We are onchain data explorers.

Spot trends, grow and build narratives with onchain data.

🧙 https://t.co/rI6QzKd307

📧 https://t.co/ShANeqt4P6

How to get URL link on X (Twitter) App

Let's break this down.

Let's break this down.

To better understand Tokenboud accounts (ERC-6551), let's use a simple backpack analogy.

To better understand Tokenboud accounts (ERC-6551), let's use a simple backpack analogy.

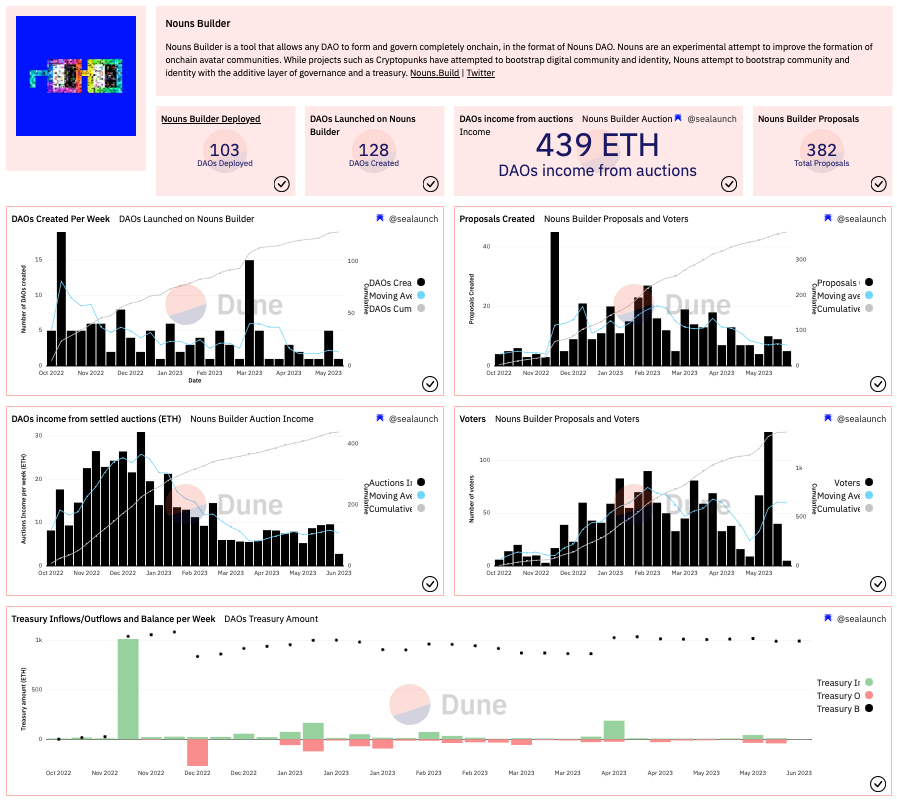

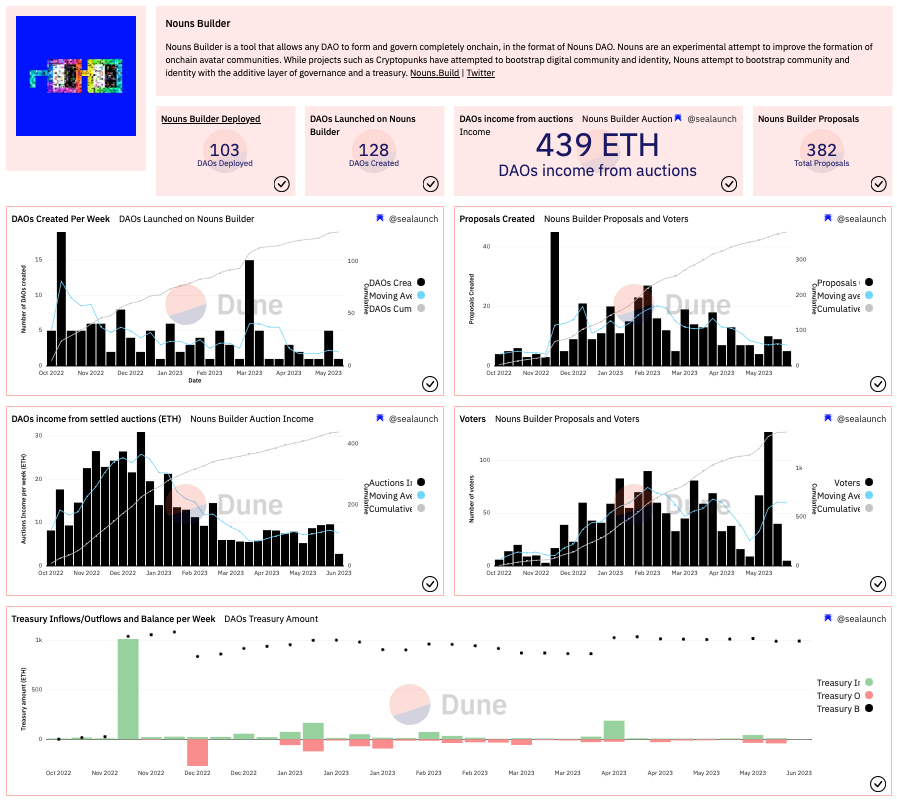

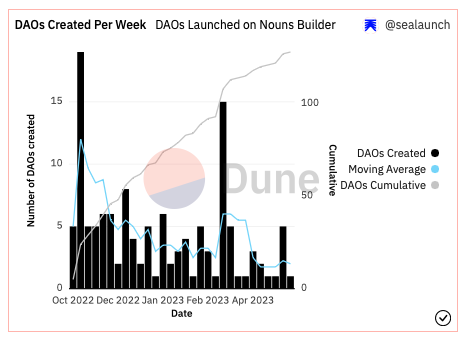

Every ween new DAOs are created and deployed using the protocol and so far, 103 DAOs fully deployed.

Every ween new DAOs are created and deployed using the protocol and so far, 103 DAOs fully deployed.

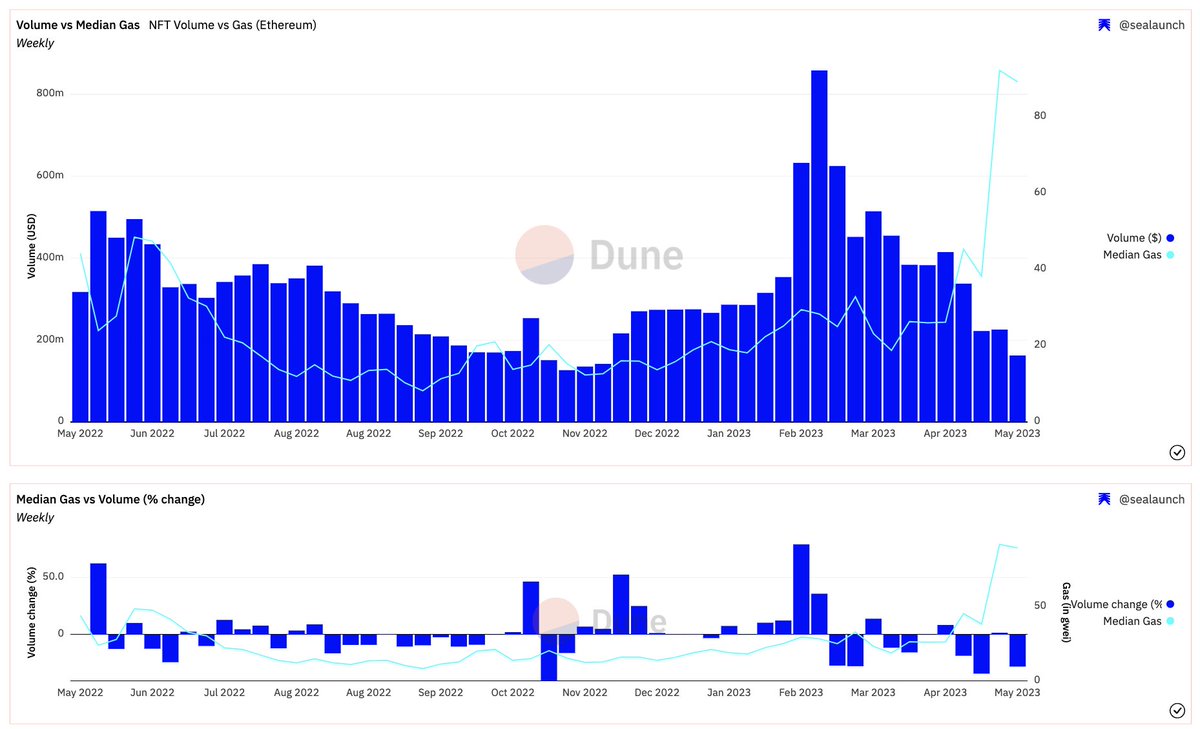

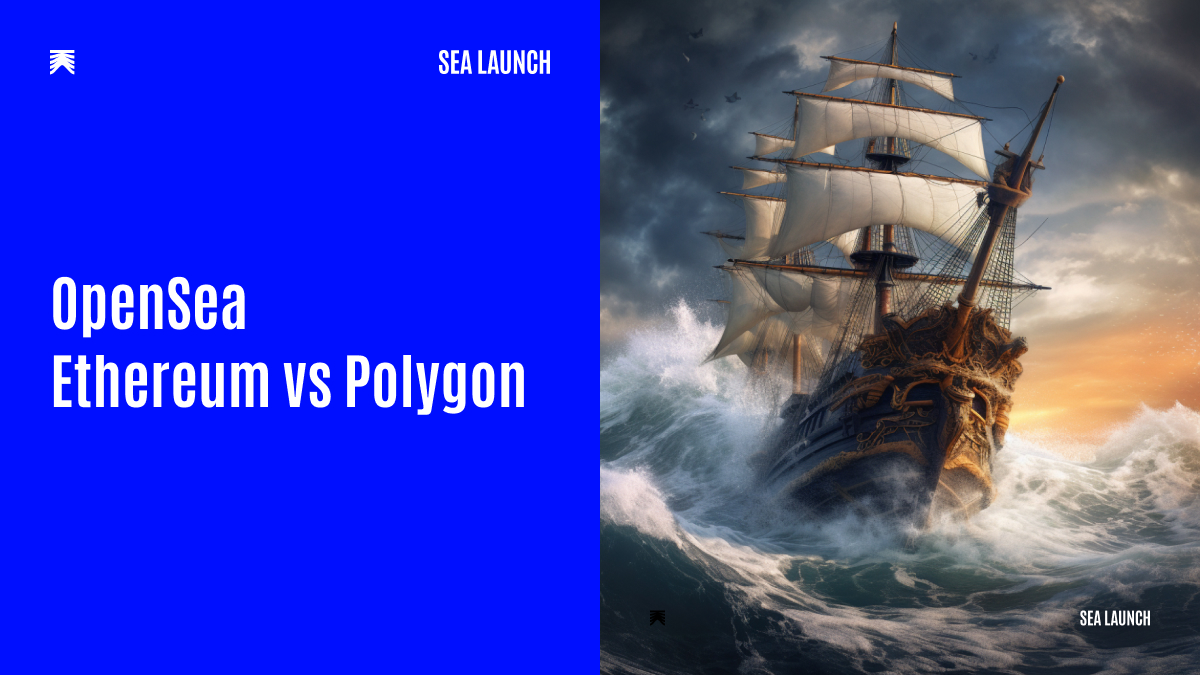

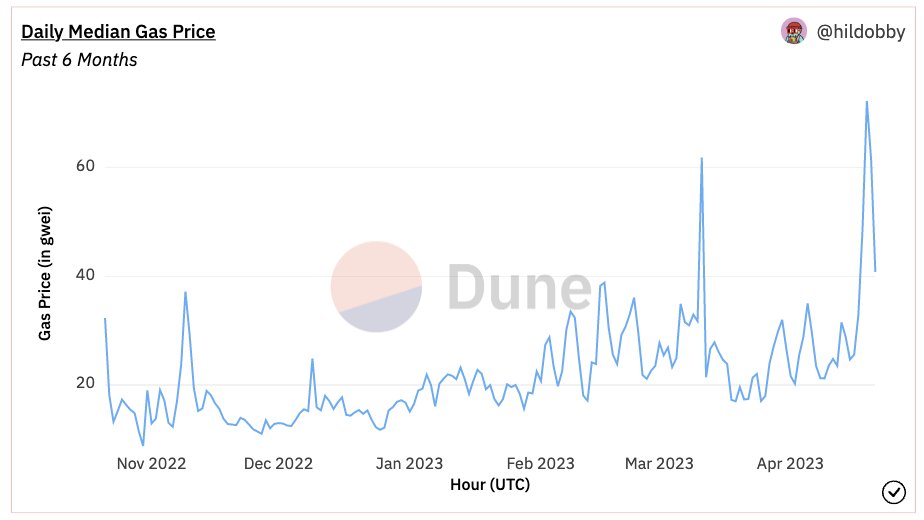

2/ The impact gas has on the volume is more obvious when gas passes a certain threshold.

2/ The impact gas has on the volume is more obvious when gas passes a certain threshold.

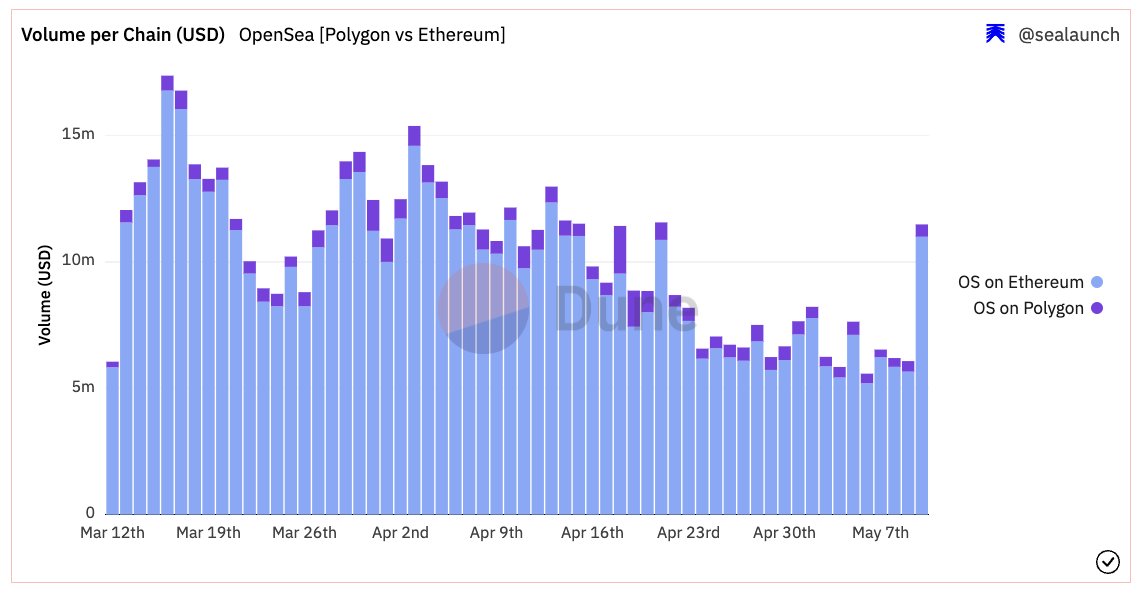

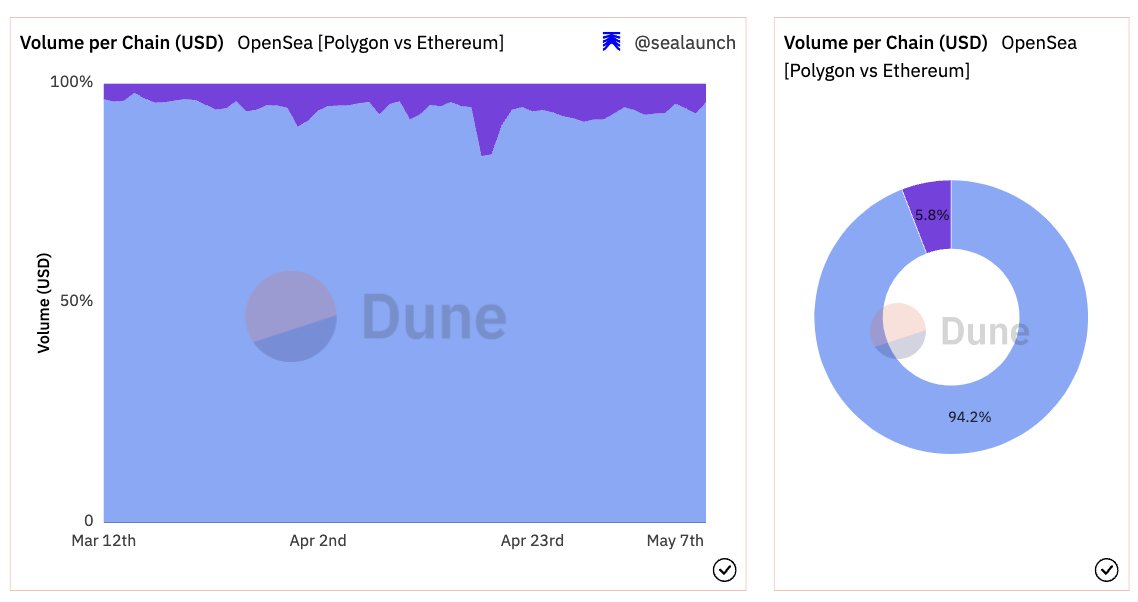

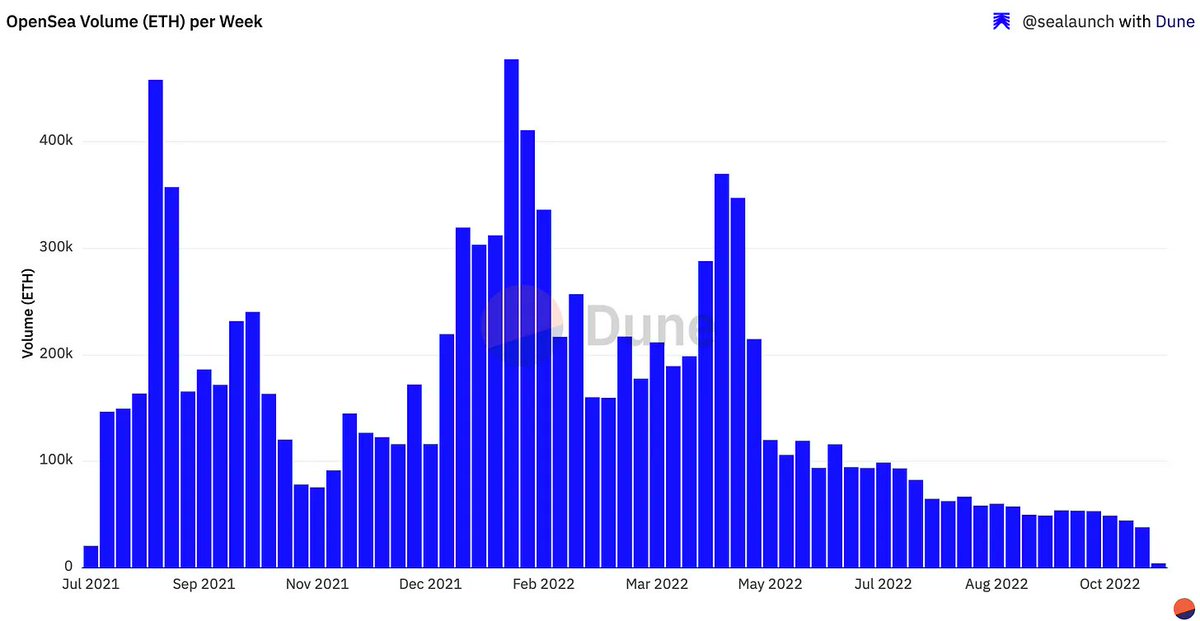

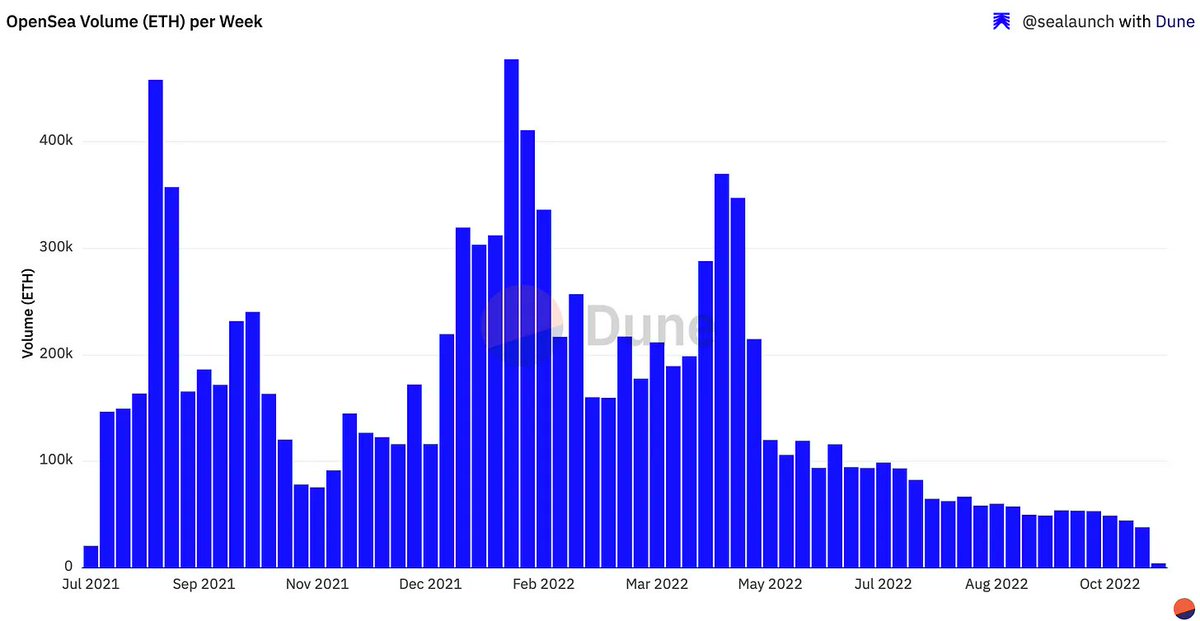

2/ It is not a surprise that most of the NFT volume is on Ethereum and the same happens on @opensea with 94% of the volume coming from this chain.

