Thread:

What is a Market Maker?

There are a ton of idiots on twitter who believe that every single movement of bitcoin is dictated by one single entity. While this could be true, this is not what a market maker is!

What is a Market Maker?

There are a ton of idiots on twitter who believe that every single movement of bitcoin is dictated by one single entity. While this could be true, this is not what a market maker is!

Market Making is the process of quoting continuous passive buy and sell prices to provide liquidity. On BitMEX market makers post two-way quotes on various products. Market makers are DELTA neutral, they don’t have an outright market view.

Traders market make to earn rebates, currently 0.025% or 2.5 basis points. Traders market make to earn their bid / ask spread. If done correctly, can be a source of consistent trading income. Traders can also market take, where they will be paying a taker fee of .075% or 7.5 bps.

Here is a very simple market making bot that you can use. ANYBODY can market make bitcoin, whenever you get a bid "hit" or an ask "lifted" you are market making.

github.com/BitMEX/sample-…

github.com/BitMEX/sample-…

I always wondered when I was first trading was "Why is there always somebody willing to trade with you?". Markets are different than selling a house, where it can take months or even years to make a trade.

That is where MM come in, MM supply liquidity, they are not directional.

That is where MM come in, MM supply liquidity, they are not directional.

Market making is way to provide consistent income by making money off people who want to pay for the privilege to have their trade executed immediately. Market makers are either quoting prices a bit above the current market price or below the current market price.

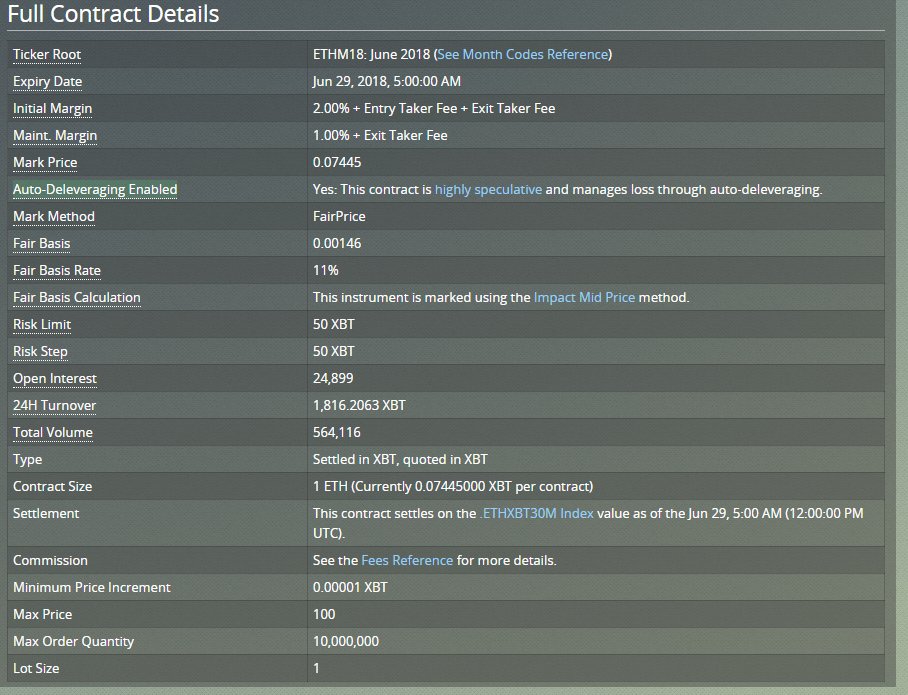

An ASK side market maker who was market making the ETH/BTC contract on BitMEX they would need:

-To calculate the fair price of the asset their trading

-An automated bot that would continous make the calculation

-Capital

-A lack of testicles since real men take directional trades

-To calculate the fair price of the asset their trading

-An automated bot that would continous make the calculation

-Capital

-A lack of testicles since real men take directional trades

Fair price (varies depending on what you're measuring against) according to bitmex is based on where you as a trader can borrow and lend BTC/USD and the rates given. If you're dumb enough to try and MM when you're making less than you would just lending, it's not worth your time

You used to have to calculate fair price by yourself, but now bitmex is nice enough to do it for you.

-Basis is the expected premium the contracts will trade at (Futures - Spot = Basis)

So if I wanted to market make the ETH contract I would determine my Spread:

-Basis is the expected premium the contracts will trade at (Futures - Spot = Basis)

So if I wanted to market make the ETH contract I would determine my Spread:

The spread is the most important part of market making, since your spread determines your potential profit.

