Open Banking 🆚 Card Payments

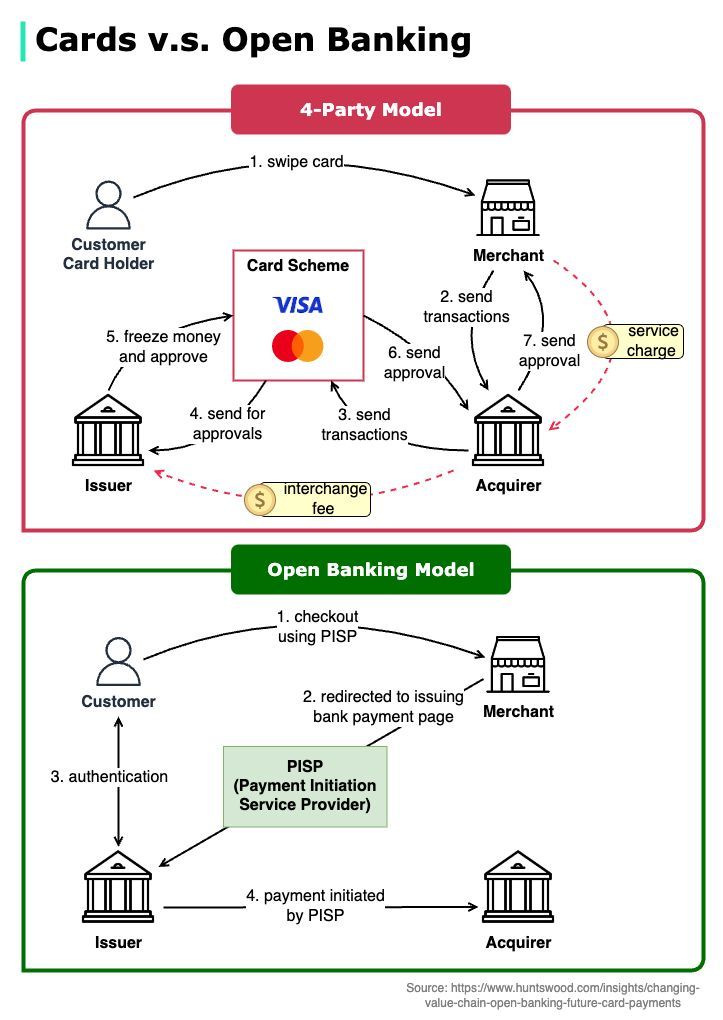

The diagram below by @bytebytego shows the differences:

Will open banking replace card payments?

The diagram below compares the information flows of the two and imagines a simplified payment model with open banking.

First, 𝗖𝗮𝗿𝗱𝘀.

A typical 4-party card model works like this:

Step 1️⃣ - The customer swipes the credit card in a merchant’s shop.

Steps 2️⃣ and 3️⃣ - The transaction is sent to the acquiring bank and then to the card scheme (Visa, Mastercard).

Steps 4️⃣ and 5️⃣ - The transaction is sent to the issuing bank for approval. Upon approval, the money in the customer’s account is frozen and the approval is sent back to the card scheme.

Steps 6️⃣ and 7️⃣ - The approval is sent back to the acquiring bank and then to the merchant.

In this workflow, the merchant is charged with a service fee, which is allocated between the acquirer, card scheme, and issuer who contribute a significant amount of effort in the process.

Second, 𝗢𝗽𝗲𝗻 𝗕𝗮𝗻𝗸𝗶𝗻𝗴.

What does open banking bring to this model?

Open banking allows us to access the customer’s bank account with the customer’s consent. It might not be necessary for the transactions to go through the acquirers and the card scheme.

This could fundamentally change the value chain of card payments. Payment companies can offer PISP (Payment Initiation Service Provider) services, which bypass card schemes.

However, the reality is, that the card scheme does more than settlement. It also clears massive amounts of transactions. So PISP eventually will settle among banks in batches too.

The diagram below by @bytebytego shows the differences:

Will open banking replace card payments?

The diagram below compares the information flows of the two and imagines a simplified payment model with open banking.

First, 𝗖𝗮𝗿𝗱𝘀.

A typical 4-party card model works like this:

Step 1️⃣ - The customer swipes the credit card in a merchant’s shop.

Steps 2️⃣ and 3️⃣ - The transaction is sent to the acquiring bank and then to the card scheme (Visa, Mastercard).

Steps 4️⃣ and 5️⃣ - The transaction is sent to the issuing bank for approval. Upon approval, the money in the customer’s account is frozen and the approval is sent back to the card scheme.

Steps 6️⃣ and 7️⃣ - The approval is sent back to the acquiring bank and then to the merchant.

In this workflow, the merchant is charged with a service fee, which is allocated between the acquirer, card scheme, and issuer who contribute a significant amount of effort in the process.

Second, 𝗢𝗽𝗲𝗻 𝗕𝗮𝗻𝗸𝗶𝗻𝗴.

What does open banking bring to this model?

Open banking allows us to access the customer’s bank account with the customer’s consent. It might not be necessary for the transactions to go through the acquirers and the card scheme.

This could fundamentally change the value chain of card payments. Payment companies can offer PISP (Payment Initiation Service Provider) services, which bypass card schemes.

However, the reality is, that the card scheme does more than settlement. It also clears massive amounts of transactions. So PISP eventually will settle among banks in batches too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh