Aptos is building for institutional adoption.

Public chains expose sensitive data by default: balances, transaction sizes, strategies. Regulators need visibility into who's transacting but not competitors.

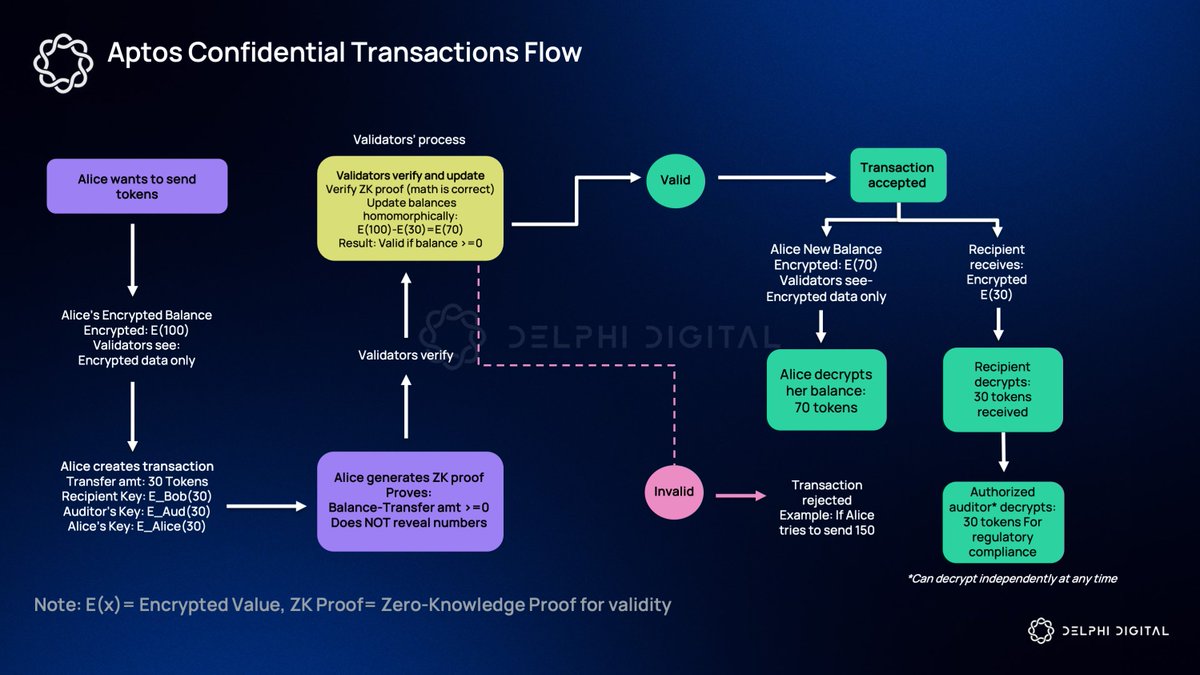

@Aptos Confidential Transactions fix this by encrypting balances and transaction amounts while keeping sender and recipient identities visible.

Launched on devnet through a partnership with Distributed Lab, the mechanism combines homomorphic encryption and zero-knowledge proofs.

When a user sends tokens, the amount is encrypted under three keys: the recipient's, an auditor's, and their own. The sender generates a ZK proof demonstrating the transfer is valid without revealing the amount.

Validators verify the proof and update balances without seeing underlying values. Token issuers can designate auditors who get independent decryption access.

This unlocks use cases that were previously impossible onchain such as enabling Payroll without revealing compensation, Institutional trading without broadcasting position sizes, and Treasury operations that don't signal strategy to the market.

Institutional capital is also arriving. BlackRock's BUIDL fund scaled past $500M in October, making Aptos the second largest host for the fund after Ethereum.

On the retail side, X-Chain Accounts remove onboarding friction. Ethereum and Solana users can create Aptos accounts using existing wallets. There is no need for new seed phrases, bridging, or acquiring APT for gas. Currently in testnet.

Aptos combines privacy, compliance, and accessibility in one stack.

Public chains expose sensitive data by default: balances, transaction sizes, strategies. Regulators need visibility into who's transacting but not competitors.

@Aptos Confidential Transactions fix this by encrypting balances and transaction amounts while keeping sender and recipient identities visible.

Launched on devnet through a partnership with Distributed Lab, the mechanism combines homomorphic encryption and zero-knowledge proofs.

When a user sends tokens, the amount is encrypted under three keys: the recipient's, an auditor's, and their own. The sender generates a ZK proof demonstrating the transfer is valid without revealing the amount.

Validators verify the proof and update balances without seeing underlying values. Token issuers can designate auditors who get independent decryption access.

This unlocks use cases that were previously impossible onchain such as enabling Payroll without revealing compensation, Institutional trading without broadcasting position sizes, and Treasury operations that don't signal strategy to the market.

Institutional capital is also arriving. BlackRock's BUIDL fund scaled past $500M in October, making Aptos the second largest host for the fund after Ethereum.

On the retail side, X-Chain Accounts remove onboarding friction. Ethereum and Solana users can create Aptos accounts using existing wallets. There is no need for new seed phrases, bridging, or acquiring APT for gas. Currently in testnet.

Aptos combines privacy, compliance, and accessibility in one stack.

Read the Aptos consulting report here.

delphi.link/Aptos2

delphi.link/Aptos2

• • •

Missing some Tweet in this thread? You can try to

force a refresh