➥ The Real Reason $WHITEWHALE Keeps Pumping and How to Stay Ahead Using Nansen

On Dec 4, I received multiple on-chain signals for $WHITEWHALE, which eventually turned into a 200x+ runner. I forgot to check one thing (see QRT below) and faded my entry, so yes, I feel a bit salty 💀

But $WHITEWHALE is also showing what I have been preaching for a long time.

The reason it keeps pumping comes down to two main factors: centralized supply control and community hype/belief, both led by a strong individual.

The price action is just a secondary effect of these forces. It truly gives me joy to see that @TheWhiteWhaleV2 fully understand the effect of this.

But let's say you're holding a large portion of $WHITEWHALE, now what?

Here is a tutorial on how I manage my own large holdings, using $WHITEWHALE as a case study👇

------

➥ First things first

If you have been following me, you know I have emphasized the importance of supply dynamics, which includes tokenomics, vestings, and unlocks, combined with onchain market-making segments.

IMO, both categories determine the potential strength of a play, as I have seen so many times.

As for $WHITEWHALE, the team now holds 35% of the supply, showing in real time exactly what I mean by this.

As long as the team continues holding or increasing their position (treasury), and other top holders (whales) keep adding, this trend will likely continue.

But the opposite can obviously happen as well.

Here is what's happening on-chain with $WHITEWHALE and how I would manage my position, focusing on supply squeeze dynamics and the flows of top holders.

------

Step 1⃣: Investigate Top 40 Holders

Just like any other S&P 500 company, the $WHITEWHALE team delivers periodic financial reports of their treasury to their most important shareholders.

Based on their latest report, I inspected each wallet and smart contract and highlighted them in the Top 100 Holders section by using @nansen_ai.

To do this yourself, go to Nansen, add the contract address for $WHITEWHALE, and click the Top 100 Addresses section.

Finding these addresses took some time because they were not always visible or were “diluted” by public vaults such as @DeFiTuna.

Note: I left out the vesting of 2,230,000 $WHITEWHALE in @streamflow_fi, as this was outside the Top 40 section.

------

Step 2⃣: Custom Label the Team’s Treasury

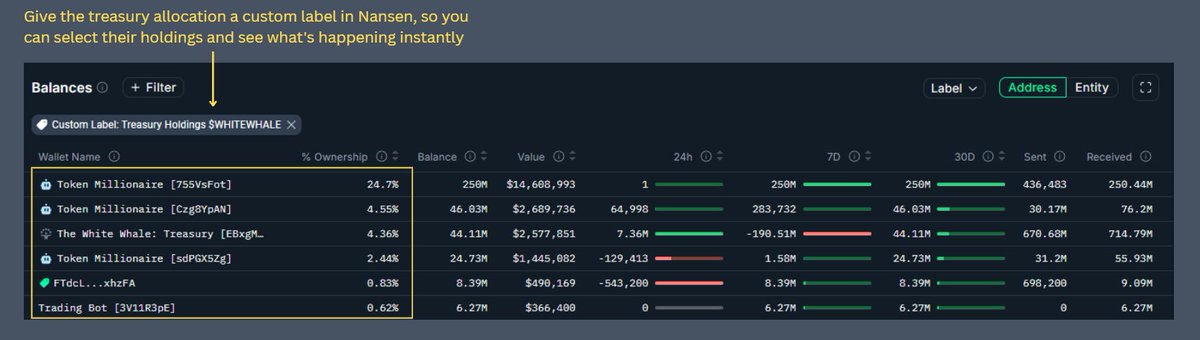

The next step is to bundle these wallets under one custom label. Click each wallet, add a label by giving it a name you prefer. Once done, you can filter them in the Top 100 section to see what is happening.

It is important to monitor inflows to these wallets, as more inflows potentially indicate accumulation.

Keep in mind though, that some of these wallets are also used for liquidity support. For example, if the price range of the @orca_so LP is reached, there may be sells from the LP. However, these sells may be offset by buys from the market, which is actually bullish. This is just one example to consider when inspecting flows. Context matters.

PS: The team did something smart here. By depositing 250M $WHITEWHALE into the ORCA LP within a very high price range of 3,700 to 37,000% above the current price, other tools do not recognize this as "top-holder holdings". Treasury holdings are basically being disguised here as liquidity. This reduces or eliminates concentration warnings, which matters for the 2% of people who actually look at onchain tools without any form of deeper investigation.

