Messari published it’s Crypto theses for 2022 a while ago.

It’s a 165 page report covering the key trends, predictions & the future of crypto.

I’ve read it all so that you don’t have to.

Here are the takeaways from the top 10 Crypto narratives for 2022.

It’s a 165 page report covering the key trends, predictions & the future of crypto.

I’ve read it all so that you don’t have to.

Here are the takeaways from the top 10 Crypto narratives for 2022.

This may be better to listen to. Here’s the video on my youtube.

Like & Subscribe!

2/

Like & Subscribe!

2/

1. The Collapse of Institutional Trust.

A lot of people in crypto view it as a life raft to escape from the grueling cycle of the economy.

• Public Debt is high

• Inflation is high

• Hike in interest rates.

People believe they won’t be able to retire without a miracle.

3/

A lot of people in crypto view it as a life raft to escape from the grueling cycle of the economy.

• Public Debt is high

• Inflation is high

• Hike in interest rates.

People believe they won’t be able to retire without a miracle.

3/

82% of Americans disapprove of Congress.

Crypto represents a change in the system. A new hope.

The system is broken.

The conventional system was set up by boomers for a different age.

Here’s a good thread by @leashless:

4/

Crypto represents a change in the system. A new hope.

The system is broken.

The conventional system was set up by boomers for a different age.

Here’s a good thread by @leashless:

https://twitter.com/leashless/status/1486147735212470274?t=H9x8fmkSBRXxu60Geautgw&s=19

4/

@leashless 2. Crypto is inevitable.

A user owned economy will outperform a monopolistic owned economy. And we’re well positioned to make it happen.

Young folks have little to lose. Society is tired of the low returns & high fees. The environment is primed for change.

5/

A user owned economy will outperform a monopolistic owned economy. And we’re well positioned to make it happen.

Young folks have little to lose. Society is tired of the low returns & high fees. The environment is primed for change.

5/

@leashless We’ve:

• Talent: Passionate, driven youngsters & some of the best minds out there

• Capital: Huge venture funds & round valuations.

• Timing: The foundation has been laid over the last decade. The tech works. Interest & adoption is steadily rising.

6/

• Talent: Passionate, driven youngsters & some of the best minds out there

• Capital: Huge venture funds & round valuations.

• Timing: The foundation has been laid over the last decade. The tech works. Interest & adoption is steadily rising.

6/

@leashless 3. Bridges, NFTs & DAOs.

3 areas that are underdeveloped atm:

• NFT infrastructure

• DAO tooling

• Inter-bridge protocols

NFTs have exploded. But NFT tooling is still missing.

• Marketplaces

• Tools for creators

• Reputation/Identity Management

7/

3 areas that are underdeveloped atm:

• NFT infrastructure

• DAO tooling

• Inter-bridge protocols

NFTs have exploded. But NFT tooling is still missing.

• Marketplaces

• Tools for creators

• Reputation/Identity Management

7/

@leashless DAO tooling.

DAOs are struggling with management.

• DAO governance is a joke & is all over the place

• Investments take too long

Most DAOs are failing. They need to get 100x better to compete with centralized groups.

This is likely going to be another hot space.

8/

DAOs are struggling with management.

• DAO governance is a joke & is all over the place

• Investments take too long

Most DAOs are failing. They need to get 100x better to compete with centralized groups.

This is likely going to be another hot space.

8/

@leashless Scaling Solutions

Eth has been struggling with scaling. This led to the rise of alt L1s.

One of the biggest pain points is the lack of interoperability between chains.

Solutions to this problem will be very hot.

9/

Eth has been struggling with scaling. This led to the rise of alt L1s.

One of the biggest pain points is the lack of interoperability between chains.

Solutions to this problem will be very hot.

9/

@leashless 4. The Decoupling of Cryptos.

Crypto is evolving. Different sectors have different sources of value.

NFTs are driven by different factors. DeFi is driven by different factors.

The information asymmetry for each space is becoming larger.

10/

Crypto is evolving. Different sectors have different sources of value.

NFTs are driven by different factors. DeFi is driven by different factors.

The information asymmetry for each space is becoming larger.

10/

@leashless It’s impossible for one person to stay on top of everything.

This is why funds & their teams are having a great time at the moment.

They’ve the man power to stay on top of asymmetry.

11/

This is why funds & their teams are having a great time at the moment.

They’ve the man power to stay on top of asymmetry.

11/

@leashless 5. Permanent Venture Capital.

An insane amount of capital came into crypto in the last year.

In the bull run, these funds made billions of dollars. A16z, paradigm & the others made a lot, raised a lot & now are waiting to buy the blood.

An insane amount of capital came into crypto in the last year.

In the bull run, these funds made billions of dollars. A16z, paradigm & the others made a lot, raised a lot & now are waiting to buy the blood.

@leashless On Institutional Capital...

On top of this, other institutions are coming into Crypto.

Despite some getting rekt, it looks like the intuitions are here to stay.

13/

On top of this, other institutions are coming into Crypto.

Despite some getting rekt, it looks like the intuitions are here to stay.

13/

@leashless 6. How High we can fly.

Well, the crash did indeed come. But I’ll touch on the top signals Ryan was looking at.

MVRV (Market Value to Realized Value) can be a useful indicator.

MVRV at 3 - good time to take profits

MVRV below 1 - good time to buy

academy.santiment.net/metrics/mvrv-r…

14/

Well, the crash did indeed come. But I’ll touch on the top signals Ryan was looking at.

MVRV (Market Value to Realized Value) can be a useful indicator.

MVRV at 3 - good time to take profits

MVRV below 1 - good time to buy

academy.santiment.net/metrics/mvrv-r…

14/

@leashless Ethereum

It’s unlikely that Eth will flip BTC this cycle.

Eth’s scaling challenges need to be addressed first.

Instead, Ryan feels like it’s more interesting & realistic to consider whether L1s collectively will flip BTC.

15/

It’s unlikely that Eth will flip BTC this cycle.

Eth’s scaling challenges need to be addressed first.

Instead, Ryan feels like it’s more interesting & realistic to consider whether L1s collectively will flip BTC.

15/

@leashless Alt L1s

There are a lot of Alt L1s that are fiercely competing with each other. Who wins is all gonna come own to:

• Good app distribution

• Attracting top talent to build on non eth chain.

These chains are going to move with eth.

16/

There are a lot of Alt L1s that are fiercely competing with each other. Who wins is all gonna come own to:

• Good app distribution

• Attracting top talent to build on non eth chain.

These chains are going to move with eth.

16/

@leashless DeFi

DeFi represents less than 1% of global banks market cap. The upside that remains long term is enormous.

However,

• Rates of top tier protocols are stalling

• Lots of technical & security problems

• Defaults

It's not compelling for everyone yet

17/

DeFi represents less than 1% of global banks market cap. The upside that remains long term is enormous.

However,

• Rates of top tier protocols are stalling

• Lots of technical & security problems

• Defaults

It's not compelling for everyone yet

17/

@leashless NFTs

Huge opportunity. In September it was estimated that NFT mcap was around $14B.

NFTs will be the trojan horse for mass adoption of crypto. Long term, the scope of this market is huge.

NFT infrastructure remains a huge opportunity.

18/

Huge opportunity. In September it was estimated that NFT mcap was around $14B.

NFTs will be the trojan horse for mass adoption of crypto. Long term, the scope of this market is huge.

NFT infrastructure remains a huge opportunity.

18/

@leashless 7. Surviving winter.

Well, the crypto winter is here.

There’s a lot of negativity. People are going to lose faith in crypto. FUD is gonna be high. Critics rejoicing. Lot’s of big folks going bust.

It’s going to be tough. But revaluate your faith in crypto & stick it out.

19/

Well, the crypto winter is here.

There’s a lot of negativity. People are going to lose faith in crypto. FUD is gonna be high. Critics rejoicing. Lot’s of big folks going bust.

It’s going to be tough. But revaluate your faith in crypto & stick it out.

19/

@leashless If you're staying:

• Stay away from leverage

• Prepare for taxes

• Don’t short

• Don’t catch the falling knife

• If you’re a builder, protect your treasury

• Build

• Be more cautious

Wgmi → We gonna survive

20/

• Stay away from leverage

• Prepare for taxes

• Don’t short

• Don’t catch the falling knife

• If you’re a builder, protect your treasury

• Build

• Be more cautious

Wgmi → We gonna survive

20/

@leashless 8. Public Options

Although Coinbase’s increase in valuation has been impressive, it hasn’t been comparable to BTC & ETH.

However, public companies serve a big purpose: Marketing.

It strengthens the narrative for the masses.

Public stocks also have alpha in their filings

21/

Although Coinbase’s increase in valuation has been impressive, it hasn’t been comparable to BTC & ETH.

However, public companies serve a big purpose: Marketing.

It strengthens the narrative for the masses.

Public stocks also have alpha in their filings

21/

@leashless 9. CopyTrading VCs

Crypto trading is social & meme driven. A lot of money has been made copying top VCs & chasing memes.

The market rewards builds & fast followers.

22/

Crypto trading is social & meme driven. A lot of money has been made copying top VCs & chasing memes.

The market rewards builds & fast followers.

22/

@leashless Here's a step by step demo on finding & tracking smart money on my youtube.

Subscribe for more crypto guides.

23/

Subscribe for more crypto guides.

23/

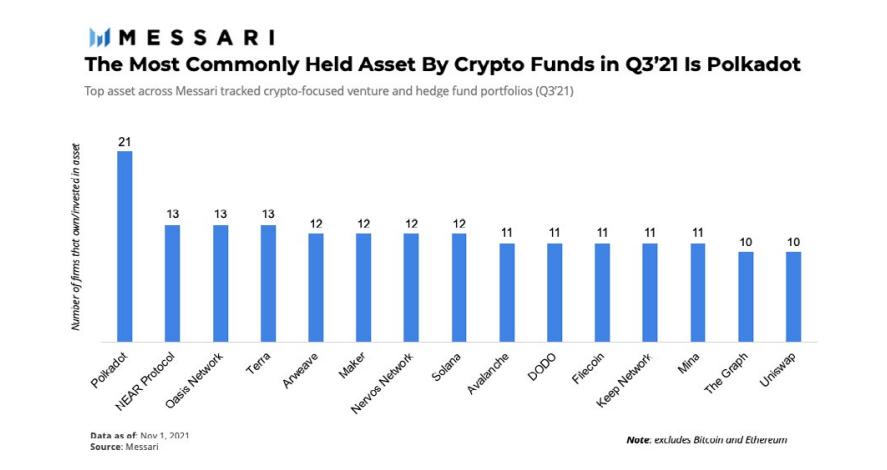

@leashless 10. What Messari Analysts are holding.

Remember, this is from a long time ago, don’t attempt to copy this stuff.

Instead, look at what areas they like & why.

24/

Remember, this is from a long time ago, don’t attempt to copy this stuff.

Instead, look at what areas they like & why.

24/

@leashless I highly recommend reading the full report.

messari.io/crypto-theses-…

It’s been some time since this has been published, things have changed.

Not everything will be right.

Instead, look at the larger picture & use this to learn.

25/

messari.io/crypto-theses-…

It’s been some time since this has been published, things have changed.

Not everything will be right.

Instead, look at the larger picture & use this to learn.

25/

@leashless I hope these top 10 narratives & trends for 2022 from Messari's report was useful.

• Give this a RT

• Follow me @Cov_duk for more

• Subscribe to my Youtube for guides, demos & interviews!

youtube.com/channel/UCk43i…

• Give this a RT

• Follow me @Cov_duk for more

• Subscribe to my Youtube for guides, demos & interviews!

youtube.com/channel/UCk43i…

Give this a retweet!

https://twitter.com/Cov_duk/status/1546388832588730369

• • •

Missing some Tweet in this thread? You can try to

force a refresh