How to truly know if you're a useless trader

A THREAD 🧵🧵

A THREAD 🧵🧵

Let's be honest here, not everyone in the markets knows what they're doing.

Some of us are just emotionally attached to bad decisions… and somehow those bad decisions make us feel like we're doing the right thing

In this thread, I'll show you how to know if you're a useless trader

Some of us are just emotionally attached to bad decisions… and somehow those bad decisions make us feel like we're doing the right thing

In this thread, I'll show you how to know if you're a useless trader

1. You confuse being busy with being profitable.

You're always in a trade, always analyzing, always doing something but your account never grows

You think the more you trade , the more money you make when in reality, more trades often just means more losses ,more mistakes, and more emotional decisions.

Being busy makes you feel productive. Being profitable strongly requires patience, and knowing when not to trade

You're always in a trade, always analyzing, always doing something but your account never grows

You think the more you trade , the more money you make when in reality, more trades often just means more losses ,more mistakes, and more emotional decisions.

Being busy makes you feel productive. Being profitable strongly requires patience, and knowing when not to trade

2. Your biggest skill is explaining losses in very intelligent-sounding ways :-

it was "market manipulation" , "fake breakouts" or "unexpected news"

You always have a smart excuse ready, but somehow your account is still bleeding.

You Sounds smart and feel painful

it was "market manipulation" , "fake breakouts" or "unexpected news"

You always have a smart excuse ready, but somehow your account is still bleeding.

You Sounds smart and feel painful

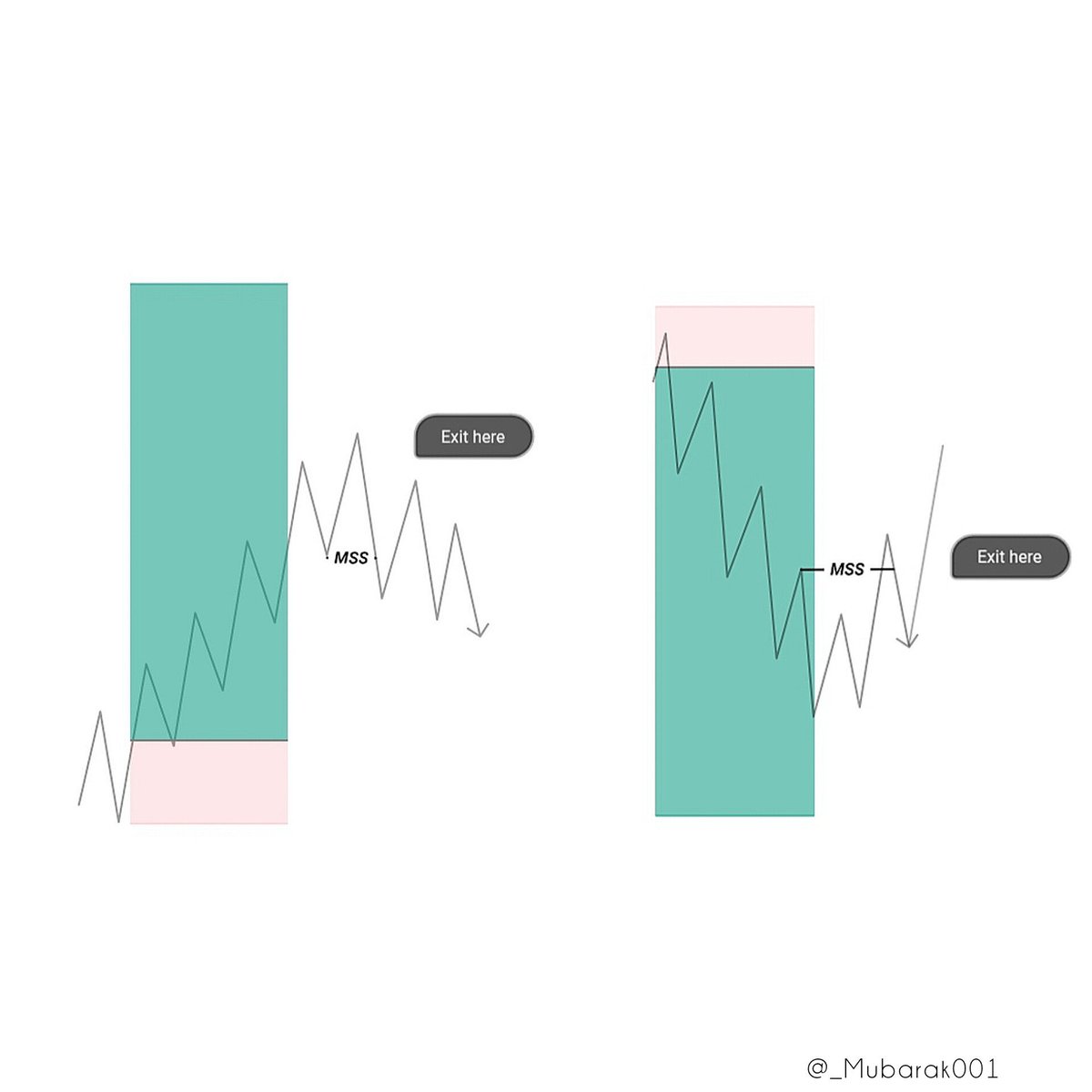

3. You keep saying "this time is different." It"s literally never different :-

Every week you tell yourself this trade is an A+ it's "the one that will finally work" .

And every week, you end up right back where you started, wondering why it didn't go your way. The market doesn't really care about your preparations .

Every week you tell yourself this trade is an A+ it's "the one that will finally work" .

And every week, you end up right back where you started, wondering why it didn't go your way. The market doesn't really care about your preparations .

At the end of the day, trading isn't about looking smart or always being busy

It's about being disciplined, patient, and actually making real money.

If half of this hits too close to home… don't worry you're not alone

Just relax and respect your risk

Trade smart, not messy 💚🥂

It's about being disciplined, patient, and actually making real money.

If half of this hits too close to home… don't worry you're not alone

Just relax and respect your risk

Trade smart, not messy 💚🥂

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh