🚨 Powell Confirms QE Starts December 12th. Here’s What It Means for #Bitcoin & Altcoins 🚨

The Fed just quietly restarted QE but they’re calling it something else.

Here’s the full breakdown and how I’m positioning into April 2026 🧵👇

The Fed just quietly restarted QE but they’re calling it something else.

Here’s the full breakdown and how I’m positioning into April 2026 🧵👇

1/x Yesterday's FOMC meeting confirmed two things:

✅The economy is weakening.

✅ QE officially begins on December 12th.

Powell avoided the word 'QE', but the Fed’s statement makes it clear: the balance sheet starts expanding again next week.

✅The economy is weakening.

✅ QE officially begins on December 12th.

Powell avoided the word 'QE', but the Fed’s statement makes it clear: the balance sheet starts expanding again next week.

2/x Unemployment ticked up from 4.2% → 4.4%.

That small change forced today’s 25 bps cut and signals the Fed is shifting toward a full easing cycle.

But the cut itself was already priced in at ~89% probability.

The real story today wasn’t rates, it was liquidity.

That small change forced today’s 25 bps cut and signals the Fed is shifting toward a full easing cycle.

But the cut itself was already priced in at ~89% probability.

The real story today wasn’t rates, it was liquidity.

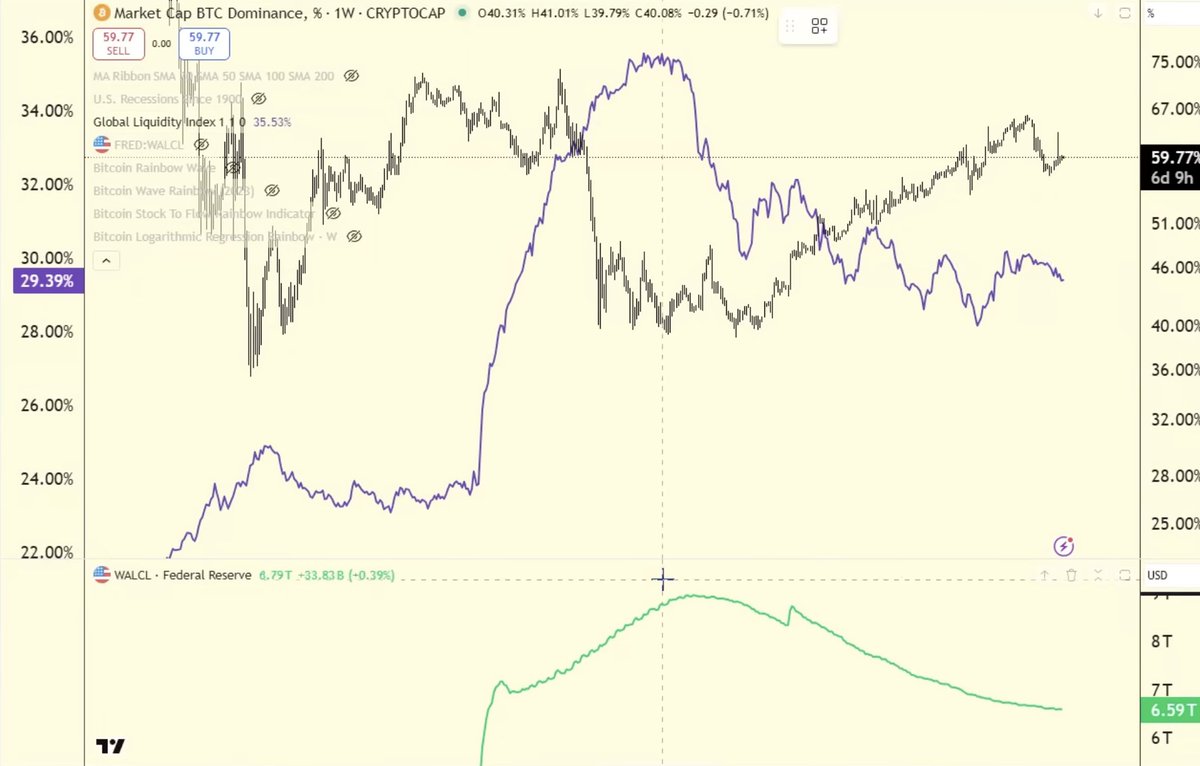

3/x Rate cuts matter far less than QE.

