Did @HyperliquidX autodeleverage (ADL) $650m of PNL that it didn’t have to?

Was this 28x more than the minimal necessary?

Did almost every exchange (incl. @binance) copy-pasta a Huobi heuristic from 2015?

Can we do better in 2026?

𝐘𝐞𝐬 (+ a new paper)

Was this 28x more than the minimal necessary?

Did almost every exchange (incl. @binance) copy-pasta a Huobi heuristic from 2015?

Can we do better in 2026?

𝐘𝐞𝐬 (+ a new paper)

https://twitter.com/53836928/status/1998451653154906236

On 10/10, a Truth Social post shocked the market and set off the largest liquidation cascade in history

This forced Hyperliquid and others to 𝗿𝗲𝗽𝗲𝗮𝘁𝗲𝗱𝗹𝘆 trigger ADL

ADL is a worst-case loss socialization: winning trader profits are haircut to cover bad debt

This forced Hyperliquid and others to 𝗿𝗲𝗽𝗲𝗮𝘁𝗲𝗱𝗹𝘆 trigger ADL

ADL is a worst-case loss socialization: winning trader profits are haircut to cover bad debt

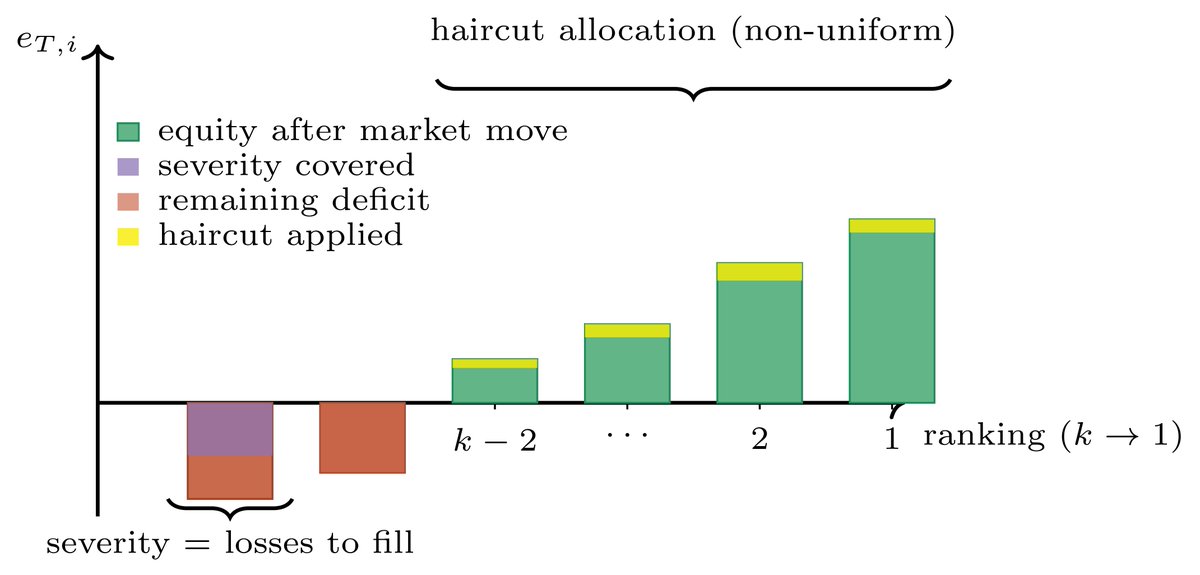

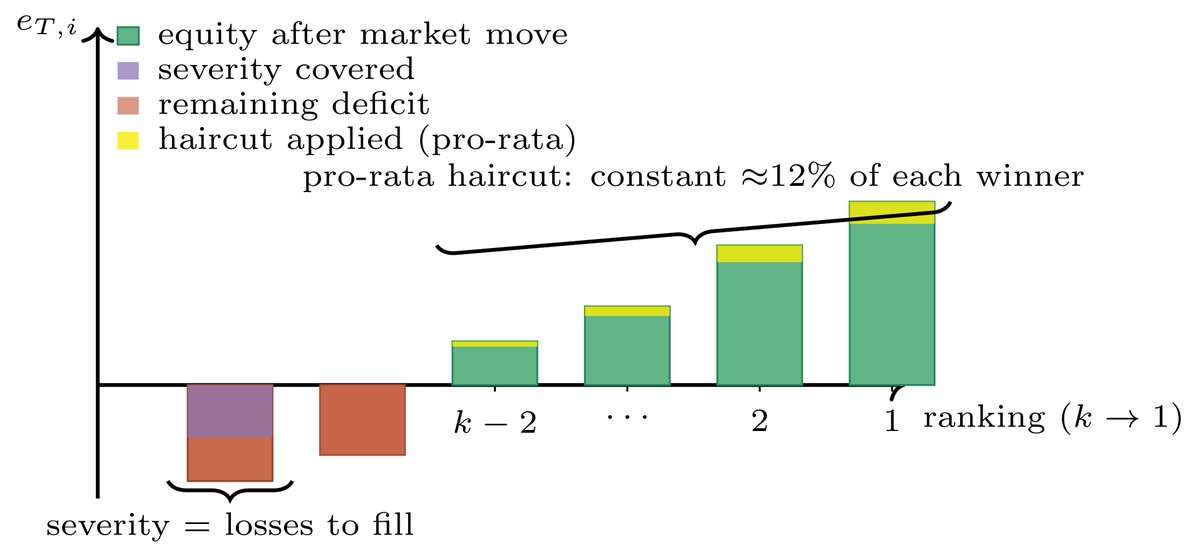

But what is ADL and why did it fail so badly? @0xdoug covered the basics, but to quantify why the ADL algorithm common to both Hyperliquid and Binance failed so spectacularly, we first need to describe ADL in geometric, mathematical terms via 𝘸𝘢𝘵𝘦𝘳-𝘧𝘪𝘭𝘭𝘪𝘯𝘨 𝘢𝘭𝘨𝘰𝘳𝘪𝘵𝘩𝘮𝘴

Water-filling algorithms are easy to draw

Below is the set of equity values (= cash + PNL) for each position ranked from smallest to highest

Negative equity = bad debt (e.g. lost more in PNL than collateral)

ADL haircuts winning traders ("removes water") to cover bad debt

Below is the set of equity values (= cash + PNL) for each position ranked from smallest to highest

Negative equity = bad debt (e.g. lost more in PNL than collateral)

ADL haircuts winning traders ("removes water") to cover bad debt

ADL algorithms have 2 parameters:

1. Severity: Fraction of debt that is socialized

2. Haircut vector: What % of profit is haircut from each winner

Water-filling constraint:

area of the yellow haircuts (water outflow) = area of the purple bad debt covered (water inflow)

1. Severity: Fraction of debt that is socialized

2. Haircut vector: What % of profit is haircut from each winner

Water-filling constraint:

area of the yellow haircuts (water outflow) = area of the purple bad debt covered (water inflow)

