I get a ton of questions about why I trade on Bitmex.

In this thread I'll give a couple advantages that Bitmex boasts over other exchanges.

In this thread I'll give a couple advantages that Bitmex boasts over other exchanges.

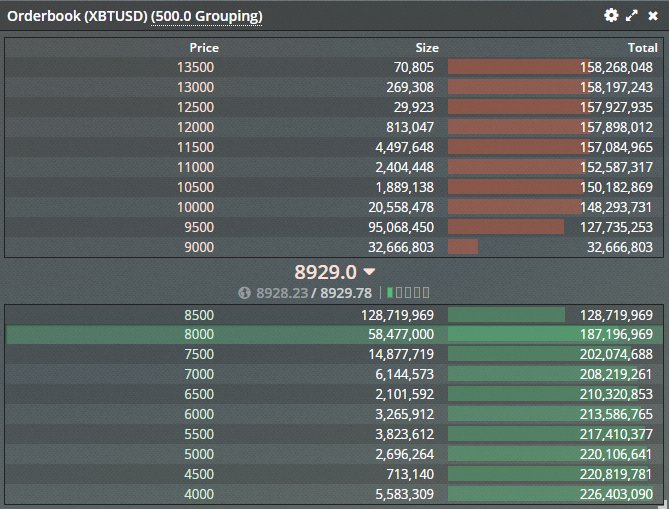

First and foremost is liquidity. Due to the amount of leverage offered at

Bitmex and the incentives for market makers to trade on the bitmex platform, bitmex has unrivaled liquidity. You can market sell and buy hundreds up bitcoin with less than 1% slippage.

Bitmex and the incentives for market makers to trade on the bitmex platform, bitmex has unrivaled liquidity. You can market sell and buy hundreds up bitcoin with less than 1% slippage.

A big factor to consider are the fees on your platform. Being able to make money for simply using limit orders is a good example. Compare the fees on Bitfinex with Bitmex's. You earn .025% of your trade when you use limit orders on bitmex vs finex, where you get nothing.

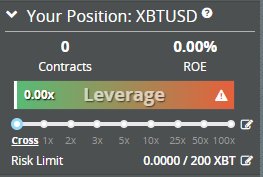

Another advantage bitmex has over other exchanges is the leverage offered. Leverage is important because it:

A) Limits your counterparty risk

B) Allows you to hedge without full spot exposure

Since bitmex allows you to trade with no liability leverage is enticing to traders.

A) Limits your counterparty risk

B) Allows you to hedge without full spot exposure

Since bitmex allows you to trade with no liability leverage is enticing to traders.

Tether speculations aside, one glaring fact stands out between bitmex and bitfinex.

Bitmex has never been hacked, and has multiple advantages over Finex.

Those being:

1) One withdraw time per day

2) compatibility with Yubikey

3) Support response time

Bitmex has never been hacked, and has multiple advantages over Finex.

Those being:

1) One withdraw time per day

2) compatibility with Yubikey

3) Support response time

Bitmex also offers futures contracts. Which are attractive to market makers who want to quote prices without worrying about funding, or traders who want to hedge or speculate on the price of bitcoin in the future! Depending on the premium/discount there are different arb opps.

Now that I've gone over the advantages, in order to remain objective I also need to go over the problems mex faces.

The most glaring problem bitmex has is the "OVERLOAD" problem. As explained by Bitmex_Sam here, they're obvious aware of the problem and actively trying to fix it.

The most glaring problem bitmex has is the "OVERLOAD" problem. As explained by Bitmex_Sam here, they're obvious aware of the problem and actively trying to fix it.

Additionally I've hypothesized that bitmex has exposure to a prolonged outage along with a massive market move. Consider the insurance fund (used to cover the fees and slippage on liquidated orders) which dropped by 12% on April 11th, due to the massive candle.

If bitmex is down for an extended period of time, and the market moves violently in one direction, once mex returns online there will be a instant liquidation of hundreds of orders, resulting in slippage of the orders liquidated at the bottom of the move.

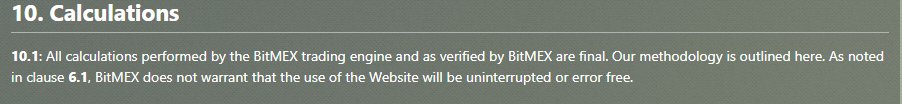

If a 17.8% move (6800 -> 8000) drained nearly 12% of the insurance fund. A move larger (mostly likely to the downside since longs are liquidated sooner than shorts) could result in a complete wiping of the insurance fund (hypothetically). In this case we refer to the bitmex TOS

Essentially it's a nice way of telling you there are no refunds, but my only question is who would pay the collateral if the slippage and fees on the liquidations exceed the insurance fund? Some food for thought.

If you would like to learn more about bitmex they have contract guides and explanations on their site, but may be confusing for beginning traders. I would recommend reading up on inverse contracts if you want to trade bitcoin on mex.

Anyways have a nice day people of twitter, I'll be talking about market making in my free discord later tonight!

Peace!

discord.gg/8S2ka7b

Peace!

discord.gg/8S2ka7b

• • •

Missing some Tweet in this thread? You can try to

force a refresh