How to get URL link on X (Twitter) App

1. Valuations of SAFTS overinflated compared to liquid tokens

1. Valuations of SAFTS overinflated compared to liquid tokens

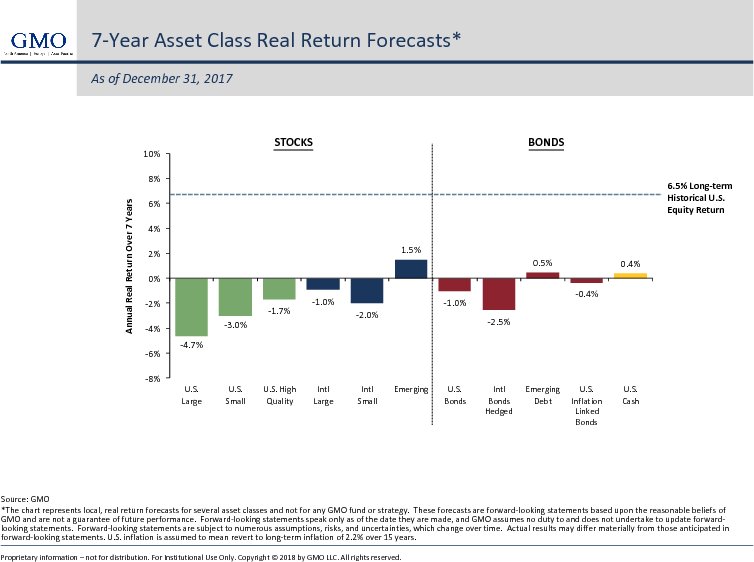

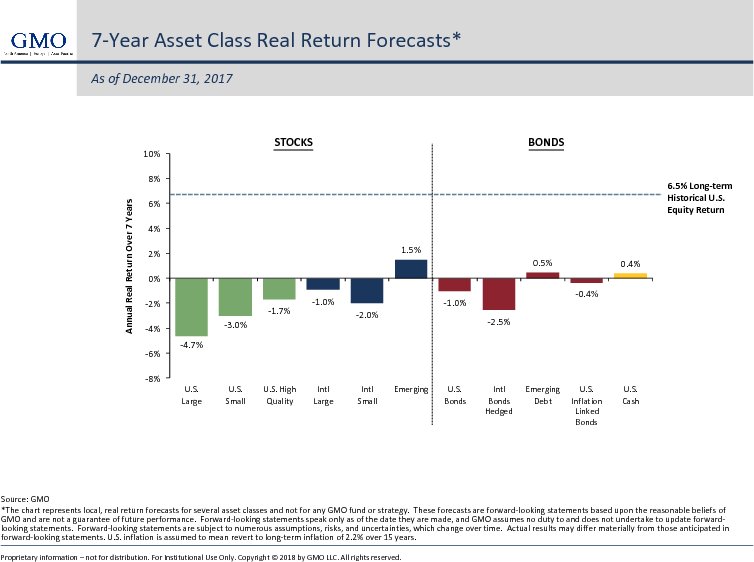

https://twitter.com/VitalikButerin/status/1072158957999771648First, every resource should be dedicated to making the largest monetary asset possible

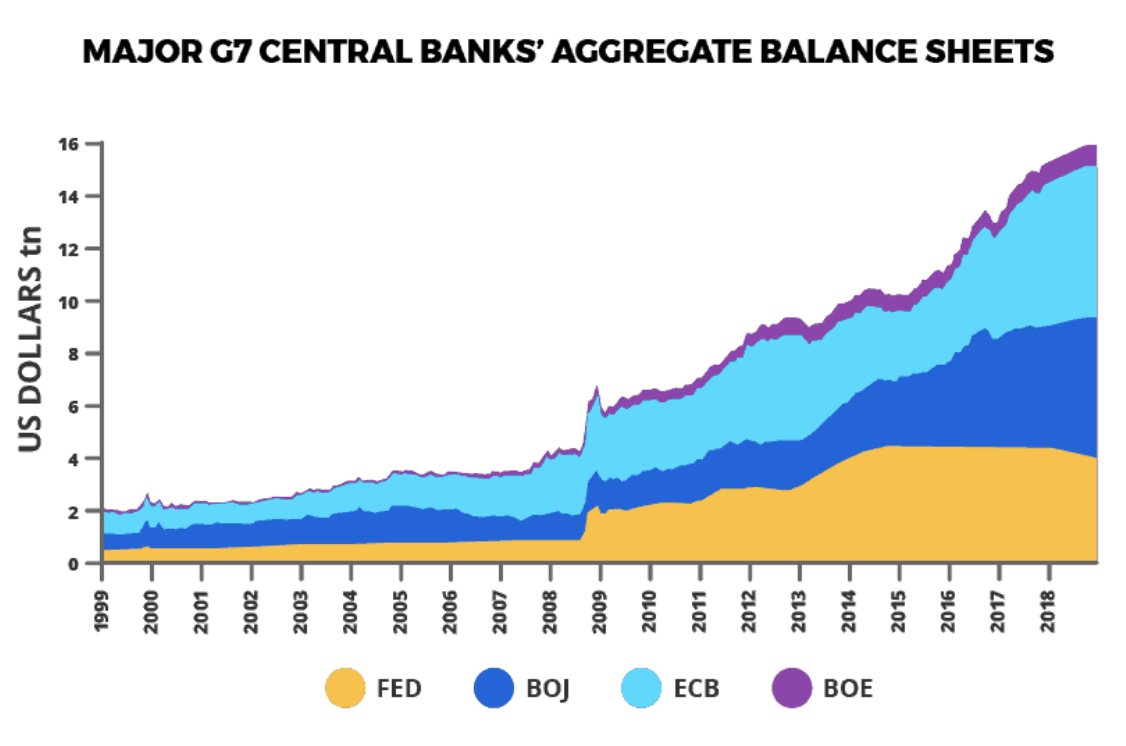

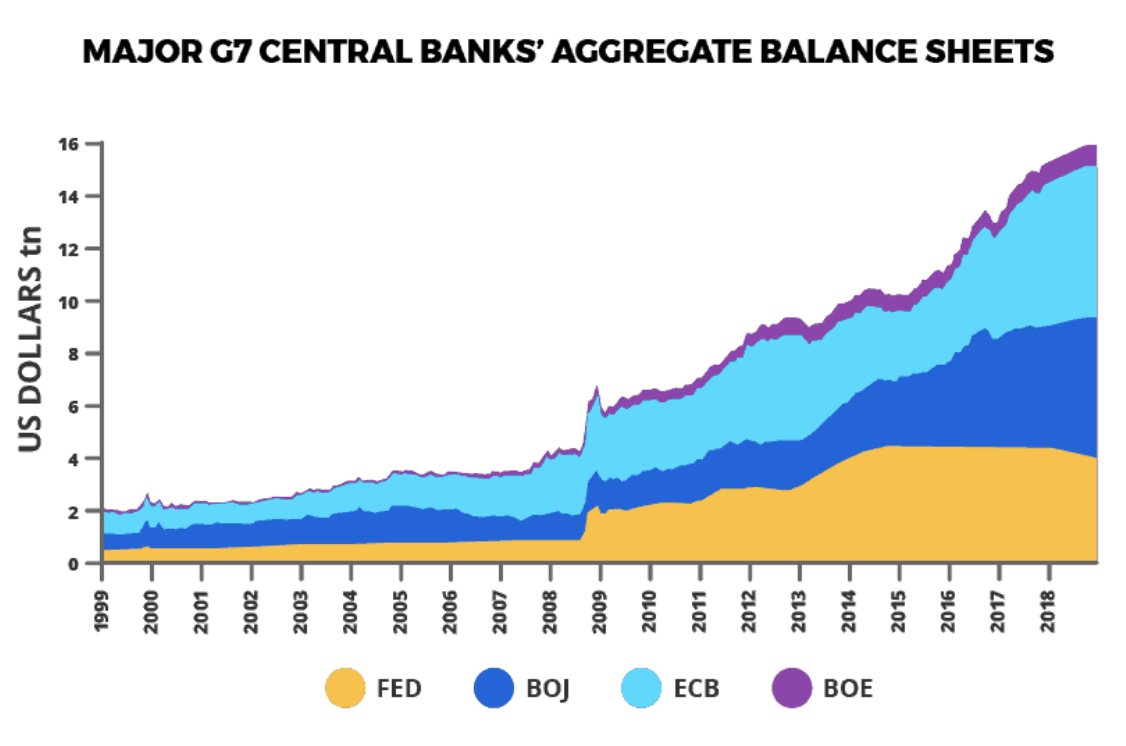

https://twitter.com/HayekAndKeynes/status/1061643721861677056They sure as hell can't get that from treasuries with rock bottom rates.

