1/ The Fusaka upgrade is coming December 3rd.

Ethereum is securely scaling.

Are you ready to support the changes?

Here’s what developers across the ecosystem need to do to prepare 🧵

Ethereum is securely scaling.

Are you ready to support the changes?

Here’s what developers across the ecosystem need to do to prepare 🧵

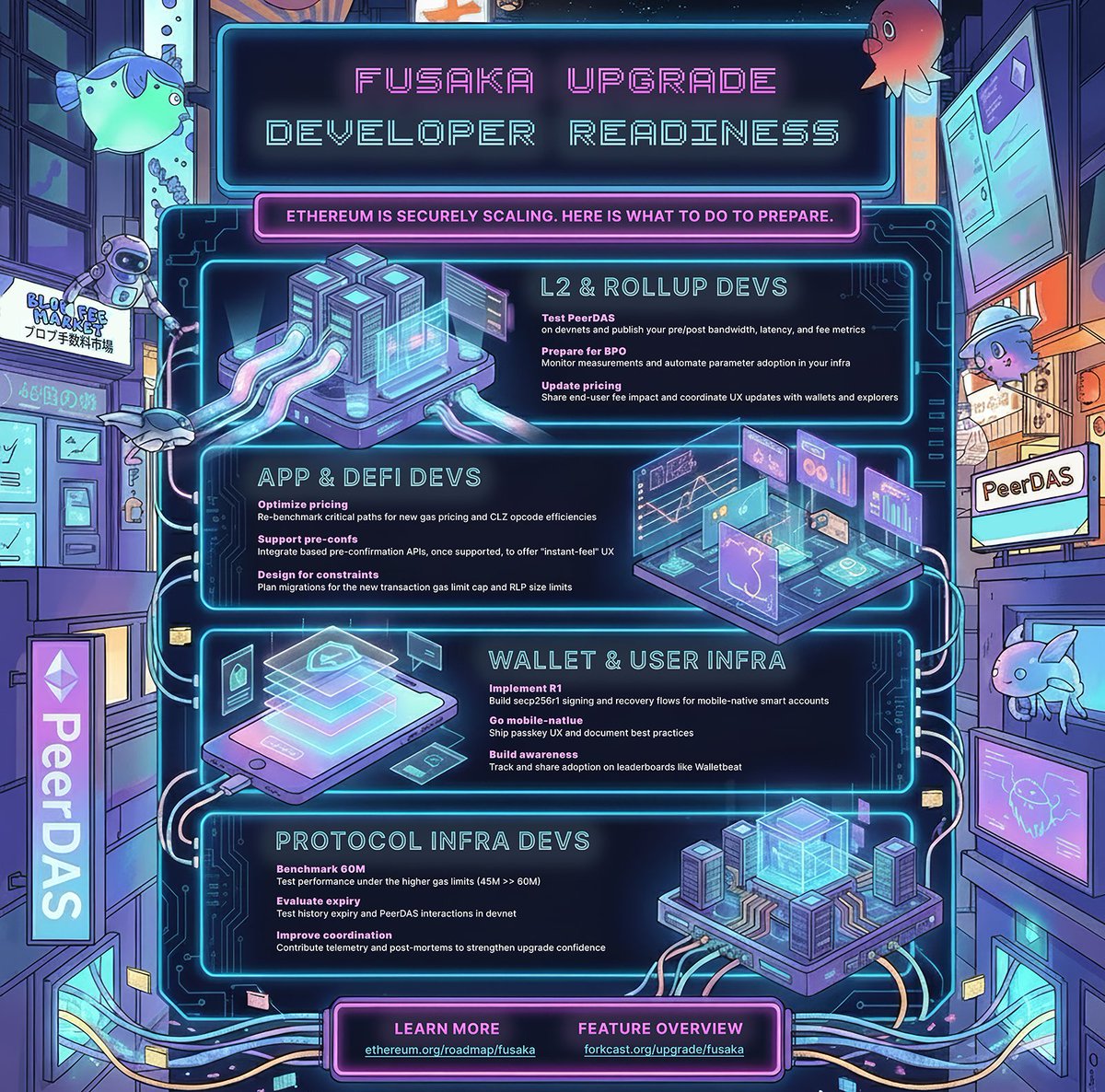

2/ L2 & Rollup Devs

PeerDAS unlocks up to 8x data throughput, meaning cheaper blob fees and faster confirmations

Get ready: Update your pricing, test PeerDAS on devnets, and prepare your infrastructure for BPO forks

Important dates to start using increased capacity: BPO1 Dec 9th & BPO2 Jan 7th

Schedule here: blog.ethereum.org/2025/11/06/fus…

PeerDAS unlocks up to 8x data throughput, meaning cheaper blob fees and faster confirmations

Get ready: Update your pricing, test PeerDAS on devnets, and prepare your infrastructure for BPO forks

Important dates to start using increased capacity: BPO1 Dec 9th & BPO2 Jan 7th

Schedule here: blog.ethereum.org/2025/11/06/fus…

3/ App & DeFi Devs

Fusaka will bring lower transaction costs and "instant-feel" UX via based pre-confirmations

How to prep: Re-benchmark critical paths for CLZ opcode efficiencies, plan for new RLP size limits, and integrate pre-conf APIs

Key change: EIP-7825 introduces a per-transaction gas limit cap of 2^24. Verify that your contracts and transaction builders conform to the new cap.

