DeFi’s Cashflow Map: Where is the fee flow heading?

There is one type of fee in DeFi that runs without needing a market pump: stablecoin fees

This is because on-chain dollars don't just serve trading; they are the settlement asset for the entire ecosystem: margin, lending, LP, treasury, and payments

To understand where DeFi is growing, don’t look at the price, look at the fees

Fees are where real demand leaves a footprint. And here, the footprint is extremely clear: stablecoin issuers are raking in hundreds of millions of USD every month

---

A) Stablecoin Issuers are Dominating the Fee Leaderboard

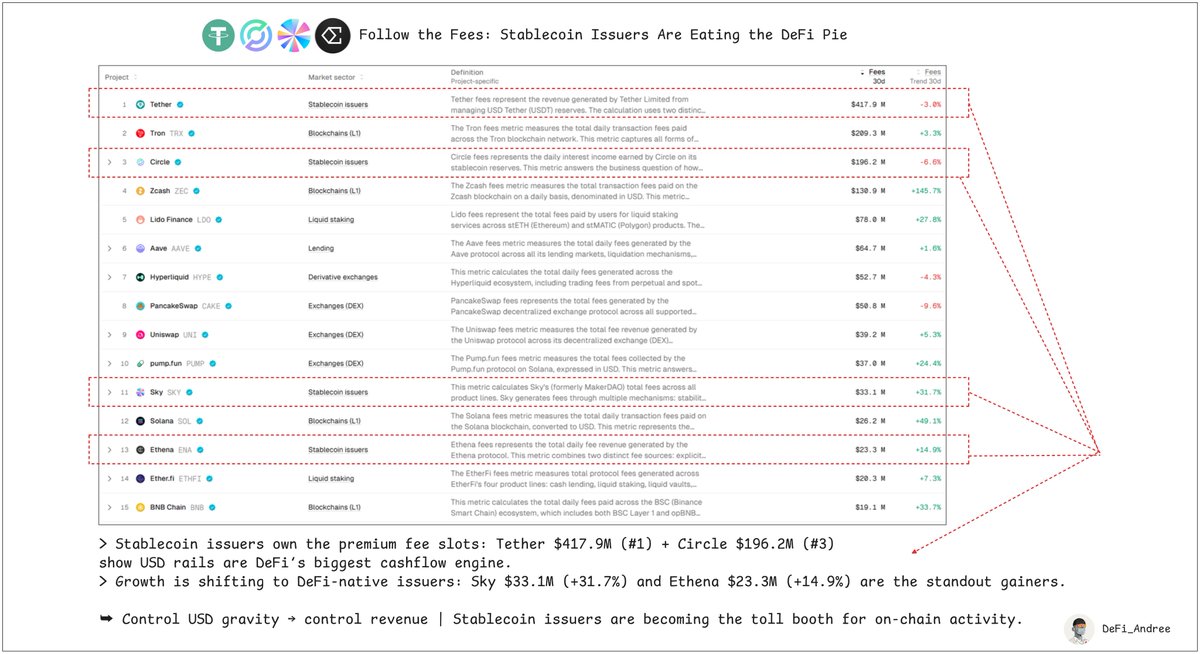

In the Top 15, stablecoin issuers appear frequently and occupy the most significant positions:

#1 @tether: $417.9M / 30D → still the “king of cashflow”.

#3 @circle: $196.2M / 30D → a massive, stable second layer.

#11 @SkyEcosystem: $33.1M / 30D (trend +31.7%) → DeFi-native issuer accelerating clearly.

#13 @ethena_labs: $23.3M / 30D (trend +14.9%) → on-chain challenger climbing the ranks via real fees.

╰➤ Sky and Ethena are showing positive growth → a new wave of growth is expanding on the crypto-native issuer side, not just within incumbent CeFi.

---

B) Why do Stablecoin Issuers Out-Earn both L1s + DEXs?

It’s not that L1s or DEXs are performing poorly. L1s are the settlement highway, and DEXs are the liquidity engine. But stablecoin issuers hold the very thing that makes both run: USD rails.

Stablecoin issuers = The toll booth of on-chain USD

> Whether the market pumps or goes sideways, USD must remain parked in the system for: trading, margin, lending, LP, payroll, treasury, settlement…

> When USD sits in the system, the issuer can monetize via the carry on the float → fees are consistent, substantial, and sustainable.

L1s depend on fees based on the rhythm of blockspace usage; the stronger the activity, the higher the fees spike.

DEXs earn fees based on flow speed (volume/volatility); the more vibrant the market, the more fees DEXs print.

---

The Core Difference:

L1 + DEX capitalize on transaction speed, while stablecoin issuers capitalize on the gravity of capital.

As crypto shifts to an on-chain USD economy, whoever holds the USD rails will naturally become the top fee winner.

Stablecoin issuers are currently the largest and most sustainable source of fees in DeFi because they monetize the USD float

➥ Ethena/Sky are the fast-growing group in the race to control the on-chain dollar toll booth.

There is one type of fee in DeFi that runs without needing a market pump: stablecoin fees

This is because on-chain dollars don't just serve trading; they are the settlement asset for the entire ecosystem: margin, lending, LP, treasury, and payments

To understand where DeFi is growing, don’t look at the price, look at the fees

Fees are where real demand leaves a footprint. And here, the footprint is extremely clear: stablecoin issuers are raking in hundreds of millions of USD every month

---

A) Stablecoin Issuers are Dominating the Fee Leaderboard

In the Top 15, stablecoin issuers appear frequently and occupy the most significant positions:

#1 @tether: $417.9M / 30D → still the “king of cashflow”.

#3 @circle: $196.2M / 30D → a massive, stable second layer.

#11 @SkyEcosystem: $33.1M / 30D (trend +31.7%) → DeFi-native issuer accelerating clearly.

#13 @ethena_labs: $23.3M / 30D (trend +14.9%) → on-chain challenger climbing the ranks via real fees.

╰➤ Sky and Ethena are showing positive growth → a new wave of growth is expanding on the crypto-native issuer side, not just within incumbent CeFi.

---

B) Why do Stablecoin Issuers Out-Earn both L1s + DEXs?

It’s not that L1s or DEXs are performing poorly. L1s are the settlement highway, and DEXs are the liquidity engine. But stablecoin issuers hold the very thing that makes both run: USD rails.

Stablecoin issuers = The toll booth of on-chain USD

> Whether the market pumps or goes sideways, USD must remain parked in the system for: trading, margin, lending, LP, payroll, treasury, settlement…

> When USD sits in the system, the issuer can monetize via the carry on the float → fees are consistent, substantial, and sustainable.

L1s depend on fees based on the rhythm of blockspace usage; the stronger the activity, the higher the fees spike.

DEXs earn fees based on flow speed (volume/volatility); the more vibrant the market, the more fees DEXs print.

---

The Core Difference:

L1 + DEX capitalize on transaction speed, while stablecoin issuers capitalize on the gravity of capital.

As crypto shifts to an on-chain USD economy, whoever holds the USD rails will naturally become the top fee winner.

Stablecoin issuers are currently the largest and most sustainable source of fees in DeFi because they monetize the USD float

➥ Ethena/Sky are the fast-growing group in the race to control the on-chain dollar toll booth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh