How to get URL link on X (Twitter) App

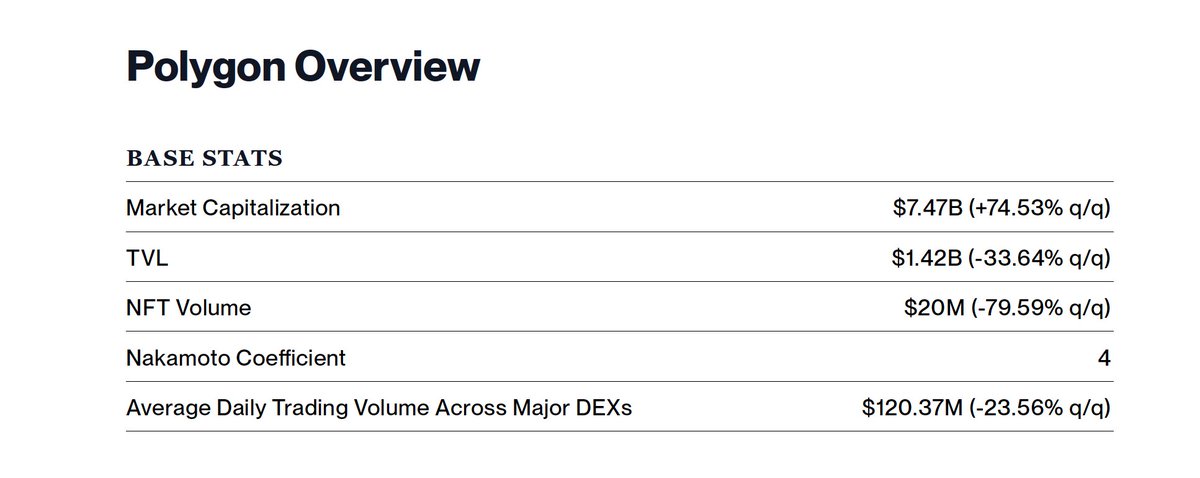

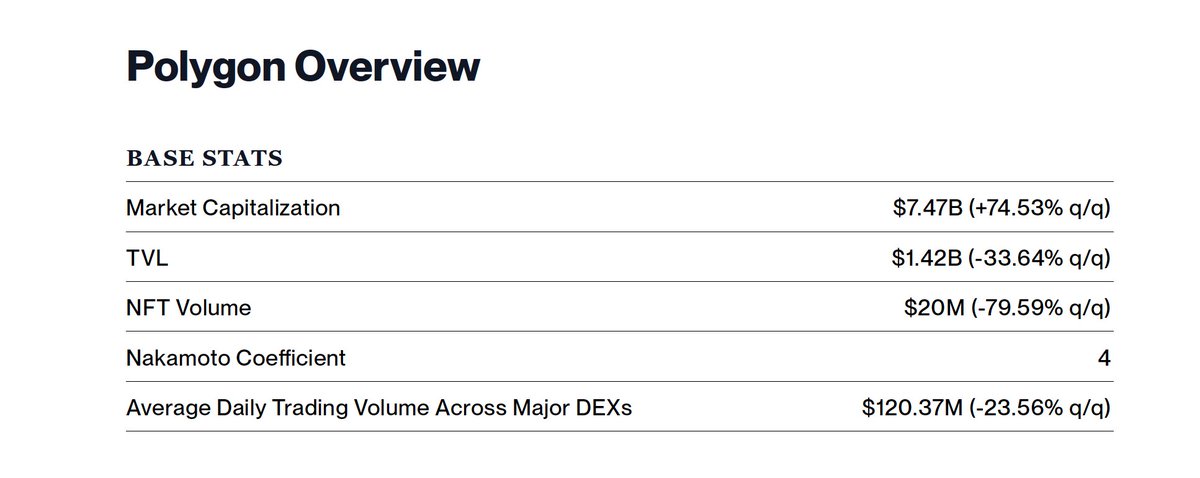

With the rollout of Polygon on-chain data, The Tie’s more than 150 institutional clients will now have access to data on one of the fastest growing ecosystems in digital assets, and be able to incorporate this data into their trading strategies.

With the rollout of Polygon on-chain data, The Tie’s more than 150 institutional clients will now have access to data on one of the fastest growing ecosystems in digital assets, and be able to incorporate this data into their trading strategies.

Serum has a full list of awarded grants visible on their site. Of the 21 grantees listed on the page, ~10 have a direct relationship to Alameda.

Serum has a full list of awarded grants visible on their site. Of the 21 grantees listed on the page, ~10 have a direct relationship to Alameda.

2/ DeFi-natives have upped pressure on operators to build ‘real yield’ into their project (i.e. turn inflationary tokens into real businesses).

2/ DeFi-natives have upped pressure on operators to build ‘real yield’ into their project (i.e. turn inflationary tokens into real businesses).

The new Governance Page reveals all proposals for a selected token, watchlist, or coins category.

The new Governance Page reveals all proposals for a selected token, watchlist, or coins category.

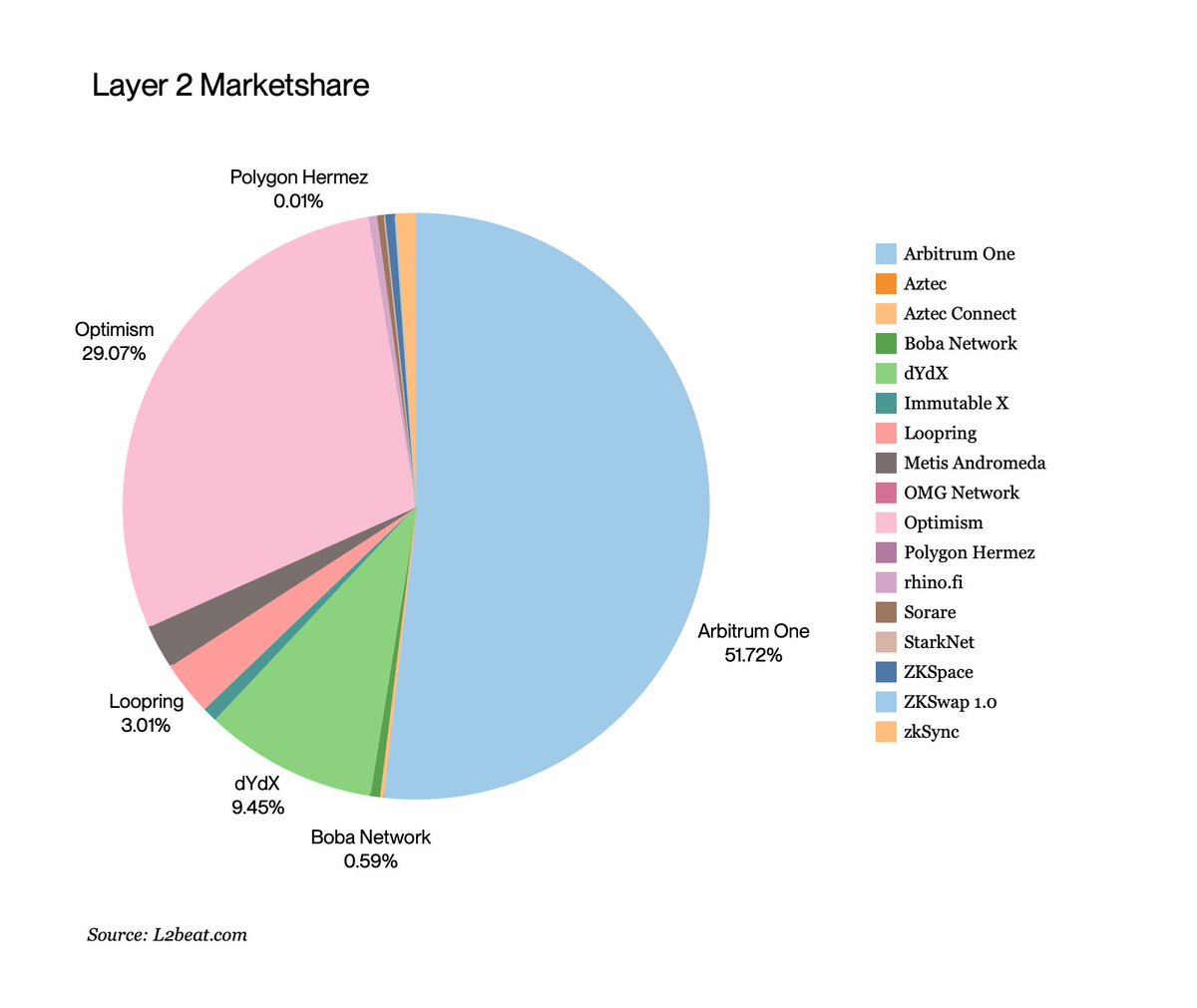

Optimistic Rollups offer a great solution to scaling Ethereum:

Optimistic Rollups offer a great solution to scaling Ethereum:

PoS inflation is the most basic source of yield, offering compensation for validation. While it’s not a ‘risk free rate’, blockchain inflation represents a baseline rate for that chain. PoS inflation is uncorrelated with TradFi, making it a haven regardless of macro conditions.

PoS inflation is the most basic source of yield, offering compensation for validation. While it’s not a ‘risk free rate’, blockchain inflation represents a baseline rate for that chain. PoS inflation is uncorrelated with TradFi, making it a haven regardless of macro conditions.

2/ Here is where brokers, hedge funds, and individual traders step in, creating the Forex market via their exchange activity. This process is re-complicated by the proliferation of different data storage systems in the form of national currencies.

2/ Here is where brokers, hedge funds, and individual traders step in, creating the Forex market via their exchange activity. This process is re-complicated by the proliferation of different data storage systems in the form of national currencies.

Our team has spent months curating Token Unlock data by hand: reviewing whitepapers, engaging directly with project founders and key stakeholders, and utilizing on-chain data to validate claims for accuracy.