Spread = ETH/XBT Volatility + Hedging Costs

ETH/XBT Volatility = your estimation of how much the price could move before you hedge or receive a trade in the other direction

Spread = ETH/XBT Volatility + Hedging Costs

ETH/XBT Volatility = your estimation of how much the price could move before you hedge or receive a trade in the other direction

Here's the trade walk through:

You quote a market on ETHM18, 1 contract on both the Bid and Offer, of 0.05 XBT / 0.1 XBT

A trader lifts your offer, you are now short 1 ETHM18 contract

To hedge your delta, you buy 1 ETH for BTC on Poloniex at 0.072 BTC

You quote a market on ETHM18, 1 contract on both the Bid and Offer, of 0.05 XBT / 0.1 XBT

A trader lifts your offer, you are now short 1 ETHM18 contract

To hedge your delta, you buy 1 ETH for BTC on Poloniex at 0.072 BTC

Your market remains 0.05 XBT / 0.1 XBT

A trader hits your bid, you are now flat on ETHM18

To hedge your delta (you are now long 1 ETH on Poloniex), you sell 1 ETH for XBT at 0.072 XBT

This would all be automated by a bot.

A trader hits your bid, you are now flat on ETHM18

To hedge your delta (you are now long 1 ETH on Poloniex), you sell 1 ETH for XBT at 0.072 XBT

This would all be automated by a bot.

MM'ing bitcoin is a bit different.

The goal of market making is to buy low, sell high as quickly as possible, as much as possible.

The more hedging you do, the less money you make.

To attract the other side, market makers will skew their quotes as they receive trades.

The goal of market making is to buy low, sell high as quickly as possible, as much as possible.

The more hedging you do, the less money you make.

To attract the other side, market makers will skew their quotes as they receive trades.

General Rule: For each full size transacted, skew your quotes half your spread.

Skew Example:

You are quoting ETHM18 at 0.05 XBT / 0.1 XBT for 1,000 contracts a side.

You are lifted for 1,000 contracts, since your spread is 0.05 XBT, you move your quotes higher 0.025 XBT.

Skew Example:

You are quoting ETHM18 at 0.05 XBT / 0.1 XBT for 1,000 contracts a side.

You are lifted for 1,000 contracts, since your spread is 0.05 XBT, you move your quotes higher 0.025 XBT.

Your new market is 0.075 XBT / 0.125 XBT

You are hit for 1,000 contracts, you now move your quotes down by 0.025 XBT

Your new market is 0.05 XBT / 0.1 XBT

You are hit for 1,000 contracts, you now move your quotes down by 0.025 XBT

Your new market is 0.05 XBT / 0.1 XBT

Remember on BitMEX you receive a 0.025% rebate as a market maker

BitMEX Trades:

Sell 1,000 ETHM18 @ 0.1 XBT, rebate 0.025 XBT

Buy 1,000 ETHM18 @ 0.075 XBT, rebate 0.01875 XBT

Market Making Profit: 2.5 XBT

Rebate: 0.04375

Total Profit: 2.9375 XBT

BitMEX Trades:

Sell 1,000 ETHM18 @ 0.1 XBT, rebate 0.025 XBT

Buy 1,000 ETHM18 @ 0.075 XBT, rebate 0.01875 XBT

Market Making Profit: 2.5 XBT

Rebate: 0.04375

Total Profit: 2.9375 XBT

So what conditions do market makers like? What type of market is attractive to a market maker?

Optimal Conditions: Low volatility market, with very active two-way flow

Bad Conditions: High volatility trending market, with one-way flow

Every MM's delta tolerance is different.

Optimal Conditions: Low volatility market, with very active two-way flow

Bad Conditions: High volatility trending market, with one-way flow

Every MM's delta tolerance is different.

As you can see MM's have a neutral outlook on the market. They don't care if it goes up or down only that it moves. They hate markets which trend in one direction for a long period of time. THEY HAVE NO INCENTIVE TO MOVE THE MARKET WITH MARKET ORDERS IT WOULD ONLY REDUCE PROFIT.

MM's aim to take advantage of the volatility of bitcoin by quoting prices above and below the current market price. A market maker that's quoting a one cent spread would get run over very quickly.

Hopefully this clears up a lot of misconceptions people have about MM's.

Peace.

Hopefully this clears up a lot of misconceptions people have about MM's.

Peace.

• • •

Missing some Tweet in this thread? You can try to

force a refresh