1/ Citadel got DeFi wrong.

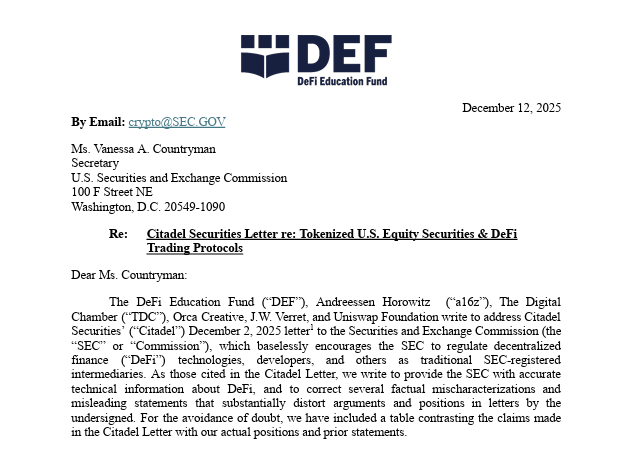

Today, DEF, @a16z, @DigitalChamber, @orca_so, @theblockprof, & @UniswapFND wrote to @SECGov in response to @citsecurities' letter misrepresenting how DeFi technology works.

Why this group? Citadel blatantly miscited us, and we feel obligated to correct the record.

Today, DEF, @a16z, @DigitalChamber, @orca_so, @theblockprof, & @UniswapFND wrote to @SECGov in response to @citsecurities' letter misrepresenting how DeFi technology works.

Why this group? Citadel blatantly miscited us, and we feel obligated to correct the record.

2/ Context: on Dec 2, Citadel Securities sent a letter to the SEC re: “Tokenized U.S. Equity Securities & DeFi Trading Protocols.”

As we explain, Citadel “baselessly encourages the SEC to regulate decentralized finance (‘DeFi’) technologies, developers, and others, as traditional SEC-registered intermediaries.” Citadel alleges that everything from validators to self-custody wallet providers to “smart contract developers” are “intermediaries” like securities brokers.

As we explain, Citadel “baselessly encourages the SEC to regulate decentralized finance (‘DeFi’) technologies, developers, and others, as traditional SEC-registered intermediaries.” Citadel alleges that everything from validators to self-custody wallet providers to “smart contract developers” are “intermediaries” like securities brokers.

3/ As organizations deeply committed to technological progress, consumer protection, and market integrity, we want to set the record straight, correcting Citadel’s mischaracterizations of our own submissions and misleading arguments about DeFi.

As we write: “Citadel’s letter rests on a flawed analysis of the securities laws that attempts to extend SEC registration requirements to essentially any entity with even the most tangential connection to a DeFi transaction.”

As we write: “Citadel’s letter rests on a flawed analysis of the securities laws that attempts to extend SEC registration requirements to essentially any entity with even the most tangential connection to a DeFi transaction.”

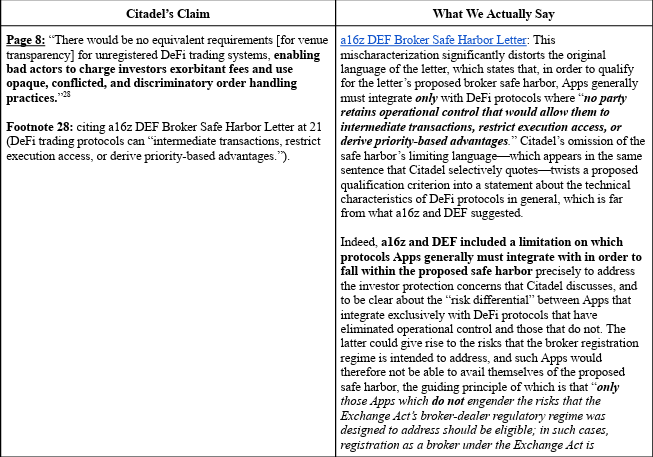

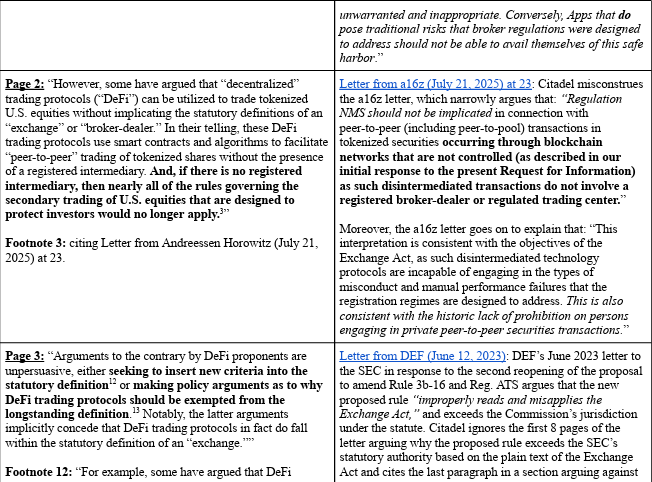

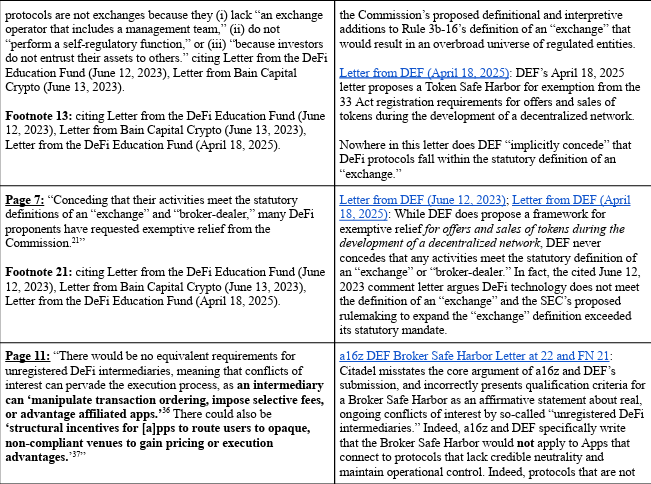

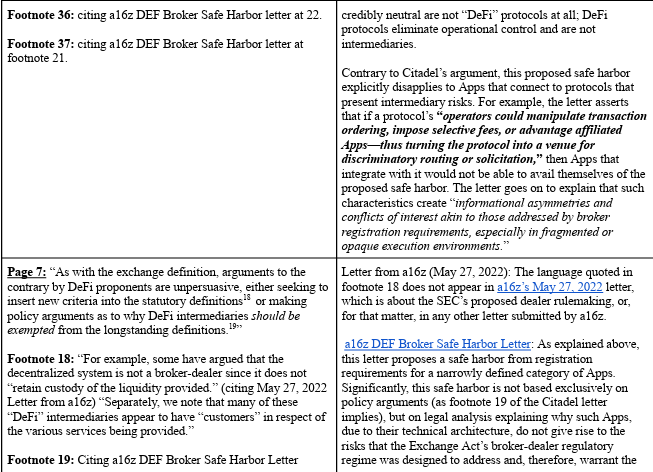

4/ Importantly, we cite-check Citadel. We highlight their faulty citations and mischaracterizations of the source material in an easy-to-read chart, sorted by “most to least egregious claims.”

5/ We are thankful to our cosignatories for joining us and standing up for DeFi.

You can read our letter at the link below.

defieducationfund.org/docs/executive…

You can read our letter at the link below.

defieducationfund.org/docs/executive…

• • •

Missing some Tweet in this thread? You can try to

force a refresh