Crypto moves with liquidity, not the cost of borrowing.

🔸QT drains liquidity → crypto bleeds.

🔸QE adds liquidity → crypto recovers.

Yesterday was the first confirmed liquidity expansion since 2021.

Crypto moves with liquidity, not the cost of borrowing.

🔸QT drains liquidity → crypto bleeds.

🔸QE adds liquidity → crypto recovers.

Yesterday was the first confirmed liquidity expansion since 2021.

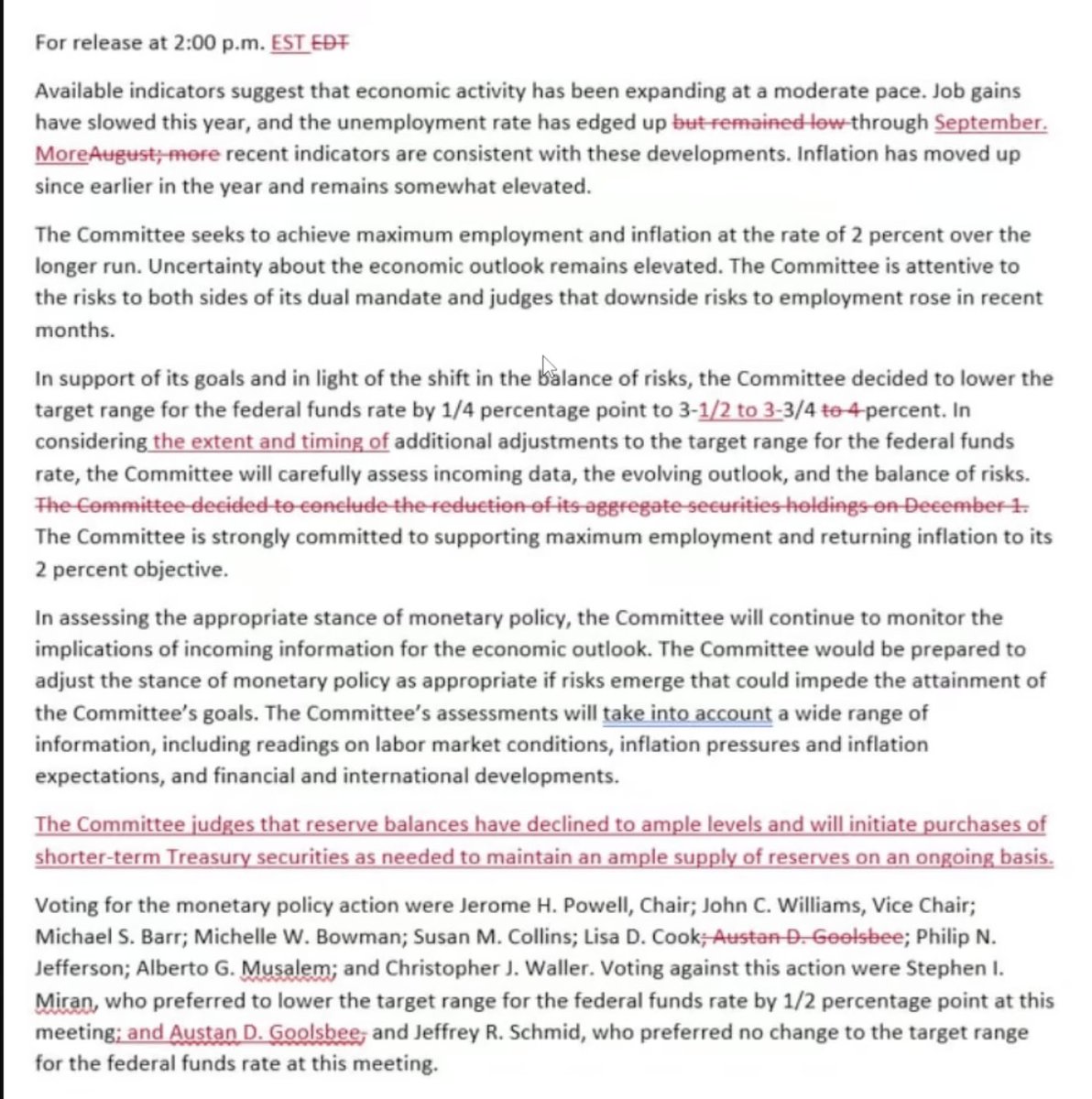

4/x The key reveal was the new paragraph in the FOMC statement.

