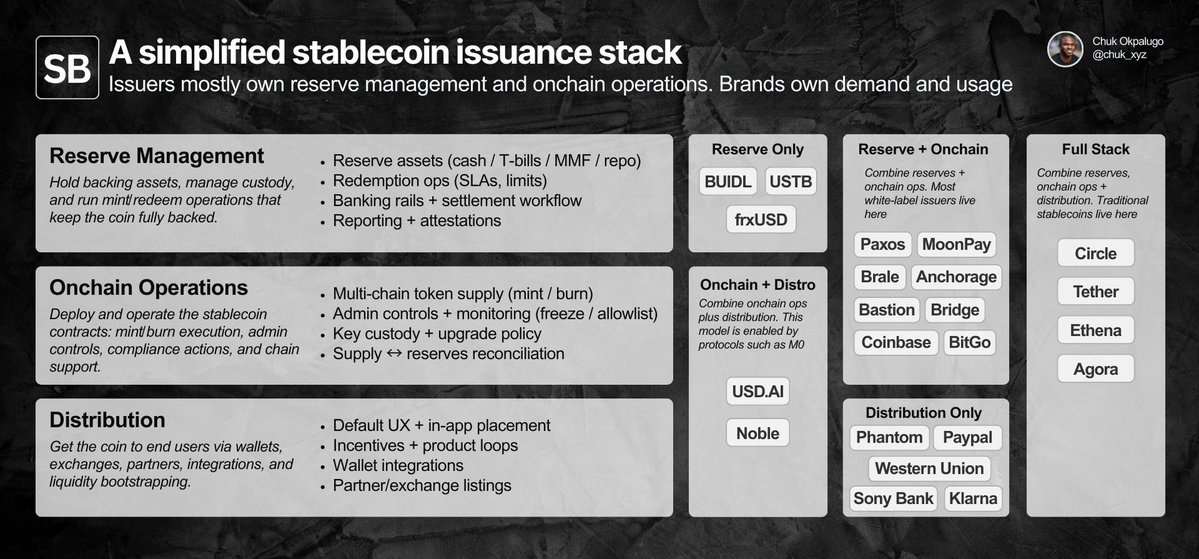

Stablecoin issuance is unbundling. Here’s the stack:

we’re moving right → left on the diagram

from “full stack” issuers (Tether, Circle) to plug-in roles: reserves, contract operator, distributor/brand.

the hard parts don’t disappear, specialization just productizes them

platforms like @m0 enable that shift, powering parts of the stack for @moonpay, Bridge (@Stablecoin), and @1MoneyNetwork

as the stack unbundles, value shifts to whoever re-bundles the full money workflow:

• KYC/KYB + on/off-ramps

• orchestration + payouts

• cards + lend/borrow

but most value accrues above that to the owner of distribution: the brand

so you end up with 3 pockets of value:

• specialists (reserves, contracts, rails, protocols)

• bundlers (one integration, workflow ownership)

• brands (demand lives at the interface)

bundler vs brand economics are negotiated:

early, startups are price takers

later, scale buys leverage

the flip is when distribution outweighs switching costs, and that looks different for every brand and their bundle

we’re moving right → left on the diagram

from “full stack” issuers (Tether, Circle) to plug-in roles: reserves, contract operator, distributor/brand.

the hard parts don’t disappear, specialization just productizes them

platforms like @m0 enable that shift, powering parts of the stack for @moonpay, Bridge (@Stablecoin), and @1MoneyNetwork

as the stack unbundles, value shifts to whoever re-bundles the full money workflow:

• KYC/KYB + on/off-ramps

• orchestration + payouts

• cards + lend/borrow

but most value accrues above that to the owner of distribution: the brand

so you end up with 3 pockets of value:

• specialists (reserves, contracts, rails, protocols)

• bundlers (one integration, workflow ownership)

• brands (demand lives at the interface)

bundler vs brand economics are negotiated:

early, startups are price takers

later, scale buys leverage

the flip is when distribution outweighs switching costs, and that looks different for every brand and their bundle

• • •

Missing some Tweet in this thread? You can try to

force a refresh