CB Ventures has been digging into the #Bitcoin Lightning network lately.

TLDR: exhibiting promising growth, with the potential to disrupt $150B a year payment + remittance industries.

Threadooor 🧵

TLDR: exhibiting promising growth, with the potential to disrupt $150B a year payment + remittance industries.

Threadooor 🧵

Lightning 101: Bitcoin's L2 payment network that lets users deposit BTC and transact near-instant and for pennies via payment channels.

It's been live since 2018, works, and can theoretically scale to millions of transactions per second.

It's been live since 2018, works, and can theoretically scale to millions of transactions per second.

Obviously at <1 cent fees, Lightning transactions are much more suitable for everyday BTC payments.

More intriguing, is Lightning's potential to replace existing payment processors for fiat transactions without the consumer ever knowing that BTC is involved. Will explain.

More intriguing, is Lightning's potential to replace existing payment processors for fiat transactions without the consumer ever knowing that BTC is involved. Will explain.

Visa/Mastercard raked in $24B in 2021 by collecting 2-3% every time someone swipes a credit/debit card.

Global remittance companies take an even fatter 6.4% for sending money across borders (on average).

Lightning can undercut them all. Here's how.

Global remittance companies take an even fatter 6.4% for sending money across borders (on average).

Lightning can undercut them all. Here's how.

Say you want to send $100 USD to a merchant.

Convert $100 to BTC on Lightning, send for essentially free, convert it back to $100 USD to pay the merchant.

If the conversion fees are sub 2-3%, it makes economic sense to do it on Lightning.

Convert $100 to BTC on Lightning, send for essentially free, convert it back to $100 USD to pay the merchant.

If the conversion fees are sub 2-3%, it makes economic sense to do it on Lightning.

This isn't just theoretical. A service called @OpenNode is able to do just that for a 1% fee.

While it may make economic sense, disrupting the payments giants is easier said than done. They enjoy massive network effects, and Lightning faces a bit of a cold start problem.

It is, however, growing.

It is, however, growing.

@ArcaneResearch estimated that in Q1 22, Lightning facilitated $20-30M in monthly payments.

A 4x YoY increase, but a far cry from the $866B that Visa facilitates each month.

A 4x YoY increase, but a far cry from the $866B that Visa facilitates each month.

While still small, Lightning is moving in the right direction, with the total amount of bitcoins in the network at all-time highs.

At present, there are 4,500 BTC locked in the network (about $100M USD)

At present, there are 4,500 BTC locked in the network (about $100M USD)

https://twitter.com/kerooke/status/1557017648742932480?s=20&t=JSQJBllPJiD_yV7AK3b0ZA

On top of a growing ecosystem, Lightning is more accessible than ever.

Cash App, El Salvador's @chivowallet, Kraken, Bitfinex, Bitstamp, Robinhood and Paxful all offer or plan on offering access to Lightning.

Cash App, El Salvador's @chivowallet, Kraken, Bitfinex, Bitstamp, Robinhood and Paxful all offer or plan on offering access to Lightning.

Funding is picking up as well.

@OpenNode: $20M Series A

@lightning: $70M Series B

Most notably, @davidmarcus of Facebook fame recently raised a Series A at a valuation that was not small, for @lightspark, which is building out Lightning infrastructure.

@OpenNode: $20M Series A

@lightning: $70M Series B

Most notably, @davidmarcus of Facebook fame recently raised a Series A at a valuation that was not small, for @lightspark, which is building out Lightning infrastructure.

So will BTC native payments finally takeoff?

Will Lightning based fiat transfers undercut the payment giants?

It's too early to say, but the ingredients and potential are there.

Will Lightning based fiat transfers undercut the payment giants?

It's too early to say, but the ingredients and potential are there.

And while Lightning's $100M network capacity pales in comparison to $1B+ ETH L2s (Arbitrum/Optimism) it's worth noting that Lightning activity is more indicative of real world utility when compared to the more speculative activity driving much of the growth on SC platforms.

Not to mention, Lightning is growing in a bear market where BTC fees are relatively low. Should the bull return and BTC base layer fees spike, we could see more users flock to Lightning - especially since the network is more accessible than ever.

If growth of the Lightning Network continues, it will have major implications on the future utility and value of the world’s oldest and most valuable digital asset.

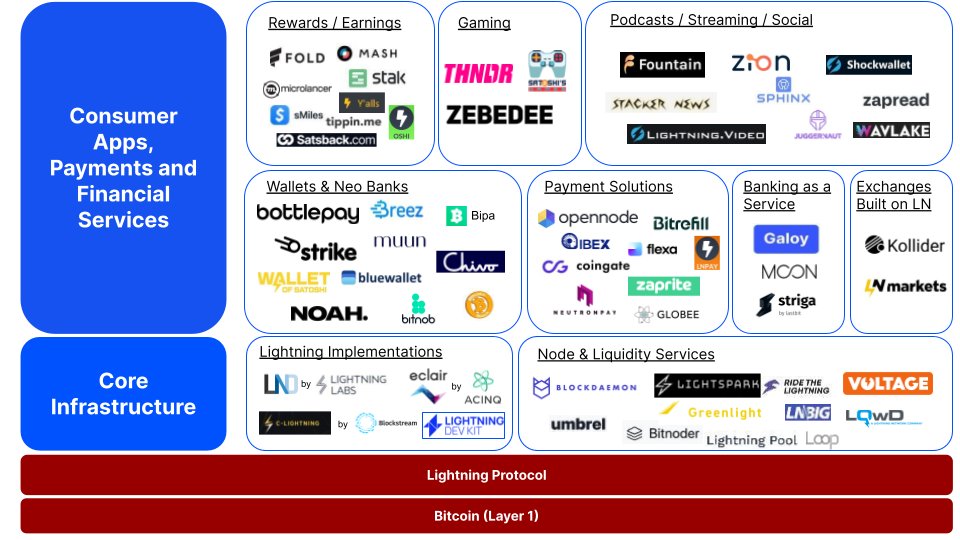

Read the full piece for more color on:

+ the Lightning stack

+ hurdles to adoption blog.coinbase.com/is-the-bitcoin…

Read the full piece for more color on:

+ the Lightning stack

+ hurdles to adoption blog.coinbase.com/is-the-bitcoin…

Shoutout to @newsalmon who did most of the mental lift researching this one. Be his 11th follower - big things to come!

Additional insights from @Nick_Prince12, @kch0e, and @yparikh98

Additional insights from @Nick_Prince12, @kch0e, and @yparikh98

• • •

Missing some Tweet in this thread? You can try to

force a refresh