Larry and Sergey can’t stay in California since the wealth tax as written would confiscate 50% of their Alphabet shares.

Each own ~3% of Alphabet's stock, worth about $120 billion each at today's ~$4 trillion market cap.

But because their shares have 10x voting power, the SEIU-UHW California billionaire tax would treat them as owning 30% of Alphabet (3% × 10 = 30%). That means each founder's taxable wealth would be $1.2 trillion.

A 5% wealth tax on $1.2 trillion = $60 billion tax bill, each.

That's 50% of their actual Alphabet holdings—wiped out by a "5%" tax.

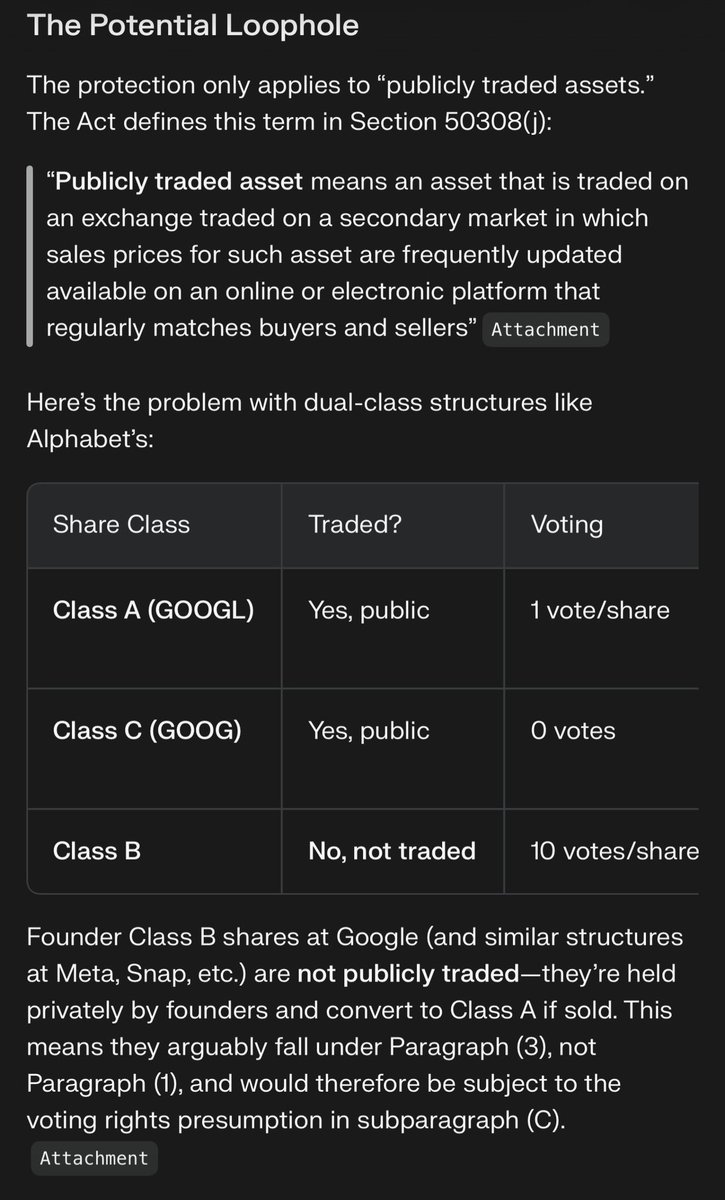

Section 50303(c)(3)(C) of the 2026 Billionaire Tax Act states: "For any interests that confer voting or other direct control rights, the percentage of the business entity owned by the taxpayer shall be presumed to be not less than the taxpayer's percentage of the overall voting or other direct control rights."

This means if a founder holds shares representing only 3% of economic interest but 30% of voting control (through Class B supervoting shares), the tax would presume their ownership stake is at least 30% for valuation purposes, not 3%.

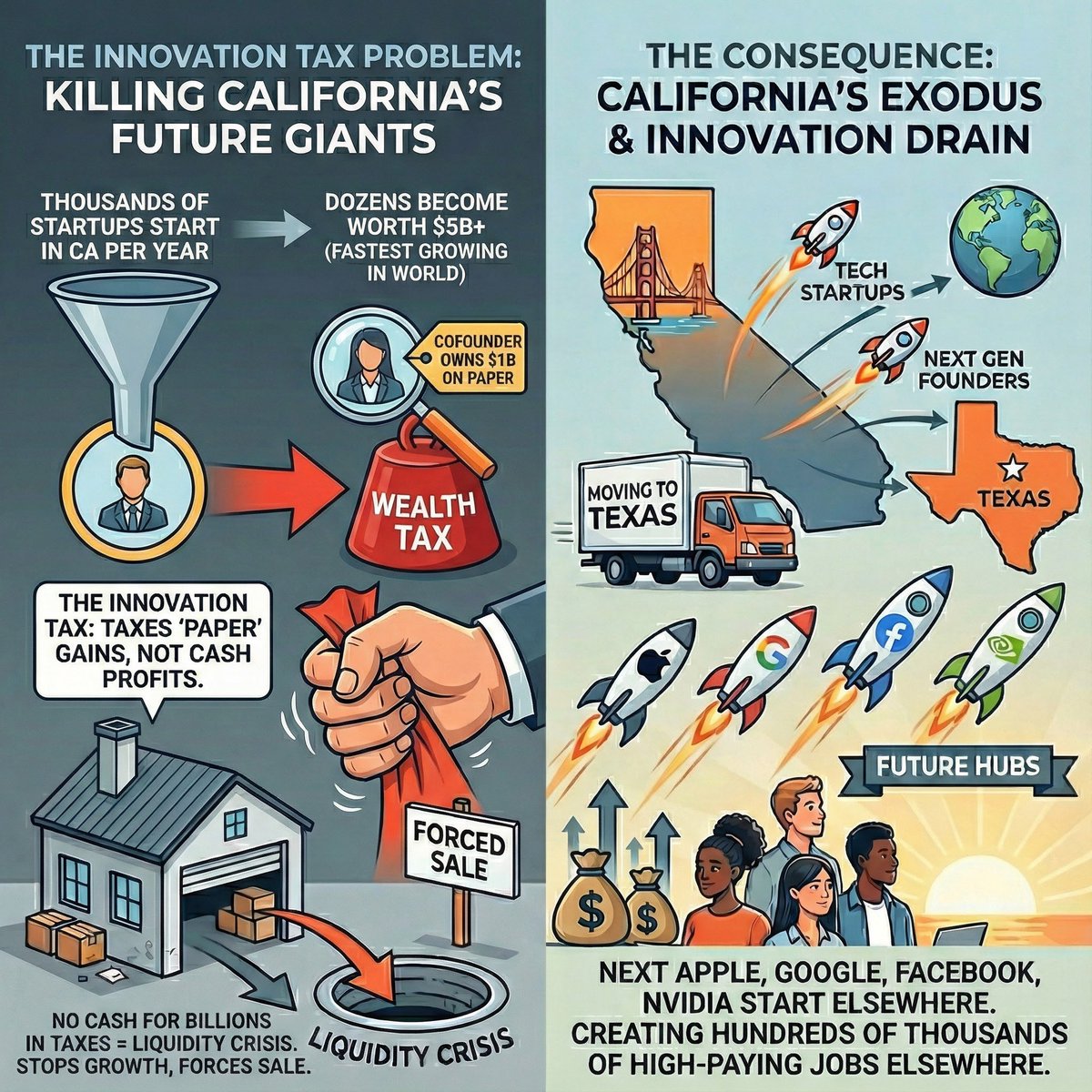

The wealth tax is poorly defined and designed to drive tech innovation out of California.

Each own ~3% of Alphabet's stock, worth about $120 billion each at today's ~$4 trillion market cap.

But because their shares have 10x voting power, the SEIU-UHW California billionaire tax would treat them as owning 30% of Alphabet (3% × 10 = 30%). That means each founder's taxable wealth would be $1.2 trillion.

A 5% wealth tax on $1.2 trillion = $60 billion tax bill, each.

That's 50% of their actual Alphabet holdings—wiped out by a "5%" tax.

Section 50303(c)(3)(C) of the 2026 Billionaire Tax Act states: "For any interests that confer voting or other direct control rights, the percentage of the business entity owned by the taxpayer shall be presumed to be not less than the taxpayer's percentage of the overall voting or other direct control rights."

This means if a founder holds shares representing only 3% of economic interest but 30% of voting control (through Class B supervoting shares), the tax would presume their ownership stake is at least 30% for valuation purposes, not 3%.

The wealth tax is poorly defined and designed to drive tech innovation out of California.

The law is so poorly written. While the lawyers who drafted it claim it doesn’t apply to publicly traded shares, they designed a legal trap where Class B voting shares would count as private shares and therefore considered ownership.

It’s so dishonest.

It’s so dishonest.

The specific tell is this passage in the text: “provisions of this Part shall be liberally construed to effectuate its purposes”

In other words capture as much tax as possible

In other words capture as much tax as possible

These clauses were the work of Professor Darien Shanske at UC Davis Law.

This is shoddy legal work that seems to be meant to destroy tech in California. There are so many other ways to tax the debt some billionaires use to fund their lives, as Bill Ackman proposed.

pro.stateaffairs.com/ca/economy-bus…

This is shoddy legal work that seems to be meant to destroy tech in California. There are so many other ways to tax the debt some billionaires use to fund their lives, as Bill Ackman proposed.

pro.stateaffairs.com/ca/economy-bus…

I can’t help but mention there are many efforts afoot to try to destroy tech and innovation in California and San Francisco

Late last year there was an effort to ban hard tech labs in SF’s Mission Districg: literally the birthplace of GPT-1 and self driving cars

Late last year there was an effort to ban hard tech labs in SF’s Mission Districg: literally the birthplace of GPT-1 and self driving cars

https://twitter.com/kane/status/2000037878944973274

• • •

Missing some Tweet in this thread? You can try to

force a refresh