2/ It is not a surprise that most of the NFT volume is on Ethereum and the same happens on @opensea with 94% of the volume coming from this chain.

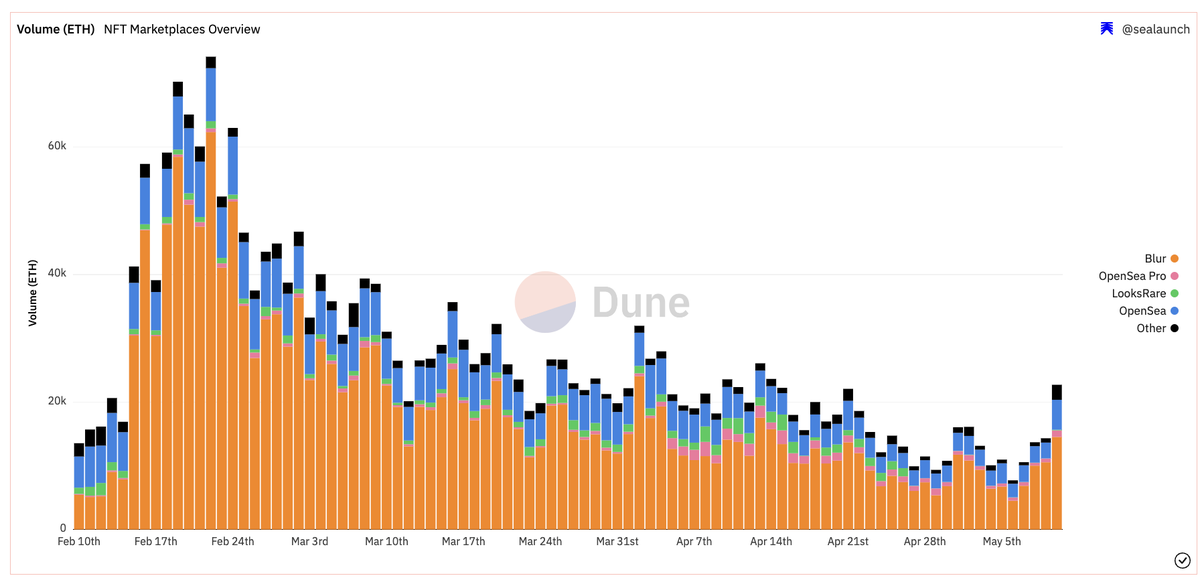

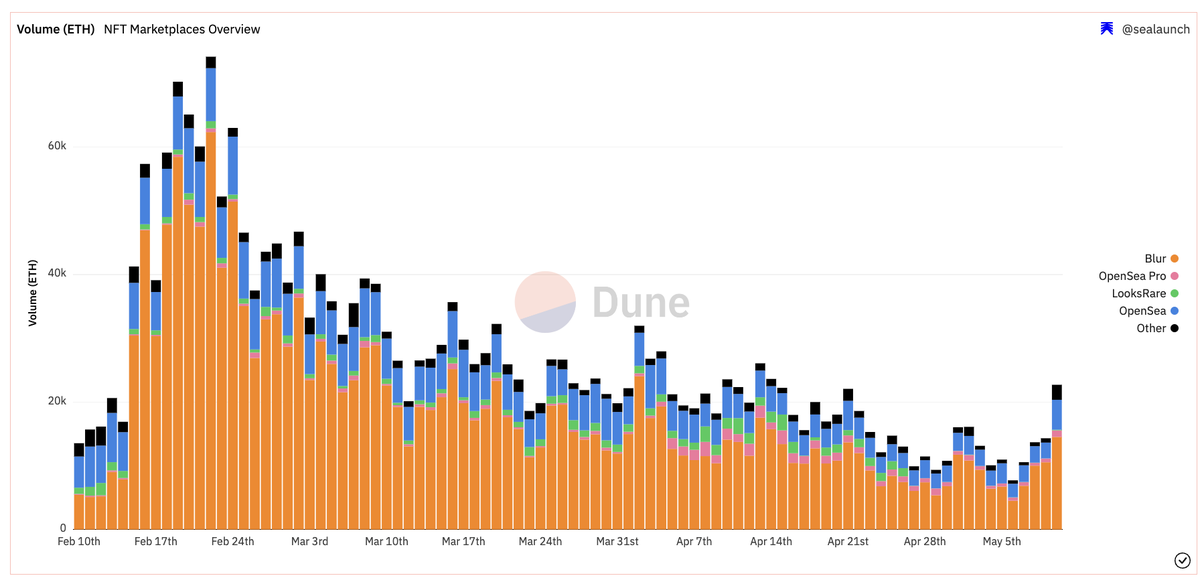

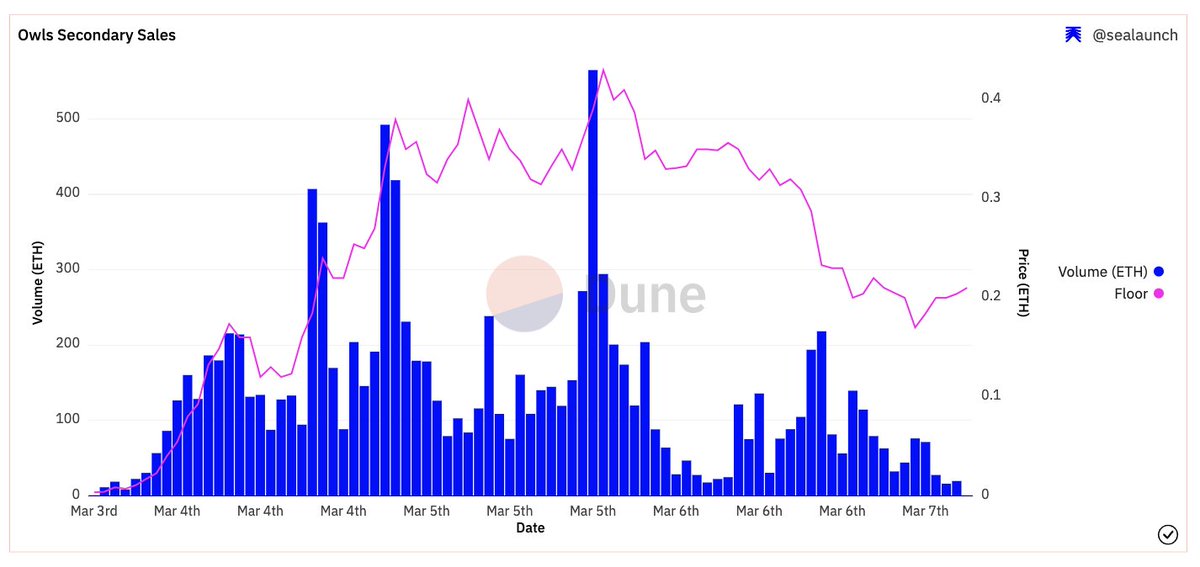

2/ This spike in volume is mostly due to the Milady frenzy initiated (or catalysed) by @elonmusk tweeting a meme with a Milady

2/ This spike in volume is mostly due to the Milady frenzy initiated (or catalysed) by @elonmusk tweeting a meme with a Milady https://twitter.com/elonmusk/status/1656326406618619910?s=20

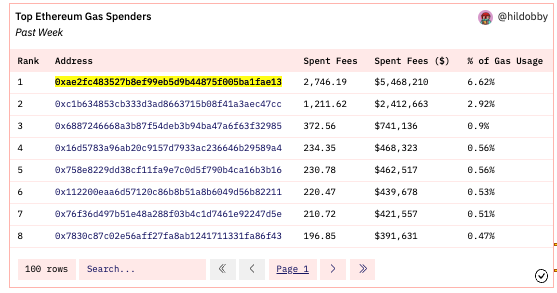

2/ jaredfromsubway is currently the highest spender of Ethereum gas for the past month, week, and day.

2/ jaredfromsubway is currently the highest spender of Ethereum gas for the past month, week, and day.

2/ How much is this MEV bot spending in gas fees?

2/ How much is this MEV bot spending in gas fees?

2/ Gas fees on Ethereum have been at a abnormally high value, taking into account the Median gas price in the last 6 months (and at the highest since the merge).

2/ Gas fees on Ethereum have been at a abnormally high value, taking into account the Median gas price in the last 6 months (and at the highest since the merge).

