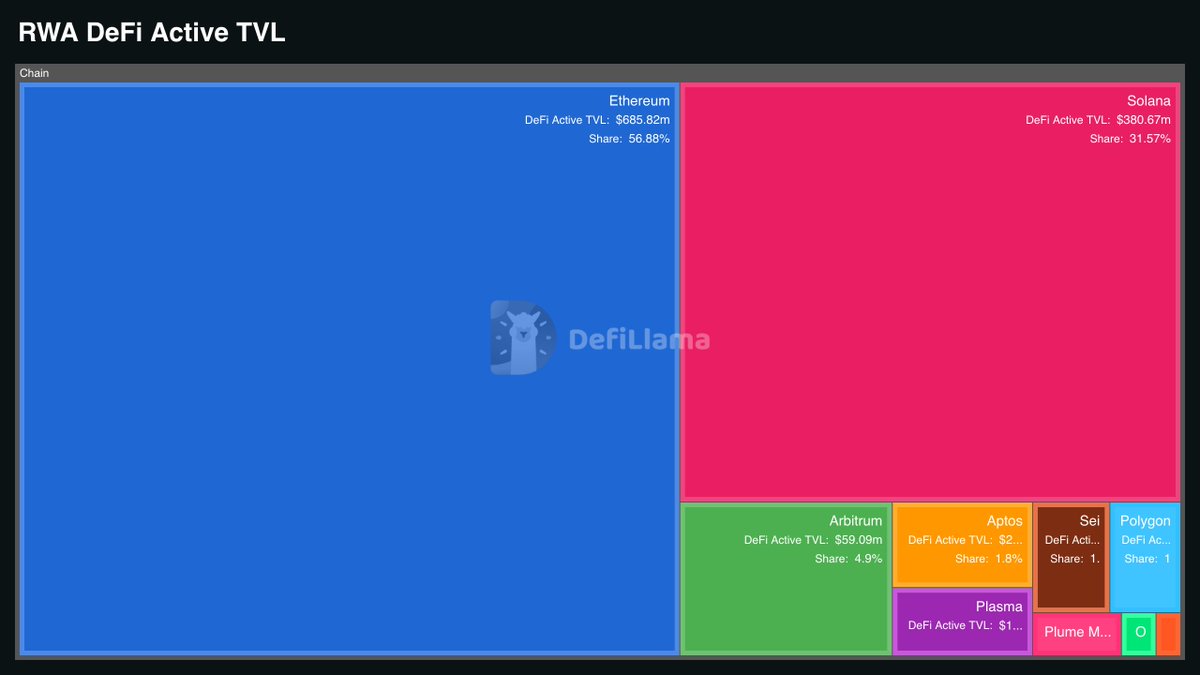

Nearly 90% of tokenized assets used in DeFi are on either Ethereum or Solana.

Will liquidity and network effects make early winners run away with the digitization of assets or is there still room for a competitor to differentiate themselves?

Will liquidity and network effects make early winners run away with the digitization of assets or is there still room for a competitor to differentiate themselves?

• • •

Missing some Tweet in this thread? You can try to

force a refresh