1/ Everyone in consumer is trying to figure out how to play emerging CPG (<$15m in revenue). EVERYONE. Every public CPG company, every retailer, every consumer VC and PE firm, every meaningful public investor. EVERYONE.

Here is why.

Here is why.

2/ In almost every category large brands losing market share to small brands b/c 1) consumers are demanding products that meet their unique needs, 2) mktg costs switching from fixed to variable, 3) direct distribution becoming more imp. Net = higher demand & lower barriers.

3/ At the same time, large brands are spending almost nothing on R&D. They don’t have a pipeline of innovation. They have 50-100 years of R&D-less cultures.

4/ Big-CPG spends too much on mtkg. So you have stale incumbents pumping $ into marketing the same products they’ve sold for 50 years. Btw- kudos to @KITKAT for evolving their tagline from "Have a break" (1960's) to "Gimme a Break" (now). Impressive.

5/ BigCPG outsources innovation because they aren’t nimble enough to do it themselves. They buy the innovation. Last year the M&A market was >$310 billion. That’s with a B. Analogy = Big Pharma.

pwc.com/us/en/industri…

pwc.com/us/en/industri…

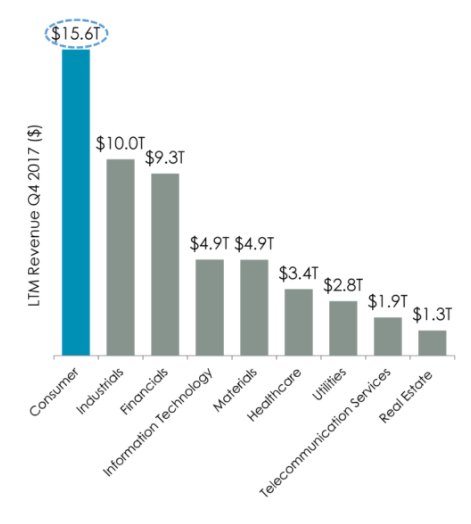

7/ Zoom out: So you have one of the largest industries in the world (CPG), with stale incumbents that are losing market share and can't innovate. Hmmmm….

8/ Big-CPG is terrified-as several large CPGs have told me: “If I try to start this co. and it flops, I get fired. If it takes off in a few years, the next person gets credit. Instead I ask corp dev to buy it. If we’re wrong, I don’t get fired.” (real quote from Fortune 200 co)

9/ PE firms are getting crowded out from mid-market. 15 years of amazing returns in consumer have led to massive inflows. The PE firms want to play earlier before the co’s get bid up. Compare avg. returns or standard deviation to tech.

10/ VC firms are frustrated with the crowds in traditional tech. They also see the huge opportunity in CPG.

11/ Larger (public) investors are going one of two ways- they are either shorting or encouraging massive cost cutting (which drives profit in short term but hurts long-term as it exacerbates the problem of low R&D spend). We call that the 3G effect.

12/ Everyone wants to participate but nobody can. There is no Silicon Valley for consumer. There is no @TechCrunch for consumer. There is no @ycombinator for consumer. There is too much friction to find & evaluate the emerging consumer co's.

13/ Try Googling “early stage consumer product funds”. Then click on a few links. You won’t find 10 funds in the country that will reliably do deals in emerging consumer/retail (non-tech). But there are >750 tech VC funds for an industry that is smaller?

14/ It turns out that the cost to invest in emerging CPG is too high as % of check. You spend 6 months to find co, then get on a plane and fly to @NatProdExpo, then fly to CO to visit the brand.. All to invest just $2m. The cost in time & $ just doesn’t work as % of investment.

15/ So what now? Investors, strategics, and retailers are all searching for a solution. Existing data providers can’t capture the long-tail of retailers or companies to have meaningful insights. The search goes on.

16/ I have reason to believe that innovation will meet this demand. As that happens we will see an explosion of action in the long-tail. More investment, M&A, emerging CPG capturing more shelf space, etc. Prediction: The next 10 yrs are the Golden Age of CPG.

• • •

Missing some Tweet in this thread? You can try to

force a refresh