European stablecoins are showing rapid growth amid declining interest in the USD.

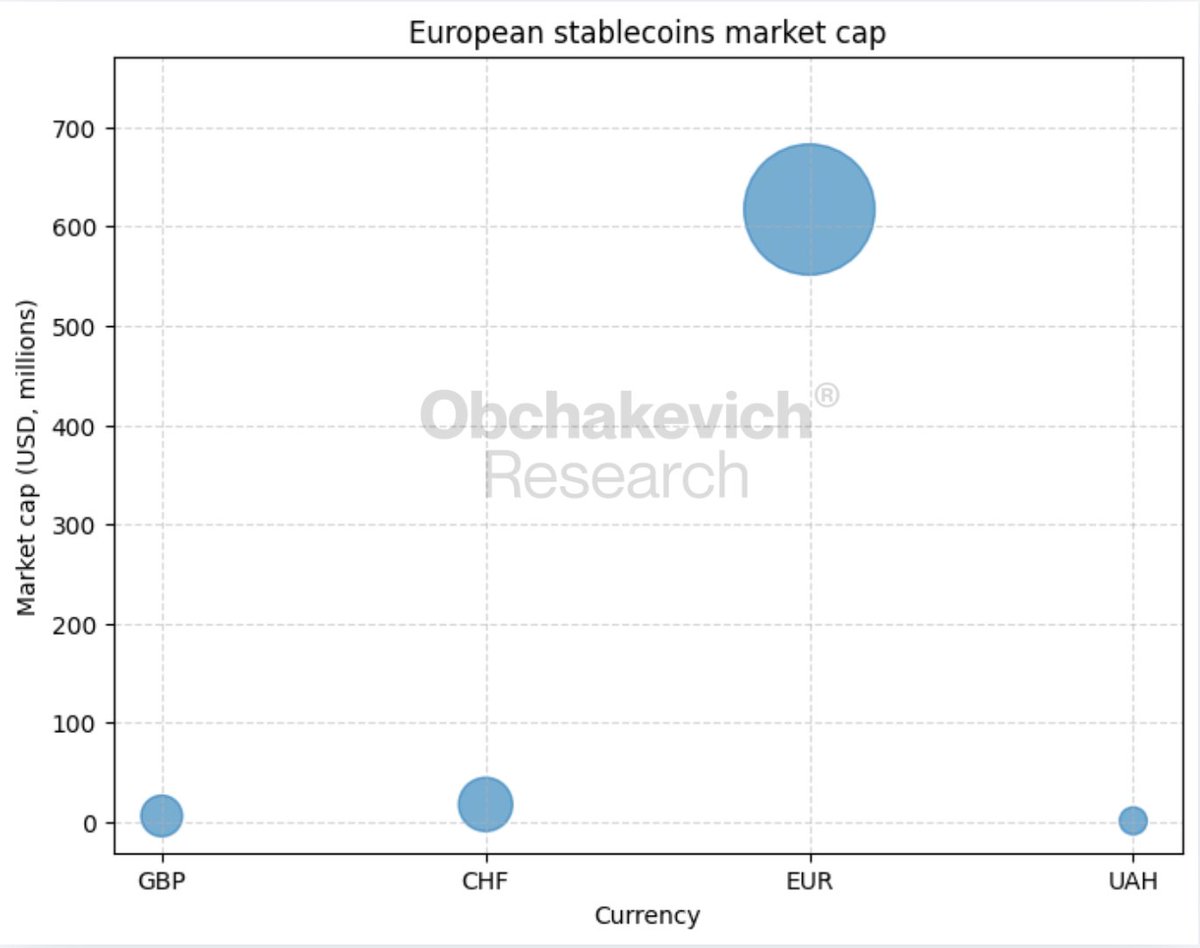

EUR stablecoins reached a $617m market cap in early 2026. The largest share belongs to EURC by @circle, with a capitalization of $398m.

Alongside EUR stablecoins, CHF-denominated ones have also been developing. Swiss stablecoins reached a $17.7m market cap, overtaking GBP. For example, ZCHF by @frankencoinzchf increased its market cap by +$2.5m in 2025.

Meanwhile, GBP stablecoins remain undervalued, with a total market cap of $6.1m, mainly represented by @monerium’s GBPe and @VNX_Platform’s VGBP.

GBP appreciated by 3% against the USD between the end of 2025 and early 2026, and this trend continues. GBP stablecoins could at least double their market cap, as stablecoins like GBPe are actively used in payments.

It’s also worth highlighting UAH stablecoins, such as @UAHg_to and UAHe, which have a combined market cap of $1.2m. Unlike EUR stablecoins, Ukrainian ones have a purely local impact, but they are actively used and developed, largely thanks to the crypto exchange @WhiteBit.

Overall, the European stablecoin market is clearly diversifying beyond USD dominance. While EUR and CHF stablecoins are already gaining scale, GBP and UAH stablecoins remain early-stage but show meaningful upside driven by payments use cases and local adoption.

EUR stablecoins reached a $617m market cap in early 2026. The largest share belongs to EURC by @circle, with a capitalization of $398m.

Alongside EUR stablecoins, CHF-denominated ones have also been developing. Swiss stablecoins reached a $17.7m market cap, overtaking GBP. For example, ZCHF by @frankencoinzchf increased its market cap by +$2.5m in 2025.

Meanwhile, GBP stablecoins remain undervalued, with a total market cap of $6.1m, mainly represented by @monerium’s GBPe and @VNX_Platform’s VGBP.

GBP appreciated by 3% against the USD between the end of 2025 and early 2026, and this trend continues. GBP stablecoins could at least double their market cap, as stablecoins like GBPe are actively used in payments.

It’s also worth highlighting UAH stablecoins, such as @UAHg_to and UAHe, which have a combined market cap of $1.2m. Unlike EUR stablecoins, Ukrainian ones have a purely local impact, but they are actively used and developed, largely thanks to the crypto exchange @WhiteBit.

Overall, the European stablecoin market is clearly diversifying beyond USD dominance. While EUR and CHF stablecoins are already gaining scale, GBP and UAH stablecoins remain early-stage but show meaningful upside driven by payments use cases and local adoption.

• • •

Missing some Tweet in this thread? You can try to

force a refresh