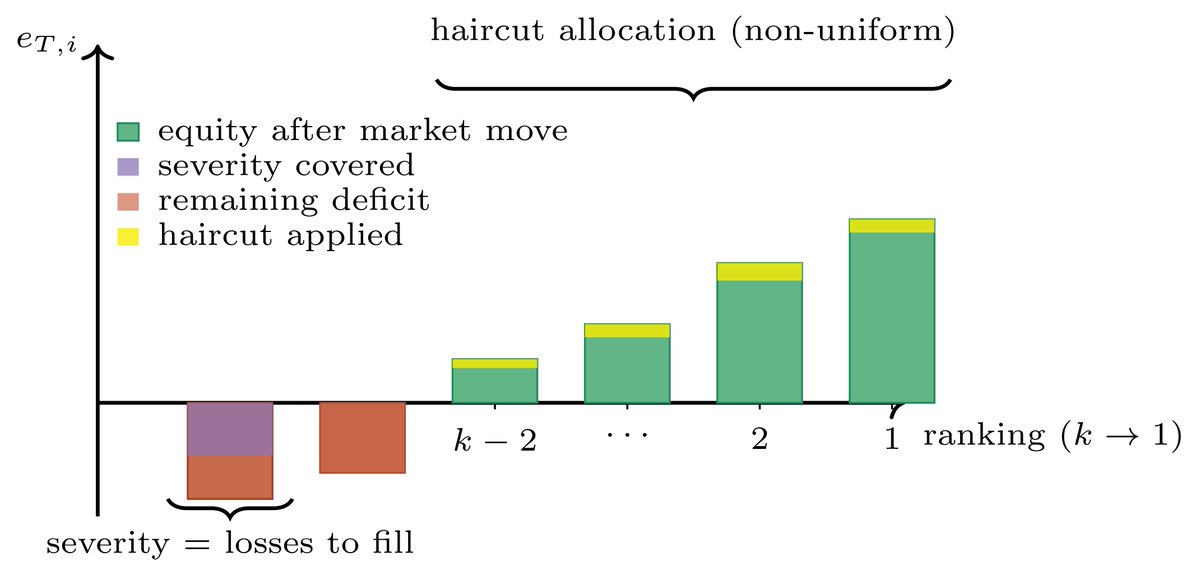

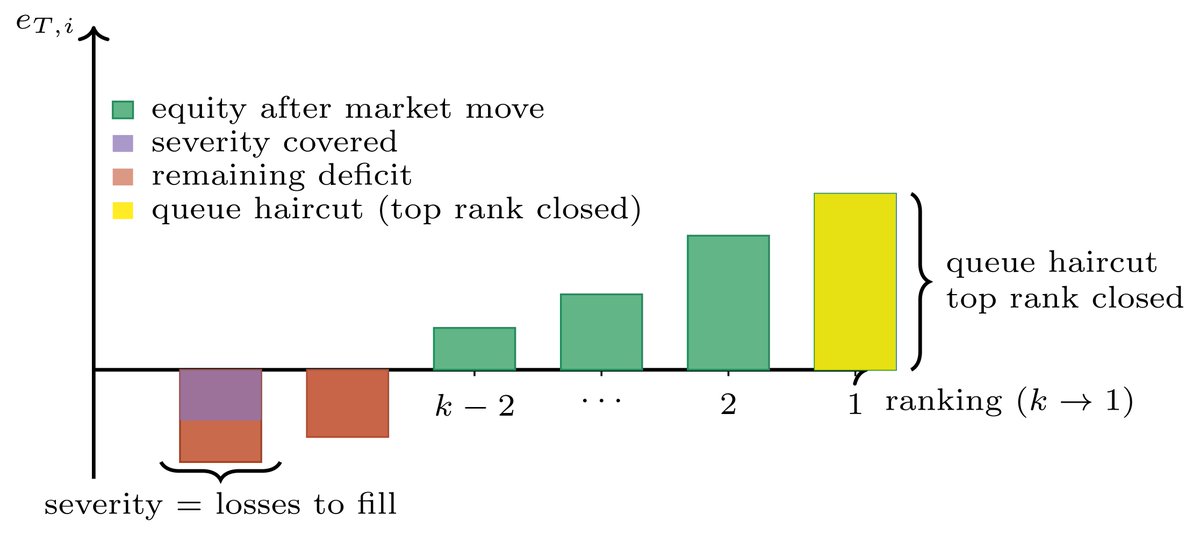

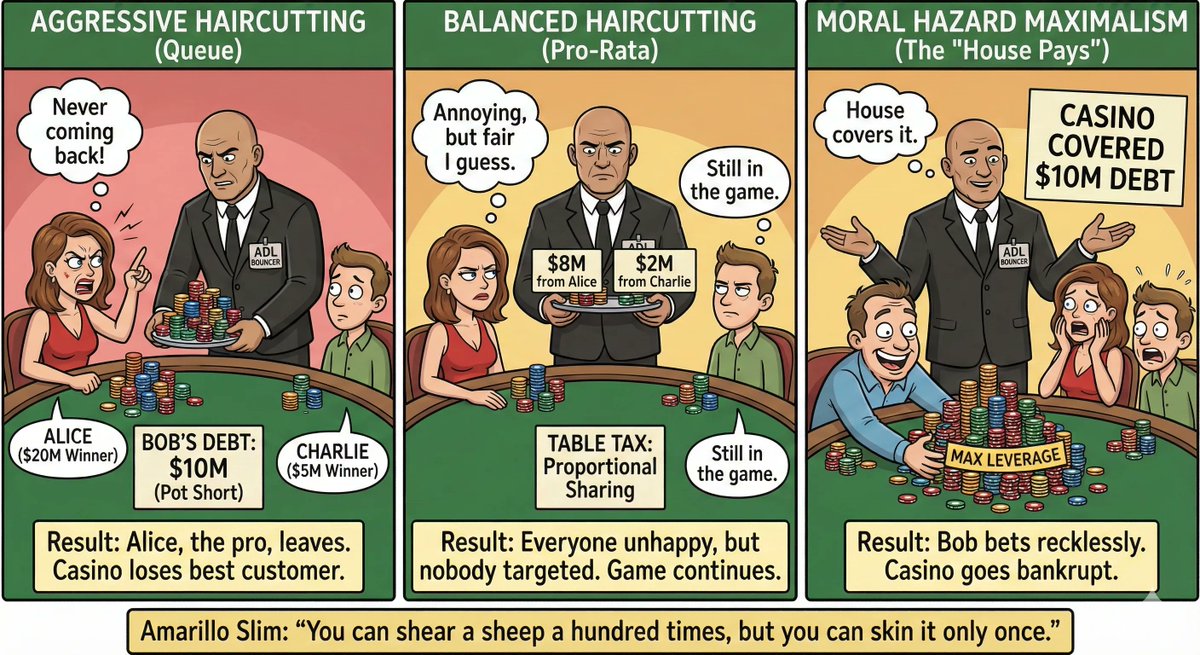

What water-filling algorithm do @HyperliquidX and @binance use?

Greedy Queue algorithm:

1. Rank traders by PNL % x Leverage

2. Fully close positions until the deficit is covered

This algorithm 𝐨𝐯𝐞𝐫𝐬𝐡𝐨𝐨𝐭𝐬 (e.g. liquidates more PNL than the deficit requires)

Greedy Queue algorithm:

1. Rank traders by PNL % x Leverage

2. Fully close positions until the deficit is covered

This algorithm 𝐨𝐯𝐞𝐫𝐬𝐡𝐨𝐨𝐭𝐬 (e.g. liquidates more PNL than the deficit requires)

Why do they use this algorithm?

As @CryptoHayes details in his latest post, Huobi first created this algorithm as a heuristic for dated crypto futures

BitMEX later repurposed it for perpetuals futures and since then most exchanges copy-pasta'd it

cryptohayes.substack.com/p/adapt-or-die

As @CryptoHayes details in his latest post, Huobi first created this algorithm as a heuristic for dated crypto futures

BitMEX later repurposed it for perpetuals futures and since then most exchanges copy-pasta'd it

cryptohayes.substack.com/p/adapt-or-die

Why is this algorithm bad, especially on decentralized exchanges?

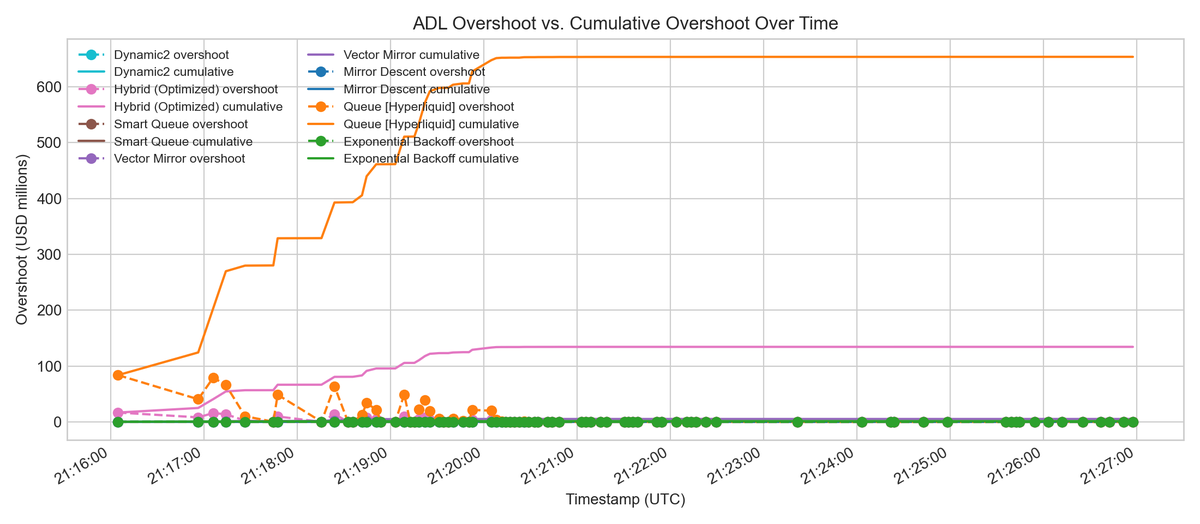

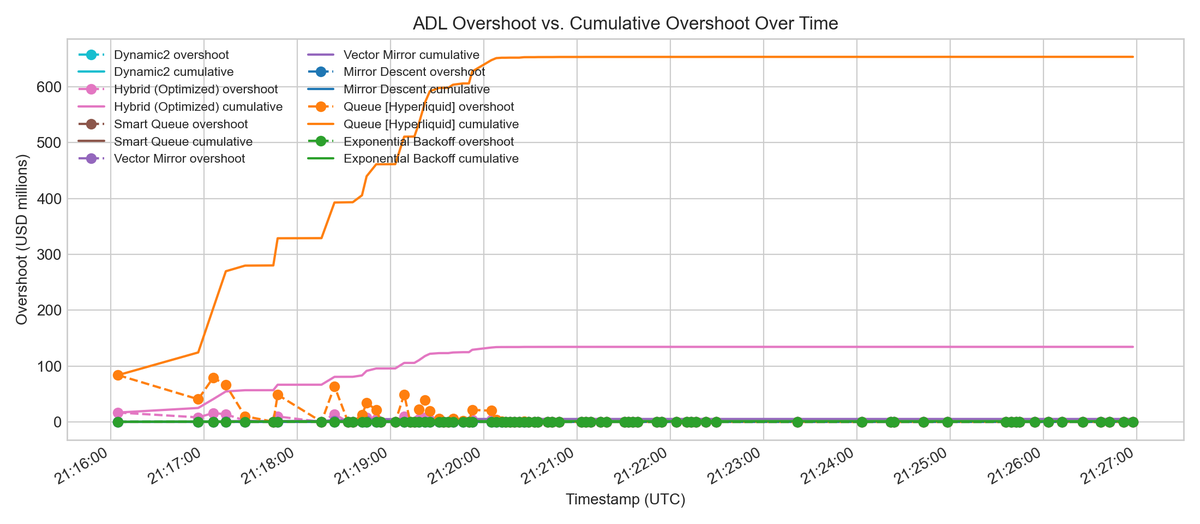

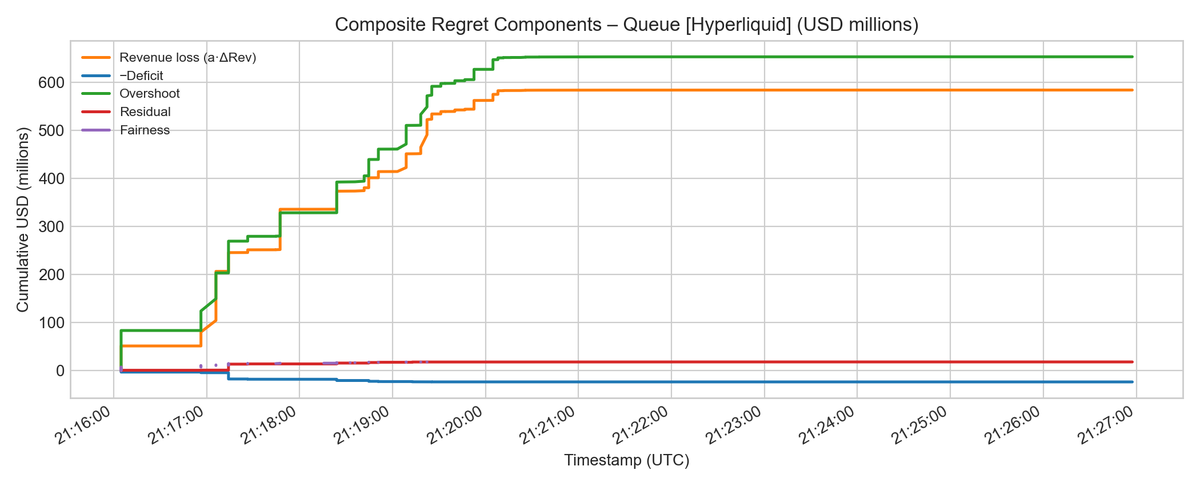

1. If ADL is used repeatedly, overshoot 𝗰𝗼𝗺𝗽𝗼𝘂𝗻𝗱𝘀 (much like a liquidation cascade)

2. Not Sybil resistant — can split positions to avoid being ADL'd

On 10/10 the overshoot was 𝗺𝗮𝘀𝘀𝗶𝘃𝗲 ($650M)

1. If ADL is used repeatedly, overshoot 𝗰𝗼𝗺𝗽𝗼𝘂𝗻𝗱𝘀 (much like a liquidation cascade)

2. Not Sybil resistant — can split positions to avoid being ADL'd

On 10/10 the overshoot was 𝗺𝗮𝘀𝘀𝗶𝘃𝗲 ($650M)

You might be asking: but wait, I thought I saw a viral post that claimed "traders made money" on Hyperliquid

This analysis was statistically misleading at best, malicious at worst

It measured 𝘤𝘰𝘯𝘥𝘪𝘵𝘪𝘰𝘯𝘢𝘭 PNL of surviving traders — conditioning on the Queue mechanism

This analysis was statistically misleading at best, malicious at worst

It measured 𝘤𝘰𝘯𝘥𝘪𝘵𝘪𝘰𝘯𝘢𝘭 PNL of surviving traders — conditioning on the Queue mechanism

https://twitter.com/1427859040671911939/status/1978179475776147482

Making a causal claim about profitability requires:

1) Counterfactual comparison (how would the optimal ADL algorithm have done?)

2) Comparison of the qty of bad debt relative to profit closed by ADL (did the exchange ADL more PNL than needed for solvency?)

@yudapearl would give this poor attempt at causal analysis a D-

1) Counterfactual comparison (how would the optimal ADL algorithm have done?)

2) Comparison of the qty of bad debt relative to profit closed by ADL (did the exchange ADL more PNL than needed for solvency?)

@yudapearl would give this poor attempt at causal analysis a D-

When you do analyze these, you find that the Queue algorithm spectacularly overshot by 28x — there was only ~$23m of bad debt, yet the ADL mechanism closed $650m of PNL

This is not "trader PNL was increased" in aggregate (not only conditioning on survivors), this was a net loss

This is not "trader PNL was increased" in aggregate (not only conditioning on survivors), this was a net loss

Unlike the bombast of this abysmal analysis, @chameleon_jeff had a measured response with a research challenge:

ADL should be improved, but it seems like you can't do it in a 𝘱𝘳𝘪𝘰𝘳-𝘪𝘯𝘥𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵 manner (e.g. not relying on historical correlations/vol).. right?

ADL should be improved, but it seems like you can't do it in a 𝘱𝘳𝘪𝘰𝘳-𝘪𝘯𝘥𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵 manner (e.g. not relying on historical correlations/vol).. right?

https://twitter.com/1622260212798291972/status/1979591612704723253

Challenge accepted!

Can we beat the Queue algorithm? Two other approaches are used:

- Pro-Rata [used by @DriftProtocol, @paradex]

- Central Clearing [used by crypto exchanges prior to 2015]

Both of these have pros and cons that differ from Queue

arxiv.org/abs/2512.01112

Can we beat the Queue algorithm? Two other approaches are used:

- Pro-Rata [used by @DriftProtocol, @paradex]

- Central Clearing [used by crypto exchanges prior to 2015]

Both of these have pros and cons that differ from Queue

arxiv.org/abs/2512.01112

Pro-Rata takes the deficit and splits it across all winners based how much profit they contribute

It can be viewed as haircutting everyone by a constant percentage and it is what @paradex and @DriftProtocol do with "socialized losses"

It can be viewed as haircutting everyone by a constant percentage and it is what @paradex and @DriftProtocol do with "socialized losses"

It satisfies three properties:

- Sybil Resistant

- Scale Invariant — scaling up all positions doesn't change haircuts

- Monotone — if you had the kth highest profit before ADL, you have the kth highest profit after ADL

These are 𝘧𝘢𝘪𝘳𝘯𝘦𝘴𝘴 properties that benefit traders

- Sybil Resistant

- Scale Invariant — scaling up all positions doesn't change haircuts

- Monotone — if you had the kth highest profit before ADL, you have the kth highest profit after ADL

These are 𝘧𝘢𝘪𝘳𝘯𝘦𝘴𝘴 properties that benefit traders

But it has one fatal flaw: not robust to multiple price shocks

Main reason: Pro-rata isn't risk-aware

2 positions: same size, one has 10x the leverage of the other

Haircut the same by pro-rata

But if there is another shock, the 10x leverage one is more likely to have bad debt

Main reason: Pro-rata isn't risk-aware

2 positions: same size, one has 10x the leverage of the other

Haircut the same by pro-rata

But if there is another shock, the 10x leverage one is more likely to have bad debt

Also, by the way, pro-rata (which @paradex calls socialized loss) *is actually* an ADL algorithm despite what you might read

This becomes clear once you see it via the lens of water-filling algorithms— its just one that makes different trade-offs than Queue

This becomes clear once you see it via the lens of water-filling algorithms— its just one that makes different trade-offs than Queue

https://twitter.com/4260536128/status/1978750722901762321

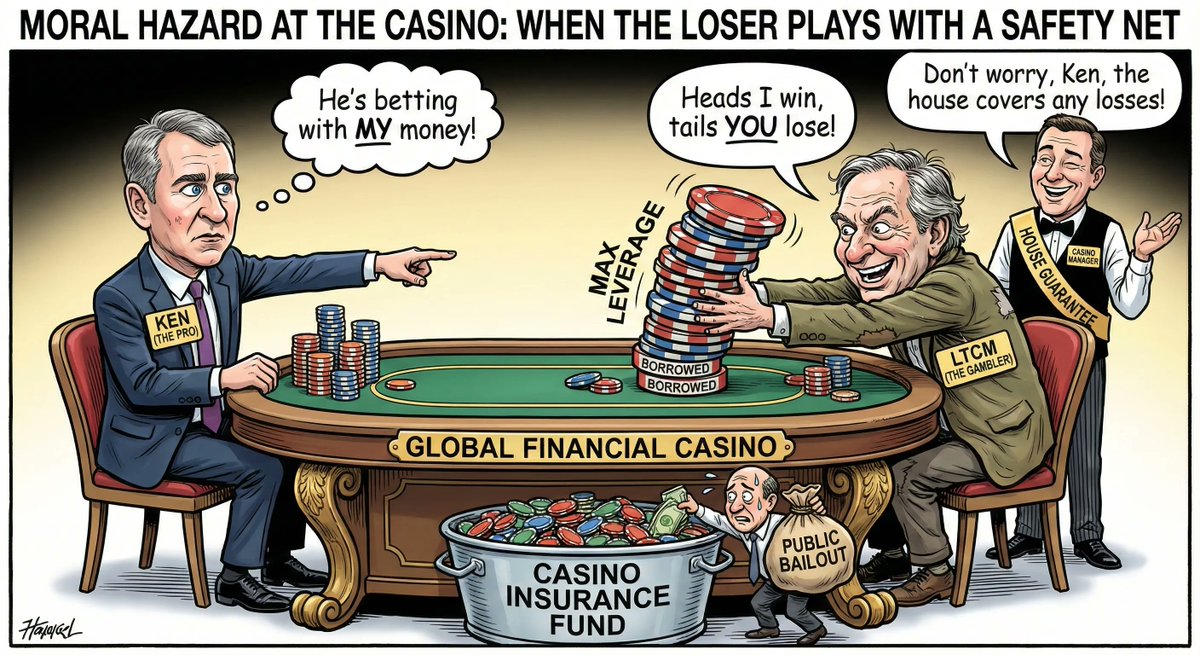

What about central clearing? This is where the exchange holds the bad debt on their balance sheet. It has the positive of not liquidating your best customers — so revenue is preserved.

But it is fundamentally not 𝘴𝘤𝘢𝘭𝘢𝘣𝘭𝘦: as the exchange grows, its ability to successfully preserves solvency decays

@cryptohayes documents that exchanges doing this faced an enormous amount of adverse selection and 𝘮𝘰𝘳𝘢𝘭 𝘩𝘢𝘻𝘢𝘳𝘥 [and blew up]

But it is fundamentally not 𝘴𝘤𝘢𝘭𝘢𝘣𝘭𝘦: as the exchange grows, its ability to successfully preserves solvency decays

@cryptohayes documents that exchanges doing this faced an enormous amount of adverse selection and 𝘮𝘰𝘳𝘢𝘭 𝘩𝘢𝘻𝘢𝘳𝘥 [and blew up]

So where does that leave us?

- Queue: Horrible overshoot, lowers revenue (e.g. liquidates high revenue generating customers)

- Pro-Rata: fair to traders, not robust

- Central Clearing: Not scalable, not decentralized, but preserves revenue

Can we get the best of all three?

- Queue: Horrible overshoot, lowers revenue (e.g. liquidates high revenue generating customers)

- Pro-Rata: fair to traders, not robust

- Central Clearing: Not scalable, not decentralized, but preserves revenue

Can we get the best of all three?

Surprisingly, the answer is 𝒏𝒐.

In my new paper, I prove an 𝗔𝗗𝗟 𝗧𝗿𝗶𝗹𝗲𝗺𝗺𝗮: no ADL mechanism can simultaneously optimize for:

- Solvency

- Fairness

- Long-Term Revenue

This is a fundamental limit on ADL!

arxiv.org/abs/2512.01112

In my new paper, I prove an 𝗔𝗗𝗟 𝗧𝗿𝗶𝗹𝗲𝗺𝗺𝗮: no ADL mechanism can simultaneously optimize for:

- Solvency

- Fairness

- Long-Term Revenue

This is a fundamental limit on ADL!

arxiv.org/abs/2512.01112

Does this negative result mean its time to pack it all up and follow @vladtenev + @drwconvexity into the land of centralized clearing?

Not so fast: crypto is a place where a trilemma never stopped anyone

The blockchain trilemma is beat with probabilistic strategies — same here?

Not so fast: crypto is a place where a trilemma never stopped anyone

The blockchain trilemma is beat with probabilistic strategies — same here?

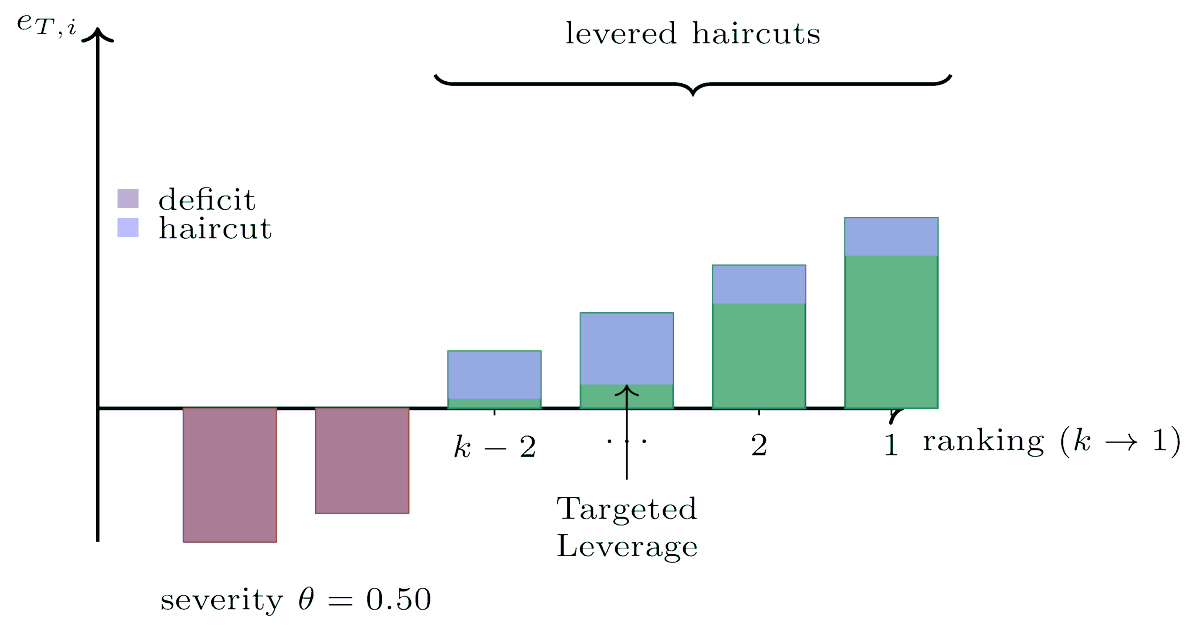

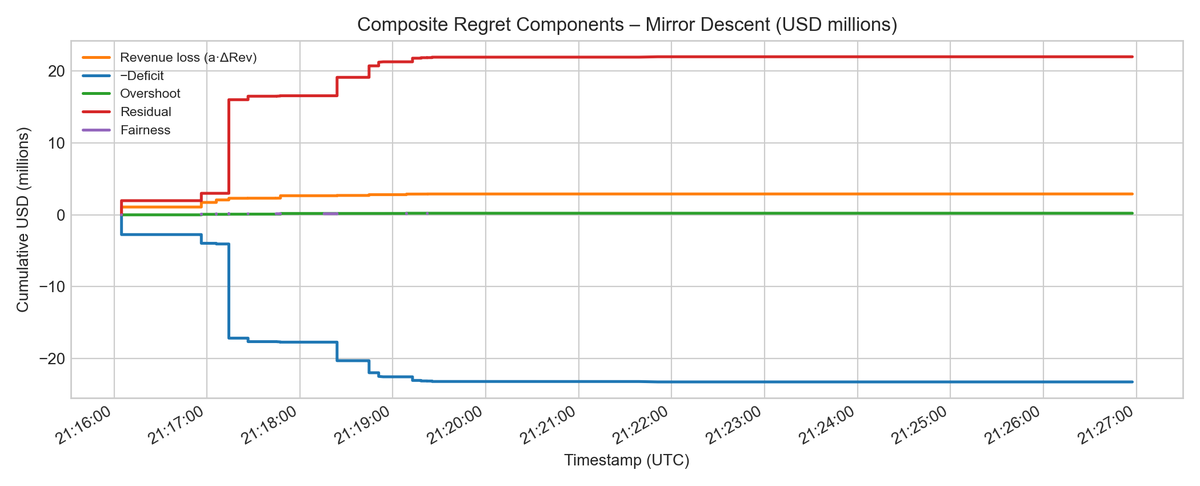

We show that one can construct an infinite set of easy to compute risk-aware strategies that non-uniformly haircut winners (see below) and both theoretically and practically outperform Queue and Pro-Rata in terms of solvency, fairness, and revenue