The Fed will begin buying short-term Treasuries 'as needed to maintain ample reserves.'

This is QE.

They’re just calling it Reserve Management Purchases (RMPs).

The Fed will begin buying short-term Treasuries 'as needed to maintain ample reserves.'

This is QE.

They’re just calling it Reserve Management Purchases (RMPs).

5/x The Fed followed up with the real number:

🔸$40B/month of Treasury bill purchases.

🔸 Starting December 12.

🔸 Running at this pace until April.

After April, purchases slow but QE does NOT reverse.

QT is over.

🔸$40B/month of Treasury bill purchases.

🔸 Starting December 12.

🔸 Running at this pace until April.

After April, purchases slow but QE does NOT reverse.

QT is over.

6/x Why now? Liquidity hit a breaking point.

🔸Reverse Repo Facility drained from $2T → near $0.

🔸Banks began tapping the Standing Repo Facility.

🔸Fed funds rate drifted to the top of the target range.

This is exactly what happened before the 2019 repo crisis.

The Fed had to act.

🔸Reverse Repo Facility drained from $2T → near $0.

🔸Banks began tapping the Standing Repo Facility.

🔸Fed funds rate drifted to the top of the target range.

This is exactly what happened before the 2019 repo crisis.

The Fed had to act.

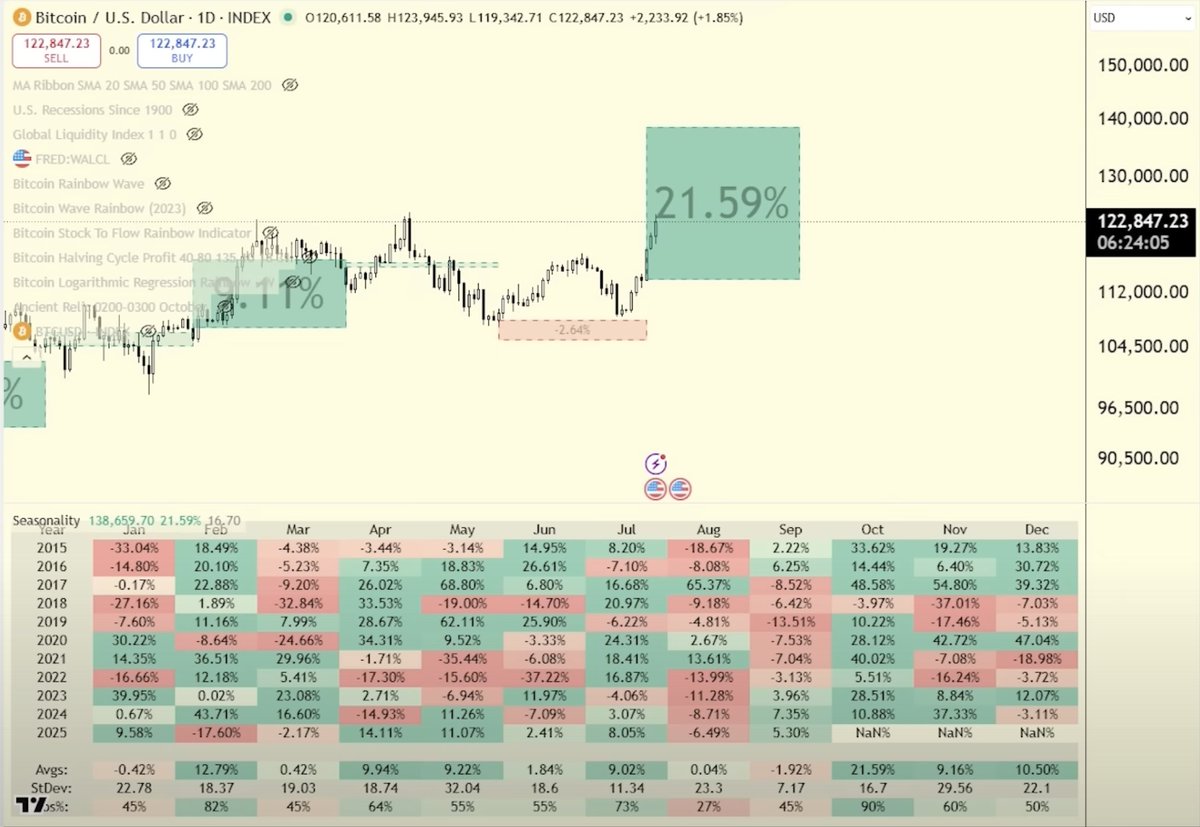

7/x What does this mean for #Bitcoin?

From Dec to Apr, U.S. liquidity will rise by ~$160B.

That’s enough for:

🔸A $BTC rebound.

🔸A retest of the 50W SMA.

🔸A relief rally in altcoins.

But it is not enough to create new ATHs on its own.

From Dec to Apr, U.S. liquidity will rise by ~$160B.

That’s enough for:

🔸A $BTC rebound.

🔸A retest of the 50W SMA.

🔸A relief rally in altcoins.

But it is not enough to create new ATHs on its own.

8/x The big wildcard is the Treasury General Account (TGA).

The TGA currently holds $937B, this is negative liquidity.

🔸If the Treasury unwinds even $90B, total liquidity rises toward $5.85T.

🔸If the proposed Tariff Dividend passes in 2026, that’s another $215B-$450B injection.

That’s when things get explosive.

The TGA currently holds $937B, this is negative liquidity.