The gold market is extremely opaque

The gold market is extremely opaque

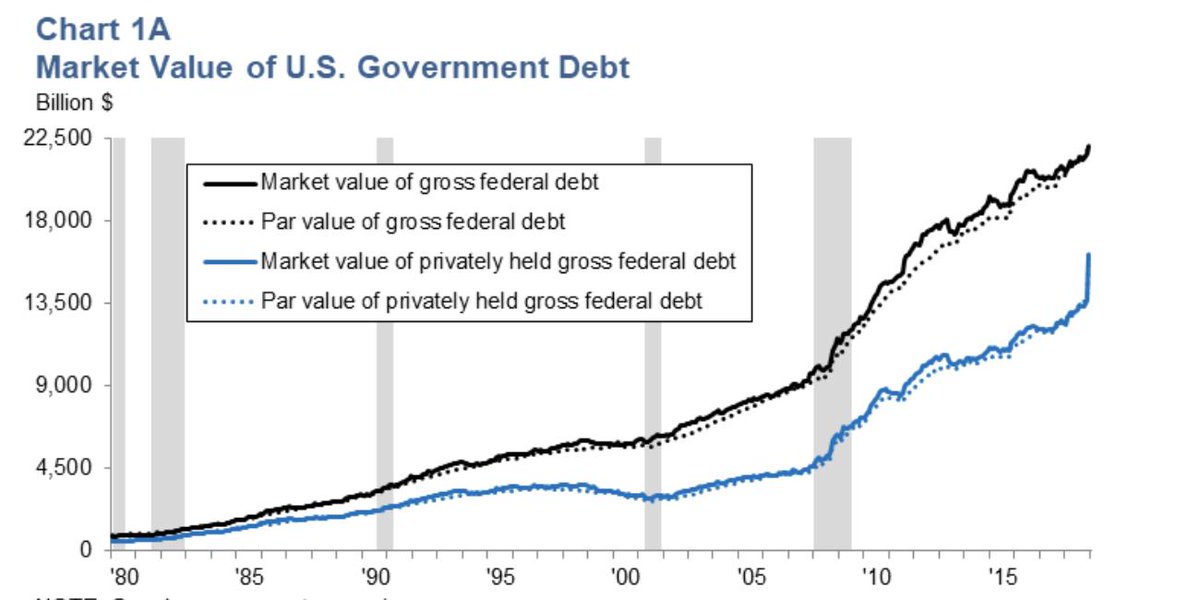

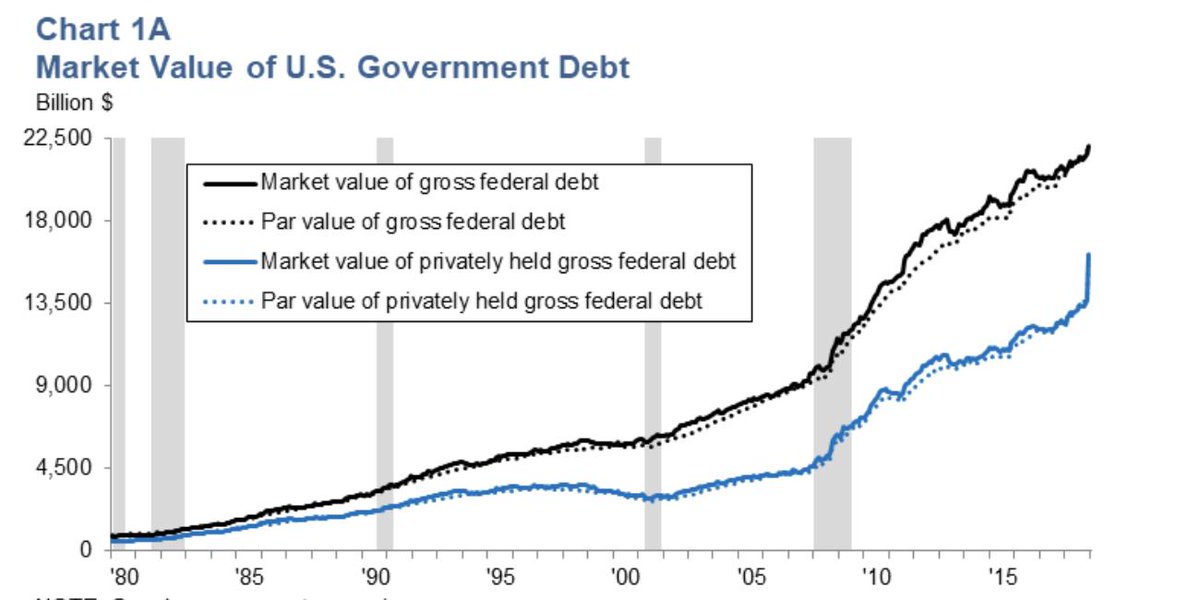

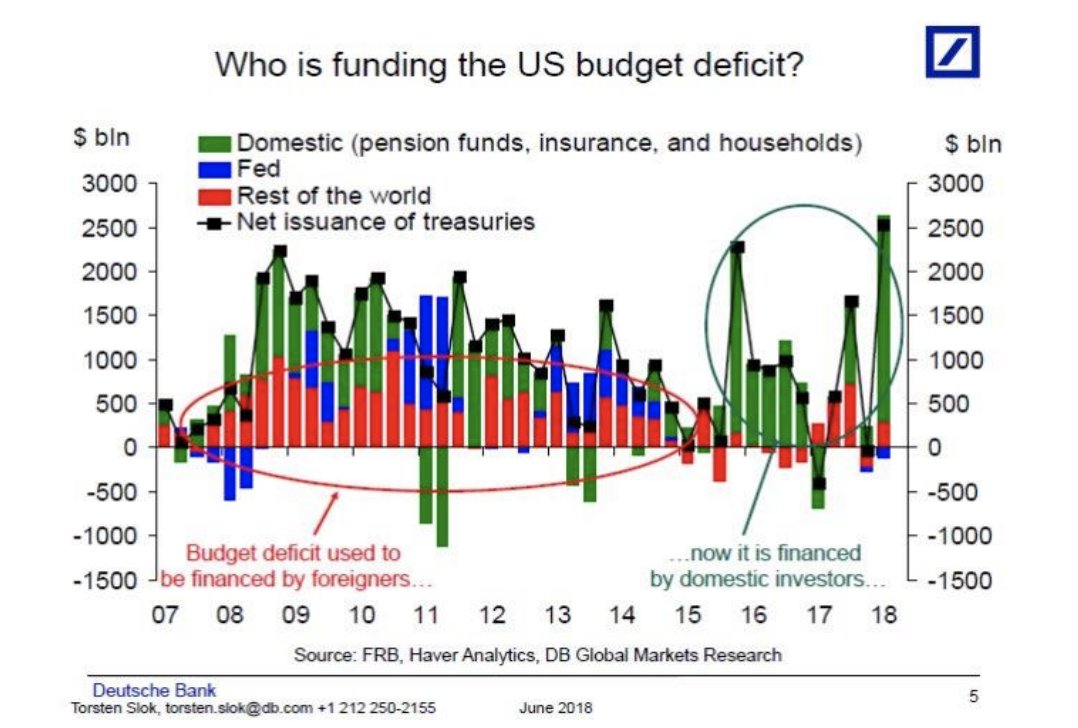

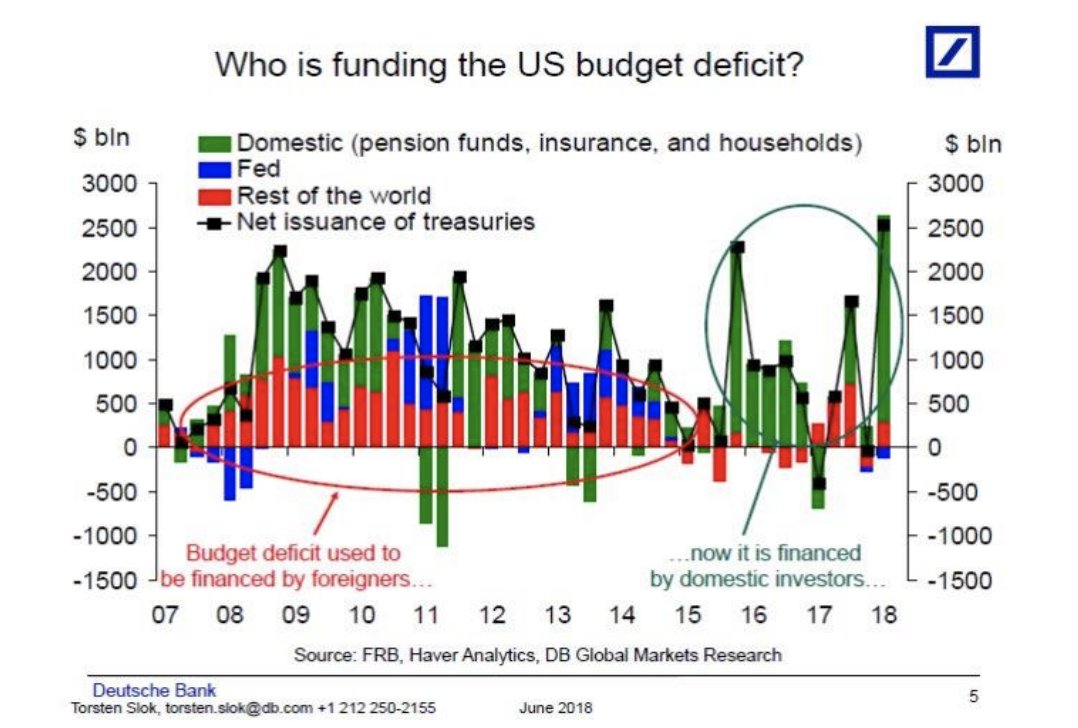

Also in 2015, our deficit reversed trend and started increasing again -- now headed to $1tn

Also in 2015, our deficit reversed trend and started increasing again -- now headed to $1tn

2/ Bc. the stock market is so critical to capitalism this has profound 2nd order effects

2/ Bc. the stock market is so critical to capitalism this has profound 2nd order effects

https://twitter.com/panekkkk/status/1035197562599428096People who don't understand this optimize for "features".

Monetary assets have extremely strong reflexivity. The lower they go in mcap, the less useful they are. Holders and dip buyers are necessary to reverse this process

Monetary assets have extremely strong reflexivity. The lower they go in mcap, the less useful they are. Holders and dip buyers are necessary to reverse this process

Out of fear we’re persuaded into believing a govt monopoly on money is necessary to preserve financial markets.

Out of fear we’re persuaded into believing a govt monopoly on money is necessary to preserve financial markets.

Despite the smaller block size and two of the largest institutions pushing BCH (ahem coinbase and bitcoin.com), BTC USD txn volume is 20x BCH's.

Despite the smaller block size and two of the largest institutions pushing BCH (ahem coinbase and bitcoin.com), BTC USD txn volume is 20x BCH's.

https://twitter.com/spencernoon/status/1016713147036655616Yes, many great apps had a bad UX at launch--but so did shitty ones. This does nothing to help explain or predict their success.

The recent avg % fee spike without accompanying USD volume increase, isn't a good sign for the sustainability of demand IMO.

The recent avg % fee spike without accompanying USD volume increase, isn't a good sign for the sustainability of demand IMO.