Pendle is rewriting the rules of liquidity incentives.

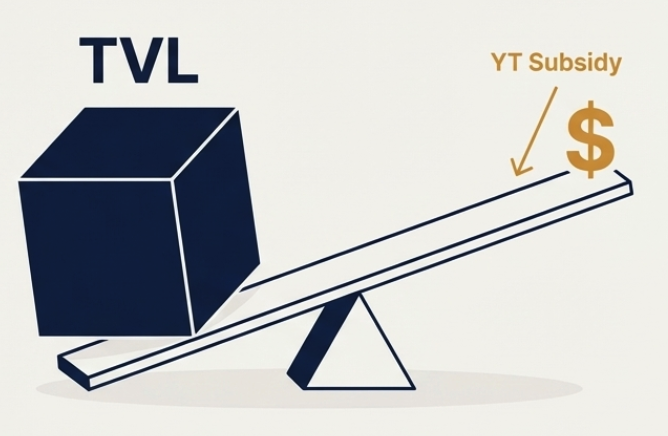

The ability to subsidize Yield Tokens (YT) is a massive game-changer for the ecosystem.

Here is why this matters:

1/ The Yield-Principal Arbitrage:

When you subsidize YT, more people want to buy it. Since the underlying asset is always the sum of the Principal Token and the Yield Token (YT), a surge in YT value forces the PT price down.

A cheaper PT means a higher Fixed APY. Suddenly, you are offering a market-leading fixed rate that is impossible to ignore.

2/ Efficient Marketing spend:

By subsidizing YT, you are effectively "leveraging" your incentives.

YT represents only a small fraction of the total position cost, but it captures 100% of the yield/incentives. You get huge APY numbers with a fraction of the budget.

3/ The Money Market Loop:

This is where it gets legendary. If the PT offers a superior fixed yield, it becomes the ultimate collateral.

Imagine taking that discounted PT, depositing it into a lending protocol, borrowing against it, and looping back into more PT. The "Looping" potential here could send TVL to the moon in record time.

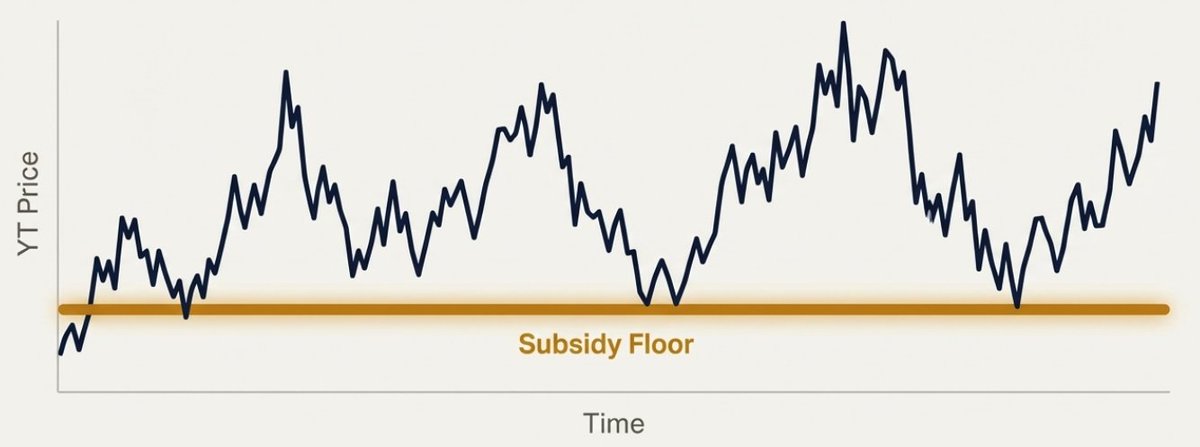

4/ Reduced Risk for Yield Longers:

Subsidies mean YT buyers are less dependent on future airdrop speculation or organic yield fluctuations to hit breakeven. It creates a floor for yield traders, making the entire market more robust and liquid.

@pendle_fi isn't just a yield protocol anymore; it’s a liquidity layer that protocols can use to "buy" TVL more efficiently than ever before.

Keep an eye on this. The math is simply too good to pass up.

The ability to subsidize Yield Tokens (YT) is a massive game-changer for the ecosystem.

Here is why this matters:

1/ The Yield-Principal Arbitrage:

When you subsidize YT, more people want to buy it. Since the underlying asset is always the sum of the Principal Token and the Yield Token (YT), a surge in YT value forces the PT price down.

A cheaper PT means a higher Fixed APY. Suddenly, you are offering a market-leading fixed rate that is impossible to ignore.

2/ Efficient Marketing spend:

By subsidizing YT, you are effectively "leveraging" your incentives.

YT represents only a small fraction of the total position cost, but it captures 100% of the yield/incentives. You get huge APY numbers with a fraction of the budget.

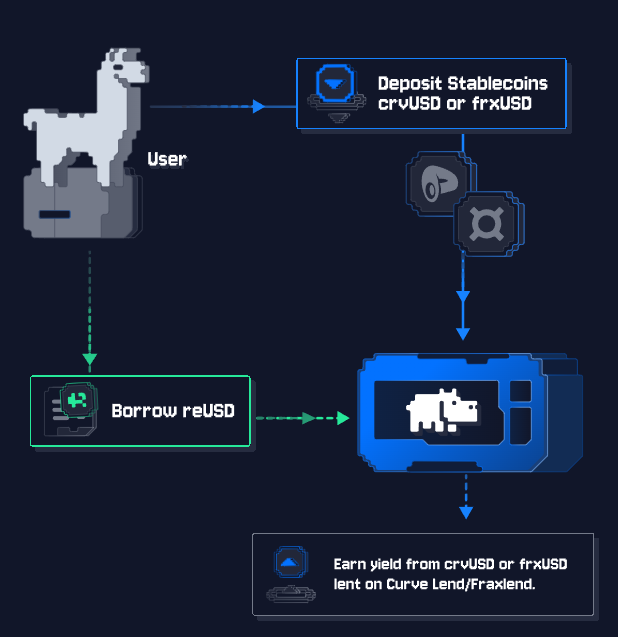

3/ The Money Market Loop:

This is where it gets legendary. If the PT offers a superior fixed yield, it becomes the ultimate collateral.

Imagine taking that discounted PT, depositing it into a lending protocol, borrowing against it, and looping back into more PT. The "Looping" potential here could send TVL to the moon in record time.

4/ Reduced Risk for Yield Longers:

Subsidies mean YT buyers are less dependent on future airdrop speculation or organic yield fluctuations to hit breakeven. It creates a floor for yield traders, making the entire market more robust and liquid.

@pendle_fi isn't just a yield protocol anymore; it’s a liquidity layer that protocols can use to "buy" TVL more efficiently than ever before.

Keep an eye on this. The math is simply too good to pass up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh