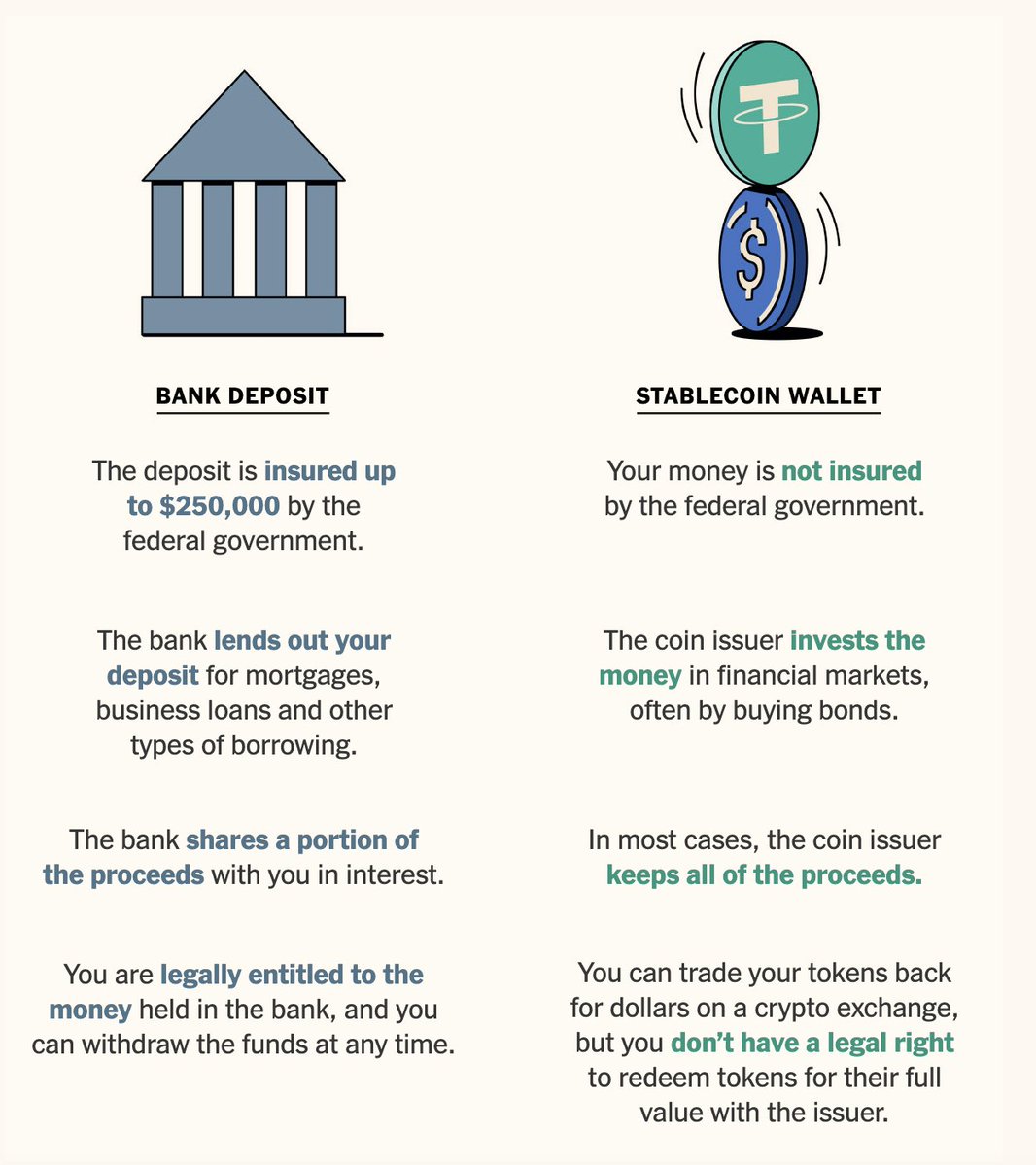

masterclass from the @nytimes on how to create anti-crypto propaganda. each point in the graphic can be refuted ad nauseam, but lets start here:

"banks share a portion of proceeds as interest; coin issuers keep all of the proceeds"

for most of the last decade, banks paid near-zero on deposits while earning healthy spreads on loans and securities. the idea that banks generously "share" yield is a lie, depositors usually get a tiny fraction of the economic value generated from their funds.

in crypto, the user can choose where yield lives. you can move that stablecoin into defi to capture yield directly instead of letting a bank capture it, and that yield is many multiples higher than what a bank will offer.

"bank deposits are insured up to $250k; stablecoins aren’t insured"

FDIC only covers up to 250k in the US. above that you are an unsecured creditor of a leveraged bank. in a lot of countries there is no credible insurance at all. for those people, a solid USD stablecoin backed by t-bills can actually be safer than the local bank.

"banks lend out your deposit; coin issuers invest the money in financial markets" (as if those are different)

banks invest your deposits too, they just call it mortgages and corporate loans and pretend that is low risk. most major fiat stablecoins sit mostly in cash and short term treasuries. same basic thing, usually with less credit and duration risk.

"you are legally entitled to bank money and can withdraw at any time; you don’t have a legal right to redeem stablecoins"

capital controls, bank holidays, random account freezes, all perfectly allowed while you "have rights" on paper. with stablecoins you get self custody, 24/7 global liquidity, and you do not have to ask a teller for permission.

they compare a fantasy version of a US checking account to a cartoon villain version of stablecoins, and call it journalism.

"banks share a portion of proceeds as interest; coin issuers keep all of the proceeds"

for most of the last decade, banks paid near-zero on deposits while earning healthy spreads on loans and securities. the idea that banks generously "share" yield is a lie, depositors usually get a tiny fraction of the economic value generated from their funds.

in crypto, the user can choose where yield lives. you can move that stablecoin into defi to capture yield directly instead of letting a bank capture it, and that yield is many multiples higher than what a bank will offer.

"bank deposits are insured up to $250k; stablecoins aren’t insured"

FDIC only covers up to 250k in the US. above that you are an unsecured creditor of a leveraged bank. in a lot of countries there is no credible insurance at all. for those people, a solid USD stablecoin backed by t-bills can actually be safer than the local bank.

"banks lend out your deposit; coin issuers invest the money in financial markets" (as if those are different)

banks invest your deposits too, they just call it mortgages and corporate loans and pretend that is low risk. most major fiat stablecoins sit mostly in cash and short term treasuries. same basic thing, usually with less credit and duration risk.

"you are legally entitled to bank money and can withdraw at any time; you don’t have a legal right to redeem stablecoins"

capital controls, bank holidays, random account freezes, all perfectly allowed while you "have rights" on paper. with stablecoins you get self custody, 24/7 global liquidity, and you do not have to ask a teller for permission.

they compare a fantasy version of a US checking account to a cartoon villain version of stablecoins, and call it journalism.

• • •

Missing some Tweet in this thread? You can try to

force a refresh