Moreover, we backtest a number of these strategies against the real data from @HyperliquidX on 10/10 and show that virtually all of these algorithms would have 𝐬𝐚𝐯𝐞𝐝 >$𝟓𝟎𝟎𝐌 𝐨𝐟 𝐭𝐫𝐚𝐝𝐞𝐫 𝐏𝐍𝐋

We also show that these algorithms outperform on fairness and revenue

The trilemma implies that they have to trade-off solvency for this(e.g. the exchange has to hold some bad debt on its balance sheet)

But the magnitude of loss is 10x smaller with optimized ADL algorithms

The trilemma implies that they have to trade-off solvency for this(e.g. the exchange has to hold some bad debt on its balance sheet)

But the magnitude of loss is 10x smaller with optimized ADL algorithms

What does this mean for real exchanges?

- Counter to the intuition @chameleon_jeff initially had, there 𝐞𝐱𝐢𝐬𝐭 𝐩𝐫𝐢𝐨𝐫-𝐢𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐭 ADL mechanisms that are easy to implement

- These methods trade-off solvency, revenue, and fairness to traders in different manner

- Exchanges can choose to optimize within this trade-off space — with the limits to optimization bounded by the trilemma

- The trilemma, by the way, is so close to formally verifiable that maybe @jessemhan / @llllvvuu can prove it for more generic set of revenue functions

- Both CEXs and DEXs benefit from this research!

- Counter to the intuition @chameleon_jeff initially had, there 𝐞𝐱𝐢𝐬𝐭 𝐩𝐫𝐢𝐨𝐫-𝐢𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐭 ADL mechanisms that are easy to implement

- These methods trade-off solvency, revenue, and fairness to traders in different manner

- Exchanges can choose to optimize within this trade-off space — with the limits to optimization bounded by the trilemma

- The trilemma, by the way, is so close to formally verifiable that maybe @jessemhan / @llllvvuu can prove it for more generic set of revenue functions

- Both CEXs and DEXs benefit from this research!

Takeaway: we don't need to be in the dark forest of central clearing, even if @RobinhoodApp just bought LedgerX (best central clearing IMO)

We can use math to design better verifiable mechanisms that

will 𝘢𝘤𝘵𝘶𝘢𝘭𝘭𝘺 𝘣𝘦 𝘢𝘣𝘭𝘦 𝘵𝘰 𝘩𝘰𝘶𝘴𝘦 𝘢𝘭𝘭 𝘰𝘧 𝘧𝘪𝘯𝘢𝘯𝘤𝘦

We can use math to design better verifiable mechanisms that

will 𝘢𝘤𝘵𝘶𝘢𝘭𝘭𝘺 𝘣𝘦 𝘢𝘣𝘭𝘦 𝘵𝘰 𝘩𝘰𝘶𝘴𝘦 𝘢𝘭𝘭 𝘰𝘧 𝘧𝘪𝘯𝘢𝘯𝘤𝘦

https://twitter.com/605700792/status/1993765804903682479

Paper: arxiv.org/abs/2512.01112

I want to thank @conejocapital, @hydromancer_xyz, @sonarx_hq, and @xulian_hl for helping me procure, verify, and clean data from October 10.

The dataset used can be found on @conejocapital’s Github.

I want to also thank @jdmaturen, @theo_diamandis, @victatorships, @MaxResnick1, @hosseeb, @alexhevans, @theyisun, @ani_pai, @conejocapital, @dara_khan, @perpsjesus, @udaiparvatha, @MatheusVXF, @vnovakovski, Murat, and @angeris for helpful feedback on the paper or this post.

If you made it this far, you don’t want to know how much longer it was before @hosseeb and @MaxResnick1 yelled at me

The dataset used can be found on @conejocapital’s Github.

I want to also thank @jdmaturen, @theo_diamandis, @victatorships, @MaxResnick1, @hosseeb, @alexhevans, @theyisun, @ani_pai, @conejocapital, @dara_khan, @perpsjesus, @udaiparvatha, @MatheusVXF, @vnovakovski, Murat, and @angeris for helpful feedback on the paper or this post.

If you made it this far, you don’t want to know how much longer it was before @hosseeb and @MaxResnick1 yelled at me

@ConejoCapital @SonarX_HQ @xulian_hl @jdmaturen @theo_diamandis @victatorships @MaxResnick1 * @hydromancerxyz

@ConejoCapital @SonarX_HQ @xulian_hl @jdmaturen @theo_diamandis @victatorships @MaxResnick1 @hydromancerxyz I also forgot @RiskRinger !

• • •

Missing some Tweet in this thread? You can try to

force a refresh