🔸If the Treasury unwinds even $90B, total liquidity rises toward $5.85T.

🔸If the proposed Tariff Dividend passes in 2026, that’s another $215B-$450B injection.

That’s when things get explosive.

9/x Liquidity required for $BTC to reclaim highs:

🔸 $BTC only makes new highs when U.S. and global liquidity trend upward together.

🔸Base QE gets us a rebound.

🔸TGA + tariff stimulus is what gets us an uptrend.

Without those, BTC likely stalls at major resistance.

🔸 $BTC only makes new highs when U.S. and global liquidity trend upward together.

🔸Base QE gets us a rebound.

🔸TGA + tariff stimulus is what gets us an uptrend.

Without those, BTC likely stalls at major resistance.

10/x My base case into April:

🔸QE drives a BTC bounce.

🔸 $BTC retests the 50W SMA.

🔸Alts recover slowly.

🔸No new ATH unless liquidity expands further.

I remain 80% $BTC / 20% alts but I am trading alts, not holding them long-term yet.

🔸QE drives a BTC bounce.

🔸 $BTC retests the 50W SMA.

🔸Alts recover slowly.

🔸No new ATH unless liquidity expands further.

I remain 80% $BTC / 20% alts but I am trading alts, not holding them long-term yet.

11/x How I'm trading it:

🔸Short-term alt rotations.

🔸2-3 week holds.

🔸Grid bots for volatility

🔸Profits rotated back into $BTC

The real trend decision comes in April when QE slows and TGA decisions become clearer.

🔸Short-term alt rotations.

🔸2-3 week holds.

🔸Grid bots for volatility

🔸Profits rotated back into $BTC

The real trend decision comes in April when QE slows and TGA decisions become clearer.

12/x Final thoughts before I wrap up:

QE is confirmed. The liquidity trend has turned. $BTC and alts finally have a real tailwind.

But this is a bounce setup, not a confirmed bull market.

Stay flexible. Follow liquidity. Adjust in April.

QE is confirmed. The liquidity trend has turned. $BTC and alts finally have a real tailwind.

But this is a bounce setup, not a confirmed bull market.

Stay flexible. Follow liquidity. Adjust in April.

13/x If you want to see the bots I'm running for this QE window:👉 bacon.link/all-bots

• • •

Missing some Tweet in this thread? You can try to

force a refresh