Whale watching time 🐳

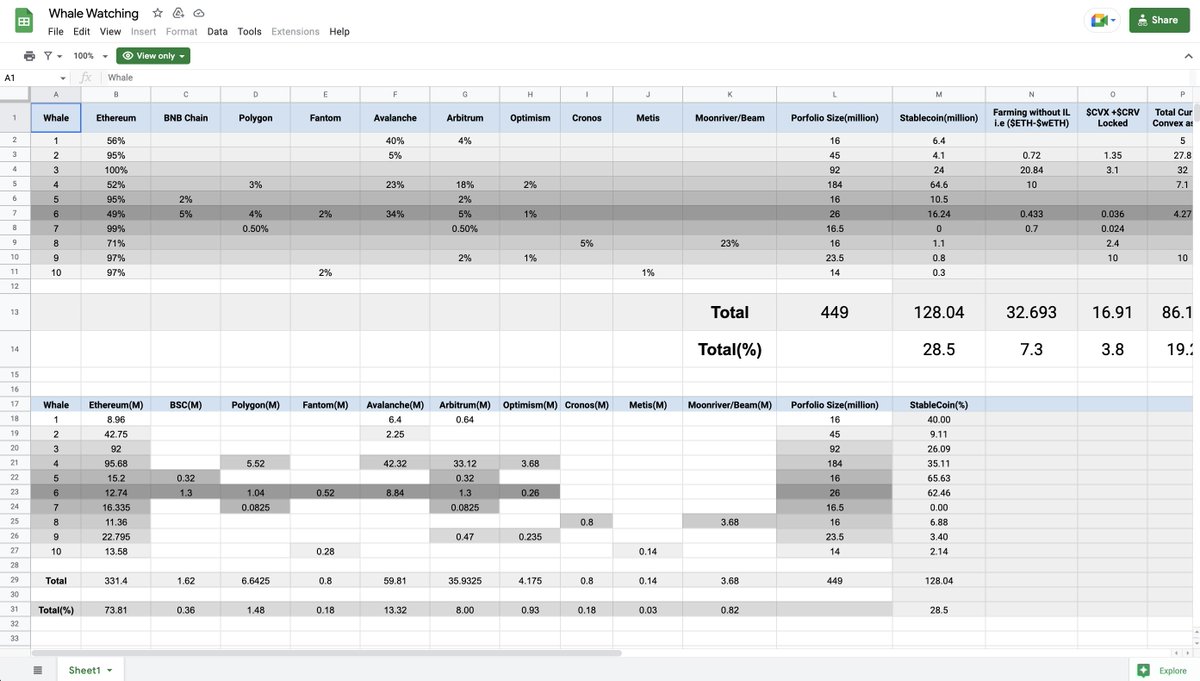

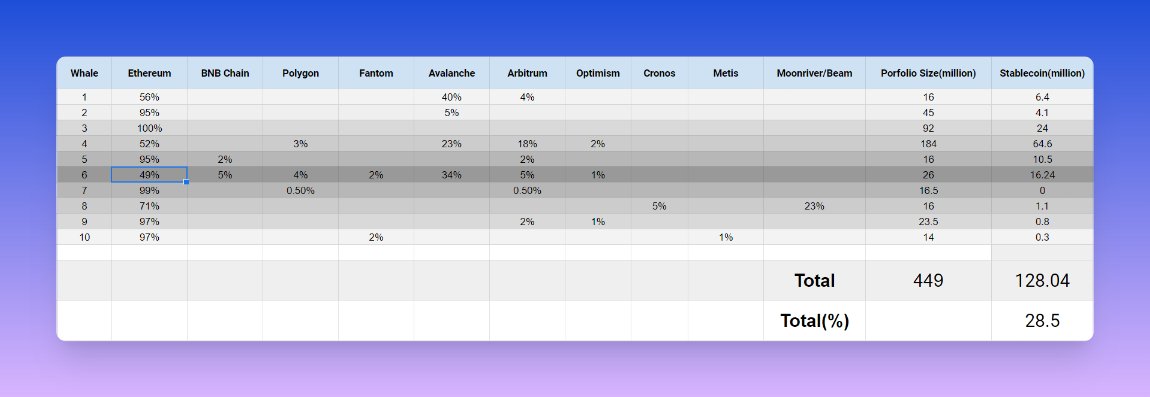

We analyzed 10 whale wallets, each with more than $10M.

Their combined portfolio size is ~$450M.

Here are the key insights we found + a spreadsheet that you can dive into...

👇 🧵

We analyzed 10 whale wallets, each with more than $10M.

Their combined portfolio size is ~$450M.

Here are the key insights we found + a spreadsheet that you can dive into...

👇 🧵

Key Takeaways:

• Most of these whales are farming stables

• Degen plays are less than 5% of portfolio

• @CurveFinance and @ConvexFinance constituted a significant % of the portfolios.