------

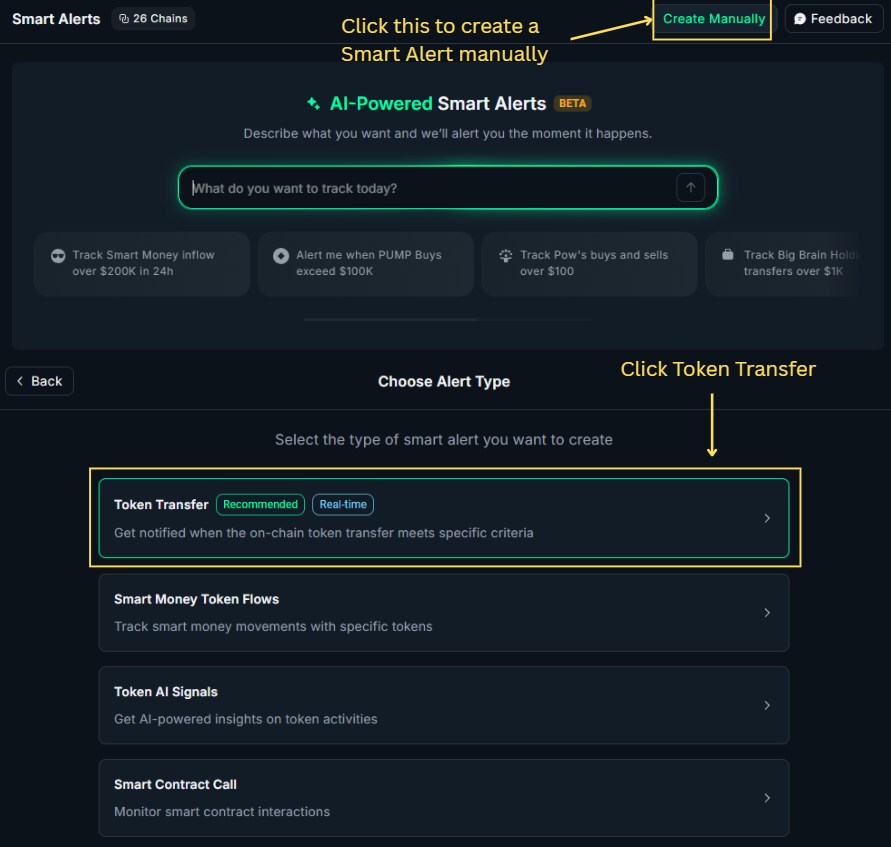

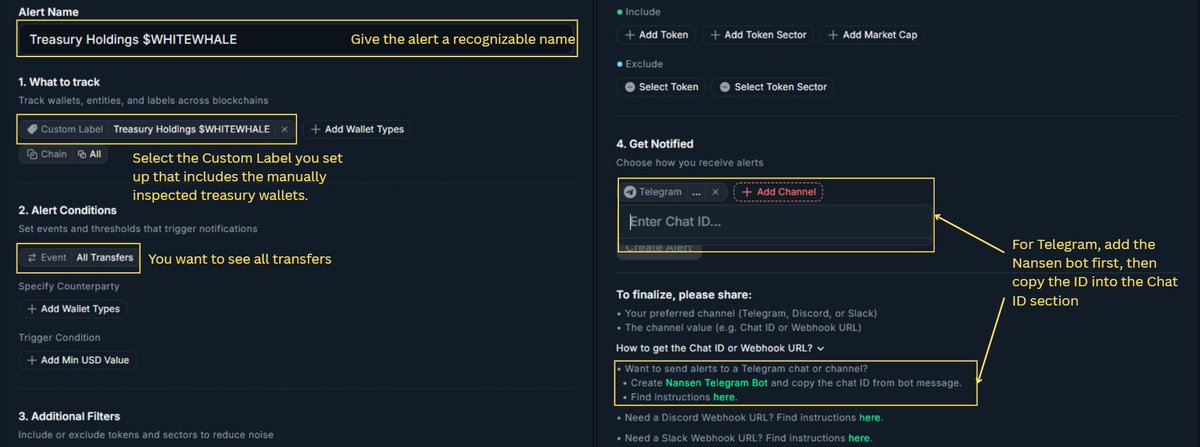

Step 3⃣: Create Manual Smart Alerts

Now that you have identified the wallets, create manual alerts for the custom labels you just added.