2/ Why Sandwich MEV Exists

2/ Why Sandwich MEV Exists

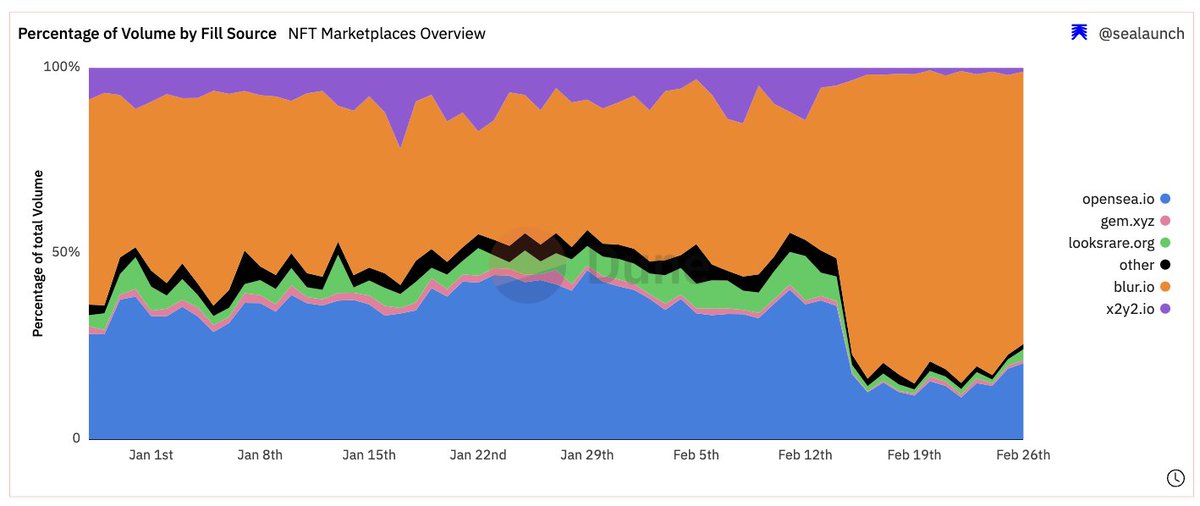

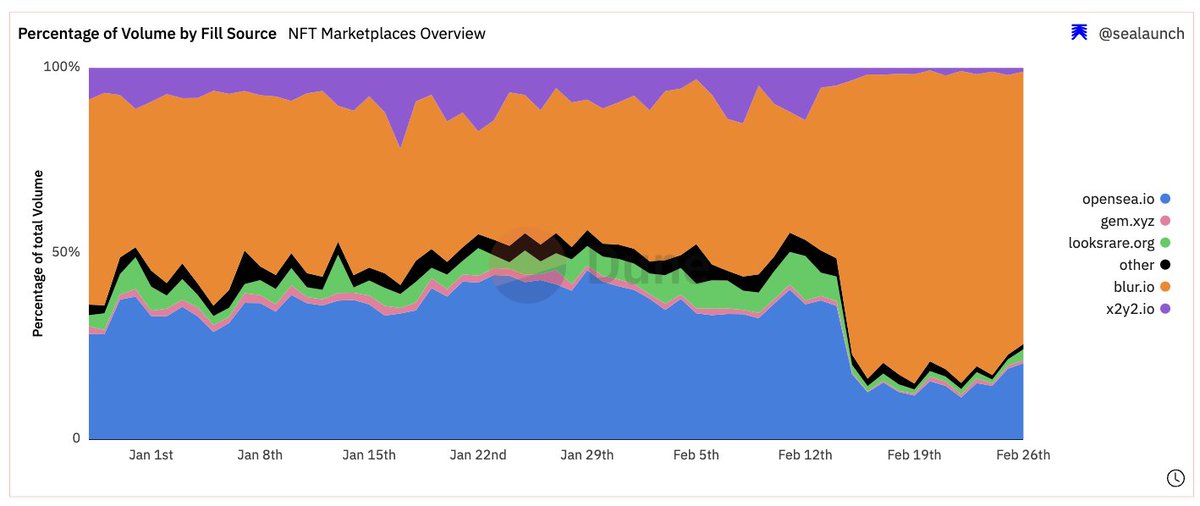

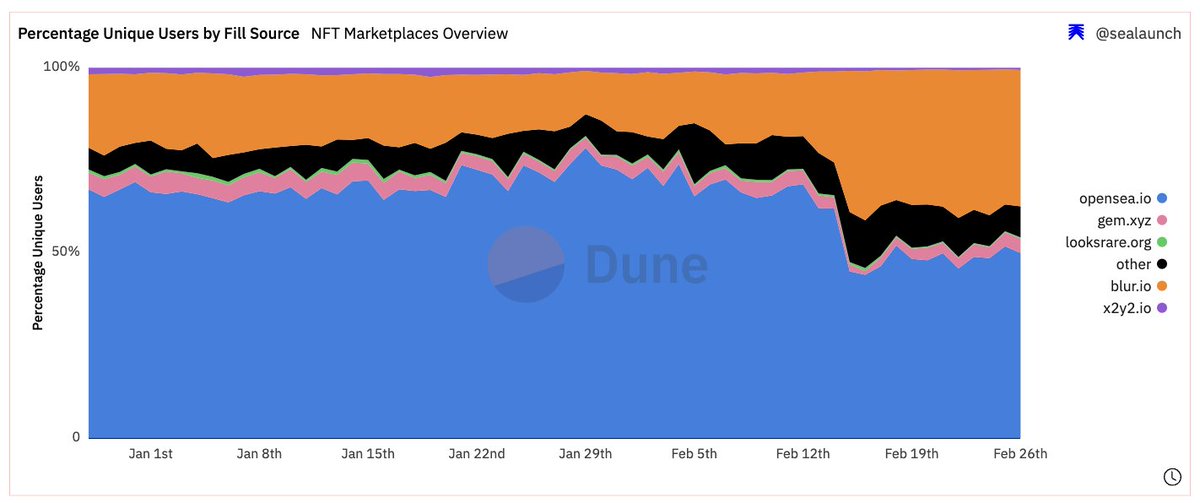

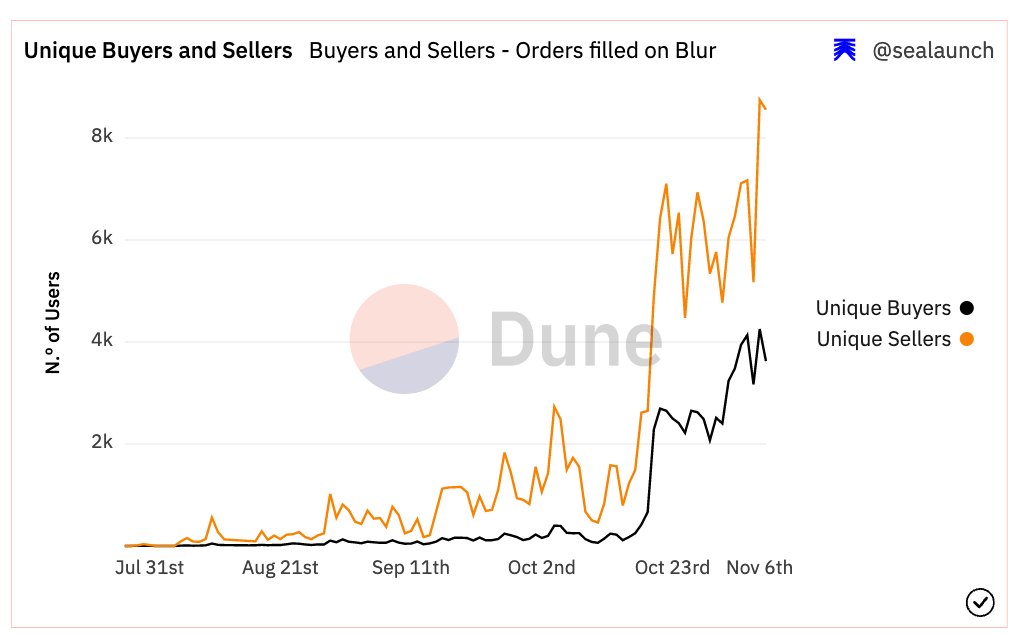

2/ Also the number of users market share on @opensea saw a slight increase

2/ Also the number of users market share on @opensea saw a slight increase

