose $70, net profit $410

If neither happens, lose $90 (your risk)

Why it works:

Pay $90 for a shot at $410+ profit.

Market underestimates the chance that at least one extreme occurs.

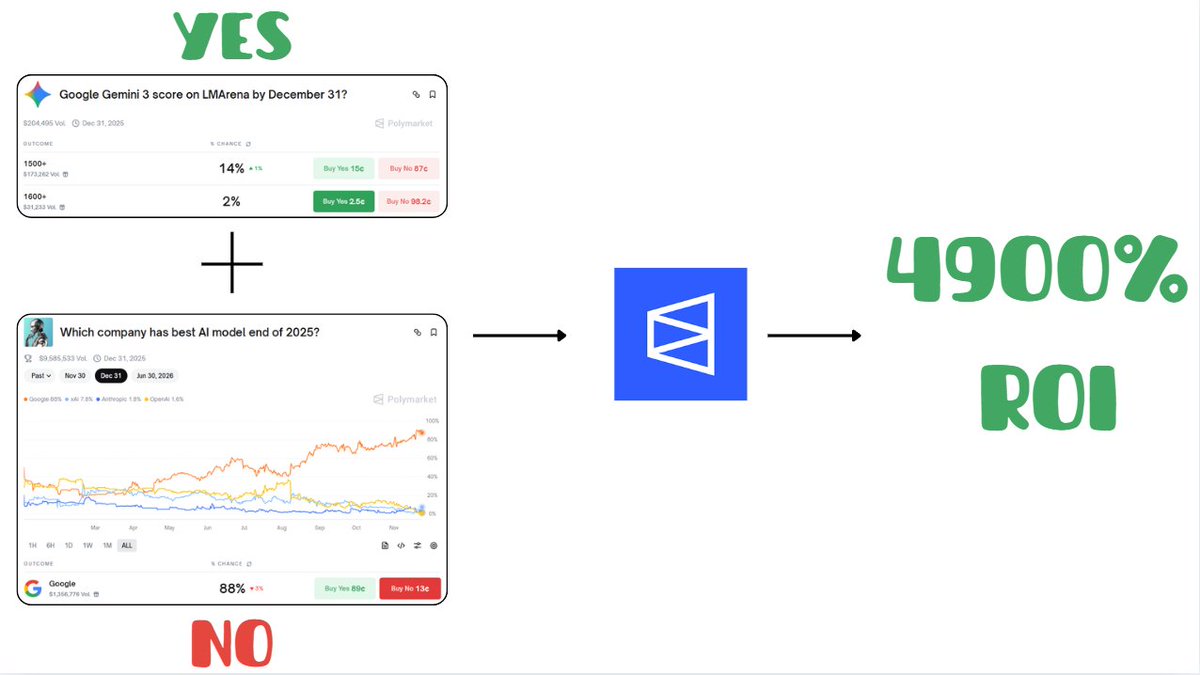

> Strategy #3: Logical Arbitrage (Google AI)

Summary: Correlated events are mispriced - exploit the gap.

Markets:

Google has best AI model by Dec 31 → 88% ($0.88)

polymarket.com/event/which-co…

Gemini scores 1600+ on LMArena by Dec 31 → 2% ($0.02)

polymarket.com/event/google-g…

Logic:

If Google is best (88%), their model should hit a high score (1600+).

But the market prices the second at just 2%!

Buy YES on the mispriced Gemini market.

How to trade (step by step):

STEP 1: Buy YES on “Gemini score 1600+” - $20 (1000 contracts at $0.02)

STEP 2 (optional hedge): Buy NO on “Google best AI”

STEP 3: Risk on Gemini is just $20.

Scenarios:

If both events happen: $1000 - $20 = $980 (4900% ROI)

If Gemini doesn’t score 1600+: lose $20

If you hedge ("buy NO" on Google), you get extra payout

Why it works:

Market ignores logical connections, creates major mispricing.

Golden rule (in the case of this strategy):

DON’T trade a single market - trade the CONNECTIONS between markets!

Profit comes NOT from guessing a single outcome,

but exploiting inefficiencies, flawed correlations, and time spreads.

NFA, DYOR, and good luck, Polyfrens!

I've analyzed the current odds across all major markets

And found three working cross-market strategies

Strategy 3 delivers up to 4900% ROI on select cross-markets

> Strategy #1: Calendar Spread (Venezuela)

Summary: One event, different deadlines - trade the time spread.

Markets:

US x Venezuela military engagement by Nov 30 → 35% ($0.35)

polymarket.com/event/us-x-ven…

US x Venezuela military engagement by Dec 31 → 57% ($0.57)

polymarket.com/event/us-x-ven…

Package Logic:

If the event happens before Nov 30:

Nov 30 market = WIN ✓

Dec 31 market = AUTOMATIC WIN ✓ (since November is included in December)

If the event happens between Nov 30 and Dec 31:

Nov 30 market = LOSS ✗

Dec 31 market = WIN ✓

How to trade (step by step):

STEP 1: Enter the first market (Dec 31)

Go to the “US x Venezuela by Dec 31” market

Buy YES (example: $570 = 1000 contracts at $0.57 each)

If the event occurs before Dec 31, you get $1000 back; if not, you get $0.

STEP 2: Hedge through the second market (Nov 30)

Go to the “US x Venezuela by Nov 30” market

Buy NO (example: $175 = 500 contracts at $0.35 each)

You instantly receive this money - insurance if the event happens early.

STEP 3: Calculate your net outlay

Spent on Dec 31 YES: $570

Received from Nov 30 NO: $175

Actual outlay: $570 - $175 = $395

Your max risk is $395.

Scenarios:

If the event happens before Nov 30:

Dec 31 YES wins → $1000

Nov 30 NO loses (nothing more received)

Net: $1000 - $395 = +$605

If the event happens in December:

Dec 31 YES wins → $1000

Nov 30 NO wins → $175 (received up front)

Net: $1000 + $175 - $395 = +$780 ✓✓✓

If the event never happens before Dec 31:

Dec 31 YES loses → $0

Nov 30 NO wins → $175

Net: $175 - $395 = -$220

Why it works:

The market pays 57% for Dec 31, but with a lower true probability spread.

You buy YES below fair value and hedge with NO for November for added efficiency.

> Strategy #2: Contrarian Straddle (MicroStrategy)

Summary: The market doesn’t believe in either extreme scenario, but one must happen.

Markets:

MicroStrategy holds 680k+ BTC → 14% ($0.14)

polymarket.com/event/will-mic…

MicroStrategy margin call in 2025 → 4% ($0.04)

polymarket.com/event/will-mic…

Total probability: 18%

Logic:

Market assumes nothing extreme will happen (82% chance no big move).

BUT in reality: MicroStrategy regularly buys BTC, CEO says more is coming.

One extreme will hit: Either strong BTC growth to 680k+, or a margin call crash.

How to trade (step by step):

STEP 1: Buy YES on 680k+ BTC - $70 (500 shares at $0.14)

STEP 2: Buy YES on margin call - $20 (500 shares at $0.04)

STEP 3: Total spend: $90

Scenarios:

If MicroStrategy reaches 680k+, get $500, lose $20, net profit $410

If margin call happens, get $500, lose $70, net profit $410

If neither happens, lose $90 (your risk)

Why it works:

Pay $90 for a shot at $410+ profit.

Market underestimates the chance that at least one extreme occurs.

> Strategy #3: Logical Arbitrage (Google AI)

Summary: Correlated events are mispriced - exploit the gap.

Markets:

Google has best AI model by Dec 31 → 88% ($0.88)

polymarket.com/event/which-co…

Gemini scores 1600+ on LMArena by Dec 31 → 2% ($0.02)

polymarket.com/event/google-g…

Logic:

If Google is best (88%), their model should hit a high score (1600+).

But the market prices the second at just 2%!

Buy YES on the mispriced Gemini market.

How to trade (step by step):

STEP 1: Buy YES on “Gemini score 1600+” - $20 (1000 contracts at $0.02)

STEP 2 (optional hedge): Buy NO on “Google best AI”

STEP 3: Risk on Gemini is just $20.

Scenarios:

If both events happen: $1000 - $20 = $980 (4900% ROI)

If Gemini doesn’t score 1600+: lose $20

If you hedge ("buy NO" on Google), you get extra payout

Why it works:

Market ignores logical connections, creates major mispricing.

Golden rule (in the case of this strategy):

DON’T trade a single market - trade the CONNECTIONS between markets!

Profit comes NOT from guessing a single outcome,

but exploiting inefficiencies, flawed correlations, and time spreads.

NFA, DYOR, and good luck, Polyfrens!

• • •

Missing some Tweet in this thread? You can try to

force a refresh