How to get URL link on X (Twitter) App

Until recently, crypto operated in a regulatory grey zone. No one knew whether a token was a security, a commodity, or something entirely different.

Until recently, crypto operated in a regulatory grey zone. No one knew whether a token was a security, a commodity, or something entirely different.

1 ) Distribution: How Top RWA Issuers Are Differentiating Themselves From the Rest 🔝

1 ) Distribution: How Top RWA Issuers Are Differentiating Themselves From the Rest 🔝

Most public attention is on the speculative nature of crypto tokens.

Most public attention is on the speculative nature of crypto tokens.

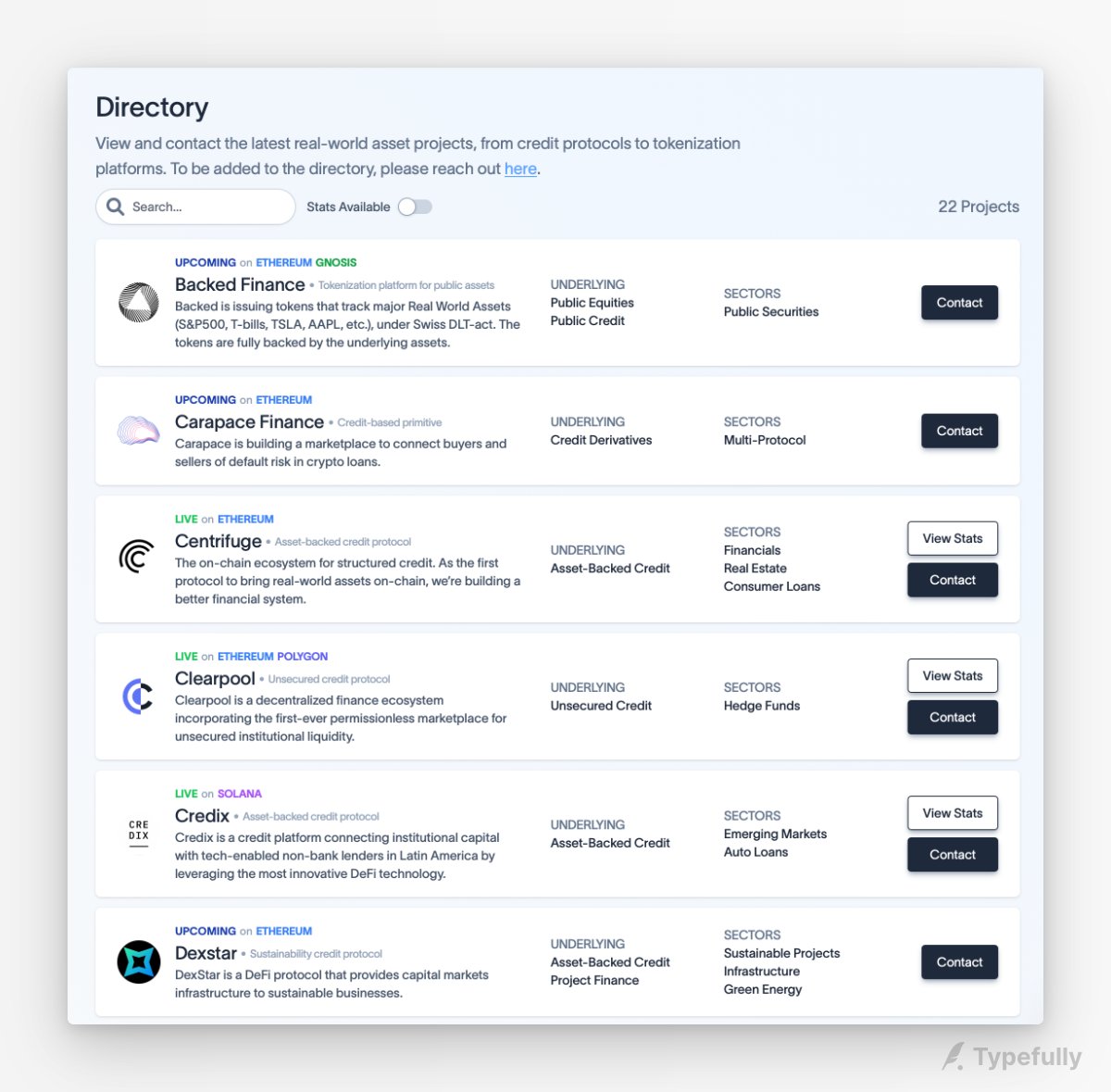

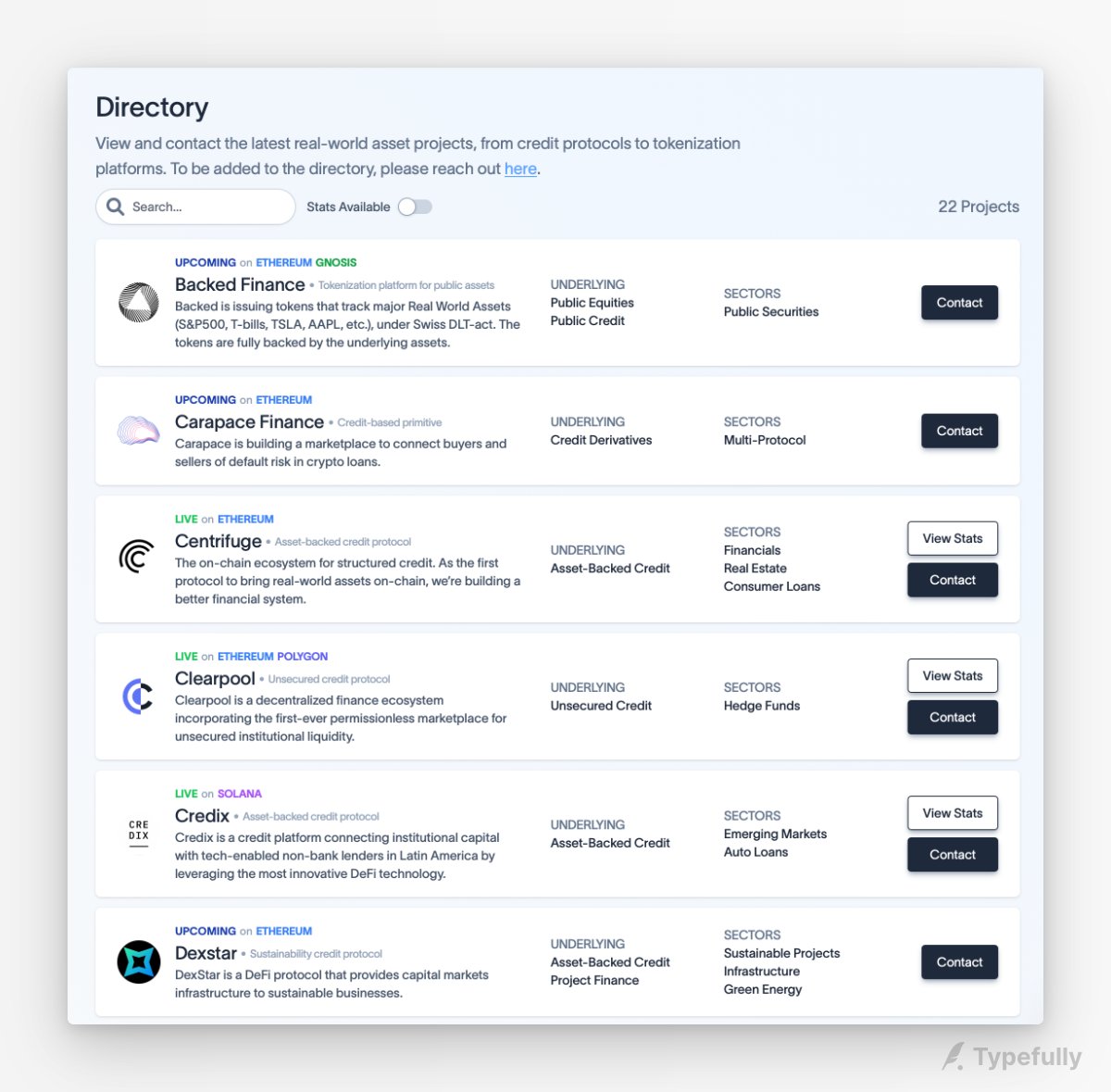

2/ Check it out here 👉 app.rwa.xyz/directory

2/ Check it out here 👉 app.rwa.xyz/directory

2/ With token rewards and ponzinomic yields drying up, investors need new, truly sustainable sources of on-chain returns.

2/ With token rewards and ponzinomic yields drying up, investors need new, truly sustainable sources of on-chain returns.

2/ @ClearpoolFin took the brunt of the credit crunch, with over 90% of loan value having been called back

2/ @ClearpoolFin took the brunt of the credit crunch, with over 90% of loan value having been called back