CA, Angel Investor, STOCK Directional, XAUUSD, Tweets are Personal & educational purpose only, Spreading Positivity. ❤️

How to get URL link on X (Twitter) App

https://twitter.com/cavardhanca/status/1425823985619537930

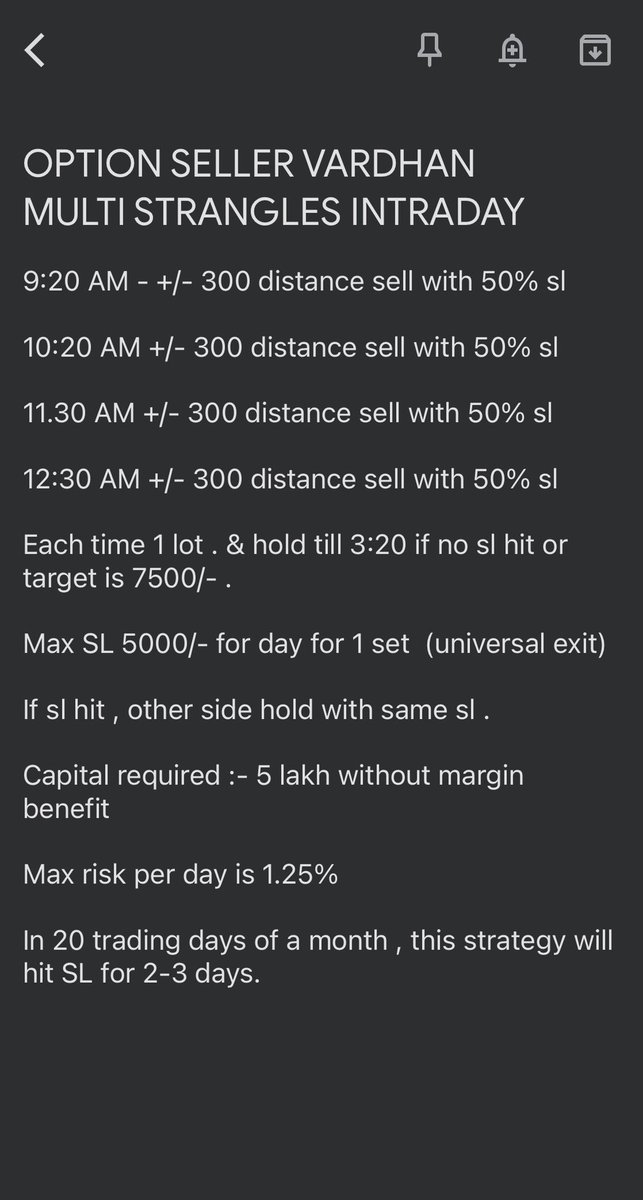

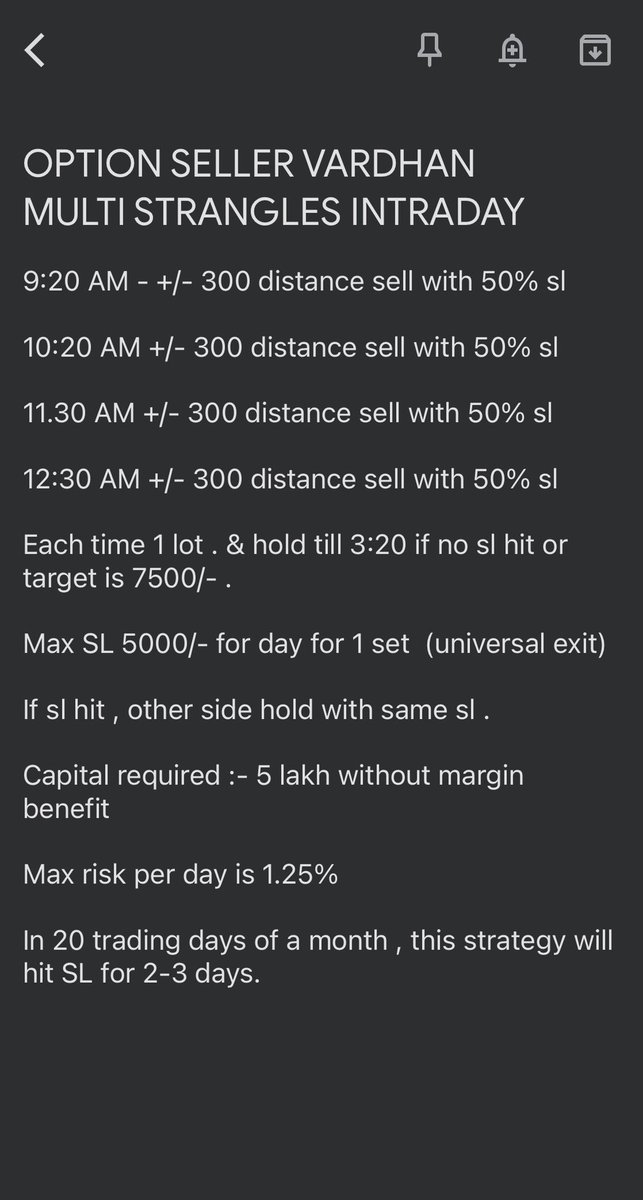

The main aim of an Intraday Trader , is not to get caught in SPIKES & big Slippages.

The main aim of an Intraday Trader , is not to get caught in SPIKES & big Slippages.

https://twitter.com/CaVardhanca/status/1349382245505671170

Trade 55 booked 110 points (carried from previous week)

Trade 55 booked 110 points (carried from previous week)

2 . Entry 9.20 Exit 3.20 SL 100% each leg

2 . Entry 9.20 Exit 3.20 SL 100% each leg