Financial Times Economics Commentator; Honorary Professor of Practice, UCL Policy Lab Sign up to my newsletter in the link below

22 subscribers

How to get URL link on X (Twitter) App

Is it contagion?

Is it contagion?

Buy peanut butter

Buy peanut butter

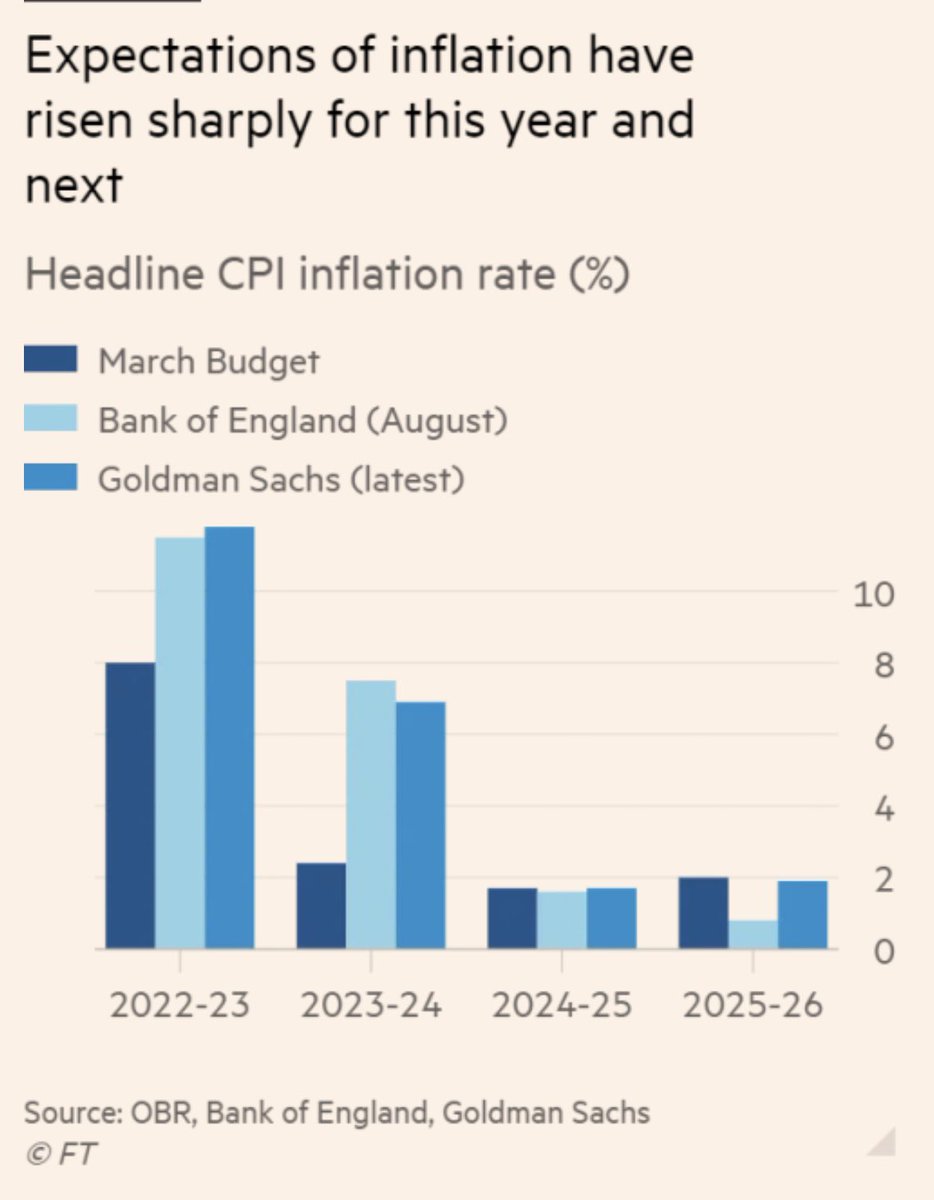

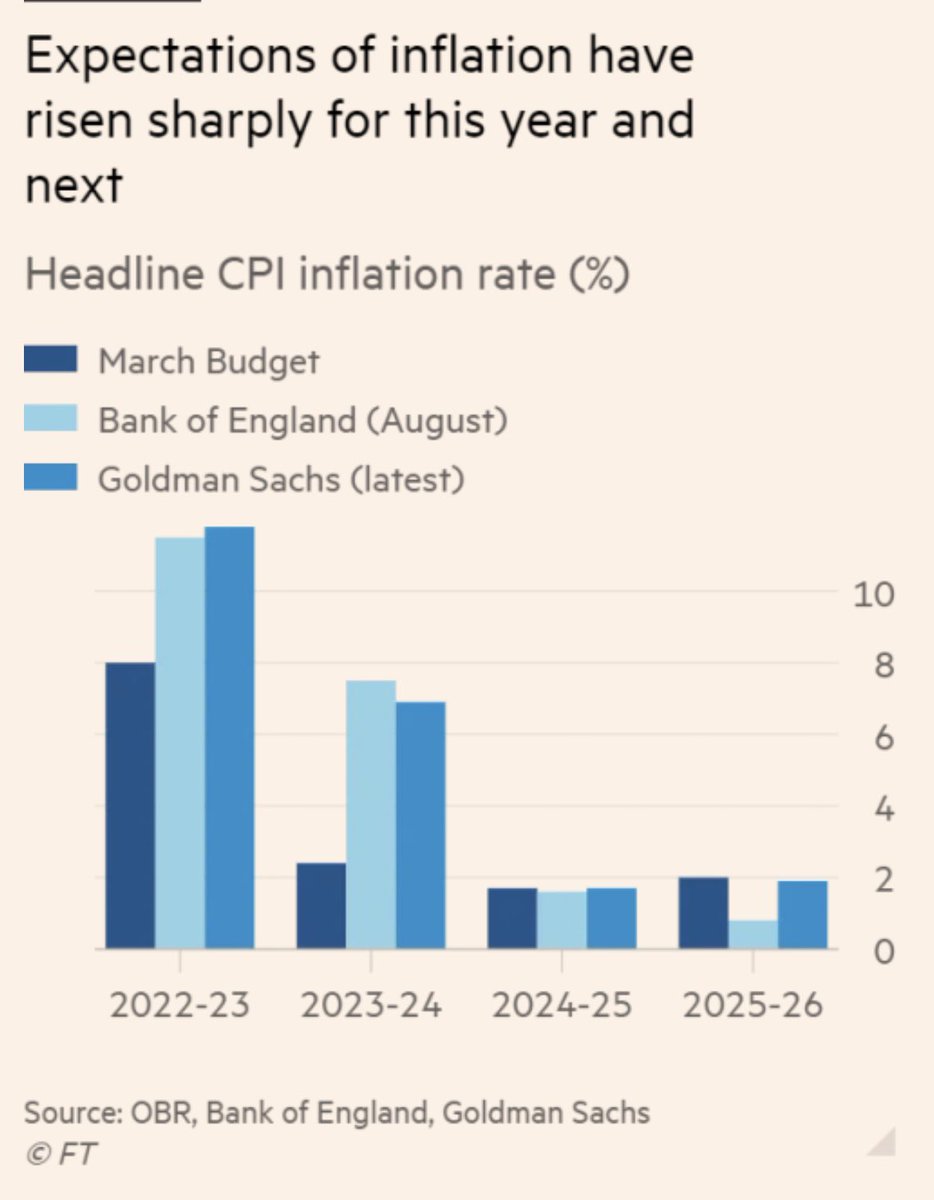

You can see this is real time because I've messed up the height of that chart

You can see this is real time because I've messed up the height of that chart

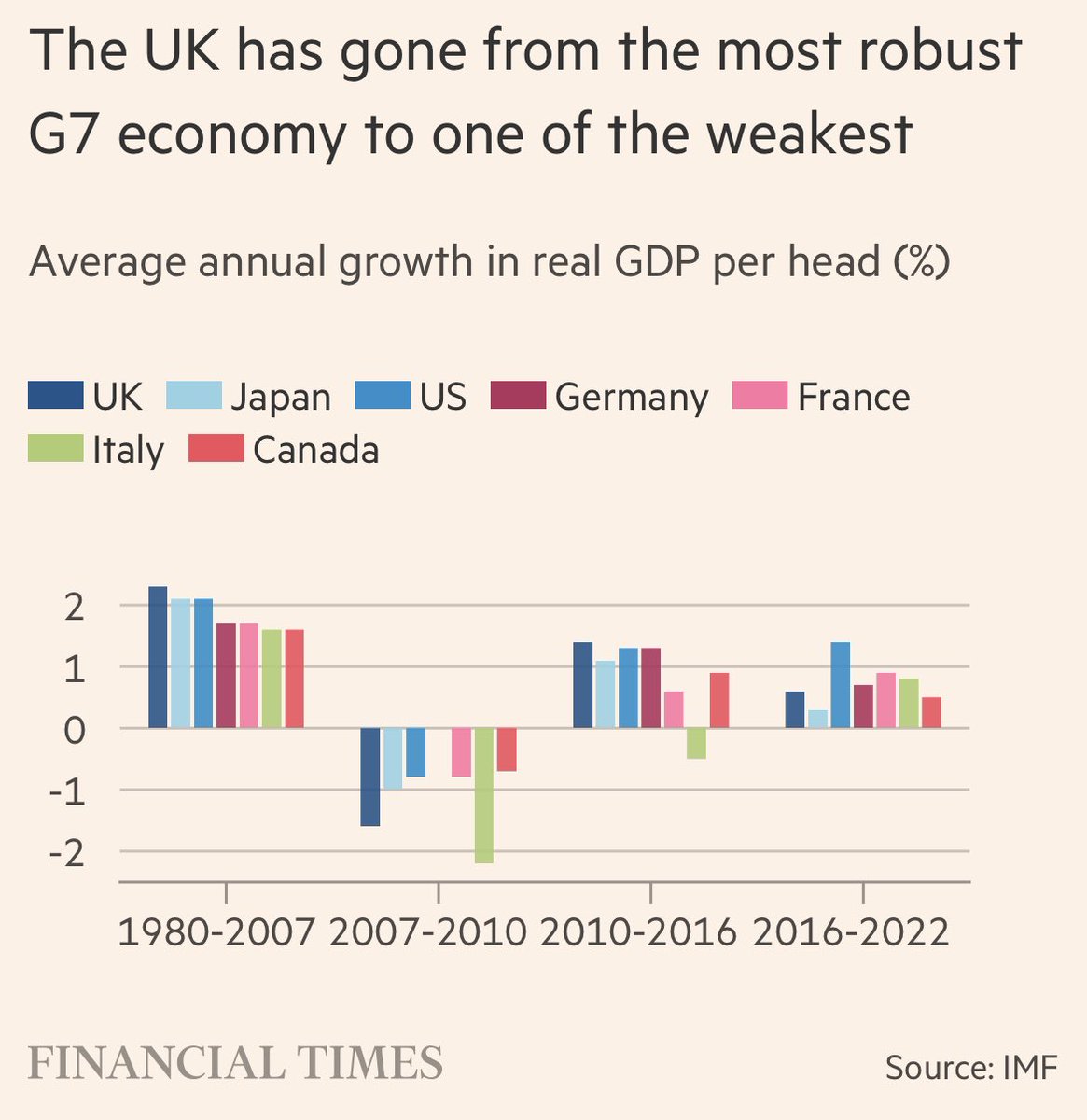

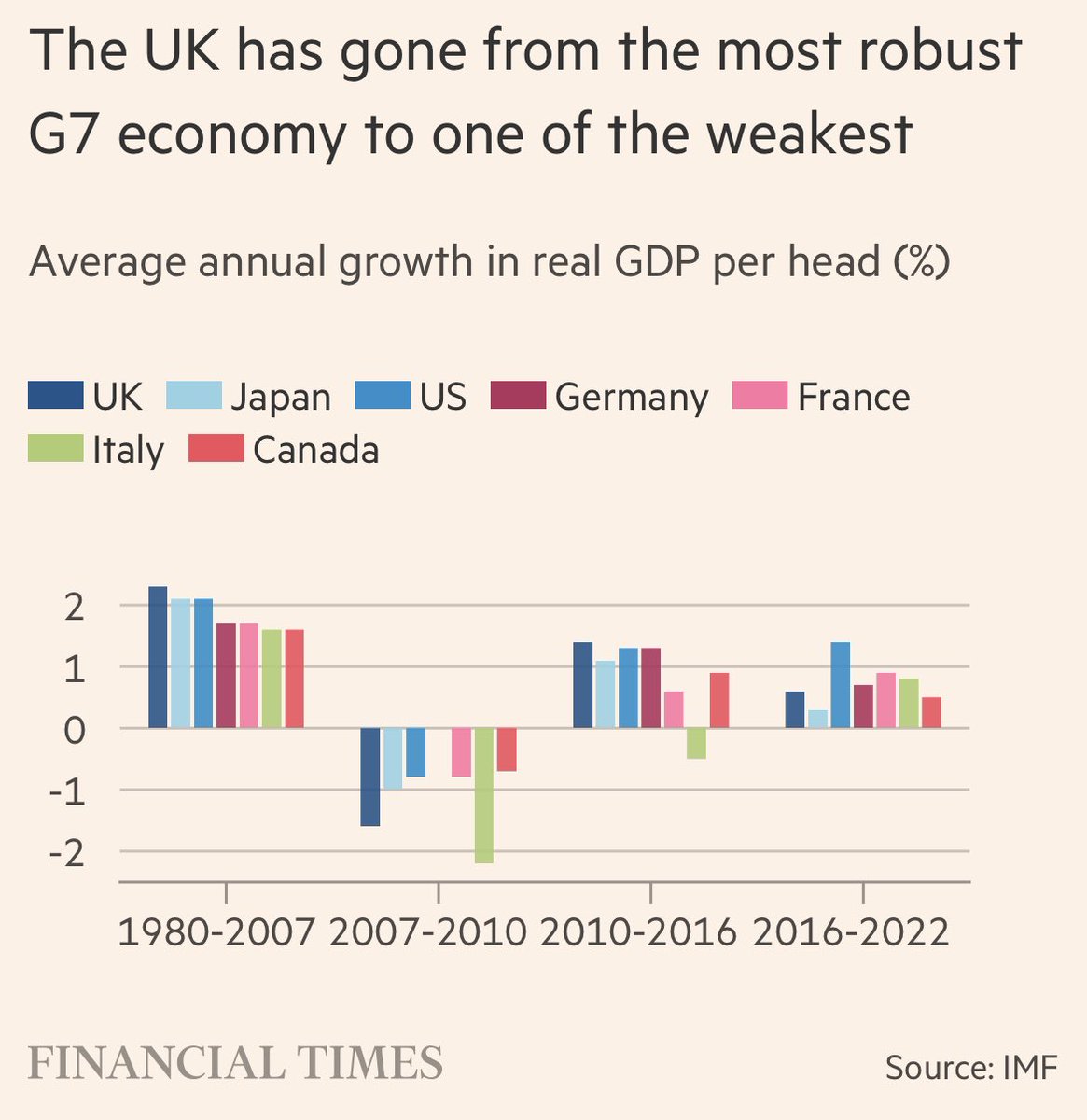

After the period of the financial crisis, which hit the UK very hard with its large financial sector…. There were 2 periods

After the period of the financial crisis, which hit the UK very hard with its large financial sector…. There were 2 periods

https://twitter.com/BootstrapCook/status/1483778776697909252@BootstrapCook I've spent the morning seeking the evidence from the official data for inflation being higher for the poorest - and in fact came up with the opposite