Give the alert a recognizable name so you know what it represents and how to interpret it, when it fires. Alerts can be sent to Telegram or via a webhook to Discord. See the other steps below in the screenshot.

------

Step 4⃣: Repeat the Process for Other Top Holders

After identifying and labeling the team’s wallets, exclude LP (DEX) or CEX holdings. This leaves the rest of the Top 40 holders, which is your second category to monitor. Label them, for example, “Top 40 Whales $WHITEWHALE,” and repeat all the steps.

Monitor inflows for these wallets. Do not panic immediately if you see outflows, as these can be routine transfers as well. Always confirm on-chain what happened.

------

Step 5⃣: Key Checks and Scenarios

Monitor both the team and top 40 holder activity as the strongest indicators of $WHITEWHALE's trend. The flows of both categories should provide a high-level view of what is happening.

🟢Bullish: Team up, top 40 up → continued growth

Both the team and whales are accumulating, showing strong confidence and coordinated support. Price is likely to keep rising.

🟠Neutral: Team stable, top 40 stable → consolidation

Holdings remain steady, indicating no major moves. Expect sideways price action or minor fluctuations.

🔴Bearish: Team down, top 40 down → potential pullback

Both team and whales reduce their positions, signaling risk. Price may face downward pressure or a correction.

Focus on these metrics with your Nansen labels and alerts. Remember, price is secondary, real insight comes from understanding where the supply is moving.

Also don't forget to update the above categories once in a while. For example, new top 40 holders could join, others could sell etc.

------

➥ Some Final Thoughts

I am very pleased to see $WHITEWHALE running this hard. I truly hope it reaches millions or even billions in MC, even while I am sidelined. I have multiple reasons for this:

1. White Whale himself transformed from victim to a hero

After the MEXC drama, where @TheWhiteWhaleV2 was falsely accused, a massive social media campaign with support from @zachxbt helped him win. This is an important moment for the space, highlighting the dangers and centralized power we often see with CEXes.

2. When handled properly tokens can still pump

$WHITEWHALE demonstrates that memes (or even any token), if managed properly, can still be highly lucrative. Many thought the space was doomed, but this project brings hope and sets a positive tone for 2026 IMO.

3. Supply dynamics and onchain flows matter

$WHITEWHALE shows the importance of supply dynamics. Supply dynamics including tokenomics, vestings, and unlocks, combined with market-making segments, determine the strength of a play. Let this set an example for all project teams and devs.

4. Validation of my signals and framework

Seeing $WHITEWHALE confirms that my signals and insights were accurate in hindsight. This strengthens my confidence in my framework for identifying future runners.

But, be aware of the hype train:

Sure, $WHITEWHALE could do another 100x from here, who knows. But let us be realistic. Holding such runners feels amazing, but as a holder, seeing constant bullposts on X can feed confirmation bias and make it hard to stay objective.