Details here: blog.ethereum.org/2025/10/21/fus…

Fusaka will bring lower transaction costs and "instant-feel" UX via based pre-confirmations

How to prep: Re-benchmark critical paths for CLZ opcode efficiencies, plan for new RLP size limits, and integrate pre-conf APIs

Key change: EIP-7825 introduces a per-transaction gas limit cap of 2^24. Verify that your contracts and transaction builders conform to the new cap.

Details here: blog.ethereum.org/2025/10/21/fus…

4/ Wallet & User Infra Devs

The R1 curve and EIP-7951 are unlocking secure mobile-native passkeys and simpler signatures

Your role: Start building secp256r1 signing flows, ship updated passkey UX, and start tracking adoption on leaderboards

The R1 curve and EIP-7951 are unlocking secure mobile-native passkeys and simpler signatures

Your role: Start building secp256r1 signing flows, ship updated passkey UX, and start tracking adoption on leaderboards

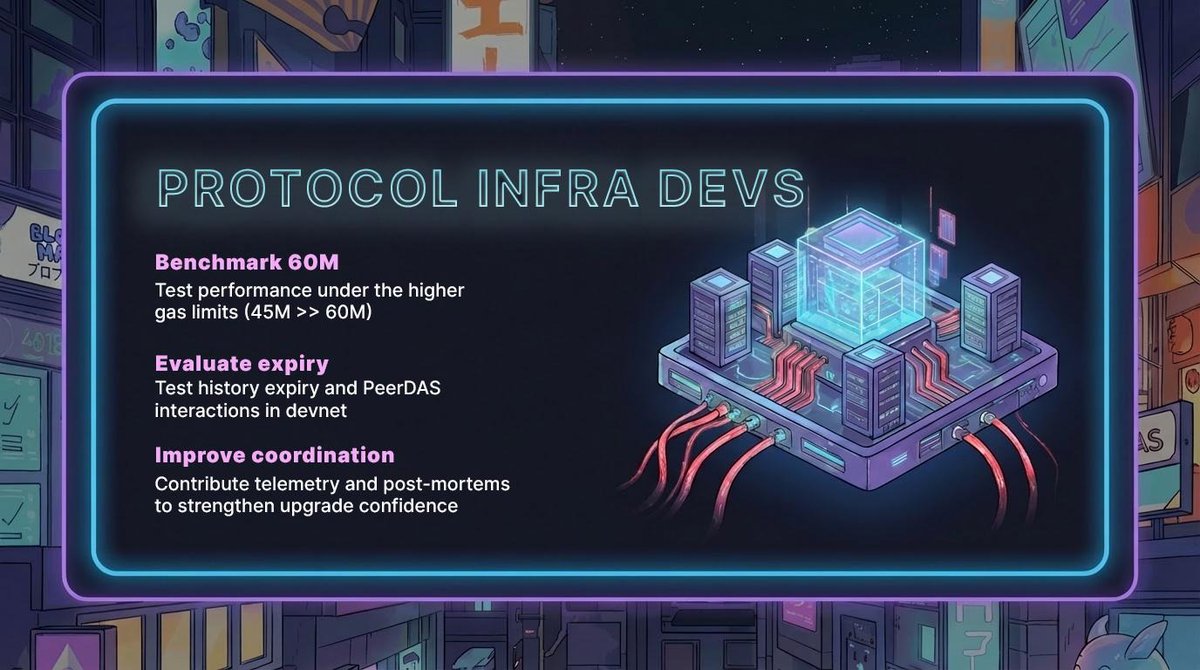

5/ Protocol Infra Devs

Fusaka brings higher gas limits (45M → 60M) and improved telemetry (EIP-7910) to strengthen upgrade confidence

To do: Benchmark performance under the new limits, test history expiry, and contribute your post-mortem metrics

Fusaka brings higher gas limits (45M → 60M) and improved telemetry (EIP-7910) to strengthen upgrade confidence

To do: Benchmark performance under the new limits, test history expiry, and contribute your post-mortem metrics

6/ Ready to get started with your Fusaka upgrade prep?

Learn more about the upgrade: ethereum.org/roadmap/fusaka

Review features in the current fork: forkcast.org/upgrade/fusaka/

Learn more about the upgrade: ethereum.org/roadmap/fusaka

Review features in the current fork: forkcast.org/upgrade/fusaka/

• • •

Missing some Tweet in this thread? You can try to

force a refresh