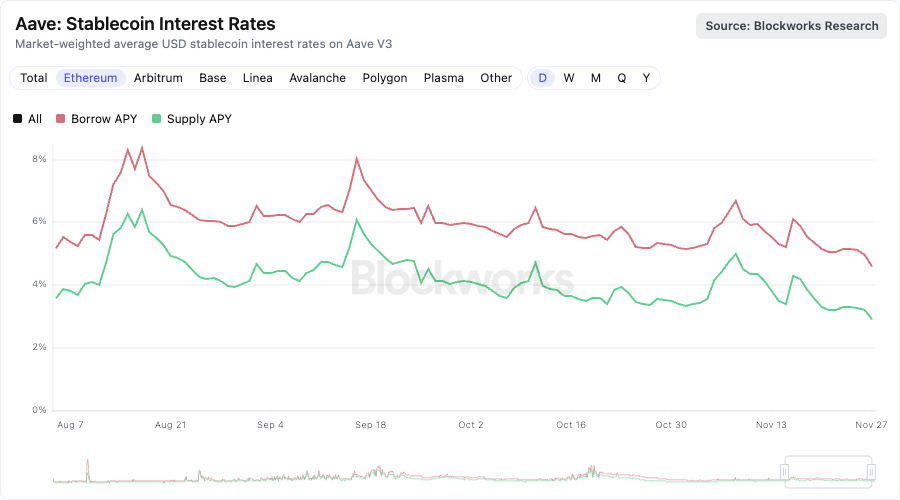

Stablecoin supply APYs on Aave's Ethereum market have fallen from an average of about 5% in late Summer to just above 3% now.

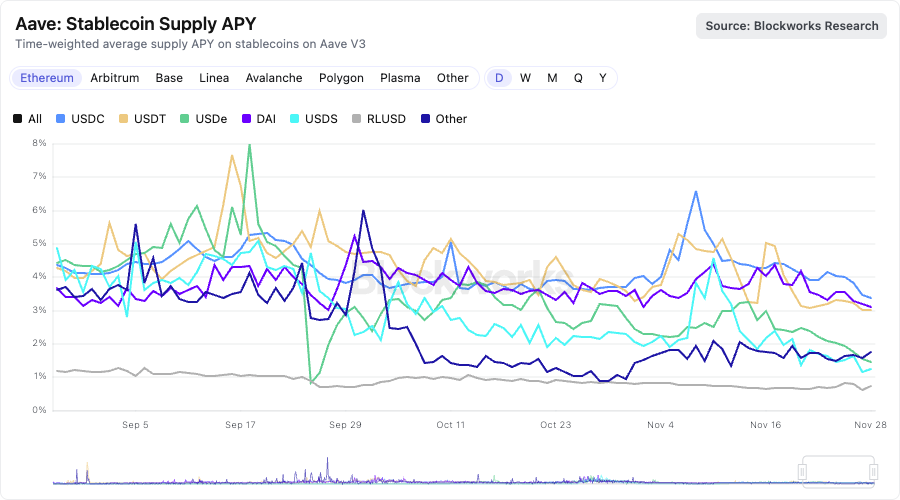

Breaking this down, we see that USDC, DAI, and USDT currently have the highest yields, each just above 3%, while USDe, RLUSD, and USDS are all below 1.5%.

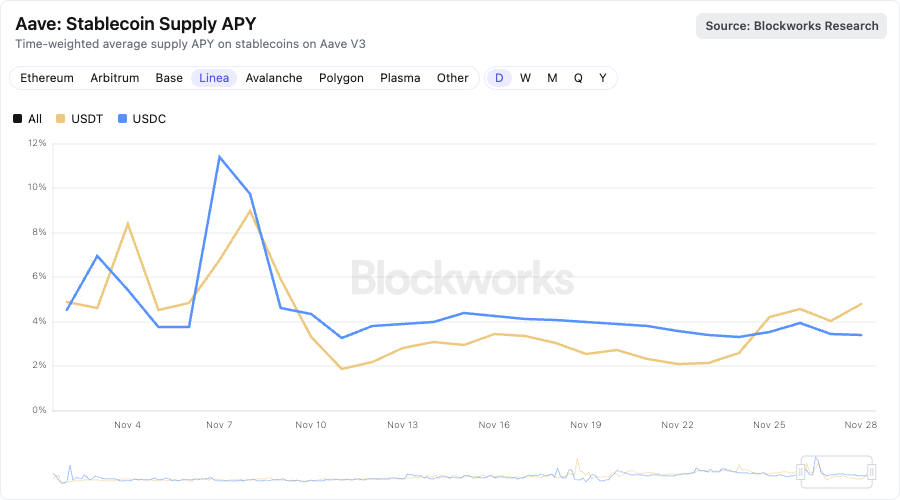

For those willing to bridge to other chains, there are a few opportunities to earn slightly higher yields. For example USDT is earning 4.8% on Linea vs 3.2% on Ethereum.

Overall, demand for stablecoins in DeFi is cooling off, pushing onchain rates below offchain alternatives.

Breaking this down, we see that USDC, DAI, and USDT currently have the highest yields, each just above 3%, while USDe, RLUSD, and USDS are all below 1.5%.

For those willing to bridge to other chains, there are a few opportunities to earn slightly higher yields. For example USDT is earning 4.8% on Linea vs 3.2% on Ethereum.

Overall, demand for stablecoins in DeFi is cooling off, pushing onchain rates below offchain alternatives.

• • •

Missing some Tweet in this thread? You can try to

force a refresh