Our team has spent months curating Token Unlock data by hand: reviewing whitepapers, engaging directly with project founders and key stakeholders, and utilizing on-chain data to validate claims for accuracy.

Successful campaigns have led to strong user growth and retention. Launch of Arbitrum Nitro enabled DEX volume to surge as a result of near zero gas fees, with this quarter seeing more than $2 billion in cumulative trading volume across three major DEXes (+21% q/q).

Successful campaigns have led to strong user growth and retention. Launch of Arbitrum Nitro enabled DEX volume to surge as a result of near zero gas fees, with this quarter seeing more than $2 billion in cumulative trading volume across three major DEXes (+21% q/q).

Since its launch, Solana has held its position as an L1 network offering one of the highest transaction throughputs (TPS), the shortest time to finality (TTF), and the most monthly-active contributors of any ecosystem. This has created a robust DeFi and NFT ecosystem.

Since its launch, Solana has held its position as an L1 network offering one of the highest transaction throughputs (TPS), the shortest time to finality (TTF), and the most monthly-active contributors of any ecosystem. This has created a robust DeFi and NFT ecosystem.

Liquid staking platforms offer investors the ability to easily stake, unstake, and trade staked Ether. While the merge officially transitioned Ethereum to PoS, the ability for validators to officially unstake ETH will likely not go live until early 2024, based on projections.

Liquid staking platforms offer investors the ability to easily stake, unstake, and trade staked Ether. While the merge officially transitioned Ethereum to PoS, the ability for validators to officially unstake ETH will likely not go live until early 2024, based on projections.

This blockchain technology includes:

This blockchain technology includes:

Effectively transitioning applications and their existing user base onto subnets to help them scale is key for AVAX. The transition to subnets has caused a decline in C-Chain transactions, with a rise in cumulative transactions across all Avalanche chains.

Effectively transitioning applications and their existing user base onto subnets to help them scale is key for AVAX. The transition to subnets has caused a decline in C-Chain transactions, with a rise in cumulative transactions across all Avalanche chains.