How to get URL link on X (Twitter) App

(to read the full FREE report, click below)

(to read the full FREE report, click below)

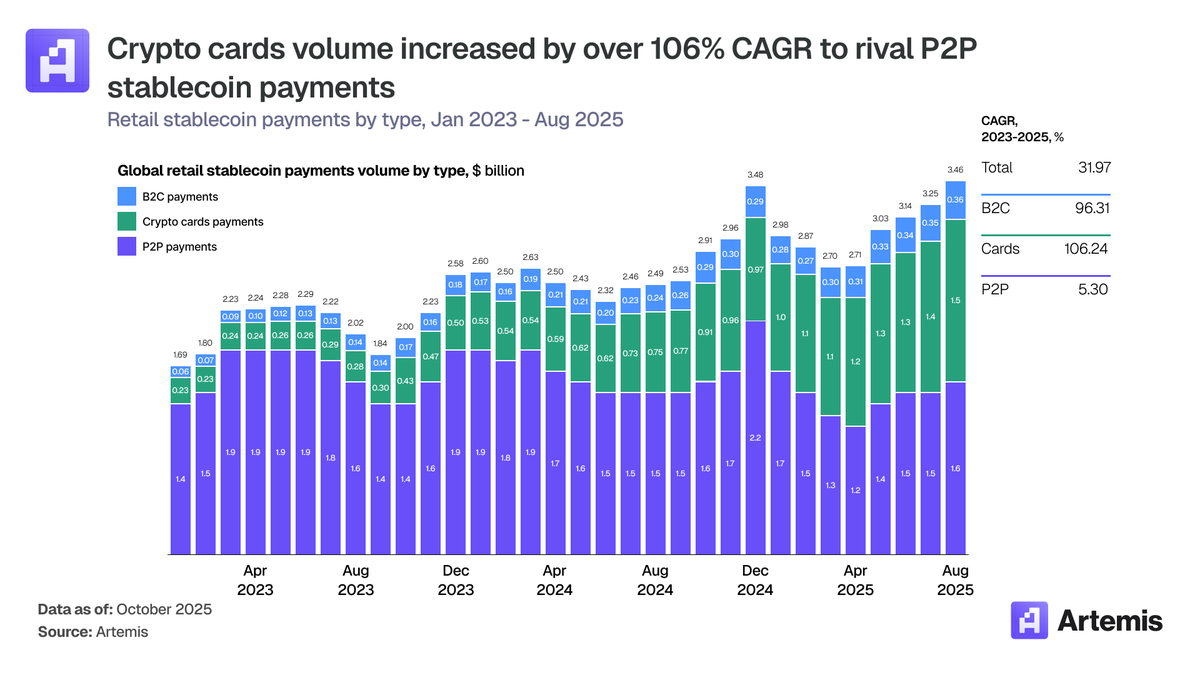

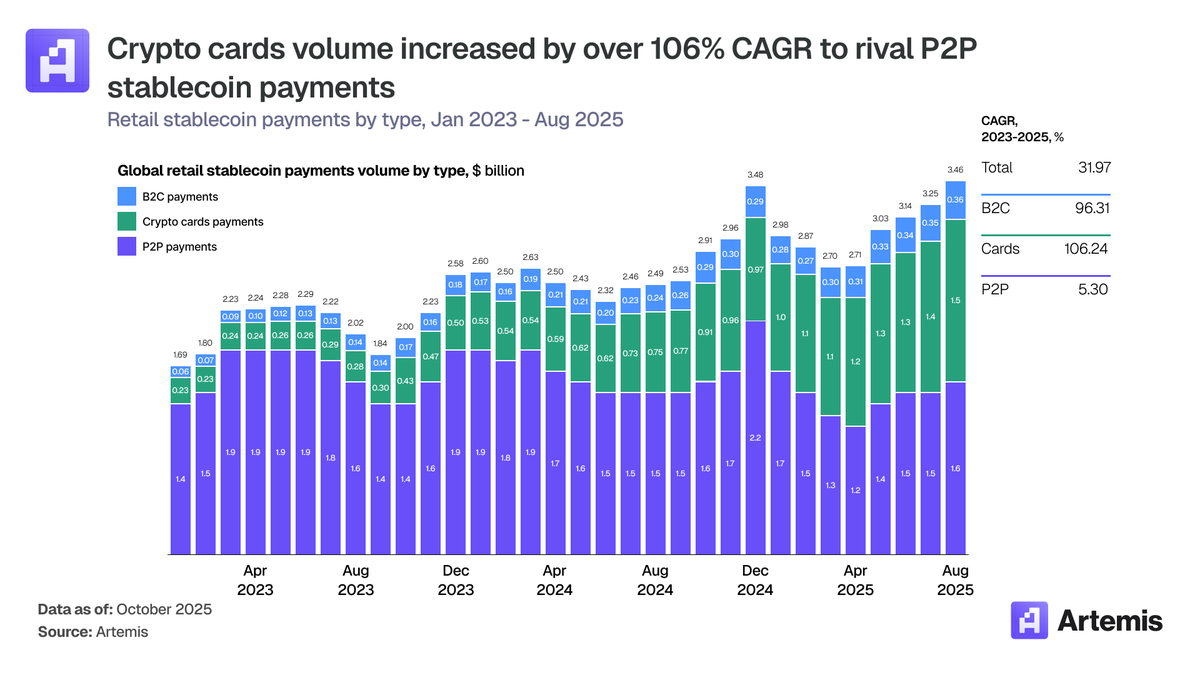

We were able to specifically attribute $94.2 billion worth of stablecoin payments settled between January 2023 and February 2025

We were able to specifically attribute $94.2 billion worth of stablecoin payments settled between January 2023 and February 2025

We know the limitations of daily active addresses, so we are taking a deep dive into @Celo stablecoin transaction volumes.

We know the limitations of daily active addresses, so we are taking a deep dive into @Celo stablecoin transaction volumes.

As shown above, today, stablecoins are responsible for between 70 and 80 percent of all value settled on public blockchains.

As shown above, today, stablecoins are responsible for between 70 and 80 percent of all value settled on public blockchains.

https://twitter.com/869659857590288384/status/1805731528023957778Since June 10, Solana stablecoin volume have diminished from $74bn to roughly $7bn a day

This report gives an overview of blockchain activity:

This report gives an overview of blockchain activity:

1/ To be clear, Artemis counts "transaction blocks" for @SuiNetwork instead of transactions when comparing with Ethereum and other chains.

1/ To be clear, Artemis counts "transaction blocks" for @SuiNetwork instead of transactions when comparing with Ethereum and other chains. https://twitter.com/Artemis__xyz/status/1656040033546059790

https://twitter.com/Artemis__xyz/status/1636378512063102981

First, let's gather assets in Arbitrum's peer group. A reasonable set of peers include EVM-compatible L1s / L2s:

First, let's gather assets in Arbitrum's peer group. A reasonable set of peers include EVM-compatible L1s / L2s:

We can see that nominal volumes have returned to roughly where things stood in Q3 '22, pre FTX collapse, and has actually grown significantly more for NFT marketplace activity

We can see that nominal volumes have returned to roughly where things stood in Q3 '22, pre FTX collapse, and has actually grown significantly more for NFT marketplace activity

Overview

Overview

Polygon is an Ethereum compatible scaling solution promising lower fees, scalability, security.

Polygon is an Ethereum compatible scaling solution promising lower fees, scalability, security.