Prediction market fee wars beginning

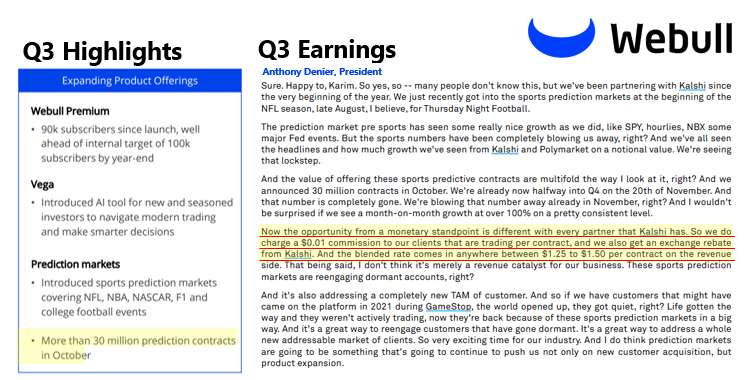

> Kalshi paying out 25/50% of its fees to WeBull (30m contracts in Oct) in exchange rebates

> Fees = 2c/contract: 1c Webull/1c Kalshi

> Using October's 30m notional: $600k in revenue ($300k Webull / $300k Kalshi). Post kickback, net using the mid is: $412k Webull / $188k Kalshi)

> If you don't own the flow, don't have any leverage. And if a PM ends up being a pure backend, turns into a math exercise: what's the least I can payout to partners to crowdout competitors, maximize volume, and earn the most in net fees? (game can play out for years)

> Kalshi paying out 25/50% of its fees to WeBull (30m contracts in Oct) in exchange rebates

> Fees = 2c/contract: 1c Webull/1c Kalshi

> Using October's 30m notional: $600k in revenue ($300k Webull / $300k Kalshi). Post kickback, net using the mid is: $412k Webull / $188k Kalshi)

> If you don't own the flow, don't have any leverage. And if a PM ends up being a pure backend, turns into a math exercise: what's the least I can payout to partners to crowdout competitors, maximize volume, and earn the most in net fees? (game can play out for years)

https://x.com/TheOneandOmsy/status/1986549187090034802

• • •

Missing some Tweet in this thread? You can try to

force a refresh