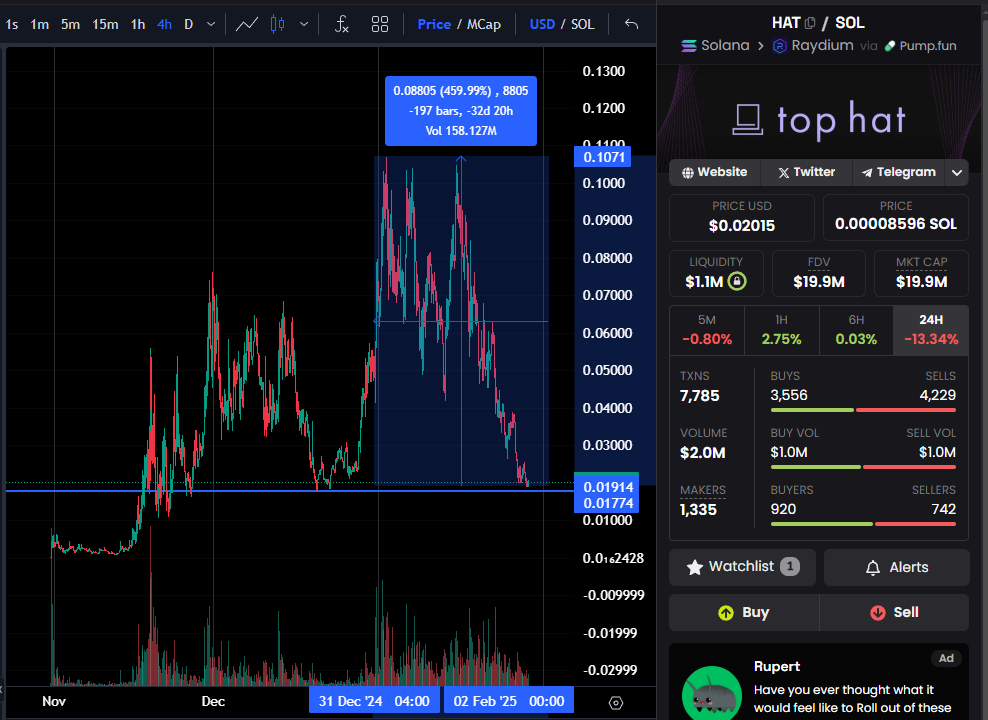

Remember, charts that go straight up often come down just as fast. I have been in this situation countless times and ended up roundtripping because I followed hype instead of on-chain data.

Therefore, make sure to close your timeline now and then, and understand the most important flows (top 40 holders), using custom labels and smart alerts with Nansen.

Because the moment something shifts, you will know first, because price is just a secondary result of these dynamics.

On Dec 4, I received multiple on-chain signals for $WHITEWHALE, which eventually turned into a 200x+ runner. I forgot to check one thing (see QRT below) and faded my entry, so yes, I feel a bit salty 💀

But $WHITEWHALE is also showing what I have been preaching for a long time.

The reason it keeps pumping comes down to two main factors: centralized supply control and community hype/belief, both led by a strong individual.

The price action is just a secondary effect of these forces. It truly gives me joy to see that @TheWhiteWhaleV2 fully understand the effect of this.

But let's say you're holding a large portion of $WHITEWHALE, now what?

Here is a tutorial on how I manage my own large holdings, using $WHITEWHALE as a case study👇

------

➥ First things first

If you have been following me, you know I have emphasized the importance of supply dynamics, which includes tokenomics, vestings, and unlocks, combined with onchain market-making segments.

IMO, both categories determine the potential strength of a play, as I have seen so many times.

As for $WHITEWHALE, the team now holds 35% of the supply, showing in real time exactly what I mean by this.

As long as the team continues holding or increasing their position (treasury), and other top holders (whales) keep adding, this trend will likely continue.

But the opposite can obviously happen as well.

Here is what's happening on-chain with $WHITEWHALE and how I would manage my position, focusing on supply squeeze dynamics and the flows of top holders.

------

Step 1⃣: Investigate Top 40 Holders

Just like any other S&P 500 company, the $WHITEWHALE team delivers periodic financial reports of their treasury to their most important shareholders.

Based on their latest report, I inspected each wallet and smart contract and highlighted them in the Top 100 Holders section by using @nansen_ai.

To do this yourself, go to Nansen, add the contract address for $WHITEWHALE, and click the Top 100 Addresses section.

Finding these addresses took some time because they were not always visible or were “diluted” by public vaults such as @DeFiTuna.

Note: I left out the vesting of 2,230,000 $WHITEWHALE in @streamflow_fi, as this was outside the Top 40 section.

------

Step 2⃣: Custom Label the Team’s Treasury

The next step is to bundle these wallets under one custom label. Click each wallet, add a label by giving it a name you prefer. Once done, you can filter them in the Top 100 section to see what is happening.

It is important to monitor inflows to these wallets, as more inflows potentially indicate accumulation.

Keep in mind though, that some of these wallets are also used for liquidity support. For example, if the price range of the @orca_so LP is reached, there may be sells from the LP. However, these sells may be offset by buys from the market, which is actually bullish. This is just one example to consider when inspecting flows. Context matters.

PS: The team did something smart here. By depositing 250M $WHITEWHALE into the ORCA LP within a very high price range of 3,700 to 37,000% above the current price, other tools do not recognize this as "top-holder holdings". Treasury holdings are basically being disguised here as liquidity. This reduces or eliminates concentration warnings, which matters for the 2% of people who actually look at onchain tools without any form of deeper investigation.

------

Step 3⃣: Create Manual Smart Alerts

Now that you have identified the wallets, create manual alerts for the custom labels you just added.

Give the alert a recognizable name so you know what it represents and how to interpret it, when it fires. Alerts can be sent to Telegram or via a webhook to Discord. See the other steps below in the screenshot.

------

Step 4⃣: Repeat the Process for Other Top Holders

After identifying and labeling the team’s wallets, exclude LP (DEX) or CEX holdings. This leaves the rest of the Top 40 holders, which is your second category to monitor. Label them, for example, “Top 40 Whales $WHITEWHALE,” and repeat all the steps.