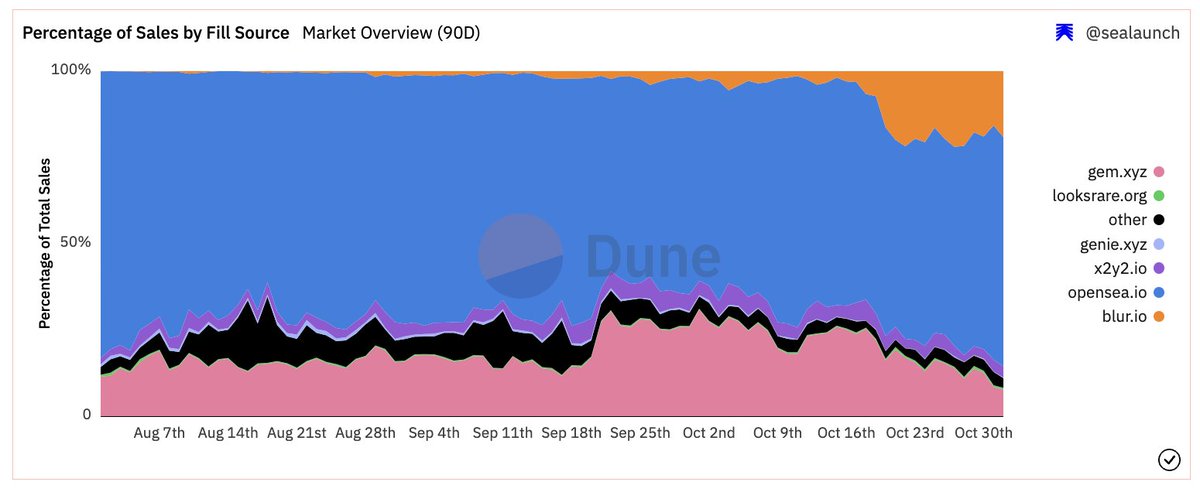

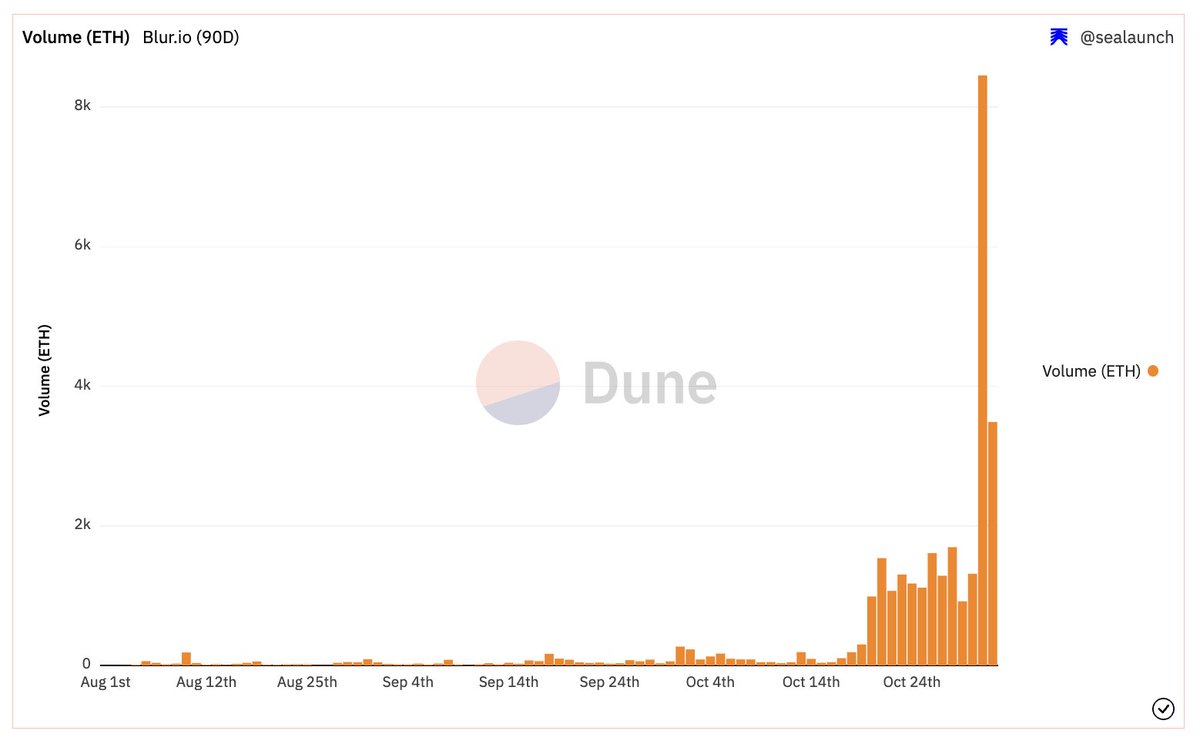

In terms of number of sales per fill source (the marketplace where the order was filled) it got ~16% market share

In terms of number of sales per fill source (the marketplace where the order was filled) it got ~16% market share