• Apex assets like $ETH & $wBTC made up a majority of their portfolio

• Most of these whales are farming stables

• Degen plays are less than 5% of portfolio

• @CurveFinance and @ConvexFinance constituted a significant % of the portfolios.

• Apex assets like $ETH & $wBTC made up a majority of their portfolio

• 2/10 whales were staking $GMX

• 0/10 whales own $OP.

• $FTM was also a very small portion (~0.18%) of total assets held by these wallets

• Most assets are being used to earn low-risk yields through staking or no-IL pools

• Virtually no shitcoin holdings

• 0/10 whales own $OP.

• $FTM was also a very small portion (~0.18%) of total assets held by these wallets

• Most assets are being used to earn low-risk yields through staking or no-IL pools

• Virtually no shitcoin holdings

1. Asset Allocation by Chain

---

Ethereum is a clear winner here (no surprises), with Avalanche and Arbitrum following.

• Ethereum: 74%

• Avalanche: 13%

• Arbitrum: 8%

• Polygon: 1.48%

• Optimism: 0.93%

• BNB Chain: 0.36%

• MoonBeam: 0.82%

• Cronos: 0.18%

---

Ethereum is a clear winner here (no surprises), with Avalanche and Arbitrum following.

• Ethereum: 74%

• Avalanche: 13%

• Arbitrum: 8%

• Polygon: 1.48%

• Optimism: 0.93%

• BNB Chain: 0.36%

• MoonBeam: 0.82%

• Cronos: 0.18%

• 10 out of 10 have assets on Ethereum

• 6 out of 10 have assets on Arbitrum

• 4 out of 10 have assets on Avalanche

• 2 out of 10 have assets on BNB

• 3 out of 10 have assets on Polygon

• 3 out of 10 have assets on Optimism

• 6 out of 10 have assets on Arbitrum

• 4 out of 10 have assets on Avalanche

• 2 out of 10 have assets on BNB

• 3 out of 10 have assets on Polygon

• 3 out of 10 have assets on Optimism

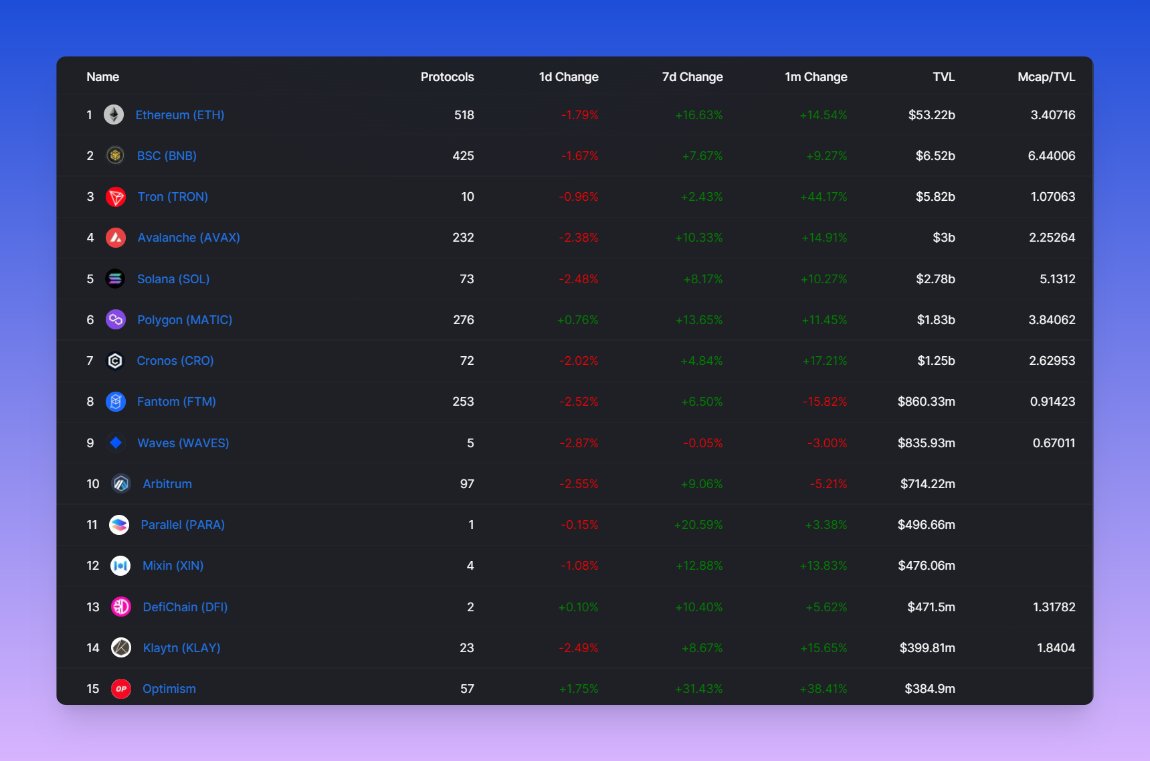

As expected, Ethereum is the most dominant chain.

Interestingly, only 0.36% of assets are on Binance Smart Chain, which is surprising given that BSC TVL is second to Ethereum.

TRON is also not represented here, even though Tron has the third highest TVL after Ethereum.

Interestingly, only 0.36% of assets are on Binance Smart Chain, which is surprising given that BSC TVL is second to Ethereum.

TRON is also not represented here, even though Tron has the third highest TVL after Ethereum.

2. Stablecoin Holdings

---

This data includes:

• Stablecoins in the wallets

• Staked Stablecoins

• Farming only in Stablecoin pairs like Curve 4 Pool

These are the holdings that they can redeem anytime they want.

---

This data includes:

• Stablecoins in the wallets

• Staked Stablecoins

• Farming only in Stablecoin pairs like Curve 4 Pool

These are the holdings that they can redeem anytime they want.

~28% of their total holdings are composed of stablecoins (not surprising since it's a bear market)

More than 50% of these are used in earning yields.

Interesting Anomaly:

1 out of 10 wallets has ~0% in stables - (permabull?)

More than 50% of these are used in earning yields.

Interesting Anomaly:

1 out of 10 wallets has ~0% in stables - (permabull?)

2. Farming without Impermanent Loss

---

If you are farming for some time you already know how severe IL can be.

Currently, half of @uniswap LPs are losing money due to IL.

nasdaq.com/articles/half-…

---

If you are farming for some time you already know how severe IL can be.

Currently, half of @uniswap LPs are losing money due to IL.

nasdaq.com/articles/half-…

Farming assets with derivatives is a great way to mitigate IL.

~20.7% of the $449 million portfolio is being farmed so.

Example: $stETH - $ETH, $CRV - $cvxCRV etc.

5 out of the 10 whale wallets are indeed farming assets against their derivatives to mitigate IL.

~20.7% of the $449 million portfolio is being farmed so.

Example: $stETH - $ETH, $CRV - $cvxCRV etc.

5 out of the 10 whale wallets are indeed farming assets against their derivatives to mitigate IL.

3. @CurveFinance and @ConvexFinance

---

These two protocols are the most preferred among these whales for earning yields.

This is because they offer better / safer yields than others.

---

These two protocols are the most preferred among these whales for earning yields.

This is because they offer better / safer yields than others.

7 out of the 10 wallets used Curve and Convex in one way or another.

A total of 19.2% of $449 million is used in these two protocols:

• 3.8% in staking $CRV & $CVX and their derivatives

• 4.4% in providing liquidity in Stablecoin pools

• 11% in other forms

A total of 19.2% of $449 million is used in these two protocols:

• 3.8% in staking $CRV & $CVX and their derivatives

• 4.4% in providing liquidity in Stablecoin pools

• 11% in other forms

4. @GMX_IO

---

GMX is a Decentralized Perpetual Exchange on Arbitrum and Avalanche

You can earn sustainable yield from fees by staking their $GMX and $GLP tokens.

---

GMX is a Decentralized Perpetual Exchange on Arbitrum and Avalanche

You can earn sustainable yield from fees by staking their $GMX and $GLP tokens.

2 out of 10 wallets have invested in GMX and are staking to earn yield.

One of these wallets belongs to @0xSifu, who has invested more than 40% of his wallet portfolio in GMX - high conviction?

One of these wallets belongs to @0xSifu, who has invested more than 40% of his wallet portfolio in GMX - high conviction?

5. Token Holdings

---

Most of the wallets are holding common tokens like $ETH $AVAX $CRV $wBTC $SNX $FXS $APE

---

Most of the wallets are holding common tokens like $ETH $AVAX $CRV $wBTC $SNX $FXS $APE

Only 2 wallets are holding $FTM and the total amount is less than 1.5% of the total holdings.

One surprising observation was that not a single wallet was holding $OP

If you found this thread helpful, follow us @0x_illuminati for daily alpha.

Consider liking / retweeting the first tweet below to share these whale portfolio observations with your community.

Consider liking / retweeting the first tweet below to share these whale portfolio observations with your community.

https://twitter.com/0x_illuminati/status/1550726403582095365

You can view the spreadsheet here

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

Enjoyed this thread?

We're curating the best crypto content and resources from around the internet.

Follow @0x_illuminati, and subscribe to our free newsletter for alpha.

We're curating the best crypto content and resources from around the internet.

Follow @0x_illuminati, and subscribe to our free newsletter for alpha.

• • •

Missing some Tweet in this thread? You can try to

force a refresh