Monitor inflows for these wallets. Do not panic immediately if you see outflows, as these can be routine transfers as well. Always confirm on-chain what happened.

------

Step 5⃣: Key Checks and Scenarios

Monitor both the team and top 40 holder activity as the strongest indicators of $WHITEWHALE's trend. The flows of both categories should provide a high-level view of what is happening.

🟢Bullish: Team up, top 40 up → continued growth

Both the team and whales are accumulating, showing strong confidence and coordinated support. Price is likely to keep rising.

🟠Neutral: Team stable, top 40 stable → consolidation

Holdings remain steady, indicating no major moves. Expect sideways price action or minor fluctuations.

🔴Bearish: Team down, top 40 down → potential pullback

Both team and whales reduce their positions, signaling risk. Price may face downward pressure or a correction.

Focus on these metrics with your Nansen labels and alerts. Remember, price is secondary, real insight comes from understanding where the supply is moving.

Also don't forget to update the above categories once in a while. For example, new top 40 holders could join, others could sell etc.

------

➥ Some Final Thoughts

I am very pleased to see $WHITEWHALE running this hard. I truly hope it reaches millions or even billions in MC, even while I am sidelined. I have multiple reasons for this:

1. White Whale himself transformed from victim to a hero

After the MEXC drama, where @TheWhiteWhaleV2 was falsely accused, a massive social media campaign with support from @zachxbt helped him win. This is an important moment for the space, highlighting the dangers and centralized power we often see with CEXes.

2. When handled properly tokens can still pump

$WHITEWHALE demonstrates that memes (or even any token), if managed properly, can still be highly lucrative. Many thought the space was doomed, but this project brings hope and sets a positive tone for 2026 IMO.

3. Supply dynamics and onchain flows matter

$WHITEWHALE shows the importance of supply dynamics. Supply dynamics including tokenomics, vestings, and unlocks, combined with market-making segments, determine the strength of a play. Let this set an example for all project teams and devs.

4. Validation of my signals and framework

Seeing $WHITEWHALE confirms that my signals and insights were accurate in hindsight. This strengthens my confidence in my framework for identifying future runners.

But, be aware of the hype train:

Sure, $WHITEWHALE could do another 100x from here, who knows. But let us be realistic. Holding such runners feels amazing, but as a holder, seeing constant bullposts on X can feed confirmation bias and make it hard to stay objective.

Remember, charts that go straight up often come down just as fast. I have been in this situation countless times and ended up roundtripping because I followed hype instead of on-chain data.

Therefore, make sure to close your timeline now and then, and understand the most important flows (top 40 holders), using custom labels and smart alerts with Nansen.

Because the moment something shifts, you will know first, because price is just a secondary result of these dynamics.

If you want to do similar analysis like I do, have a look at Nansen.

With my Nansen referral link (nsn.ai/cryptor) or by using my code cryptor you get 10% off and pay $44.10/month.

Make sure join to my free TG channel as well. I share updates, smart money flows, and my own setups there first.

t.me/onchainintelhub

Early next year, I will start my private group with realtime signals, tutorials, my workflow, joined by like minded onchain sleuthing grinders.

With my Nansen referral link (nsn.ai/cryptor) or by using my code cryptor you get 10% off and pay $44.10/month.

Make sure join to my free TG channel as well. I share updates, smart money flows, and my own setups there first.

t.me/onchainintelhub

Early next year, I will start my private group with realtime signals, tutorials, my workflow, joined by like minded onchain sleuthing grinders.

Thank you for taking the time to read my article. I truly appreciate your support and I hope you enjoyed it. Tagging friends with great minds to let me know their thoughts on my vision: @0xCheeezzyyyy, @kenodnb, @YashasEdu, @Crypto_Nolt, @Eli5defi, @AmirOrmu, @Altcoinist_com, @alphabatcher, @_SmokinTed, @VirtualKenji, @RubiksWeb3, @JiraiyaReal, @TrycVerrse, @bullish_bunt, @web3_alina, @the_smart_ape, @sortition1337, @TheDeFiPlug, @arndxt_xo, @NagatoDharma, @ShmentLord, @Mars_DeFi, @PhilMrlo, @Dionysus_crypto, @CryptoShiro_, @charliekavanz, @ASvanevik

• • •

Missing some Tweet in this thread? You can try to

force a refresh