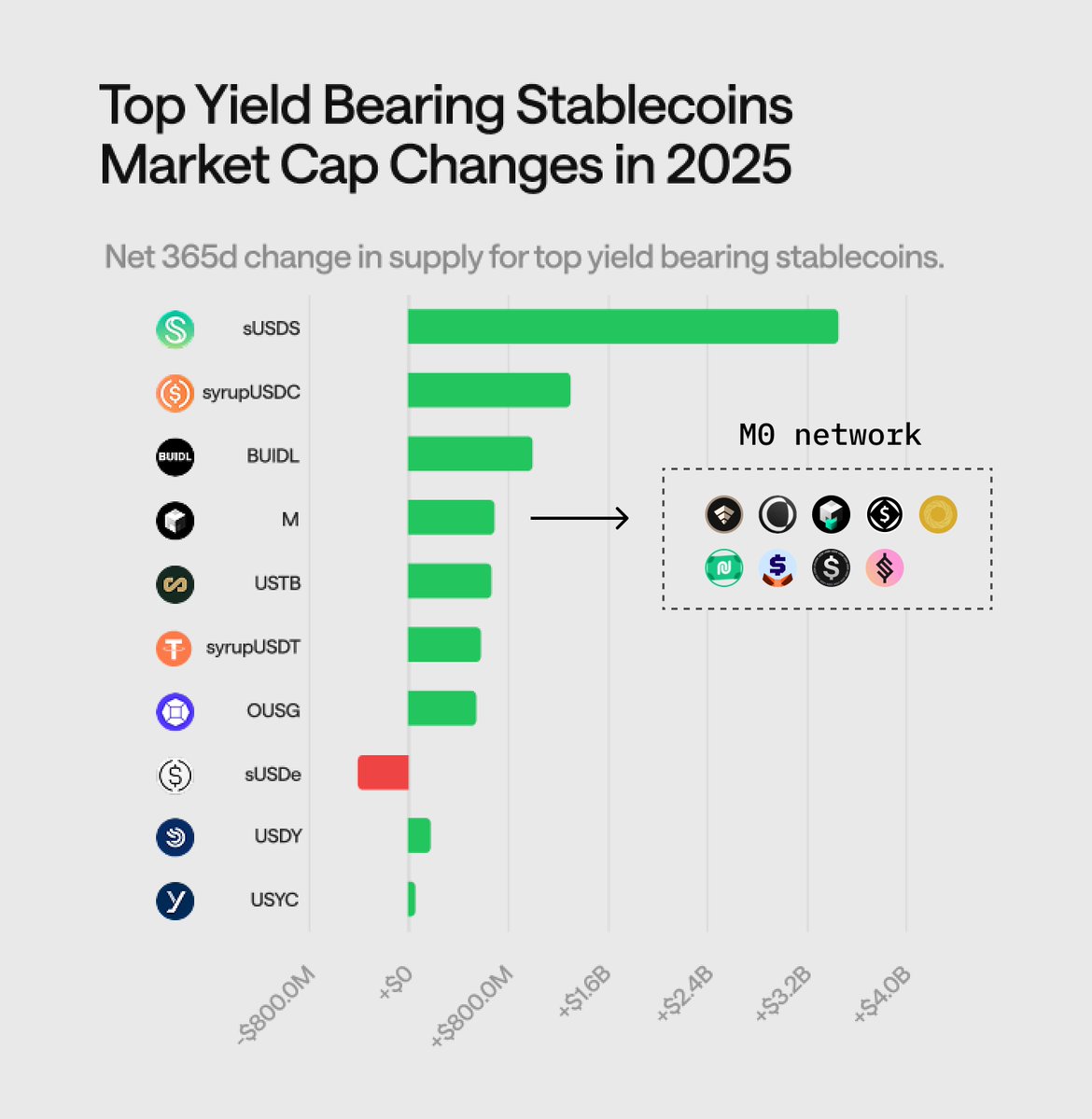

White-label stablecoins are the next step after the boom of yield-bearing stablecoins in 2025

Blockchains and protocols have learned one key lesson ➞ Owning a native stablecoin lets them capture the full value, instead of sending fees and yield to traditional issuers like Circle or Tether.

⤷ This is why many projects now choose white-label or multi-issuer stablecoin models.

Infrastructure platforms allow builders to launch custom stablecoins, but still share liquidity and security.

Ethena and M0: two different paths, same direction

➣ @ethena_labs started by leading the YBS wave ➞ Now it is becoming a stablecoin layer, supporting multiple ecosystems like MegaETH and Sui.

Ethena shows how stablecoins can scale across chains and apps.

➣ @m0 takes a different approach ➞ M0 is a universal stablecoin platform where institutions and builders can issue their own "crypto dollars"

These stablecoins are ↓

- Programmable

- Backed mainly by US Treasuries (around 3-4% yield)

- Designed for DeFi, RWA, and payments

By January 2026, M0 reached $880M total supply and supports 10+ different stablecoins, such as USDai, @noble_xyz USDN and MetaMask mUSD.

Why the M0 model scales so fast

- M0 is not exclusive like USDC. Each issuer can set custom rules for yield sharing, access, and compliance

- Stablecoins issued on M0 can swap easily and integrate natively

- Revenue comes from minting fees, penalties, and auctions with $13.3M

- Treasury yield can be split between users, LPs, wallets, or distributors.

⤷ For example, MetaMask can directly share yield from mUSD with users.

This fits perfectly with the RWA and tokenization boom.

In a strong stablecoin and RWA cycle in 2026, the "platform for builders" model gives M0 a real chance to reach $2 - 5B. supply, especially if partnerships with players like Exodus and MoonPay

Blockchains and protocols have learned one key lesson ➞ Owning a native stablecoin lets them capture the full value, instead of sending fees and yield to traditional issuers like Circle or Tether.

⤷ This is why many projects now choose white-label or multi-issuer stablecoin models.

Infrastructure platforms allow builders to launch custom stablecoins, but still share liquidity and security.

Ethena and M0: two different paths, same direction

➣ @ethena_labs started by leading the YBS wave ➞ Now it is becoming a stablecoin layer, supporting multiple ecosystems like MegaETH and Sui.

Ethena shows how stablecoins can scale across chains and apps.

➣ @m0 takes a different approach ➞ M0 is a universal stablecoin platform where institutions and builders can issue their own "crypto dollars"

These stablecoins are ↓

- Programmable

- Backed mainly by US Treasuries (around 3-4% yield)

- Designed for DeFi, RWA, and payments

By January 2026, M0 reached $880M total supply and supports 10+ different stablecoins, such as USDai, @noble_xyz USDN and MetaMask mUSD.

Why the M0 model scales so fast

- M0 is not exclusive like USDC. Each issuer can set custom rules for yield sharing, access, and compliance

- Stablecoins issued on M0 can swap easily and integrate natively

- Revenue comes from minting fees, penalties, and auctions with $13.3M

- Treasury yield can be split between users, LPs, wallets, or distributors.

⤷ For example, MetaMask can directly share yield from mUSD with users.

This fits perfectly with the RWA and tokenization boom.

In a strong stablecoin and RWA cycle in 2026, the "platform for builders" model gives M0 a real chance to reach $2 - 5B. supply, especially if partnerships with players like Exodus and MoonPay

data source: @stablewatchHQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh