I am no longer on this website since I'm shadowbanned. Find me elsewhere

https://t.co/e8ikG2gzW0

email: crisesnotes@gmail(dot)com

Signal: NathanTankus.01

17 subscribers

How to get URL link on X (Twitter) App

Specifically Marko Elez, 25 year old former SpaceX employee, has read & write access for The Payment Automation Manager (PAM) & Secure Payment System (SPS) at the Bureau of the Fiscal Service (BFS). PAM processed 4.7 trillion dollars of payments in 2024.

Specifically Marko Elez, 25 year old former SpaceX employee, has read & write access for The Payment Automation Manager (PAM) & Secure Payment System (SPS) at the Bureau of the Fiscal Service (BFS). PAM processed 4.7 trillion dollars of payments in 2024.

In my last piece I went into detail about why we were facing an alarming “five alarm fire” constitutional crisis. That was Friday morning. Now it’s clear that we face something far, far worse. Musk’s DOGE has gotten access to the Treasury’s payment system architecture

In my last piece I went into detail about why we were facing an alarming “five alarm fire” constitutional crisis. That was Friday morning. Now it’s clear that we face something far, far worse. Musk’s DOGE has gotten access to the Treasury’s payment system architecture

https://twitter.com/tparsi/status/1827815016638107991It was publicly announced in June and the @nytimes buried the story On June 27: "the Times buried the Bund story at the end of a column of short news items from Europe." They then played down the reporting in early July 1942

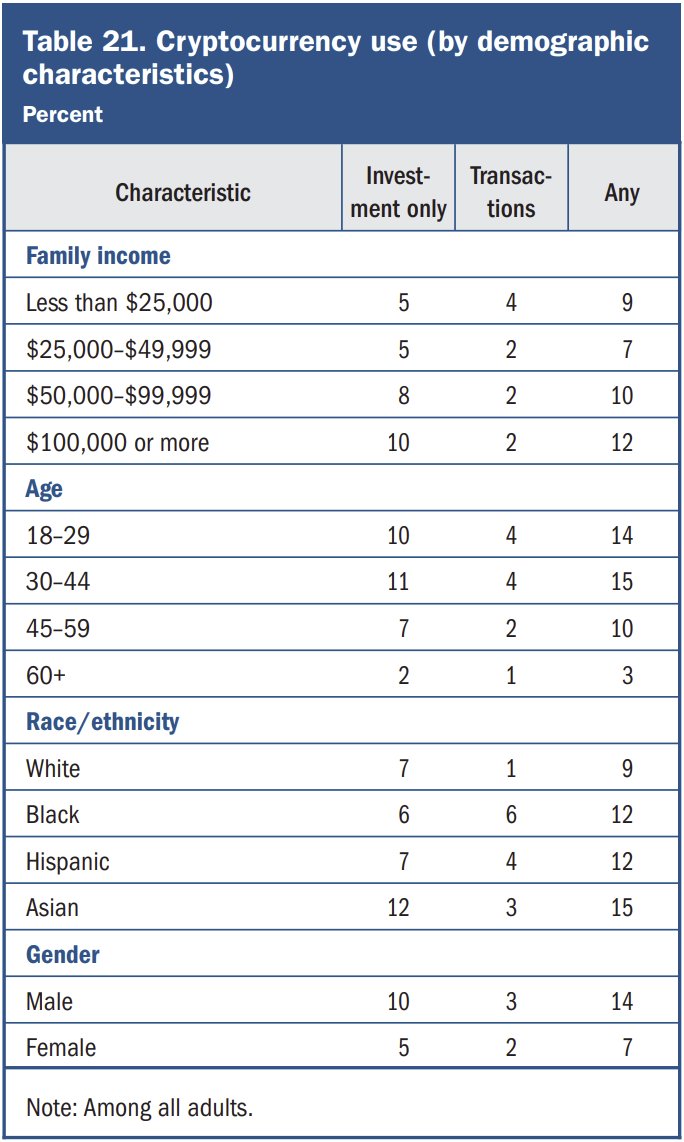

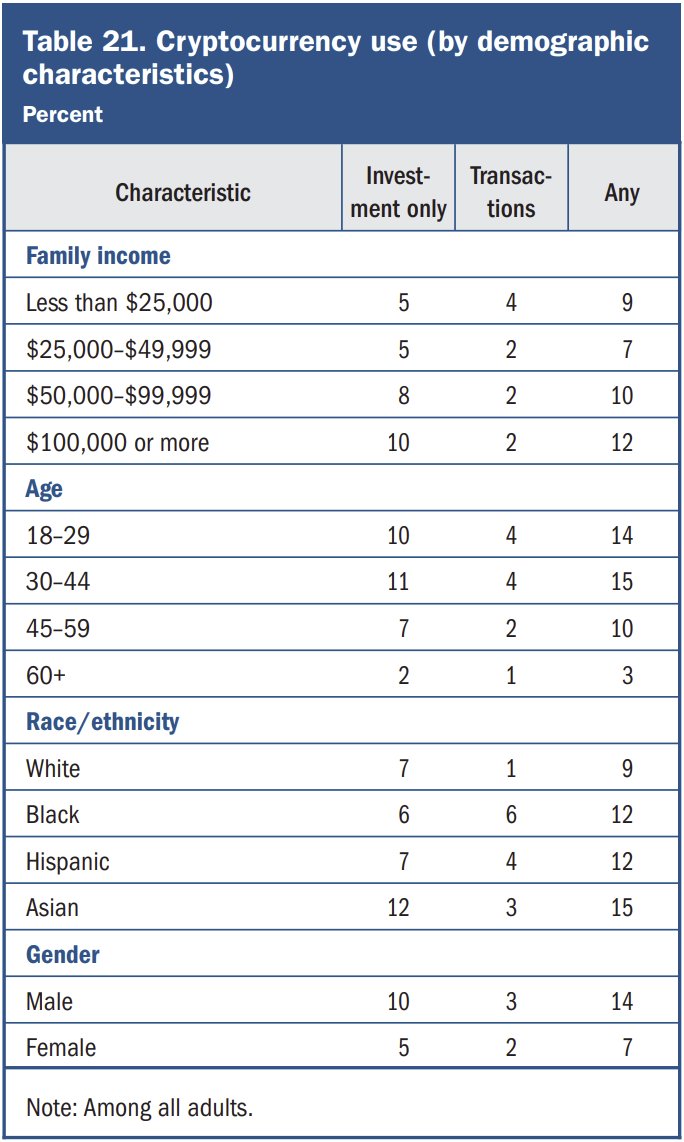

Based on their numbers (and using the "identify as x" only adult U.S. population numbers) the rough estimate of the percentage of cryptocurrency investors who are Black is 11.5%, below the percentage of U.S. adults who only identify as Black.

Based on their numbers (and using the "identify as x" only adult U.S. population numbers) the rough estimate of the percentage of cryptocurrency investors who are Black is 11.5%, below the percentage of U.S. adults who only identify as Black.

Actually got a quick reply before I finished reposting this from my typo. Pretty unsatisfying, but good to know we won't know anything for days. Established journalists should grill them on this stuff.

Actually got a quick reply before I finished reposting this from my typo. Pretty unsatisfying, but good to know we won't know anything for days. Established journalists should grill them on this stuff.

https://twitter.com/PeterContiBrown/status/1636069375651336193Let's take the historical component first. Here,where I think @PeterContiBrown is wrong is based in original historical research I began conducting a decade ago & have presented on,but got derailed from finishing and publishing (I'm hoping to devote at least part of my PHD to it)