RABOBANK: STABLECOINS ARE A GEOPOLITICAL WEAPON FOR THE US

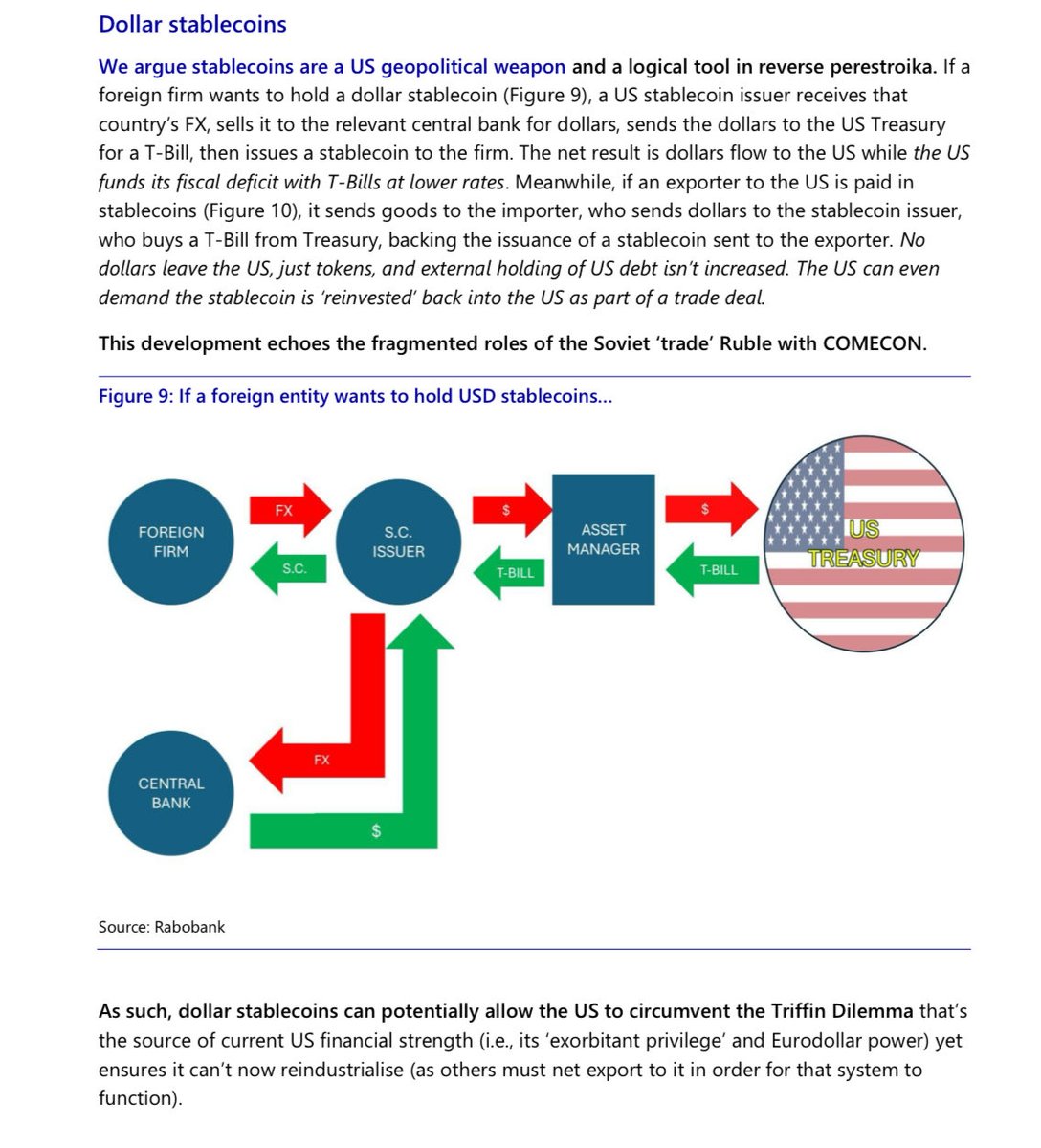

Rabobank argues dollar stablecoins are becoming a powerful U.S. geopolitical weapon and a tool for what it calls “reverse perestroika.”

Here’s the core mechanism:

When a foreign firm wants to hold a dollar stablecoin, it first provides its local currency to a US stablecoin issuer.

That issuer (ie Tether) converts the foreign currency into dollars via the relevant central bank, then sends those dollars to the US Treasury in exchange for T bills.

The stablecoin is then issued to the foreign firm.

The result: dollars flow into the US, while the US funds its fiscal deficit with Treasury bills at lower rates.

In trade, the effect is even stronger.

If a US importer pays an exporter in stablecoins, the importer sends dollars to the stablecoin issuer.

The issuer buys a T bill from the Treasury and issues stablecoins to the exporter.

No physical dollars leave the US.

Only tokens do.

And foreign holdings of US debt do not increase.

Rabobank notes the US can even require that those stablecoins be “reinvested” back into the US as part of trade agreements.

The bank compares this structure to the Soviet-era “trade ruble” used within COMECON, where settlement units circulated internationally while real monetary control stayed domestic.

In effect, Rabobank argues stablecoins could allow the US to sidestep the Triffin Dilemma.

The same dilemma that underpins America’s exorbitant privilege and eurodollar power, but also constrains its ability to reindustrialize.

Stablecoins export dollars without exporting dollars. And that changes the global monetary game.

Rabobank argues dollar stablecoins are becoming a powerful U.S. geopolitical weapon and a tool for what it calls “reverse perestroika.”

Here’s the core mechanism:

When a foreign firm wants to hold a dollar stablecoin, it first provides its local currency to a US stablecoin issuer.

That issuer (ie Tether) converts the foreign currency into dollars via the relevant central bank, then sends those dollars to the US Treasury in exchange for T bills.

The stablecoin is then issued to the foreign firm.

The result: dollars flow into the US, while the US funds its fiscal deficit with Treasury bills at lower rates.

In trade, the effect is even stronger.

If a US importer pays an exporter in stablecoins, the importer sends dollars to the stablecoin issuer.

The issuer buys a T bill from the Treasury and issues stablecoins to the exporter.

No physical dollars leave the US.

Only tokens do.

And foreign holdings of US debt do not increase.

Rabobank notes the US can even require that those stablecoins be “reinvested” back into the US as part of trade agreements.

The bank compares this structure to the Soviet-era “trade ruble” used within COMECON, where settlement units circulated internationally while real monetary control stayed domestic.

In effect, Rabobank argues stablecoins could allow the US to sidestep the Triffin Dilemma.

The same dilemma that underpins America’s exorbitant privilege and eurodollar power, but also constrains its ability to reindustrialize.

Stablecoins export dollars without exporting dollars. And that changes the global monetary game.

• • •

Missing some Tweet in this thread? You can try to

force a refresh